Overview of Charles Schwab IRA

Schwab is a popular choice for many investors, thanks to its advertising and reputation. But how does it really stack up in key areas, and how does it compare to its main competitors? We’ve looked into it, and here’s what we found.

Range of Products

Schwab offers a wide range of products, including stocks, options, ETFs, fixed-income securities (like STRIPS and CDs), closed-end funds, mutual funds, forex, IPOs, and futures (including bitcoin futures and options on futures). However, it doesn’t offer precious metals, contracts for difference, cryptocurrencies, or warrants.

Customer Service

Schwab has reduced its commission fees but still offers 24/7 phone support. They also provide service in Chinese during certain hours and have international phone numbers for clients outside the U.S.

Schwab offers 24/7 chat support on its website, though we did encounter an incorrect response during our test. The site also has internal messaging.

For those who prefer in-person service, Schwab has over 300 branch locations across the U.S., with additional offices in Puerto Rico, Hong Kong, and London.

Get Charles Schwab IRA

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Learning Materials

Schwab’s website is packed with educational resources suitable for both beginners and experienced investors. Topics include investment taxation, life events like marriage or divorce, retirement planning, job changes, and education savings.

The site features several calculators, like a life insurance calculator that helps determine how much coverage you need based on factors like mortgage balance, annual income, and debt.

There are many articles covering the products Schwab offers, such as how to read option chains, understanding preferred shares, and the basics of closed-end funds. The site also hosts numerous videos.

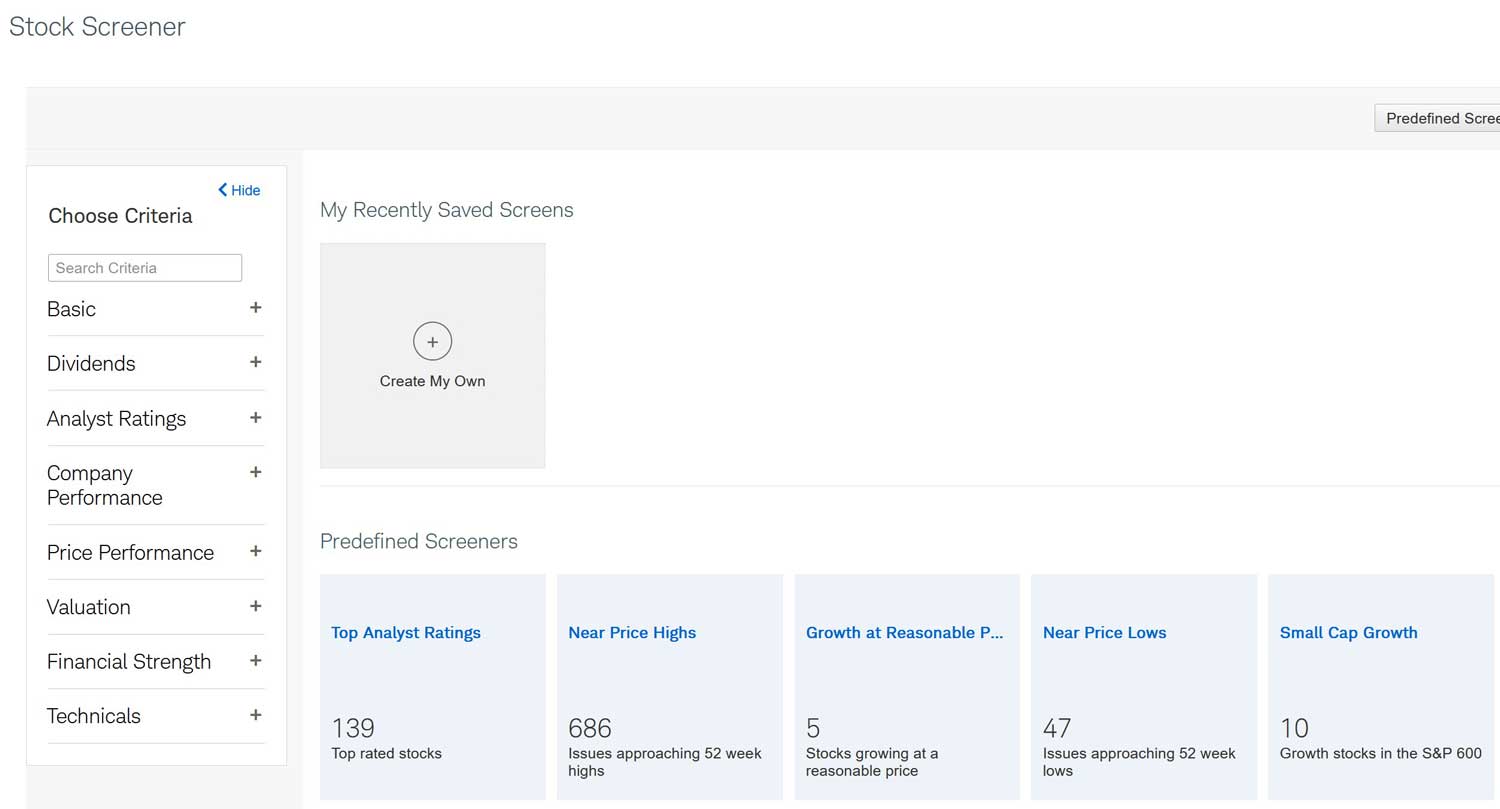

Schwab’s screeners help investors find undervalued opportunities in the market. The equity search tool has numerous variables, including analyst ratings, PEG ratio, cash flow per share, and 5-day stochastic oscillator.

Stock profile pages offer detailed information, including free PDF reports from sources like CFRA, Schwab, and Thomson Reuters.

Website

Schwab’s website is loaded with tools and information, which can sometimes make it challenging to navigate. However, the abundance of features is a major benefit for Schwab’s clients.

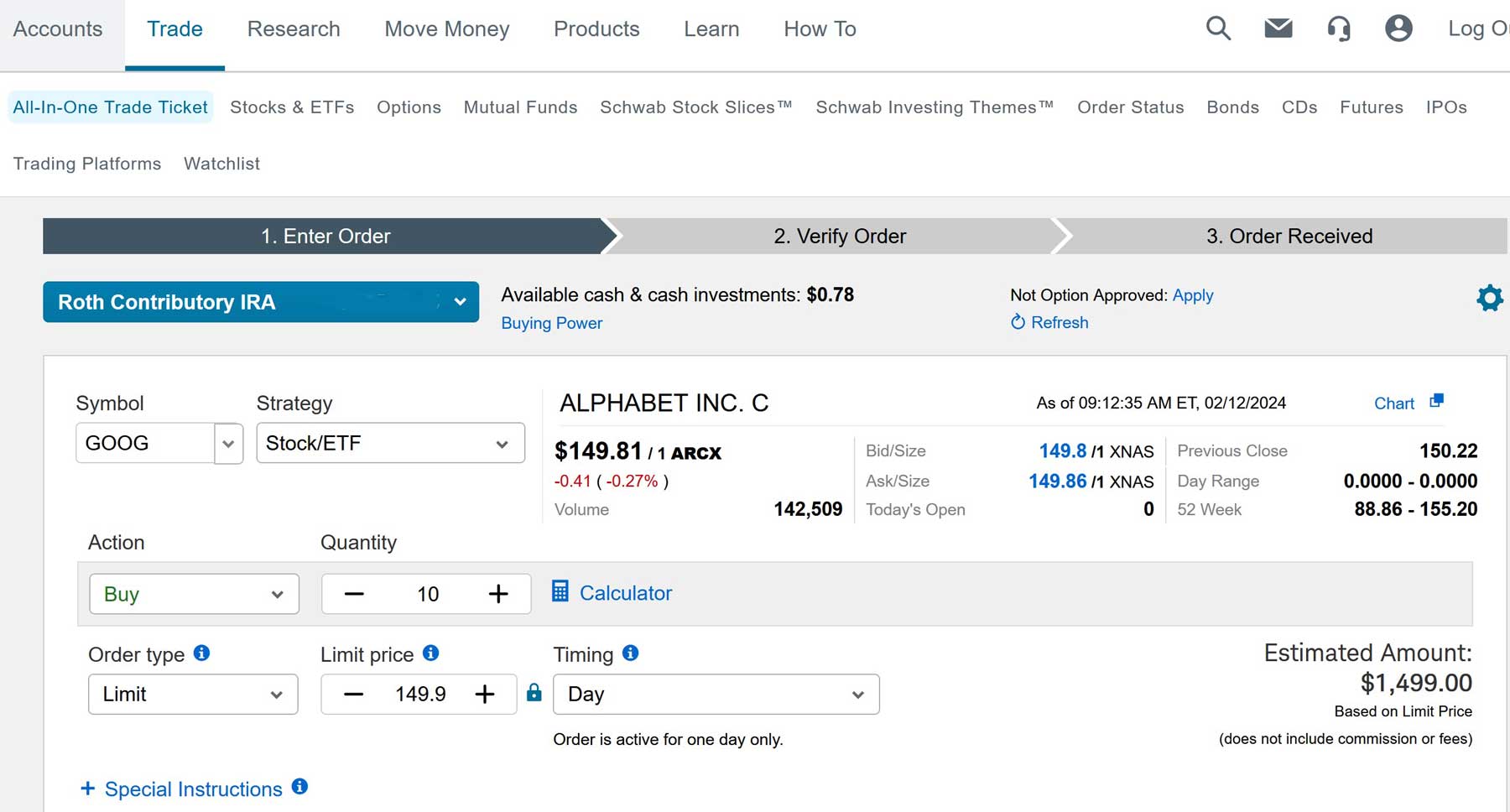

One feature is a trade bar at the bottom of the screen, which provides trade data like volume and the day’s high and low prices for any entered ticker symbol. It also offers pop-up charts and news articles. However, orders cannot be submitted directly from the trade bar; this must be done via the order form on the webpage. The site supports various order types, including market, limit, trailing, and stop orders. Timing options include day, GTC, fill or kill, and extended hours.

The site’s charting tools include around 50 technical indicators, numerous drawing tools, comparisons, eight display styles, and three company events. One downside is the inability to display a chart across the full width of the monitor.

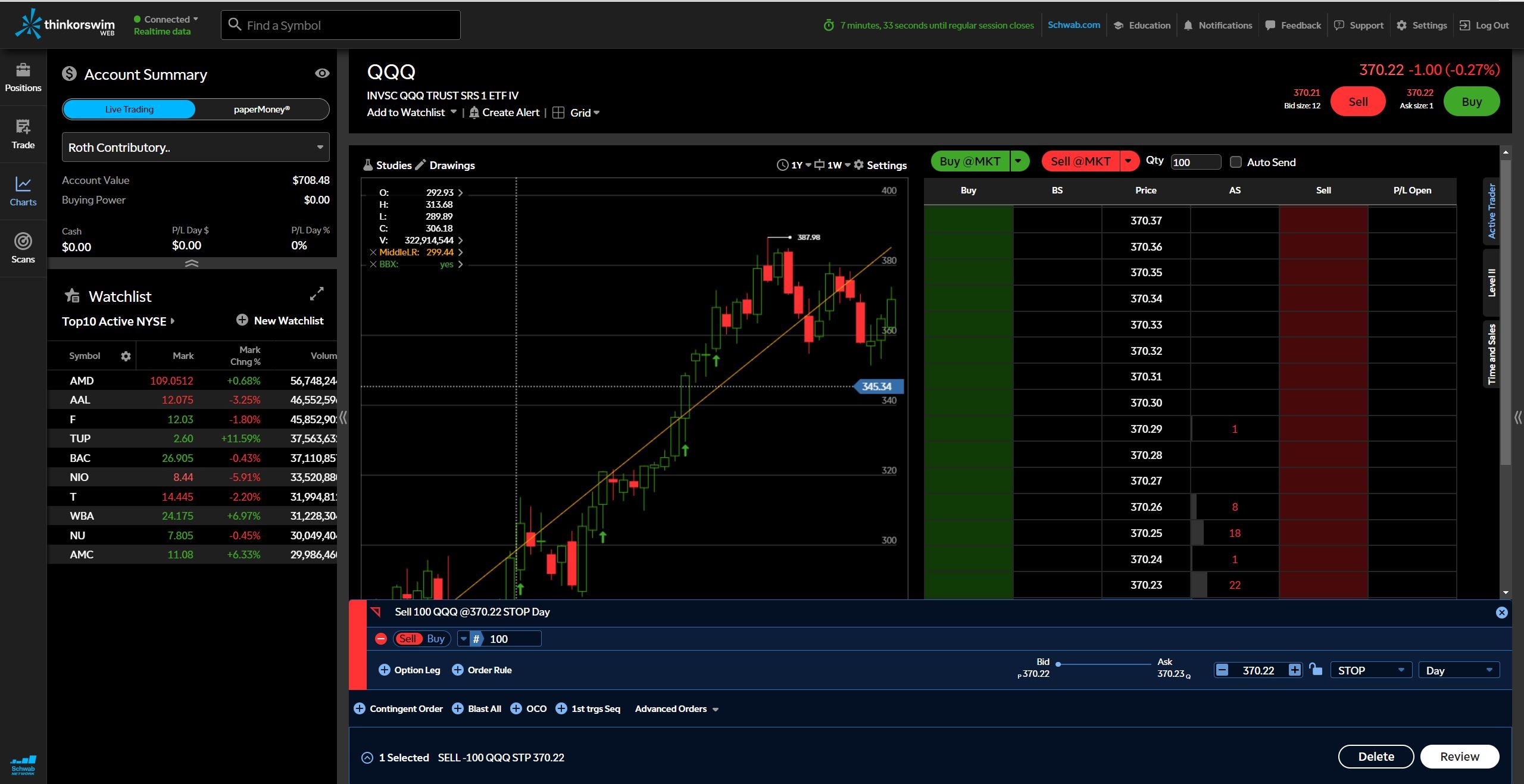

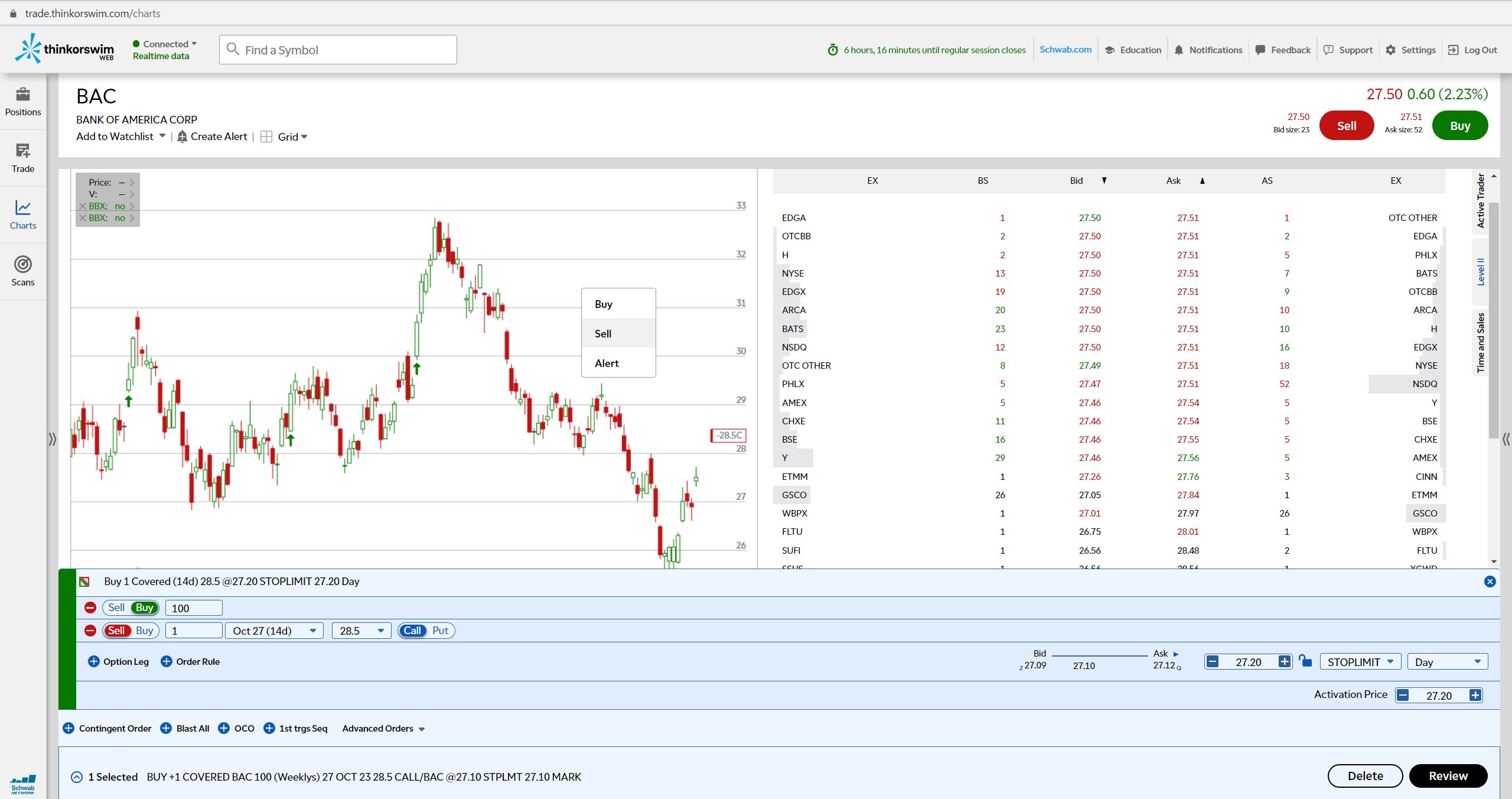

Thinkorswim is a browser platform specializing in futures trading, though it also supports other products. It compensates for the website’s limitations by offering full-screen charting and additional features on its trade ticket, like triggers.

Mobile App

For those who prefer mobile trading, Schwab’s app is available for both phones and tablets. It includes features like ACH transfer, mobile check deposit, and bill pay, all without fees. The app integrates watchlists, displays heat maps, and highlights market movers.

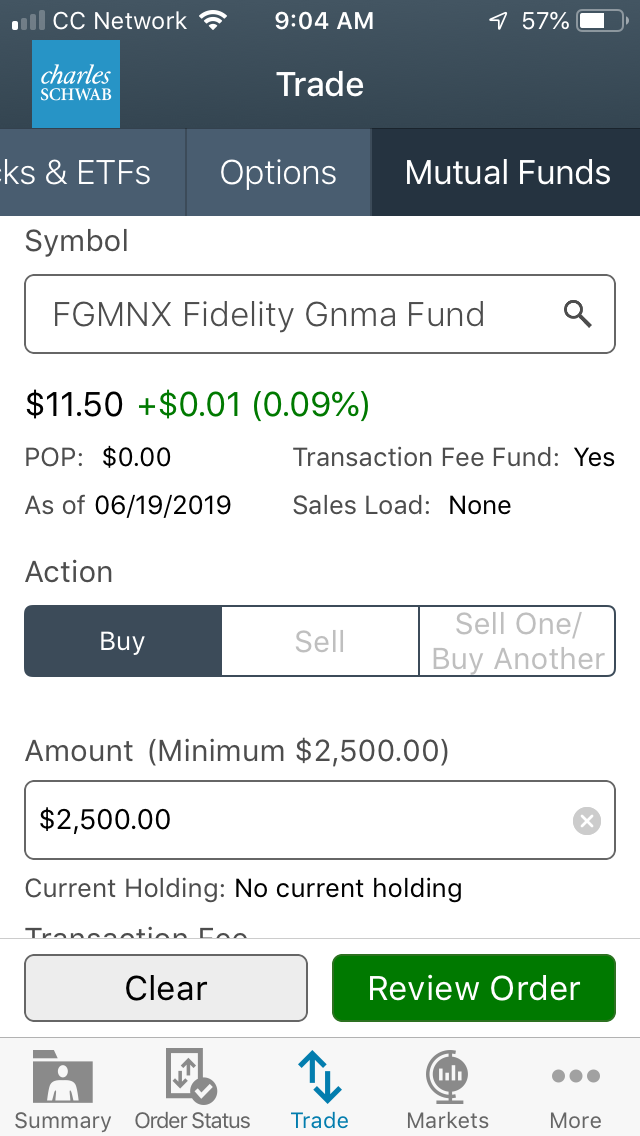

The app allows trading of stocks, ETFs, closed-end funds, options, and mutual funds. While it lacks advanced features like direct-access routing and Level II data, it offers multiple order types and duration options.

The app’s charting tools include events, comparisons, and technical indicators. It supports seven graph styles and up to 40 years of price history, which is impressive for a mobile platform.

Other Trading Tools

For those who prefer not to use Schwab’s mobile app, website, or browser platform, there’s thinkorswim, a desktop program loaded with tools. The software is free to use and doesn’t require an account. It offers CNBC streaming, Level II quotes, and technical analysis tools from Recognia. Option chains display not just calls and puts, but also several multi-leg trade ideas.

The order ticket on Edge includes direct-access routing, customization options, and several order types. The charting feature supports full-screen mode, various technical studies, drawing tools, and right-click trading. Price action can be tracked from tick-by-tick up to 20 years.

Schwab also offers a skill for Amazon Echo and Echo Show, which provides quotes, creates watchlists, and broadcasts market updates. There’s also an app for Apple Watch that shows a small graph with the current trade price, volume, high and low prices, and bid-ask spread. You can also access your watchlist.

Exchange-Traded Funds

Schwab offers commission-free trading for all ETFs. The website has robust tools for trading these and other U.S.-listed funds. The screener can search for funds based on various criteria, including total assets, price range, Morningstar rating, cash flow growth, 30-day yield, and sector exposure.

An ETF’s profile page provides a wealth of information, including a link to the fund’s prospectus and analysis from Market Edge.

Schwab’s Select List features pre-screened funds chosen by the company’s investment advisors based on their low expense ratios, though we hoped for more in-depth analysis.

Get Charles Schwab IRA

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Mutual Funds

Schwab’s mutual fund selection is decent, though not extensive, with around 5,867 funds available. Of these, 3,456 carry no transaction fee and no load.

Schwab’s mutual fund screener offers numerous criteria, including top ten holdings, fund strategy, Sharpe ratio, tax-equivalent yield, distribution frequency, and more. Scans can be saved or detached into a separate window, and pre-defined screens are available.

Mutual fund profile pages at Schwab provide detailed data, including information on automatic investing eligibility, gross expense ratio, top holdings, growth of $10,000, and management details.

Schwab also offers a personalized portfolio builder that creates diversified portfolios using ETFs and mutual funds. The tool asks questions about taxes, risk profile, and time horizon to recommend investments.

Retirement and Education Accounts

Schwab offers a variety of account types, including a self-employed 401(k) and multiple Individual Retirement Accounts (Roth, Traditional, Inherited, Custodial, SIMPLE, and SEP). You can also transfer a retirement plan from a former employer into a Schwab IRA, and annuities are available.

For education savings, Schwab offers a 529 plan, a Coverdell Education Savings Account, and a custodial account.

Schwab Fees, Commissions, and Account Policies

Schwab charges $0 for stock and ETF trades. Options cost an additional 65 cents per contract. The mutual fund transaction fee is $49.95 on the buy side only. Futures contracts are $1.50 per contract per side, and options on futures have the same pricing.

Fixed-income securities cost $1 each, with a $10 minimum commission and a $250 maximum. Preferred stocks have no equity commission, and Treasury debt has no commissions, though there may be a markup on purchases and a markdown on sales.

These fees assume online trading. Using Schwab’s automated phone system adds a $5 surcharge, and a live representative costs an extra $25.

Schwab has eliminated all account fees, including for both taxable and nontaxable accounts. There are no account minimums or deposit requirements, except for a charitable trust, which has a $5,000 minimum balance.

Free Charles Schwab IRA

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Managed Accounts and Financial Advice

Schwab offers the world’s cheapest robo-advisory service, costing 0.00%. The service is free because a large cash position is held at Schwab Bank, and the ETFs in the program are Schwab ETFs. However, these are conflicts of interest. There’s also a $5,000 minimum deposit requirement.

Schwab also offers a hybrid service that combines a computer algorithm with a CFP®-certified human financial advisor. This program requires a $25,000 minimum and a $30 per month advisory fee, plus a one-time $300 planning fee. These fees provide a financial plan, ongoing access to the financial planner, and some website tools not available with the free plan.

Traditional plans are also available, with fees ranging from 65 to 135 basis points, depending on the securities chosen. Stock accounts require $100,000, while balanced and fixed-income accounts require $250,000.

Cash Management

Schwab clients can open checking or savings accounts with Schwab Bank. These accounts are linked to brokerage accounts. The checking account comes with free checks and a Visa debit card. The website offers a feature to switch the card on and off. Schwab does not offer an FDIC sweep program, as Schwab Bank is the only option. However, Schwab does provide unlimited global ATM fee refunds, which is unique.

International Trading

Schwab offers a Global Account that allows access to foreign markets, or you can add global access to an existing brokerage account. Twelve foreign securities markets are available in local currencies, including Australia, Finland, Japan, and the UK. Schwab provides non-professional traders with real-time quotes.

Recommendations

Schwab is a solid choice for investors looking for a full-service firm that offers a wide range of services at reasonable prices. With its educational resources, Schwab is especially good for beginners. Its no-fee policies make it a great option for smaller accounts, and its IRAs are definitely worth considering.

Charles Schwab IRA Review Summary

Schwab offers great value with many useful services. While it may not be the best for mutual fund, option, and forex traders, it’s an excellent choice for everyone else.

Open Charles Schwab IRA

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Updated on 7/19/2024.

|