Axos vs Schwab and Others: Cost

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Charles Schwab

|

$0

|

$49.95 ($0 to sell)

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Robinhood

|

$0

|

na

|

$0

|

$0

|

$0

|

|

M1 Finance

|

$0

|

na

|

na

|

$0

|

$0

|

|

Fidelity

|

$0

|

$49.95

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Etrade

|

$0

|

$0

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Axos Invest

|

na

|

na

|

na

|

0.24%

|

0.24%

|

Axos vs Fidelity and Others: Services

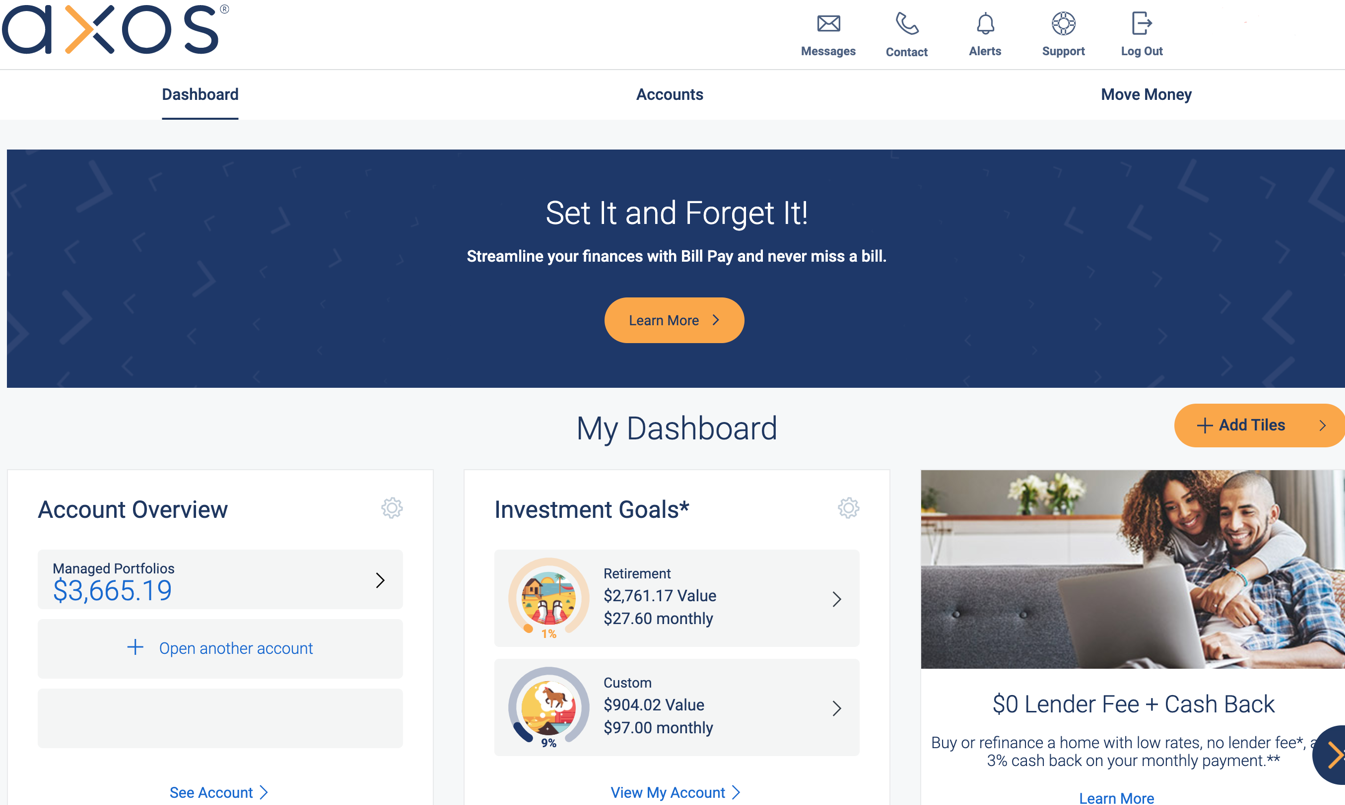

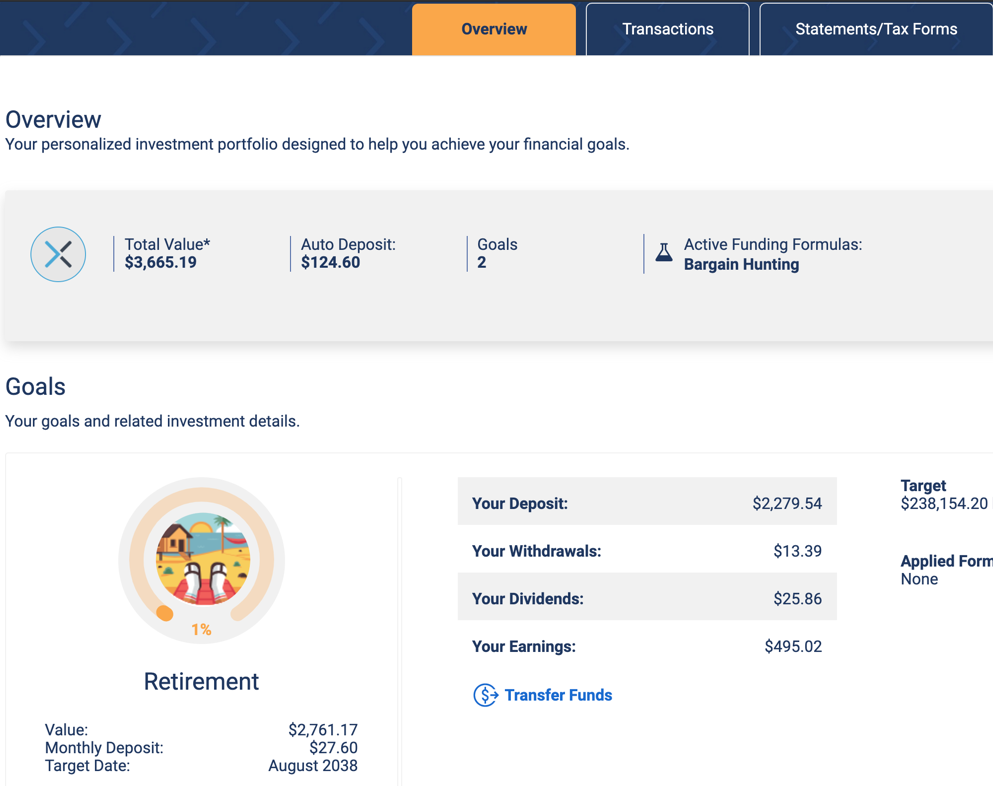

Axos Invest Overview

Today, Axos Invest operates as a part of Axos Bank. It was previously known as WiseBanyan, and the

founders launched this service to give the world its first free financial advisor. What started as

a potentially innovative idea that would make way for users new to investing and those who couldn't

rationalize brokerage firms’ services due to steep fees turned into an unnecessarily confusing and

technically frustrating experience.

General details

- This is a robo-advisor with no human advisor options available.

- To open an Axos account, a new customer has to invest $500 right away (by the way,

the account minimum used to be $1).

- The service is no longer free; the annual advisory fee for account management is 0.24%.

- Axos Invest offers 32 asset classes to create a better-diversified portfolio and minimize the

risks.

- There is a $10 fee for closing an IRA account and a $30 fee for a returned check.

- For IRA account options, three choices are available (traditional, Roth, and SEP).

- The company offers reliable customer service: if an email is sent during their work hours (Monday - Friday, 8am - 4pm PST), the response from a human, not a bot quickly follows.

- All individual investment accounts include unlimited automatic rebalancing and tax-loss harvesting.

Axos Invest Pros

Let's start with Axos Invest advantages, especially since this service has a few great things to offer.

The robo-adviser promises to monitor their users' portfolios for them and charge no hidden fees. So far,

so good. Essentially, if someone is looking for inexpensive management of their funds, needs help

with savings or reaching their financial goals, wants to be hands-off yet still get the benefits

of passively managed investments, this service will do the trick.

Moreover, it is fairly easy to customize a portfolio according to one's needs and priorities.

Axos Invest asks its customers to answer a few questions to evaluate how risk-averse they are.

Based on this, they create a "risk score", which the client can adjust later, from conservative to

moderate to more aggressive or the other way around.

This robo-adviser will build the original portfolio based on recommendations to account for users'

goals and financial situation. It is also possible to rebalance it manually later. A client can add

or remove any of the 32 offered investment classes, having more control over their money, compared

to alternative options. In this way, customers can prioritize sectors they believe in or want to

support, for example, blockchain or artificial intelligence stocks, socially minded or small-cap

companies.

Axos Invest Performance

Speaking from personal experience, general returns from Axos Invest with their aggressive portfolio

are surprisingly impressive: around 15% growth since opening an account with them a couple of

years ago.

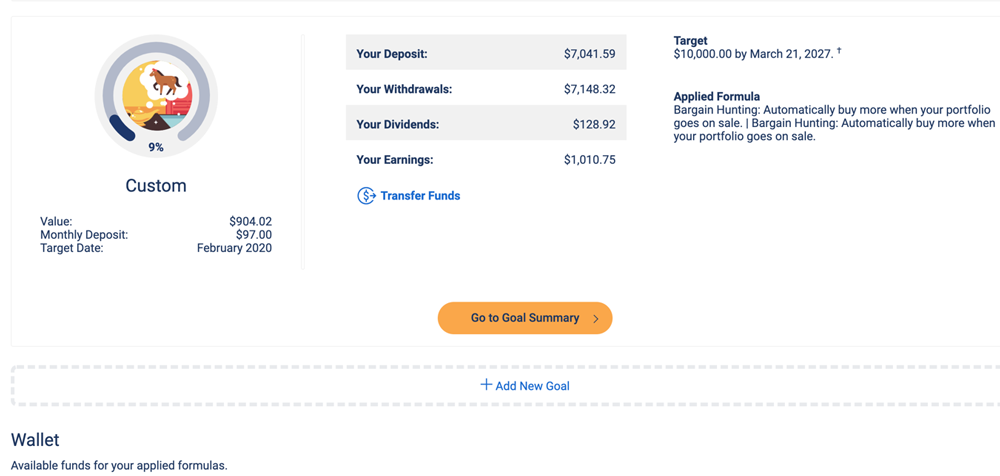

Formulas and Milestones

The company also does a nice job of helping customers achieve their financial goals with several

strategies. There is an option for automating investments with a free feature called Formulas that

only works with taxable finds, not the money in IRA accounts. This is the way to direct additional

funds either from the bank account linked to the profile or from a built-in Wallet that lets set

aside some amount of money with it being readily available for withdrawal. Having these funds not

tied to investments is supposed to make the company's customers feel safer and more prepared for

any kind of emergency. Otherwise, they would have to wait 3-6 business days after selling their

stocks.

Formulas also let clients match funds for dividends paid on their investments or purchase

additional shares if a stock drops in price.

A different feature, Milestones, guides Axos Invest

clients towards their goals. It lets calculate the amounts of money that should be invested to get

closer to reaching their milestones, given particular personal details, such as timeline, income,

and net worth.

Axos Invest Cons

Now onto Axos Invest negatives. Apart from a hefty initial account minimum and lack of access to

human advisers, there are some other major downsides.

For example, sometimes money will just be

sitting in the account: if a user puts money in Cash or Wallet as a "rainy day", emergency fund,

this amount will not be invested. With Wallet, the rule is that the customer manual defines what

triggers it: let’s say, someone wants to buy more stocks if their portfolio drops by 2%. If it

drops by 1.99% or anything below the set value, the money would not be put to use.

Surprisingly, it is very easy to forget that the money sits there at all. It would have been much

more beneficial if Axos would have sent an occasional email, reminding about Waller or suggesting

revisiting the rule to invest and grow the money.

Instead, the company doesn't even make it easy to figure out where the money is in the first place,

since the navigation of the account is often problematic. The interface is overwhelming customers

of the service with misleading features and, in general, unnecessarily convoluted design.

Moreover, there is no option to open a joint account with your spouse or additional custodial accounts

for children.

Additionally, when a client tries to log into their account, the system now requires an

additional step, it sends a one-time security code. There is nothing wrong with the additional security

measures to ensure that only the owner of the account can access it. However, the system that Axos

uses to deliver this passcode either via an email (works) or a phone number (doesn't work) is not the

most reliable one, only leading to more frustrations.

Axos Invest charges a fee. There are plenty of options where you can invest free of charge:

Also, sometimes the pages just crash or show unknown errors for no apparent reasons, leaving the IT

support of this service to be desired.

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

|