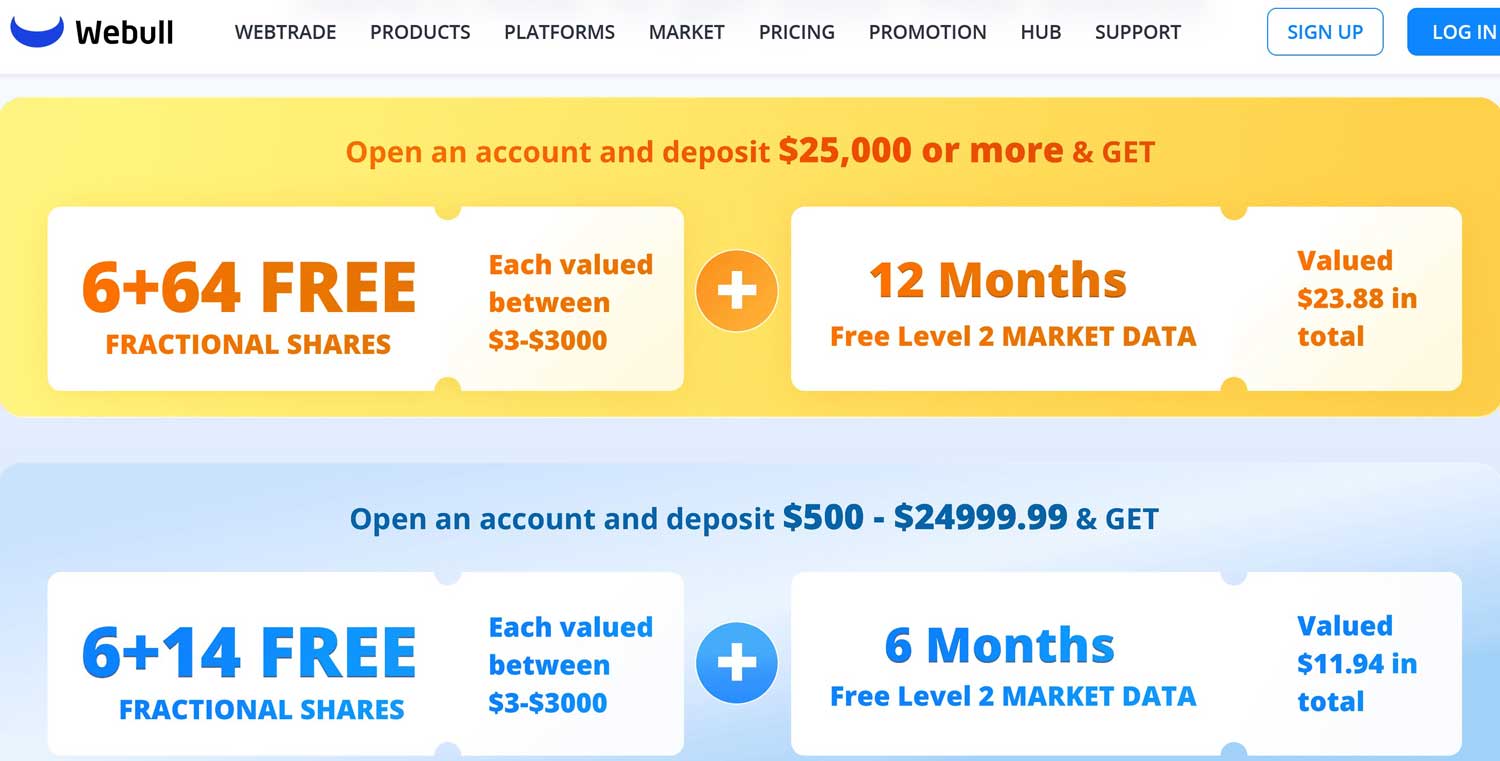

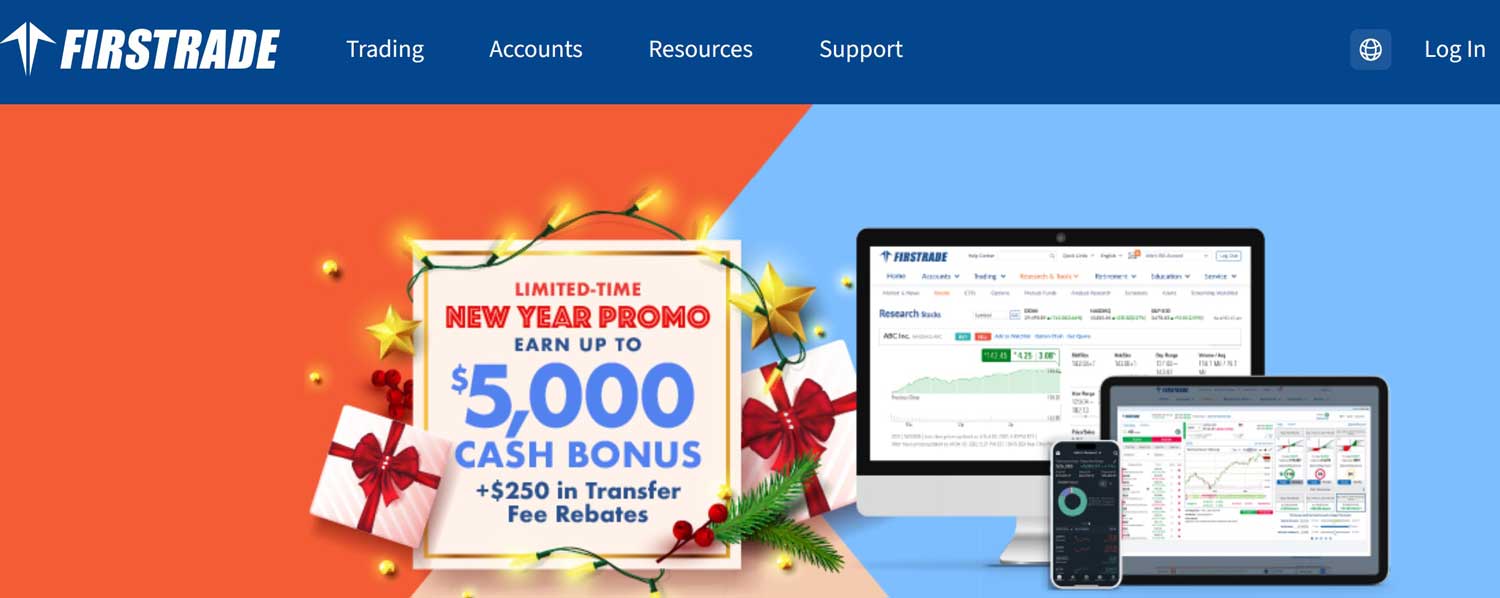

ROTH IRA Promotions at a Brokerage Firm

Many online brokers offer special promotions to entice investors to open a new ROTH IRA account. Both Traditional and ROTH IRA holders

are eligible to receive these free stocks or cash bonuses.

Reasons to Open a ROTH IRA at a Brokerage Firm

Opening a ROTH IRA with bonus offer above can be a good way to start building a nest egg for retirement. This tax-advantaged account can be opened at different financial

institutions, including banks. As we shall see, a broker is an excellent place to open the account.

ROTH IRA at a Bank

It’s possible to open a ROTH IRA at a bank and deposit the retirement account’s contributions into a savings account, money market deposit account, or certificate of deposit. Doing so will result in a stable return over the lifetime of the account. Savings accounts, money market accounts, and CD’s are guaranteed not to go down in value, and in return you receive a small annual stream of income. Typically, this can be 1% or even lower. Bank of America, for example, offers a money market IRA account that pays just 3 basis points per year.

The investment choices with a bank IRA are very limited. Typically, you only get three options: a savings, money market, or CD account. Most banks only offer savings accounts and certificates of deposit for IRA’s.

Ally Bank currently offers a savings account ROTH IRA that pays 1.15% on all balance levels. The bank’s CD’s are eligible for retirement accounts. They pay between 0.30% and 2.25%, depending on term level and balance. Synchrony Bank pays between 0.25% and 2.35% for its CD’s, which can be used inside a ROTH IRA. Its ROTH IRA money market account pays 85 basis points.

Bank products, including balances from a ROTH IRA, are insured by the FDIC. But the government limits this protection to $250,000 per customer.

Advantages of a Brokerage ROTH IRA

Some retirement savers aren’t going to be satisfied with the ROTH IRA rates that banks offer. And that’s why the brokerage version of the ROTH IRA has become more

popular. Holding a retirement account at a broker-dealer opens up many more investment opportunities than what a bank can provide, although with increased return comes

increased risk.

Some of the available investments when you open brokerage ROTH IRA with promotion offer above include stocks and bonds. Bonds have more stable price histories, while stocks have very high return potential. For example, in 2016, U.S. Steel (ticker symbol X) returned 316%. This was one of the best performing stocks on American exchanges that year. Obviously, this is much higher than any bank account yielded in the same year. Of course, there is far less consistency in the stock market. The year before, the same stock went down 69%. On a two-year average, that’s still over a 100% return.

Besides stocks and bonds, there are other investments available to ROTH IRA account holders at a brokerage house. Mutual funds are very popular, and target-date funds are designed for retirement savers. These securities become less risky as the target date approaches. This is the date that retirement is supposed to begin. Available target dates are usually in multiples of fives—2030, 2035, 2040, and so on. Because mutual funds are securities, they are not available in a bank IRA.

Although brokerage accounts are not protected by the FDIC, most brokers offer coverage through SIPC. This is the brokerage world’s primary insurance. It protects accounts up to $500,000. This is twice the amount of insurance that the FDIC provides. Furthermore, many brokerage firms, including Fidelity and Vanguard, provide supplemental insurance for accounts above $500,000. Retirement savers who have large accounts would obviously be better off with a brokerage IRA rather than a bank IRA.

Many brokerage firms also offer a wide range of brokered CD’s. These can be traded inside a brokerage ROTH IRA. Because there are usually multiple banks that provide these products, buying a CD in a brokerage IRA is actually a better idea. By going through a broker-dealer, you will get a larger selection of CD’s. For example, E*Trade’s CD screener returns over 40 products from several banks, including Discover Bank, HSBC, Bank of China, Berkshire Bank, JP Morgan Chase, and others.

Many broker-dealers also provide large amounts of retirement planning resources. The Schwab and TD Ameritrade websites, for example, host articles and videos that discuss many important retirement topics. These include how to generate income during retirement and how to incorporate Social Security into a retirement plan. Retirement calculators that can make very important financial estimations are also on both websites. Most banks don’t provide their customers with such thorough educational materials on retirement planning.

Many on-line discount brokerage firms today offer account management services. If you don’t have the time or ability to manage your ROTH IRA, licensed financial advisors can manage your account for you. Usually, this costs 1% or more per year. Robo-advisory services cost far less. This type of account management uses a computer program to make trading decisions, and it can be used for a retirement account. Banks don’t provide these types of services.

The Employer’s Role in Funding a ROTH IRA

As the name suggests, a ROTH Individual Retirement Account is typically funded individually without any assistance from an employer. However, an employer can make after-tax contributions to a ROTH IRA on behalf of an employee.

Most employer-sponsored retirement plans are 401(k)’s or similar arrangements. These usually have much more limited investment options, sometimes just from a single mutual fund family. This means stocks and other securities won’t be available. But a ROTH IRA at a brokerage firm can invest in virtually any asset, including option contracts. There are also IRA’s that can invest in gold and silver coins.

ROTH IRA Promotions Summary

If a ROTH IRA is opened at a brokerage house, it will come with a host of benefits that aren’t

available at a bank. Some of these advantages are great ROTH IRA promotion offers. Over time,

these benefits can lead to a much larger account balance.

Updated on 7/2/2024.

|