Best IRA Firms Pricing

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Margin

Rate |

Maintenance

Fee |

Annual IRA

Fee |

|

Charles Schwab

|

$0

|

$49.99 ($0 to sell)

|

13.575%

|

$0

|

$0

|

|

WeBull

|

$0

|

na

|

9.74%

|

$0

|

$0

|

|

Robinhood

|

$0

|

na

|

6.75%

|

$0

|

$0

|

|

Firstrade

|

$0

|

$0

|

13.75%

|

$0

|

$0

|

Best IRA Firms Services

Overview of the Best IRA Companies

Before opening an Individual Retirement Account (IRA) at any brokerage firm, be sure to take a look at the IRA lineups of the following four brokers:

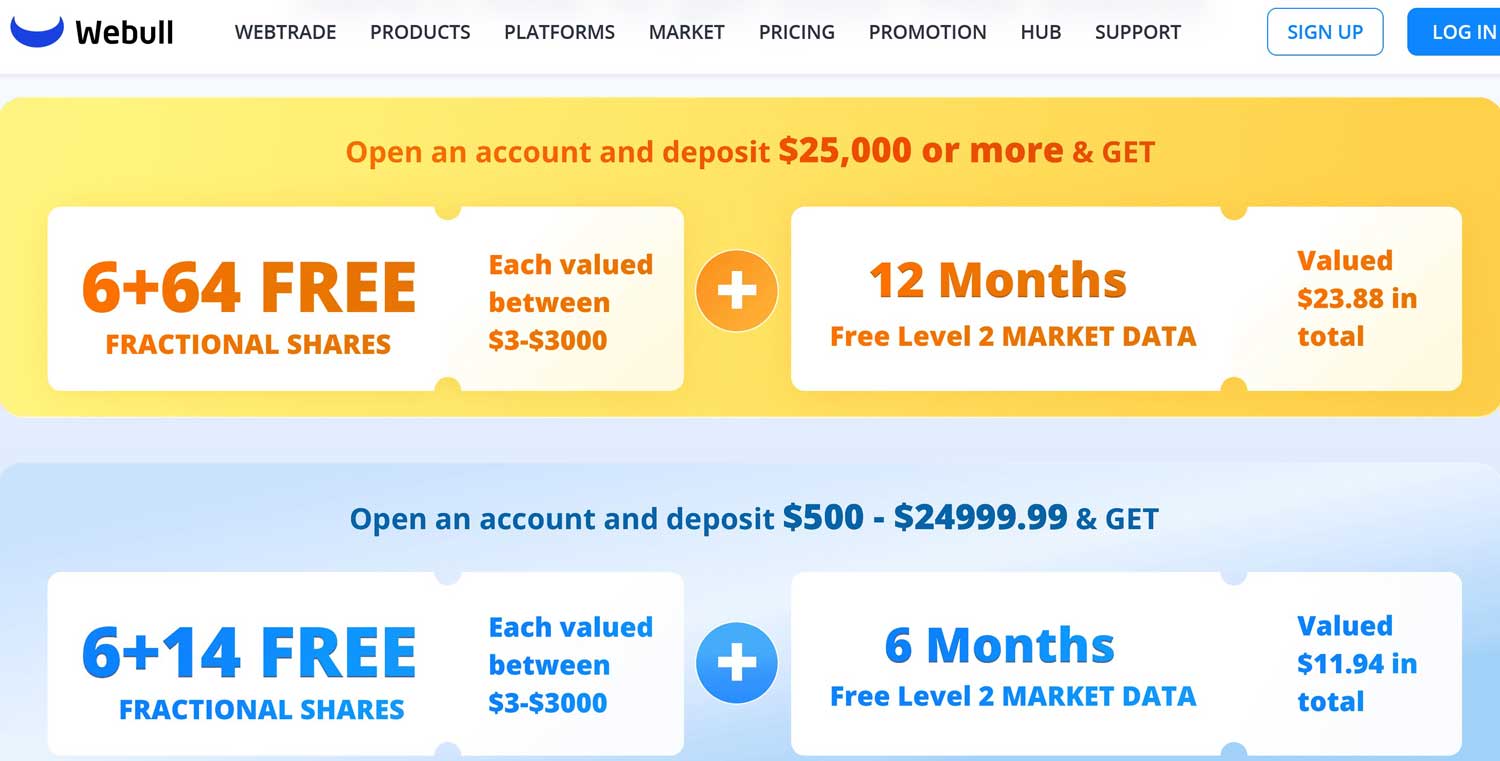

Webull

Webull accepts IRA transfers from other brokerage firms. If your transfer is worth $5,000 or more, you'll receive a $75 bonus. But consider a few key differences between an IRA at Webull and other brokers before making a decision:

(1) Webull does not offer financial planning or advice that retirement savers might need.

(2) It doesn’t offer lifecycle mutual funds or any mutual funds at all. Webull also lacks fixed-income securities.

Despite these drawbacks, there are advantages to using Webull’s IRA services. There are no annual or account closure fees.

Webull's trading software is highly rated, starting with its browser platform. It provides robust tools for both beginners and experienced traders. Full-screen charting and a practice mode can help users familiarize themselves with the platform.

The desktop version offers similar features, plus the ability to save custom layouts like multi-chart trading setups.

Another strong point is fractional-share trading, allowing small IRAs to invest in high-value stocks with as little as $5.

Webull's major drawback for IRA investors is the lack of comprehensive retirement planning resources. It is geared more towards active trading rather than long-term financial planning.

Cryptocurrencies and day trading are not available within Webull's IRA accounts.

Learn more...

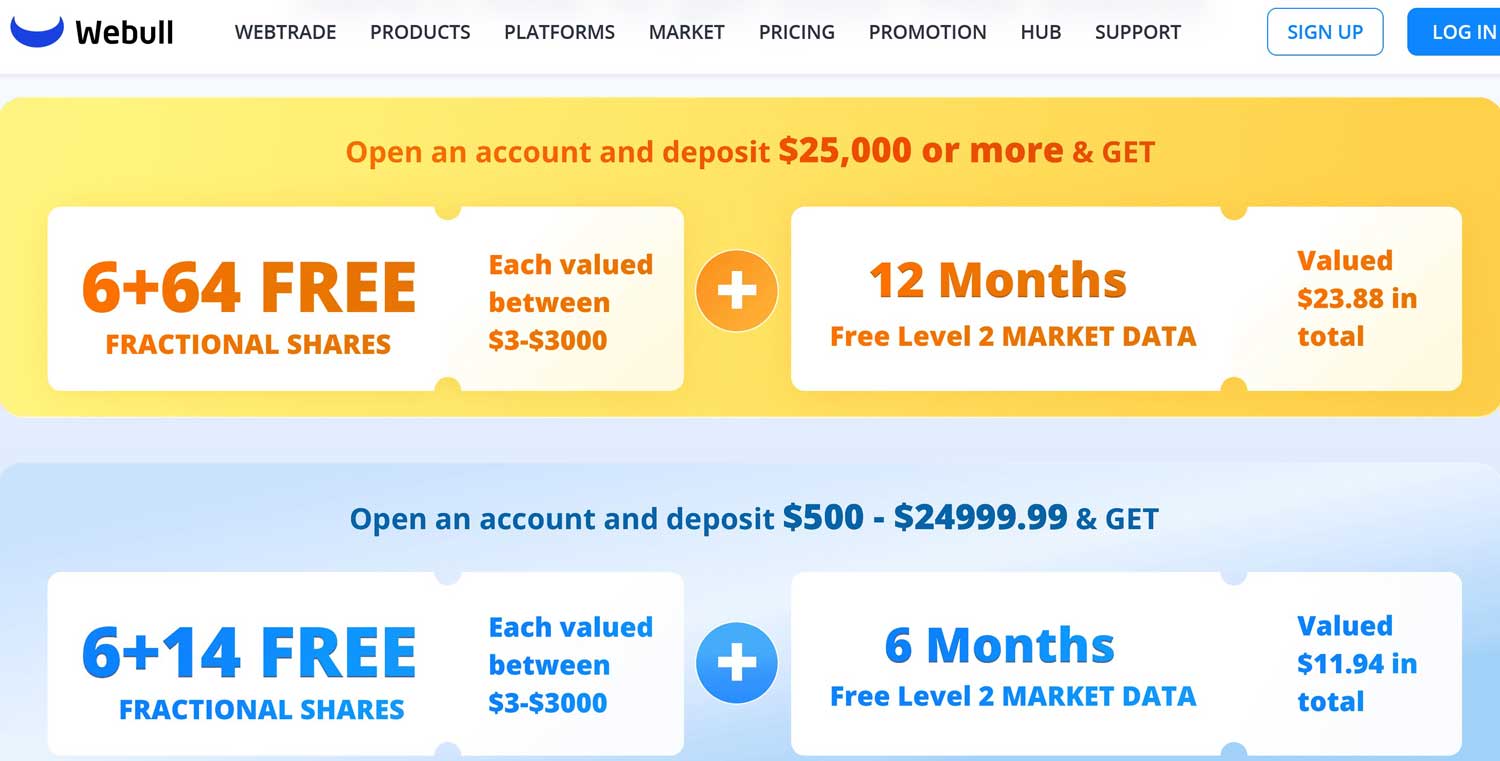

Webull Incentive

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Charles Schwab

Charles Schwab offers a variety of IRA accounts, including ones with advanced trading tools and automated features.

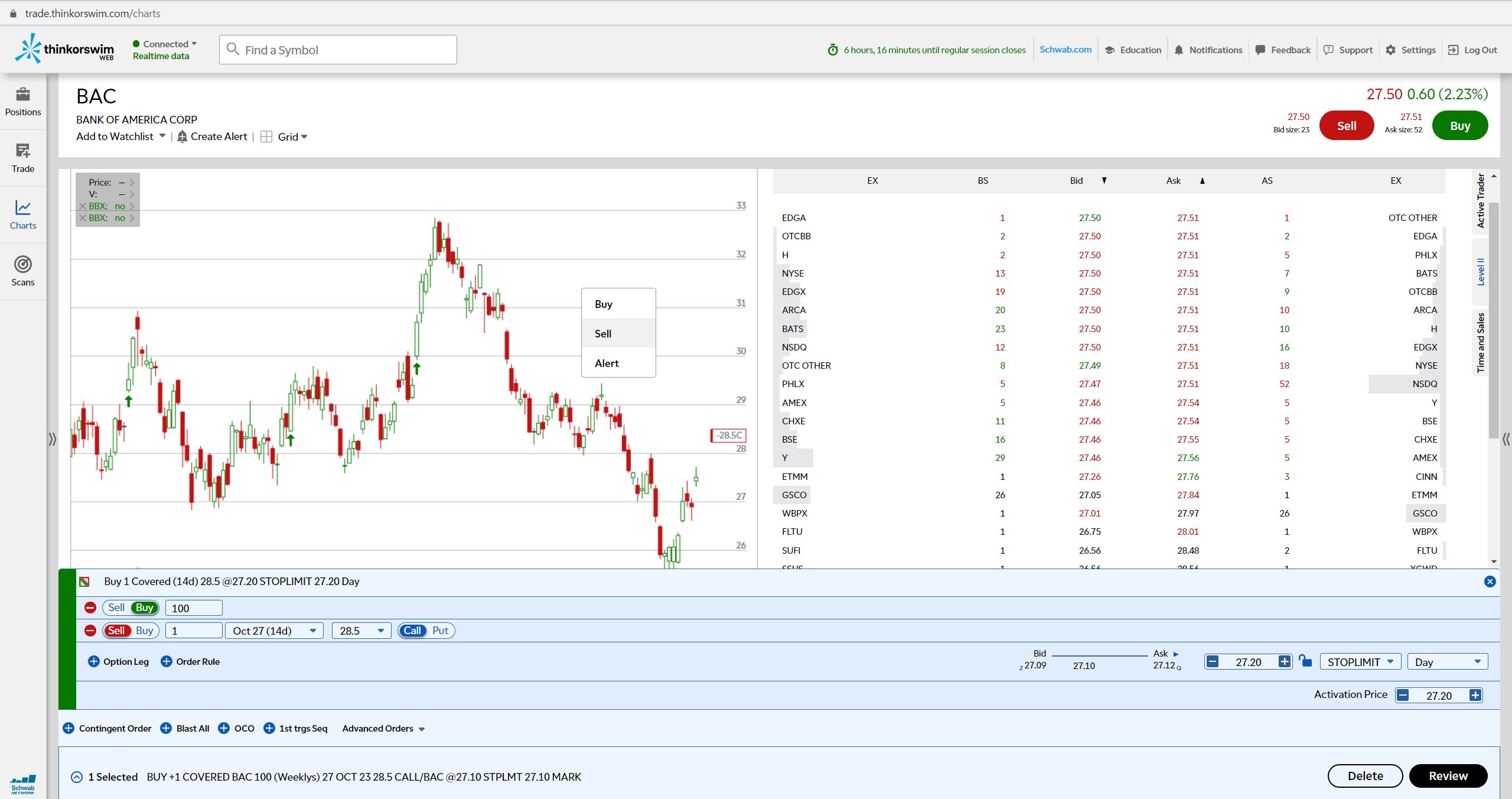

Schwab allows IRAs to use margin for enhanced trading opportunities, which is rare for IRAs.

Margin is not automatically activated in Schwab IRAs. You must request it by completing a form, available under 'Support' on Schwab’s website. Once completed, the form can be uploaded or sent via mail or fax.

If needed, you can contact Schwab’s Client Service Team via live chat or phone at (800-435-4000) to get the form.

While IRAs at Schwab can use margin to trade with unsettled funds and use options spreads, they cannot borrow against the account or sell securities short.

The minimum to enable margin in a Schwab IRA is $5,000 if you plan to sell options.

Schwab offers a range of specialized IRA accounts, such as Traditional, Roth, Rollover, Inherited, Custodial, Individual 401(k), SEP-IRA, and Simple IRA.

Schwab's IRAs allow trading in stocks, ETFs, options, fixed-income, OTC, futures, and Forex. They also provide access to automated ETF portfolios, financial planners, and wealth management services.

Learn more...

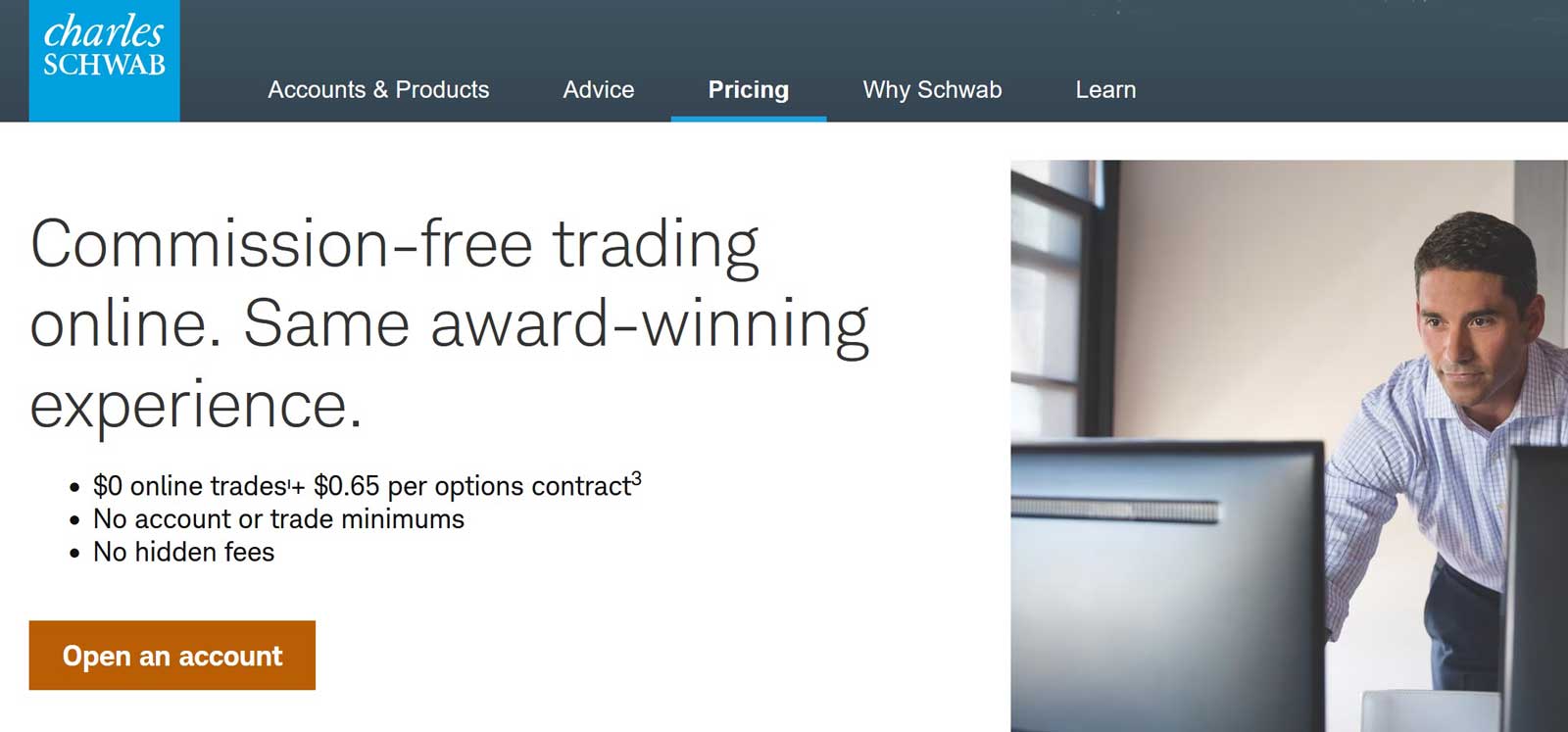

Charles Schwab Website

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Overview of the Best IRA Companies

Before opening an Individual Retirement Account (IRA) at any brokerage firm, take a look at the IRA options from these top brokers:

Webull

Webull accepts IRA transfers from other firms. If you transfer an IRA worth $5,000 or more, you get a $75 bonus. But, there are some differences to consider compared to other brokers:

(1) Webull does not offer financial planning or advisory services.

(2) It lacks lifecycle mutual funds and fixed-income securities.

Despite these downsides, Webull has no annual or account closure fees and offers excellent trading software. Its browser platform and desktop version come with advanced charting tools and a practice mode to help users learn to trade.

Webull also supports fractional-share trading, which is great for small account holders. However, it falls short in providing retirement planning education and doesn't allow cryptocurrency trading or margin trading within IRAs.

Learn more...

Learn more...

Webull Incentive

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Robinhood

Robinhood offers both Traditional and Roth IRAs, which are simpler than those at full-service brokers like Charles Schwab but include an attractive match program to boost your contributions.

Robinhood's IRA Match program adds an extra 1% to your contributions. This bonus doesn't count towards your annual contribution limit and applies to all deposits and transfers without a cap.

To keep the match, you must leave the contributions in the IRA for at least five years. Gold members can earn an additional 2% match by maintaining membership for a year after receiving the initial 3% match.

For 2024, investors under 50 can contribute up to $6,500 and those over 50 up to $7,500, potentially earning an extra $65 or $75 on top of regular contributions. Robinhood offers a good selection of U.S.-listed stocks, ETFs, and options, though its security options are more limited than some other brokers.

Robinhood also features a Recommended Portfolio, which includes ETFs tailored to your investment goals and can be customized.

Learn more...

Robinhood Incentive

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Firstrade

Firstrade rounds out our list of top IRA providers, offering both personal and small-business IRAs. These accounts are self-directed as Firstrade doesn't manage investments.

Firstrade's self-directed IRAs allow trading in equities, mutual funds, ETFs, closed-end funds, and bonds. Cryptocurrency trading, offered outside of IRAs, is not available within them.

Firstrade stands out for its vast selection of mutual funds—over 16,000 available to new investors. Its mutual fund screener reveals many lifecycle mutual funds without transaction fees, and many are no-load.

Firstrade provides modest retirement planning resources on its website. It offers several financial planning calculators, though their retirement calculator could be improved by including an option to enter starting balances.

Firstrade has no ongoing fees for its tax-deferred accounts and doesn't charge for closing one. However, paper documents like statements and tax forms may incur fees.

Firstrade accepts rollovers from old employer's retirement plans with no fee and offers up to $200 back for any fees charged by the outgoing firm on transfers valued at $2,500 or more.

Learn more...

Firstrade Incentive

Get up to $250 ACAT rebate and $0 commission trades.

Open Firstrade Account

Best IRA Companies Recap

Investors who want a full-service broker with extensive offerings and learning resources may prefer

Charles Schwab. Those who want fractional shares may prefer Webull, while those looking for a

contribution match program may prefer Robinhood. Firstrade could be a good choice for those seeking a

wide variety of mutual funds and no fees for tax-deferred accounts.

| Broker | Robo | Annual fee | Cancel fee | IRA Versions | Rollover Service |

|---|

| Charles Schwab | Yes | $0 | $0 | 8 | Yes |

| Webull | Yes | $0 | $0 | 3 | Yes |

| Robinhood | No | $0 | $0 | 3 | Yes |

| Firstrade | No | $0 | $0 | 4 | Yes |

Promotions

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.