Overview of Betterment and Ally

You might be familiar with Betterment, but are you aware of Ally Invest? Before committing to either

brokerage firm, consider this analysis:

First Up Is Methods of Investing

Betterment emerged as one of the earliest robo-advisors and continues to operate an automated ETF

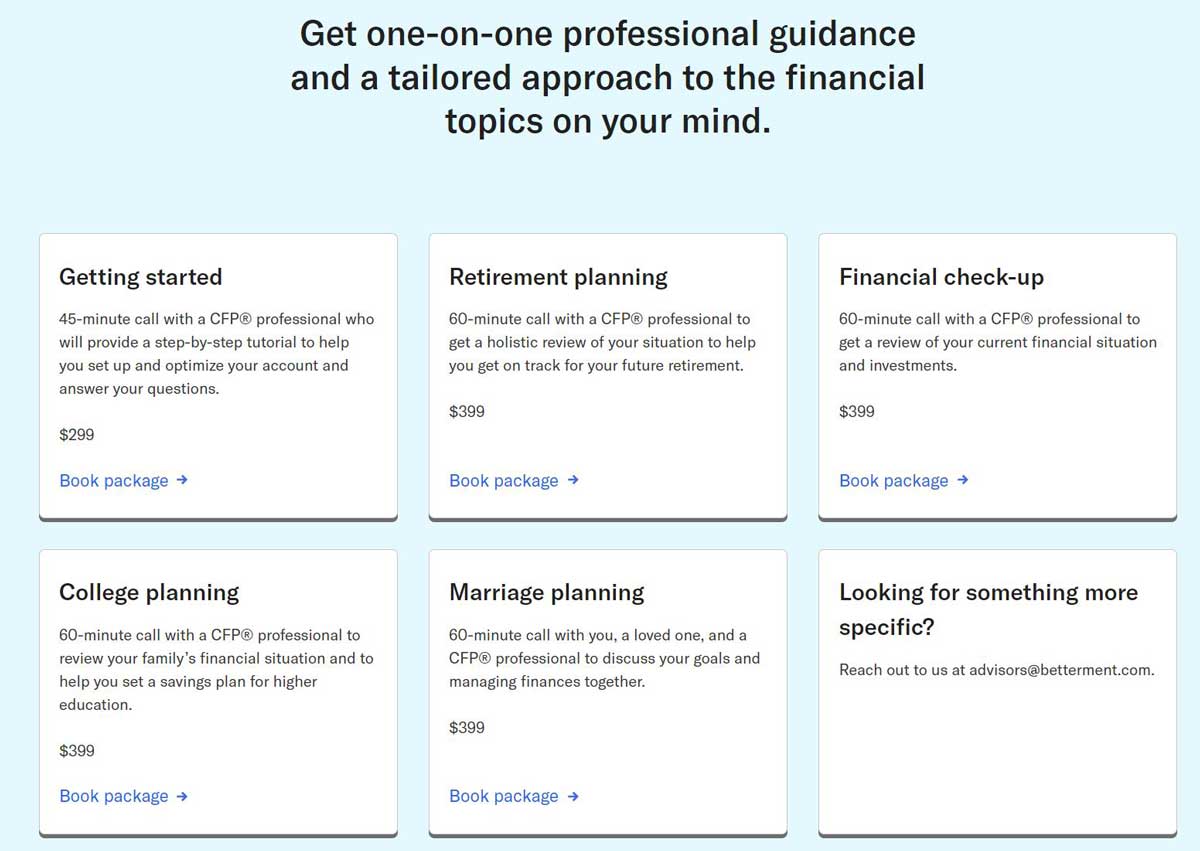

investing service that charges only 0.25% per annum. Clients with $100,000 and willing to pay 40

basis points yearly get unlimited phone consultations with licensed human investment advisors.

Betterment does not offer self-directed investing.

On the other hand, Ally Invest does. The company offers trading in:

- Stocks

- Bonds

- Mutual funds

- ETF’s

- Closed-end funds

- Options

- Forex

Beyond the self-directed alternative, Ally Invest also features a robo service. At a cost of 0.30% (or free with a substantial cash position), the service trades in low-cost ETFs. There are, however, no human advisory options available.

Winner: Ally Invest

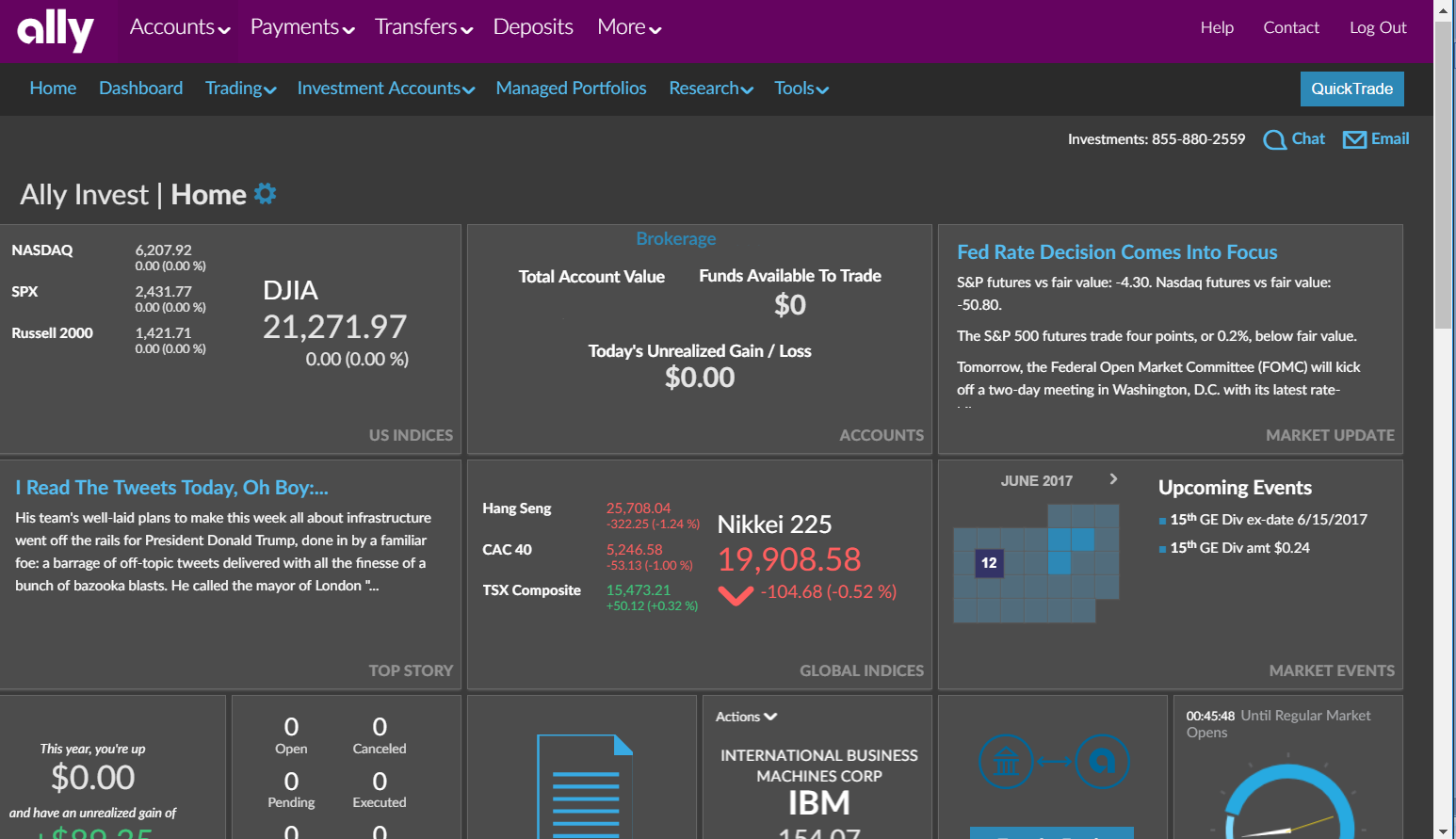

Second Is Websites

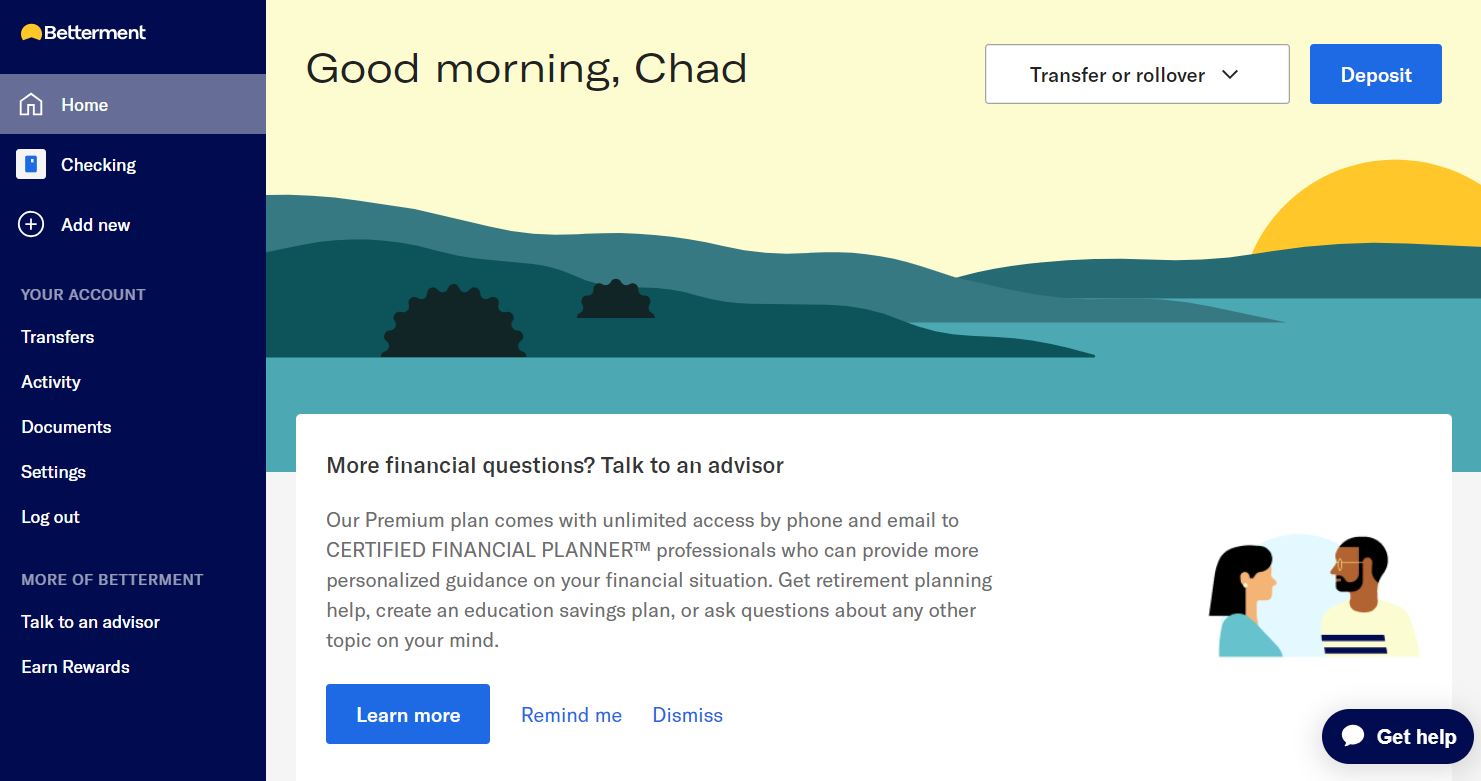

Betterment's website is designed to be straightforward, easy to navigate, and user-friendly. It accomplishes all three. As a result, the site content is relatively limited, which is unsurprising given that the brokerage firm does not support self-directed accounts. A Betterment checking account can be linked to a single login, streamlining access to both deposit and investment accounts within one interface. The Betterment site offers tools to transfer funds, earn rewards, and formulate a financial plan.

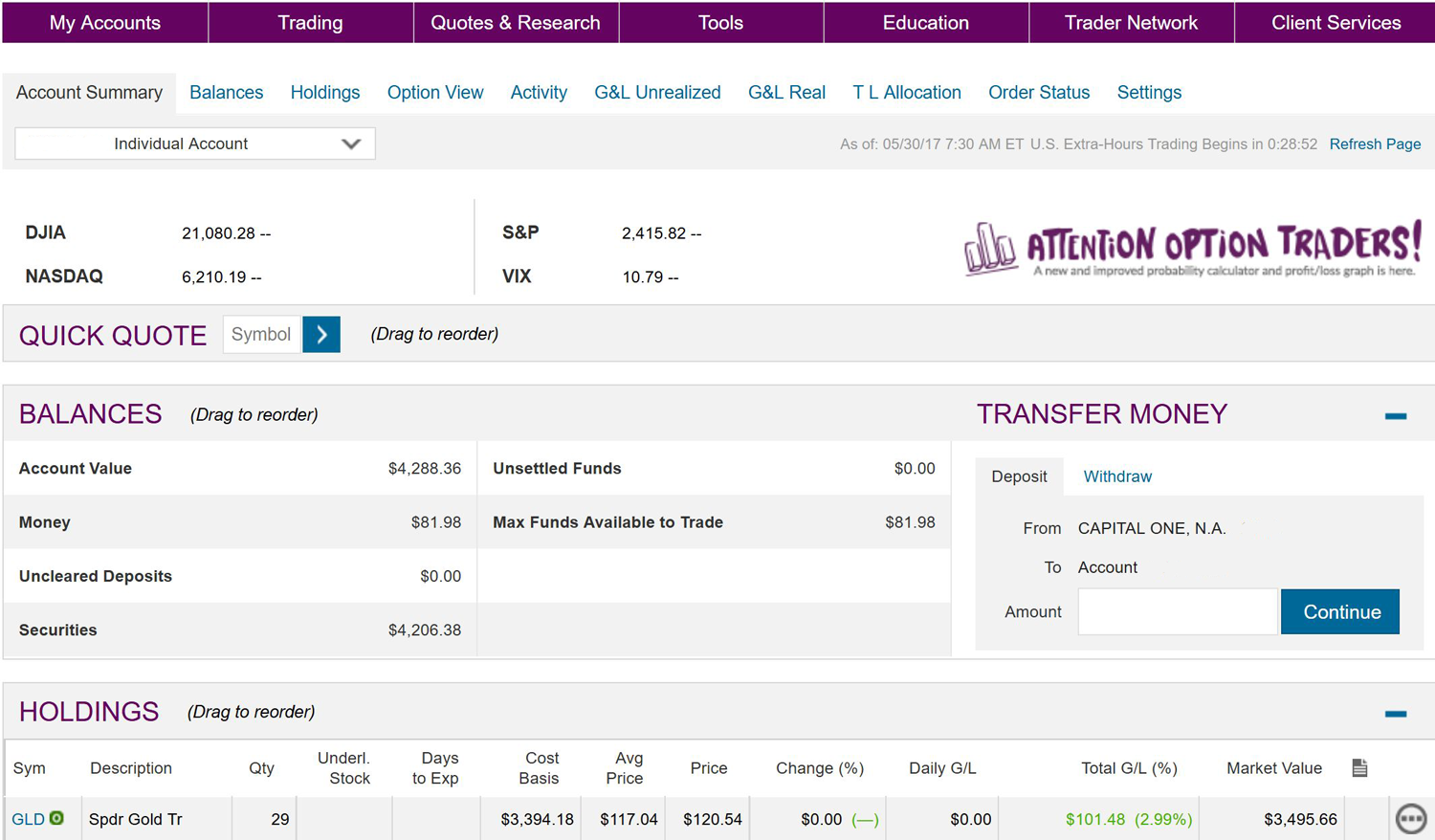

Ally Invest's website, in contrast, boasts a plethora of self-directed tools. These include a trade bar at the bottom of the screen, a gadget that performs several functions, including submitting orders and delivering real-time data on a ticker symbol.

Although the website includes charting, a browser platform offers a superior experience. Launched

from the site, this software provides many advanced options tools, including profit-loss diagrams

and a strategy workbench. Fixed-income securities can also be researched and traded from the platform.

Winner: Ally Invest

Next Is Mobile Apps

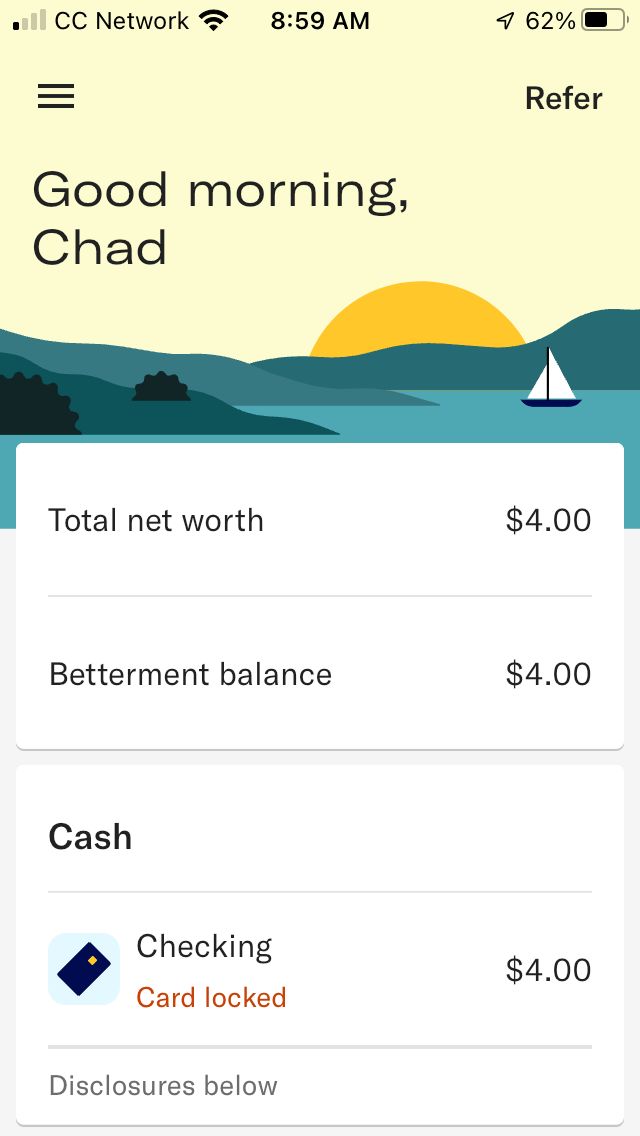

Mobile apps extend the website experience. Betterment's mobile software mirrors much of its website, offering many of the same tools and display features. Like the website, it's possible to link external accounts for a comprehensive financial overview.

The Ally Invest mobile app is incorporated into the Ally Financial mobile app. Here, bank and securities accounts coexist. A main menu includes cash management tools like Zelle transfers and mobile check deposit, both absent from the Betterment app.

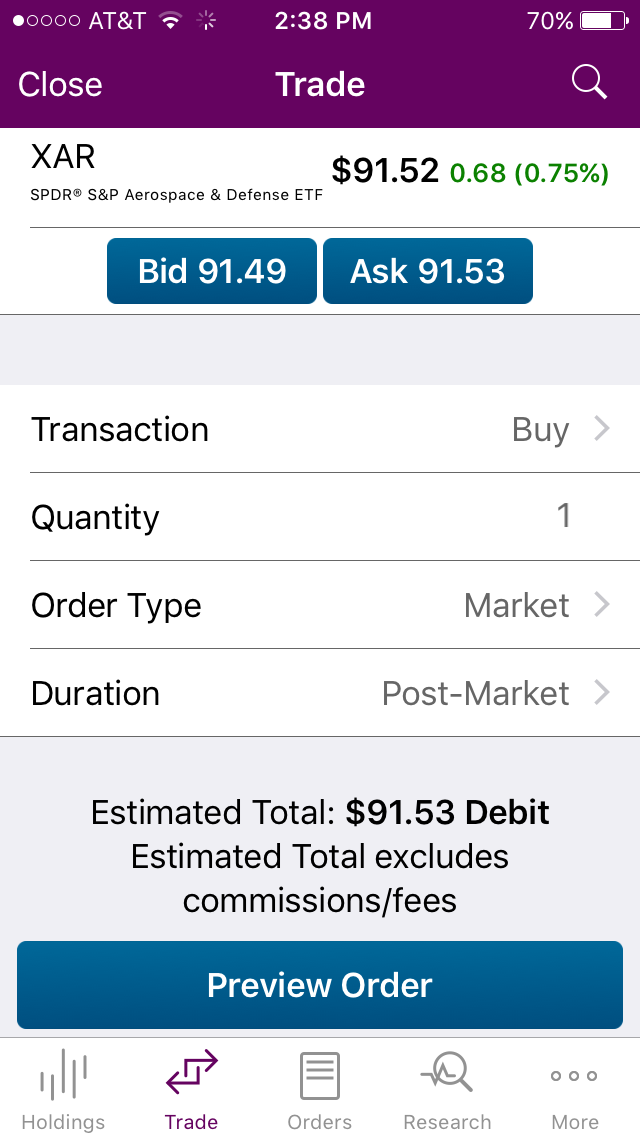

Brokerage tools consist of option chains (spreads are not included), charting with multiple features and display styles, and an advanced order ticket. Trade types comprise stop and stop limit. However, mutual fund trading is not yet available on the app.

Winner: Ally Invest

Fourth Is Desktop Software

Ally Invest clients seeking more than the broker's web-based trading platform might find Quotestream appealing. This third-party platform, accessible through Ally Invest with ten trades a month, offers tools not found on the website. These include time & sales data and option spreads.

Due to Betterment’s robo-only policy, it does not have a desktop trading system.

Winner: Ally Invest

Fifth Is Robo Investing

As already mentioned, Betterment’s robo service costs 5 basis points less per year compared to Ally Invest’s automated program. But there are other differences.

For example, Betterment’s robot engages in tax-loss harvesting. Ally’s software program does not do this. Also, the average expense ratio of the funds used in Ally’s service is 0.07%. By comparison, Betterment’s expense ratio average is 0.11%.

Another difference is that Betterment does not charge account transfer fees, while Ally Invest does

assess a $50 fee to move one of its robo accounts.

Both automated programs provide free automatic rebalancing and socially-responsible options.

Winner: Betterment

Sixth Is Research and Education

Yes, Betterment is a robo-only advisor. But that doesn’t mean it doesn’t offer any investment education. On the contrary, the company has a large online library of learning materials (mostly articles) that cover not just investing, but also personal finance. Here are some examples we found:

- Using a 401(k)

- Buying Real Estate

- How To Avoid Common Investor Mistakes

- Thanks to Ally Invest’s partnership with Ally Bank, it too has many personal financial topics, ranging from buying a car to planning for a wedding. Besides these resources, there are also investment articles and videos. They cover options, bonds, stocks, wealth management, and more.

Winner: Ally Invest

Seventh Is Margin Trading

Ally Invest customers can add margin trading (to self-directed accounts) at very reasonable rates.

Borrowing nothing costs nothing. Borrowing a little costs 13%.

Borrowing more will lower this rate, eventually reaching 8.5%.

Once again, Betterment fails to offer anything in this category.

Winner: Ally Invest

Last, But Not Least, Is Miscellaneous Services

Fractional Shares: Both firms trade fractional shares of ETF’s in their robo programs. Ally Invest does not yet offer fractional-share trading for self-directed clients.

Individual Retirement Accounts: Although both broker-dealers offer IRA’s, only Betterment has the SEP account.

Access to IPO’s: Not available at Betterment or Ally Invest.

Cash Management Tools: Betterment clients can sign up for a Visa debit card. It comes with zero ATM fees and zero forex fees, but check writing is unavailable. Over at Ally Invest, an Ally Bank account (with check writing) can easily be connected to a brokerage account, although Ally Bank restricts the number of ATM fee rebates, and forex fees are always charged on non-US dollar transactions.

Automatic Mutual Fund Investing: Ally Invest does not offer this beneficial service, and of course Betterment does not.

DRIP Availability: Both Ally Invest and Betterment provide dividend reinvesting services (Ally Invest for both robo and self-directed customers).

Extended Hours: Available only with Ally Invest.

Winner: Slight advantage to Ally Invest

Recommendations

Beginners: A robo account at Ally Invest will open up the possibility of self-directed trading. The tools and resources are there in the website for any customer to peruse. For this reason, we think new investors will gain more out of Ally Invest.

Small Accounts: Ally Invest requires a $100 deposit from robo customers. Betterment has no minimum for its basic plan without human advisors. Ally has no requirement for self-directed trading.

Retirement Savers and Long-Term Investors: Because Betterment has one additional IRA type, and because it offers actual human planning services through multiple channels (phone and email right now), we think it would be a better choice than its rival.

ETF & Stock Trading: Ally Invest either with Quotestream or its browser-based platform.

Ally vs Betterment - Judgment

Betterment may have been first, but that doesn’t mean it’s better. Ignore the name and choose

the right broker.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|