Account Transfers Between Schwab and Acorns

Moving a brokerage account from Charles Schwab to Acorns or from Acorns to Schwab is possible, although only if done in a very specific way. This is because Acorns doesn’t accept or send ACAT transfers. Therefore, an alternative method must be used in either direction.

Transfer an Account from Charles Schwab to Acorns

First, you need to open an Acorns account.

Acorns will only accept transfers of cash. It will not accept transfers of securities through any

method, such as DTC, ACAT, or otherwise. Therefore, to move an investment account from Schwab to

Acorns, the first step is to sell everything in the Schwab account so that all holdings can be turned

into cash.

Remember that selling securities in a taxable account could result in tax implications, and withdrawing

cash from a tax-advantaged account could do the same. Therefore, be sure to consult with a licensed tax

pro before committing to either course of action.

Once the Schwab account has been reduced to cash, it’s time to move this money to a linked checking or

savings account. Before this migration can be accomplished, sales may need to settle, which could take

a couple of business days in the case of stocks and ETFs.

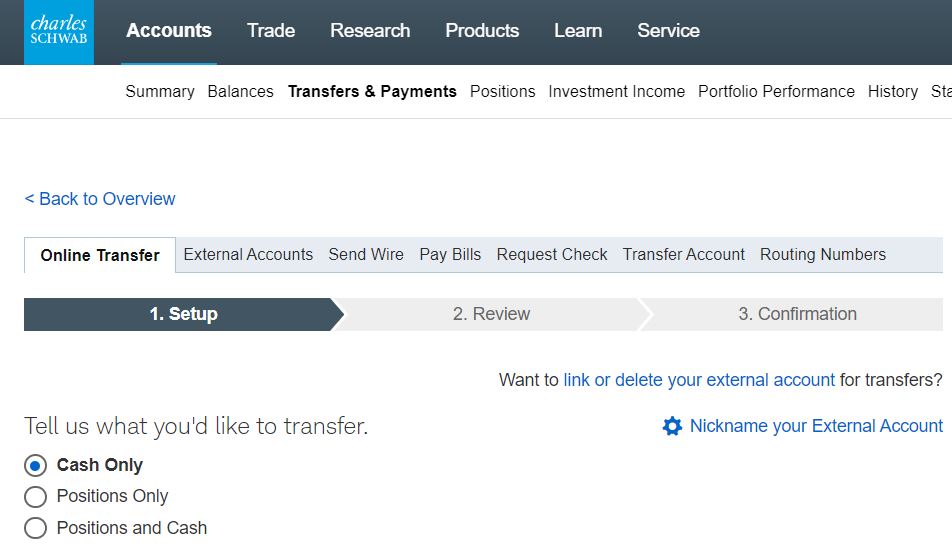

Once the cash is ready to be moved out, head over to the More page on the Schwab mobile app (find the

More icon in the bottom menu) and select Transfers & Payments. On the next page, tap on Transfers and then complete the form to transfer funds to a linked bank account.

If you don’t have a bank account linked to the Schwab account, one can be added on the website. The

mobile app doesn’t have this capability.

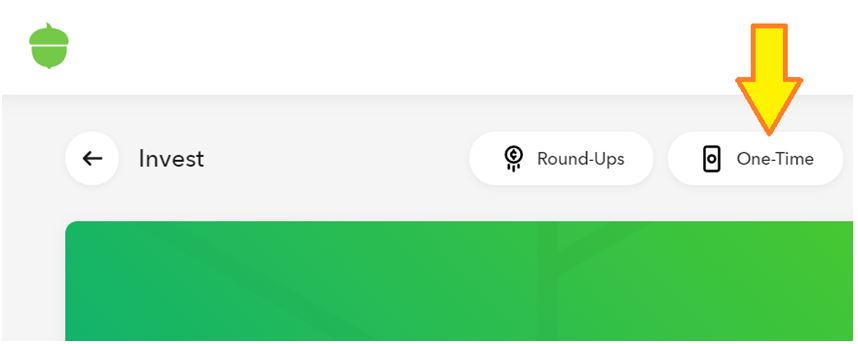

Once the funds arrive in the external deposit account, you’ll need to send these funds to the brokerage

account at Acorns, which should be open at this point. To make a deposit into the new Acorns account, a

one-time deposit or recurring deposit schedule can be established using either the mobile app or website.

Once the funds arrive in the Acorns account, the broker’s digital investment guru will allocate the

money into a variety of low-cost ETFs.

Open Acorns Account

Open Acorns Account

Transfer an Account from Acorns to Charles Schwab

Going in the other direction will follow a somewhat different path if you want to keep your ETFs. These can be moved into a self-directed account at Schwab but not into a robo account (Schwab will only allow cash to go into an automated account).

To push securities into a self-directed account, a non-ACAT transfer out from Acorns is possible. Notice that we said, “possible,” not easy or convenient. Here are the steps:

(1) Open a Charles Schwab account.

(2) Contact Schwab and request a non-ACAT transfer from Acorns. You will need physical paperwork for the transfer.

(3) With the physical paperwork in hand, you’ll need a medallion signature guarantee on it. This can be obtained at a local financial institution.

(4) Submit the final paperwork to Acorns via email (help@acornssecurities.com) or snail mail:

Acorns Securities

ATTN: Account Transfers

5300 California Ave, Bldg 1

Irvine, CA 92617

After Acorns receives the paperwork, it will email the account holder for verification. If Acorns doesn’t receive a response confirming the transfer, it will cancel it.

Only whole shares can be moved out of Acorns. The broker will convert any fractional shares into cash, and this cash balance will be moved to a linked bank account.

To move an Acorns account into a robo account, the entire Acorns account will have to be liquidated to meet Schwab’s cash-only policy. This could actually be easier because of the elimination of the bureaucracy inherent in the non-ACAT transfer Acorns offers. But again, selling will be required to obtain the cash that will be withdrawn. Either event could result in tax implications.

Free Charles Schwab Account

Open Schwab Account

Possible Cost of Switching

Schwab doesn’t charge commissions on sales of most US-listed stocks and ETFs, but liquidation of other assets could carry fees. There could also be a fee for a medallion signature guarantee.

How Long Does an Account Transfer Take?

Transferring from Acorns to Schwab could take a few weeks due to the amount of red tape involved. Going the other way could face a similar time to completion due to selling assets, waiting for the trades to settle, moving cash to a bank account, waiting for the cash to be available for withdrawal, and finally transferring to Acorns.

|