Firstrade IRA Account Review

Firstrade is one of the underdogs in the brokerage world. Despite its smaller size, it does offer investors quite a few services. Here’s the lowdown on this humble broker:

Bulls Talk About...

Best commission schedule out there. Small does not necessarily mean worse. Firstrade has a better

commission schedule than all of the big hitters in the industry.

New cash management policies. Firstrade has revised its previous policies that prevented most account holders from getting a debit card.

International accounts are available. Residents of most countries can open a Firstrade account, a service unavailable at most brokerage firms.

Bears Talk About...

Customer service has been scaled back. That apparently is the price of the broker’s new $0 commission schedule.

Trading tools are undeveloped. This is the broker’s Achilles heel.

Educational materials are lacking. Articles are short, and there are just a few videos.

Cash Management Tools

Firstrade customers can add checkwriting and a debit card to an existing brokerage account. There are no fees

for this great service. A separate bank or cash management account is not available at Firstrade. The broker

does require $100 in assets to qualify for its banking tools. The first order of checks and card can be

overnighted to virtually any location in the world free of charge.

The downside of Firstrade’s banking service is that ATM fees aren’t reimbursed, and Firstrade operates no cash

machines. So pretty much every ATM withdrawal will cost something. A transaction in a foreign currency is an

extra 3%.

UMB is the bank that provides Firstrade’s debit card and checks. Fidelity also uses UMB.

Tradable Assets

Firstrade has a medium-sized list of investment vehicles. There are mutual funds, exchange-traded funds, closed-end funds, bonds, stocks, and option contracts. Over-the-counter securities and penny stocks that trade higher than $0.10 are also available.

Missing at Firstrade are precious metals, warrants, forex, futures contracts, options on

futures, and cryptocurrencies.

Commission Schedule

And what do these investments cost? The answer is usually nothing, at least to trade.

Firstrade was one of the first brokerage firms to go to a zero-commission schedule. Transactions of equities, ETF’s, mutual funds, closed-end funds, and options cost nothing. There are no per-contract charges on derivative trades, either; and exercises and assignments now cost $0 as well. Firstrade is one of the few broker-dealers to offer such generous policies on option trades.

So what products still carry commissions? Bonds. Every fixed-income security either costs $30 per transaction (primary market certificates of deposit) or is priced on a markup/markdown basis (everything else).

Firstrade also charges $19.95 for stock, ETF, and option orders that are placed over the phone with the assistance of a live agent. Option trades placed in this manner are also subject to a $0.50 per-contract charge.

Although mutual funds are now commission-free, there still is a $19.95 short-term redemption fee on shares that are held less than 90 days.

Margin rates at Firstrade vary from 8.5% to 12.75%.

Promo Link

Open Firstrade Account

Customer Support

Investors can chat with an Artificial Intelligence on the Firstrade website 24/7. Called Sammi, it is able to answer many (but not all) questions. During a test chat, it could not give us the stock price of General Motors. After moving to its zero-commission model, Firstrade eliminated human chat.

Phone service is available during the weekday. There is a toll-free number for domestic clients and an international number for overseas customers. There is a free call-back service if the broker’s phone lines are busy.

Firstrade can also be contacted by fax, snail mail, and e-mail. The company has one physical location in Flushing, New York where it holds office hours.

The company’s website has a document upload tool for customers who need to send a form to the broker but don’t want to snail mail it in. There is an extensive document download center where pdf and electronic forms of all sorts of forms can be found.

Mutual Funds

As already mentioned, Firstrade no longer has any transaction-fee mutual funds. Some funds (8,127 to

be exact) do have a load. There are more than 11,000 total funds available. The broker’s screener

offers a moderate amount of search variables. Some examples include fund family, Morningstar rating,

portfolio turnover, and 5-year return history. Results can be sorted by any variable selected for

the search.

Fund profiles at Firstrade are Morningstar clones; the broker simply pulls data and graphics from Morningstar’s site. While this may raise some eyebrows, it does translate into a lot of good information.

Fund documents, such as the prospectus and annual report, are linked on a fund’s profile. A fund can also be added to a watch list, and trade buttons are displayed at the top.

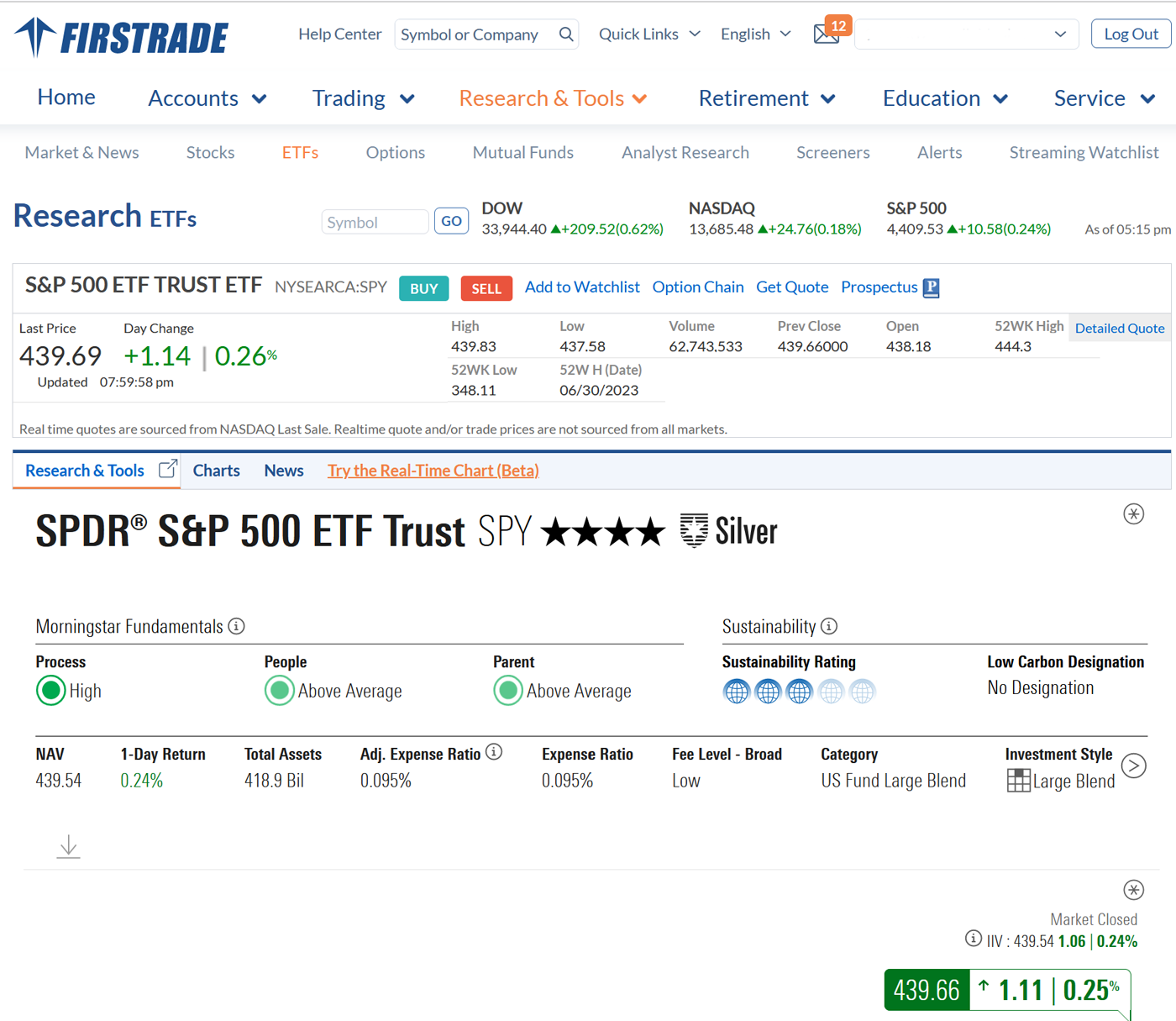

Exchange Traded Funds

The ETF screener on Firstrade’s website provides more search variables than its mutual fund cousin. Some of the available choices include sector weightings, regional exposure, price/book ratio, number of holdings, and analyst ratings.

During our examination, we found it easy to sift through ETF search results. Sorting is possible by any variable. One feature missing in the results is a trade button. Clicking on a ticker symbol produces a profile page, and once again, this is a Morningstar clone.

Some of the available data points include an asset allocation pie chart, a history of monthly premium or discount trading from NAV, sustainability ratings, and top holdings.

Option chains can be accessed for any ETF that has them by clicking on an options link at the top of the page.

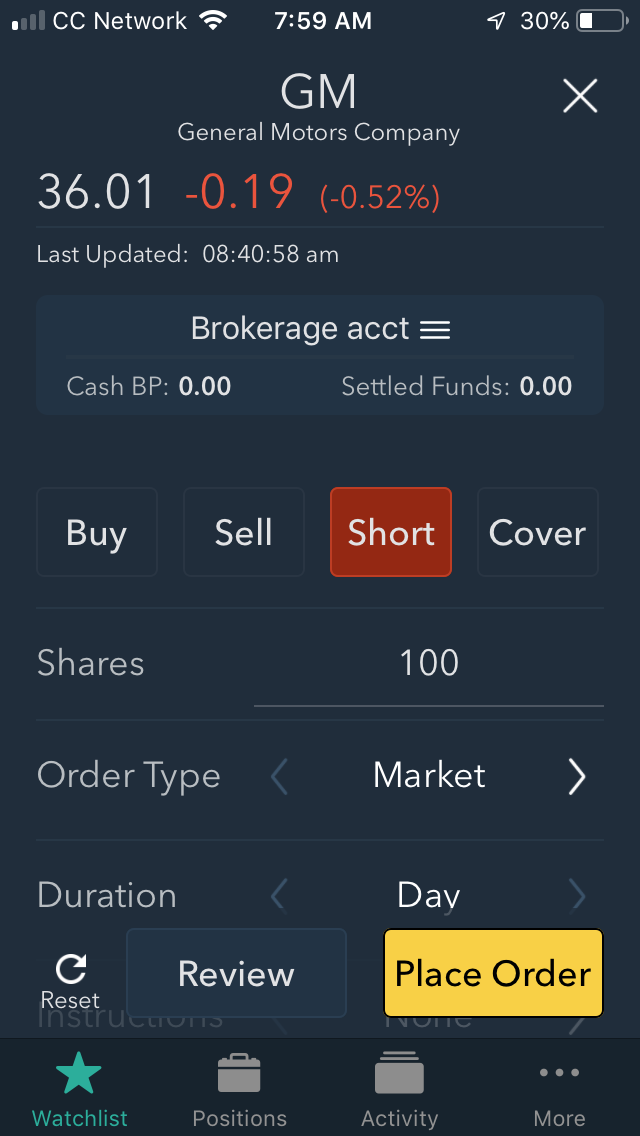

Mobile Trading

Firstrade customers get to use a mobile app that offers some good charting tools. A graph can be rotated horizontally for better viewing. There are multiple graph styles (OHLC bars, candlesticks, hollow candles, Heikin Ashi, line, area, and baseline); and many other features can be adjusted, too. For example, the vertical axis can show price, percent change, or a price indexed to 100.

To get into the app, we were able to use Touch ID on an iPhone. During our testing, we couldn’t find a mobile check deposit feature, bill pay, or streaming financial news. There is an ACH transfer tool and a trade ticket. Options can be traded, but not mutual funds.

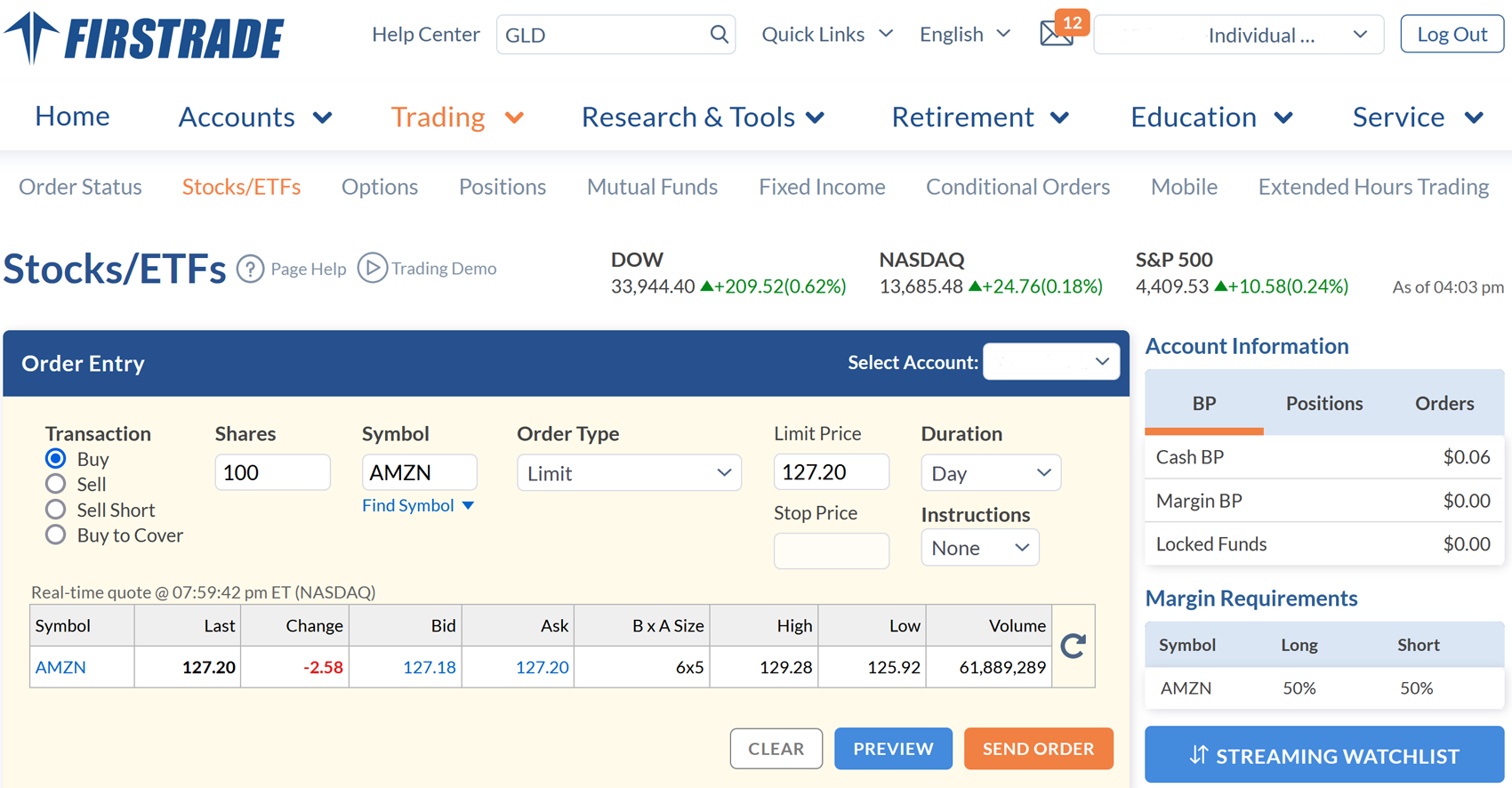

Website Trading

Moving to Firstrade’s website, we do find mutual fund trading. There’s a search bar in the top menu where a ticker symbol, company name, or fund name can be entered. Buy and sell buttons appear on a mutual fund’s profile, and clicking on one generates a new web page with an order ticket. There are two reinvestment options: reinvest both (not either) capital gains and dividends or pay both in cash.

A trade bar sits at the bottom of the browser. It can be used to trade stocks, ETF’s, closed-end funds, and options (calls and puts only). Up-to-the-second trade data is shown for bid and ask numbers, last trade price, and volume. Option chains can be expanded above the bar. There are multi-leg strategies presented, but choosing one of them requires a trade to be placed on a web page instead of the trade bar.

For stock and ETF trading, the trade ticket offers stop, stop limit, and trailing orders. Duration choices include day, good for 90 days, extended hours only, and extended hours plus regular session.

There is no browser platform at Firstrade.

Account Types

For self-directed investors, Firstrade offers both individual and joint taxable accounts in both cash and margin varieties. For retirement saving, the brokerage house provides Roth, traditional, and rollover accounts. For minors, there are UTMA and UGMA accounts. And for education savings, there is the Coverdell Education Savings Account.

There are accounts for trusts and estates; and businesses and investment clubs have their own choices as well.

None of Firstrade’s accounts have any fees. There are no opening, closing, annual, low-balance, inactivity, or maintenance charges.

Firstrade does not offer a solo 401(k) plan or a 529 account.

Global Investing

Firstrade is one of the few U.S.-based brokerage firms to offer accounts to residents of foreign countries. Most countries are eligible, although we noticed that Cuba and North Korea are not on the list.

Firstrade’s weakness in this category is that it doesn’t provide trading in foreign securities (other than

ADR’s and OTC stocks in the American marketplace). Firstrade does provide Chinese language service, and its

website can be accessed in two versions of Chinese.

Learning Materials

Firstrade offers its clients a small selection of materials for general investment education. It can be found by clicking on the “Education” tab in the top menu. During our inspection, we found articles on the basics of stocks, options, mutual funds, and bonds. The segment on derivatives offers numerous option calculators, courtesy of the Options Industry Council, and quite a few e-books. Videos cover many topics, such as how to place a trailing stop order.

Another great tool on Firstrade’s website is a glossary that provides definitions for many investing terms. This would be a great resource for beginners.

Stock profiles once again are pulled from Morningstar. Included is free research from the analyst, including a price target.

Other Services

Firstrade customers can reinvest dividends at no charge. It’s also free to sign up for robo purchases of mutual fund shares.

Comparison

Robinhood doesn’t charge any per-contract, exercise, or assignment fees for option trades, either. But Firstrade

has better option tools.

TD Ameritrade offers $0 equity

commissions, but still charges fees on mutual funds, OTC stocks, and options.

TradeStation has a desktop platform; and it offers access to several foreign exchanges but it charges

some fees and is not as user-friendly.

Recommendations

Small Accounts: Because Firstrade accounts have neither fees nor minimums, we can recommend

them for traders with few assets.

Individual Retirement Accounts: Firstrade is a hard to beat option for IRA accounts.

Beginners: New traders need excellent customer service, a good selection of learning materials, and

user-friendly software. Charles Schwab

would be a better choice than Firstrade.

Mutual Fund Investors: Firstrade’s no-transaction-fee policy on all funds is impossible to beat.

Active ETF and Stock Trading: Although we do like Firstrade’s trade bar, it just isn’t enough for

sophisticated investors. Webull gets the nod here.

Firstrade IRA Review Summary

Firstrade offers an unbeatable value in brokerage services, especially for option traders and international

customers. Traders who need certain services, such as desktop software or forex trading, will have to go

elsewhere.

Open Firstrade Account

Open Firstrade Account

Updated on 1/1/2025.

|