Charles Schwab vs Betterment 2024

Robo-Investing at Betterment versus Charles Schwab

Robo-advisory accounts are available at Schwab and Betterment. There are some similarities, but very important differences as well. Let’s take a close look at the computerized investment services at the two brokers, and see if one can be considered the better value.

Betterment

The robo-advisory service at Betterment costs 0.25% for the most entry-level plan. It includes tax-efficient investing methods with low-cost ETF’s. There is no minimum balance required to get the company’s lowest management fee.

The next plan is called the Plus package. It costs 40 basis points per year and requires $100,000 to begin. The service includes one phone call per year with investment advisors that hold a Certified Financial Planner license. Betterment promises “additional account monitoring by our team of licensed experts,” but the company doesn’t go into detail as to what exactly that means.

The highest-tier plan is called Premium. It costs 0.50% and also requires a hundred grand to start. The advantage of this service over the Plus is that unlimited phone calls with CFP professionals are available.

With all three plans, Betterment imposes to transfer fees for withdrawing or depositing funds. Rebalancing of any portfolio is done automatically and costs nothing extra. There are also no commissions on any ETF trades. (All three plans trade only exchange-traded funds with low management fees.) The broker also has a satisfaction guarantee.

Betterment is so confident that you’ll like its robot’s investment decisions that the broker provides a free month of service for a $10,000 deposit. An opening deposit of $25,000 earns two months of free service, while half a million dollars garners a full year of computerized management at no cost. Funds must be received by the firm within 45 days of account opening.

A Betterment account has no minimum balance, and no management fees are charged to accounts with a zero dollar balance. The broker offers both taxable and retirement accounts. Trusts, IRA’s, and employer-sponsored 401(k) plans are available.

Accounts that are cancelled before a month is over receive a prorated rebate of Betterment’s management fee. The broker also doesn’t charge a dime for balances above $2 million.

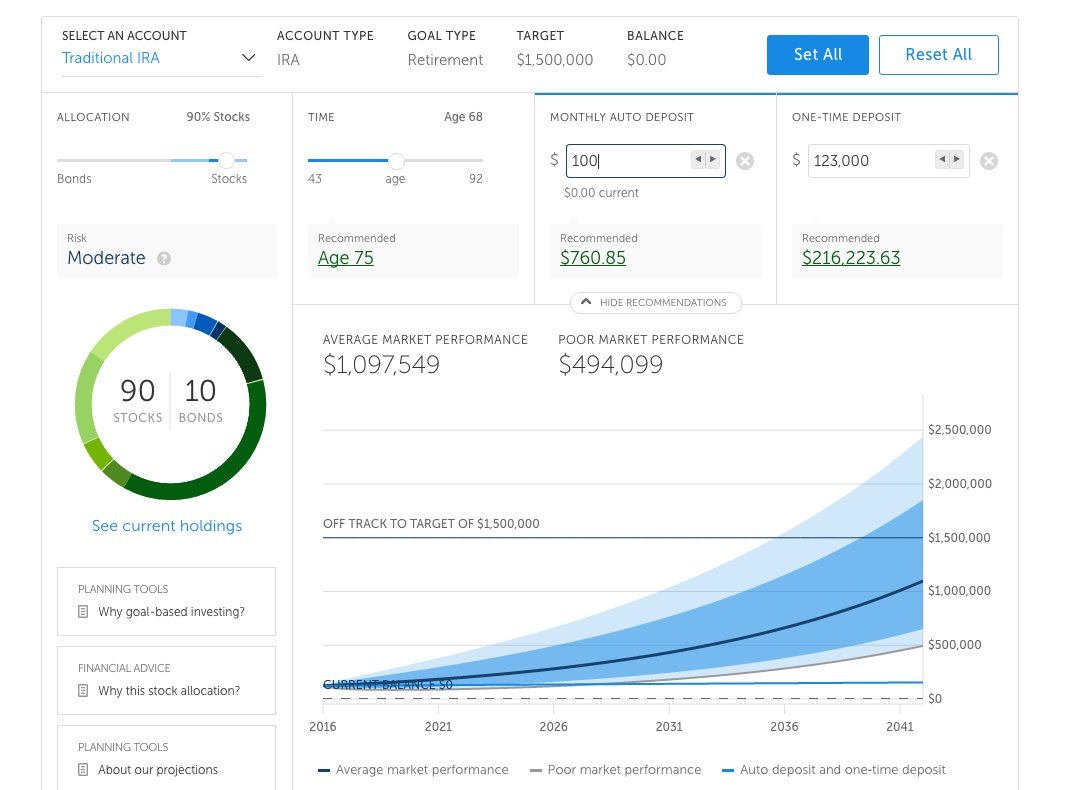

The Betterment website hosts a very brief questionnaire that recommends a model portfolio based on three issues: age, retirement status, and annual income.

Free Charles Schwab Account

Open Schwab Account

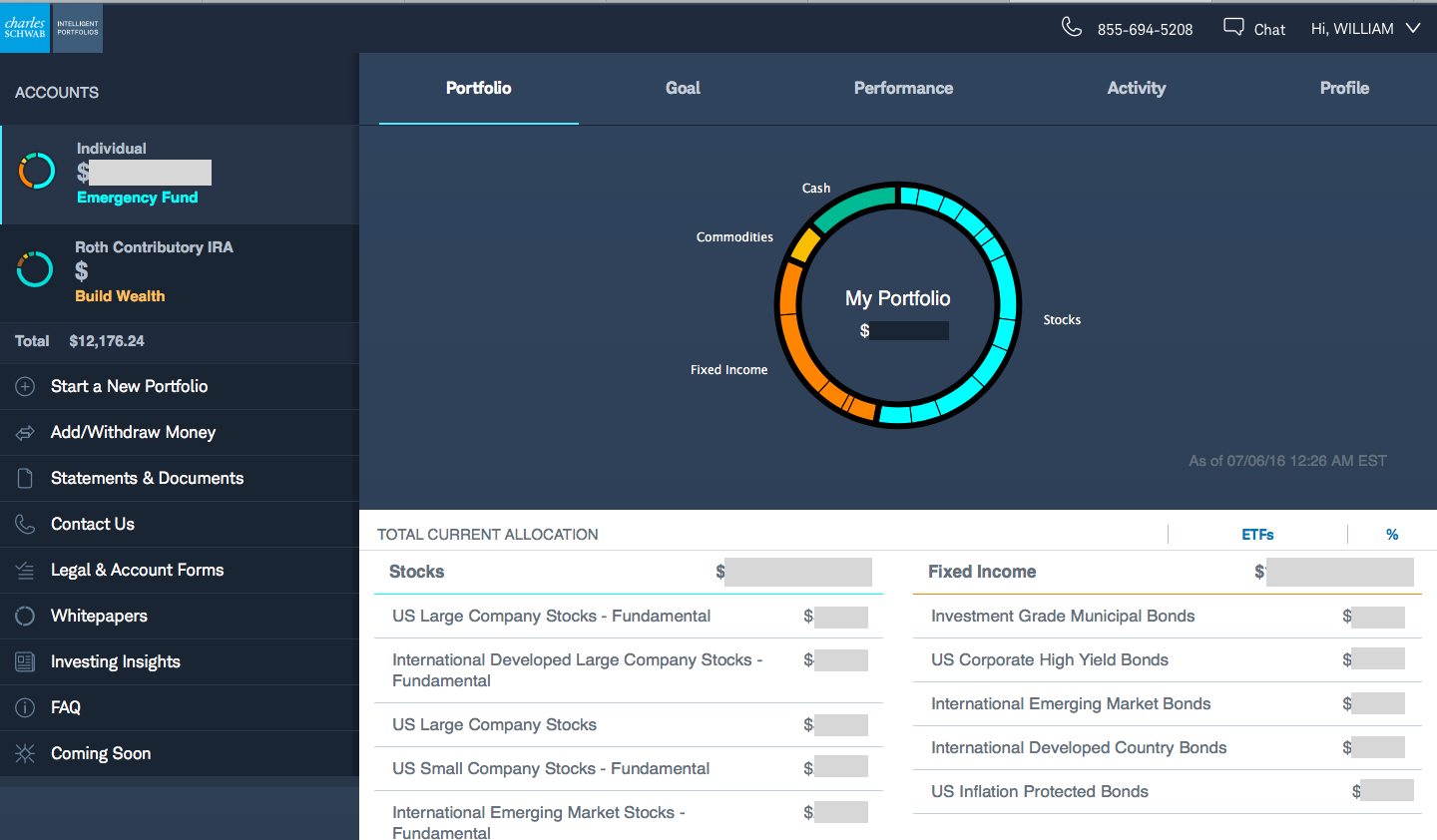

Charles Schwab Intelligent Portfolios

A far more thorough questionnaire can be found on Schwab’s website for its robo-advisory service, Intelligent Portfolios. It asks twelve questions, still very brief, but more comprehensive than Betterment’s survey. Schwab’s assessment incorporates the user’s investment knowledge, risk tolerance, initial deposit, and other variables.

Schwab has established an unsurpassable standard in the brokerage industry by charging nothing for its robotically-managed accounts. That’s right, Intelligent Portfolios is free. How exactly does Schwab do this? It does this, controversially, by building a portfolio that it’s able to make money off of. Schwab and its affiliated companies earn revenue from the cash and securities in robo accounts. The service invests in Schwab ETF’s. The company also earns income by providing services related to third-party ETF’s that can be traded in Intelligent Portfolios. The broker also earns income from market centers where ETF trades are routed.

Intelligent Portfolios also uses an above average cash position. Schwab uses this cash to earn revenue. An Intelligent Portfolios account normally has around 8-9% in a cash position, whereas a Vanguard mutual fund might have less than 1% in cash. Obviously, a zero management fee comes at a price. But it also comes with Schwab’s long history of investment success, something that Betterment hasn’t achieved in its very short history.

Unlike Betterment, Schwab requires $5,000 to begin its computerized service. Like Betterment, Schwab charges nothing to place trades in an account, or to rebalance it. An Intelligent Portfolios account has no annual fee.

Schwab’s software program uses tax-loss harvesting strategies when making trading decisions. The company claims that it was able to save an account $10,000 between 2008 and 2015 with tax-loss harvesting alone, assuming the account began with $100,000. That’s a 10% gain just from the program’s tax strategies.

Like Betterment, Schwab’s robo accounts can be set up as taxable vehicles or retirement accounts. Trusts, IRA’s, and 401(k) plans are available.

Other Financial Services

Betterment is strictly a robo-broker. It does not provide self-directed accounts or human-managed services, either. The firm does not provide mutual funds, options, individual bonds, or many other financial services.

Schwab on the other hand offers a wide variety of financial products and services. It offers traditional management, meaning you can hire a human advisor if you don’t like the company’s robo service. A traditionally-managed account starts at 0.90% and decreases to 20 basis points for balances above $1,000,000. There is a minimum investment of $25,000 to begin the service. Besides ETF’s, mutual funds are available here.

Banking services with FDIC insurance are also available at Schwab. The company provides checking and savings accounts with free checks and a Visa debit card, both of which can be conveniently linked to a securities account. ATM fees incurred anywhere in the world are refunded by the broker.

Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Betterment:

Get up to one year managed free.

Charles Schwab vs Betterment - Final Thoughts

Investors looking for the lowest possible cost obviously will find the best deal with Schwab.

Updated on 1/19/2024.