Webull IRA Review

If you want to build a nest egg, an Individual Retirement Account (IRA) is a great way to get started. Providing easy opening and some lucrative tax breaks, an IRA is super user-friendly. Webull does offer IRAs but falls short in some areas. Here are the details:

Webull IRA Overview

There are two IRA versions available at Webull: Roth and Traditional. There are no small business IRAs or other IRA types. Unavailable versions include SEP, SIMPLE, Minor, and Inherited.

Webull only permits its customers to open one IRA, Roth or Traditional. It’s not possible to have one of each. This is an unusual policy in the industry.

Webull IRA Fees and Minimums

Webull is an ultra-low-cost investment firm. This policy extends to its IRA service, so tax-deferred accounts have no fees or minimums of any kind. An IRA can be opened with $0 if desired. There is no annual IRA fee at Webull, and there’s no fee to close an IRA, either.

IRAs at Webull get the same great pricing schedule that other accounts have. This means online trades typically will qualify for zero commissions.

Available Assets

Webull offers trading in stocks, options, ETFs, and closed-end funds.

Webull does not offer trading in mutual funds, so it’s not possible to invest in a lifecycle fund. Because fixed-income securities are not available, either, an IRA cannot build a bond ladder.

Opening a Webull IRA

Thanks to Webull’s user-friendly software, it’s quite easy to open an IRA with the brokerage firm. It

takes just a few minutes on the company’s website.

Be sure to specify the IRA type you want to open (Roth or Traditional).

If you already have a taxable account open, log into the site and click on the account name in the

top-right corner and select My Account. On the next page, there will be a link to open an IRA. This is

the easiest way to open an IRA at Webull because personal information will already be pre-filled on

the account application.

Open Webull IRA

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Webull Rollover Service

Webull accepts rollovers of retirement plans from previous employers. The first step in this rather bureaucratic process is to open an IRA with Webull if you haven’t done so yet. The second step is to contact the human resources department with the old employer and request a rollover into the IRA at Webull. You’ll have to fill out some paperwork, but once this red tape is taken care of, your old account will appear in your Webull IRA (as cash).

The whole process could take two weeks. This assumes everything goes well and there are no snags along the way. If there are any mistakes in the paperwork, it could take longer.

Types of Qualified Retirement Plans (QRPs) that Webull will accept as rollovers include 403(b), 401(k), and 457(b) plans. SEP IRAs and SIMPLE IRAs can be moved as well. There are three methods to rollover one of these accounts: wire, check, and 60-day rollover.

With the first option, the plan administrator will liquidate all holdings in the account and wire the cash balance into the Webull account. To use this method, provide the following details to the plan administrator:

| Field | Details |

|---|

| Amount | U.S. Dollar amount |

| Recipient Bank Name | BMO Harris Bank

Bank Address

111 W Monroe St, Chicago, IL 60603 |

| ABA Number | 071000288 |

| SWIFT Code | HATRUS44 |

| For the Benefit of (FBO) | Apex Clearing Corporation |

| Bank Account Number | 1617737 |

| Beneficiary's Address | One Dallas Center, 350 N. St Paul Suite 1300 Dallas, TX 75201 |

| Beneficiary's Phone Number | 888-828-0618 |

| Name on the Webull account and the 8-digit alphanumeric account number 5XXXXXXX |

Instead of sending cash proceeds to Webull via wire, the old employer could send the balance via check. The check should be made payable to “Apex Clearing Corporation FBO (account holder’s name and account number).” It should be sent to the following address:

Apex Clearing Corporation

c/o Banking

350 N St Paul Street, Ste 1300

Dallas, TX 75201

The third and final method to move a QRP into an IRA at Webull is through a 60-day rollover. In this case, the previous employer will mail you the check, and you’ll have 60 days to send it to Webull. Taxes could be withheld from the proceeds in this method. Be sure to speak with a tax advisor before rolling over a QRP into an IRA.

Although Webull charges nothing to receive a transfer, the outgoing firm may charge something. In all cases, a Roth account can never be moved into a Traditional IRA.

Webull IRA Transfer

A much simpler process is to transfer an IRA from another brokerage firm into the IRA at Webull. This system is easier (at least, could be easier) because there’s no employer, and assets can be moved into the Webull IRA without selling them. This assumes Webull offers the same assets for trading. This may not always be the case, however.

The starting point for an IRA-IRA transfer is the incoming brokerage firm, not the outgoing firm. The incoming firm in this case is Webull, who has a really convenient online form for account transfers.

To find the form, open the mobile app and tap on the Menu icon in the bottom menu. On the Menu page, you’ll see a Promotion Center at the top. Scroll through the tiles until you see the one for the account transfer bonus. Tap on this tile, and you’ll get details on Webull’s transfer special, if available at the time, for taxable accounts and IRAs.

On the transfer page, tap on the button to transfer an IRA and follow the instructions. It’s also possible to transfer an IRA using Webull’s website. To do this, go back to the My Account page. This time, in the left-hand menu, click on Transfer Stocks.

In the drop-down menu for the receiving account, an IRA must be selected (in case you have more than one account at Webull) in order for this form to work. The minimum transfer amount is $500. Webull also will not accept any transfer of option contracts that expire in less than 2 weeks, and naked options of any kind are not supported at all. Pink-sheet stocks and over-the-counter instruments are also not transferable.

Open Webull IRA

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Software

An IRA at Webull has access to the same trading software that other accounts get to use. These resources include a mobile app, desktop program, and a browser platform. There are multiple order tickets, full-screen charting, a stock screener (but not an ETF screener), and multiple trading layouts on the desktop system.

Managing an IRA

Webull does not permit shorting, option spreads, or trading on margin inside an IRA. The account’s balance can never be negative. Day trading is only possible in an IRA with settled funds. An IRA cannot be margin-enabled at Webull, so it is essentially a cash account in all cases.

Webull supports recharacterizations and the Backdoor Roth strategy. Withdrawals from an IRA must be completed using a paper form:

Adding a Beneficiary to an IRA

Although a taxable account at Webull cannot add a beneficiary, an IRA can. Adding a beneficiary to a retirement account is quite easy to do on either the mobile app or website.

On the app, tap on the bull’s horns in the bottom menu. Next, tap on the settings icon in the top-right corner. On the next page, tap on Modify Account Profile. On the next page, scroll down to add a beneficiary.

On the website, go back once again to the My Account page. This time, click on the “Manage My Account” link. On the next page, there will be a link to add a beneficiary.

Webull Retirement Advice

Webull does not offer any type of investment advice or financial-planning service that retirement savers may want to take advantage of. Robo accounts and other types of advisory services are not available. All accounts are self-directed, and as already mentioned, there are no lifecycle mutual funds.

Retirement Education

There is a learning hub on Webull’s website. Combined with a discrete FAQ center, there is quite a bit of information new customers may want to browse through. However, most of these resources are not geared towards IRAs or retirement planning. The FAQ page does have a brief section on IRAs (look for it at the bottom of the page). Examples of questions include:

- How can I Recharacterize my Roth IRA into a Traditional IRA?

- What are the requirements to open a traditional IRA?

- Does Webull support a Back Door ROTH?

Webull IRA Review Judgement

Webull certainly does better in the IRA arena than one of its major competitors, Robinhood, who offers no IRAs at all. Webull has good trading software (better than Robinhood’s) that does a decent job at high-demand tasks such as full-screen charting and right-click trading.

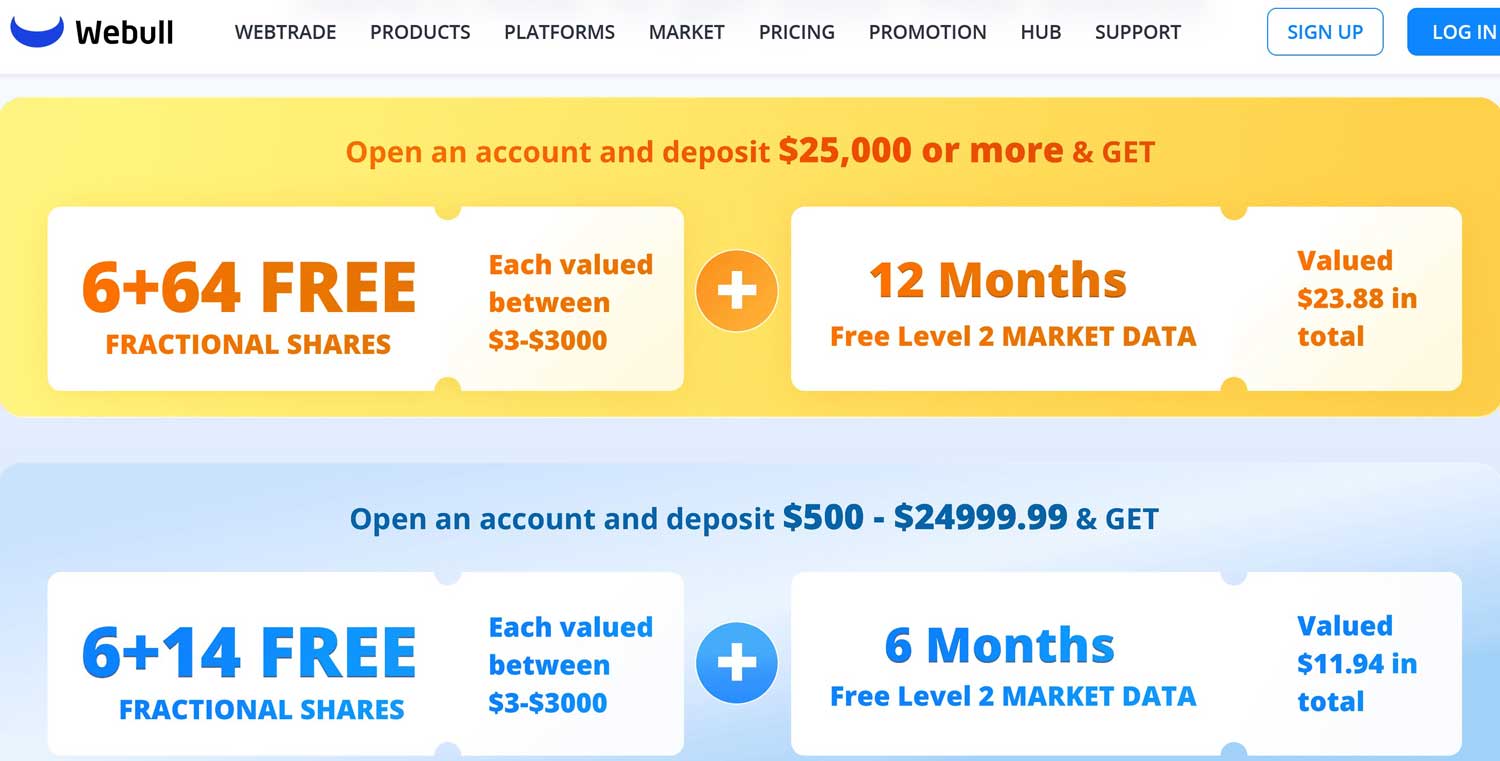

Webull IRA Promotion

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

|