Transfer from Cash App to Charles Schwab

Getting assets from Cash App to Schwab is easier than you think. Just follow our user-friendly guide.

Transfer Stocks from Cash App to Schwab

First Step: Open a Schwab robo or self-managed account. If you already have one, it will suffice if it meets the following conditions:

- Has the same name on it as the Cash App account.

- Is an individual taxable account. Cash App only offers this type of account, and the two accounts must match exactly.

Second Step: Prepare the Cash App account for the upcoming transfer. Any cryptocurrencies in the account will need to be handled appropriately because these digital assets can’t be moved in an ACATS transfer, which is what we’re fixing to do here. Digital currencies should be handled in one of three ways:

- Sell.

- Leave them behind in a partial transfer.

- Move to a second Cash App account and perform a partial transfer.

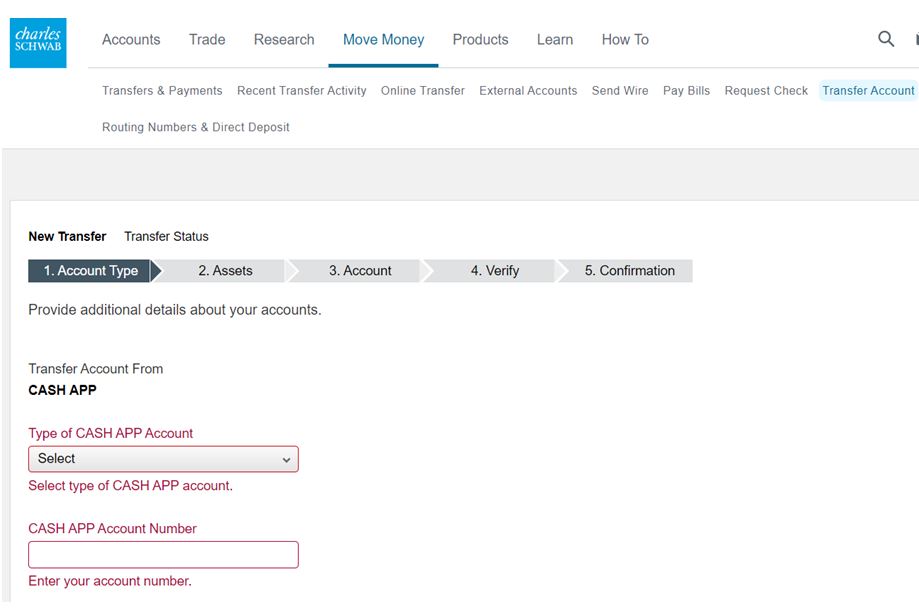

Third Step: Request the ACATS transfer. This will be handled by Schwab, so log into its website and submit an account transfer request. Just follow these prompts on the site:

Move Money -> Transfers & Payments -> Transfer an Account

On the transfer form, specify Cash App as the outgoing brokerage firm. Be sure to use your full Cash App account number, including the word CASH and any other letters in the account number. Submit the transfer e-form when everything looks okay.

Cash App does charge $75 for its leg work on this deal. Schwab might reimburse it. Contact Schwab through phone or chat to request a refund.

Free Charles Schwab Account

Open Schwab Account

Transfer Money from Cash App to Schwab

First Step: To move cash, you’ll need to get a Cash Card from Cash App. This is easy to do on the company’s app. Tap on the Cash Balance tile that appears on the main screen. Follow the prompts to make your request.

Second Step: Once you have that Cash Card, you’ll see account and routing numbers in the app. Use these at Schwab to link the Cash App account to either an investment or bank account with Schwab. On Schwab’s mobile app, tap on the Move Money icon in the bottom menu to link the Cash App account.

Third Step: Pull some cash into Schwab from Schwab’s mobile app or website. On the former device, go back to the Move Money section and you’ll see the ACH transfer form. An ACH transfer is quite a bit faster than an ACATS transfer. Expect about 1 to 3 days instead of 5 to 8 days.

Alternative: It’s also possible to perform an instant transfer between Cash App and Schwab Bank (but not Schwab brokerage) by using the debit card from a checking or savings account with Schwab. Simply enter that number on the Cash App. Look for the Add Cash button on the home menu to do this. Once added, it will be possible to perform an instant ACH transfer from Cash App to Schwab. There is a fee for this.

|