Overview of Webull and Fidelity

Fidelity is your traditional brokerage firm, offering a large range of financial services to both online and in-branch customers.

Webull is something very different, but still manages to provide some trading services that Fidelity customers should consider.

Here’s the rundown on these two:

Variety of Investment Choices

Webull is a low-cost firm that survives by cutting costs as much as possible. As a result, the

company only offers trading in stocks, options, and ETF’s (no closed-end funds).

Moreover, stocks and ETF’s that go under $1 in price are placed on a blocked list. Securities that

drop below $10 million in total market capitalization are placed on the same list. The

broker-dealer provides access to over-the-counter market, and penny stocks that

trade on major exchanges are available.

Fidelity clients can buy and sell stocks and ETF’s, plus closed-end funds, mutual funds, and

fixed-income securities. OTC equities are available as well. The broker does offer 4 crypto-currencies.

Fidelity wins the opening category.

Website

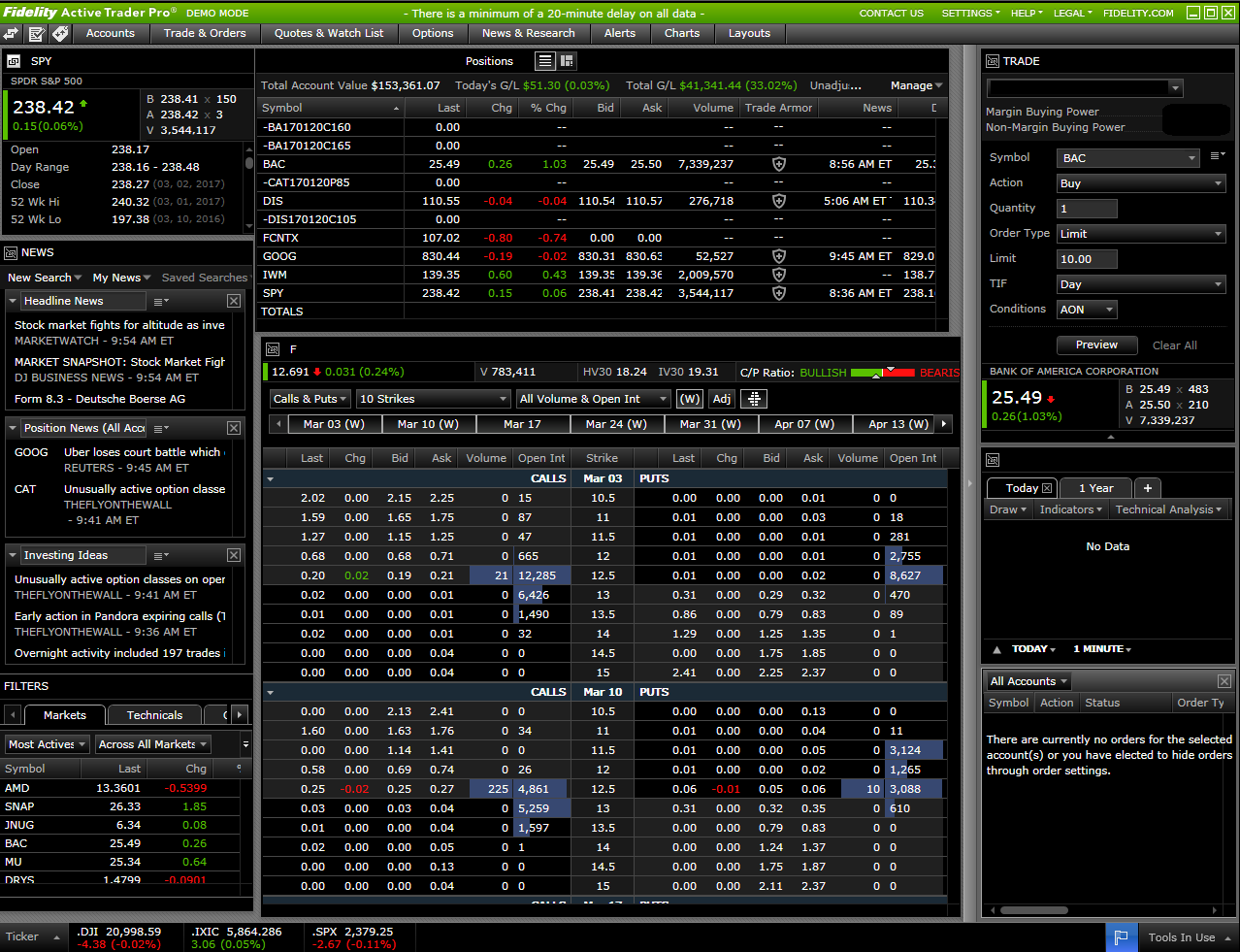

Fidelity traders get a very good website where orders for all securities available can be submitted. Although there isn’t a permanent trade bar sitting at the bottom of the Fidelity website, clicking on a trade button generates a user-friendly pop-up order ticket. This can be used to submit orders for funds and equities, but not options.

Options trading is trouble-free on the Fidelity website. Multi-leg strategies are pre-programmed, a histogram can be overlaid, the amount of open interest can be specified, and several derivative tools are available. These include an IV index and a probability calculator.

Charting on Fidelity’s website offers a lot of sophistication. During our testing, we found technical studies, company events, comparisons, and drawing tools.

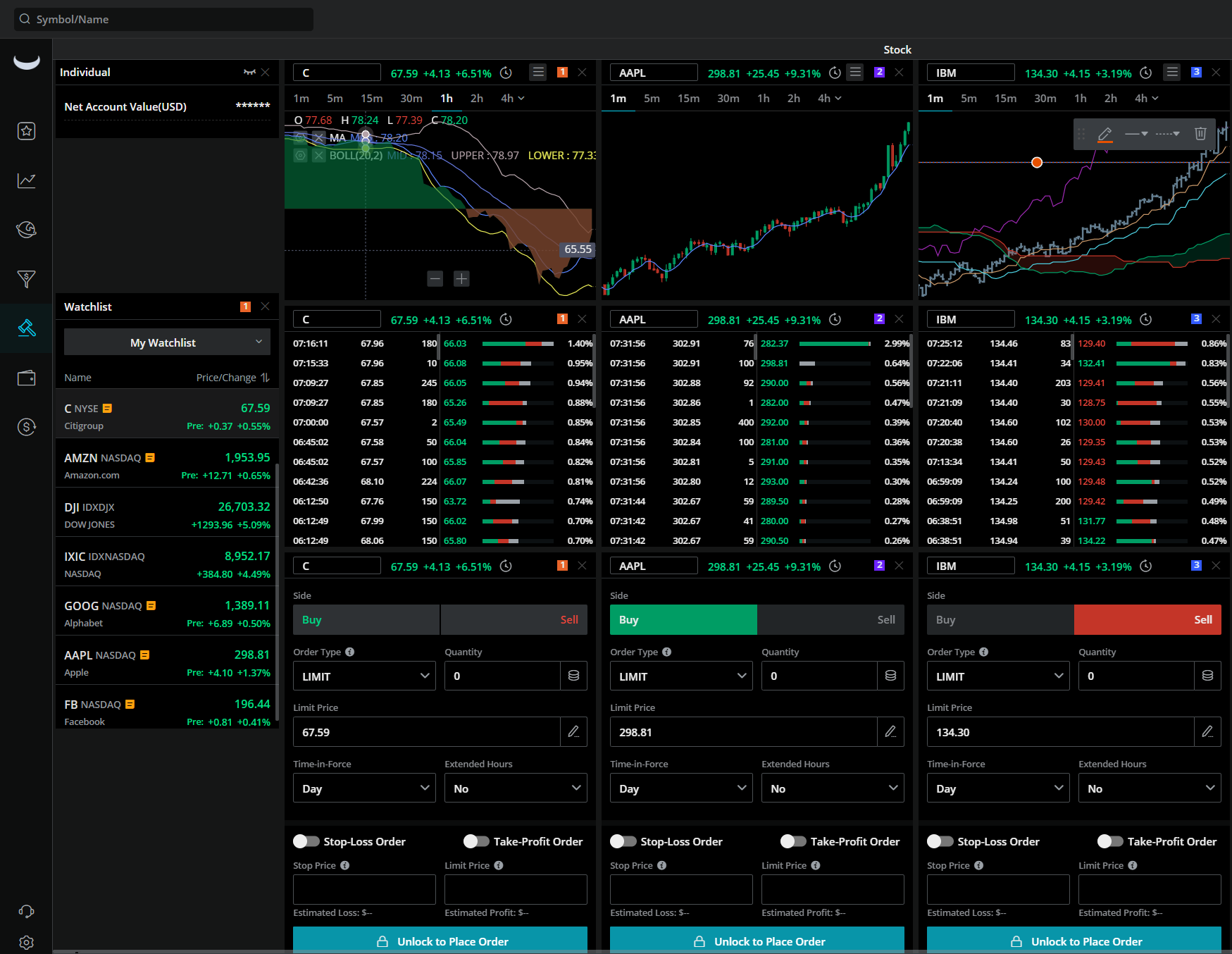

On Webull’s browser platform, traders can send orders to the exchanges whenever they want. The

software application is very similar and packs quite a few powerful features. During our testing,

we found these features to be of great value:

- Full-screen charting with drawing tools and more

- Multiple order tickets

- Option Greeks

Webull’s web-based platform is launched from its website, which is used for account management.

Fidelity takes the second category.

Incentives

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Mobile Apps

Webull provides one of the best mobile platforms on the market. Charting is second to none. We found technical studies, multiple chart display choices, and a very long time frame (five decades worth of data). We also liked the fact that a chart can be rotated.

The Webull order ticket provides market, limit, and stop orders; and extended hours are on tap. Option chains are shown, but trading derivatives is not possible.

Webull’s app offers ACH transfers, but not mobile check deposit. Features that we liked include an economic calendar, a watchlist, and a simulated trading mode for extra practice without risking real money.

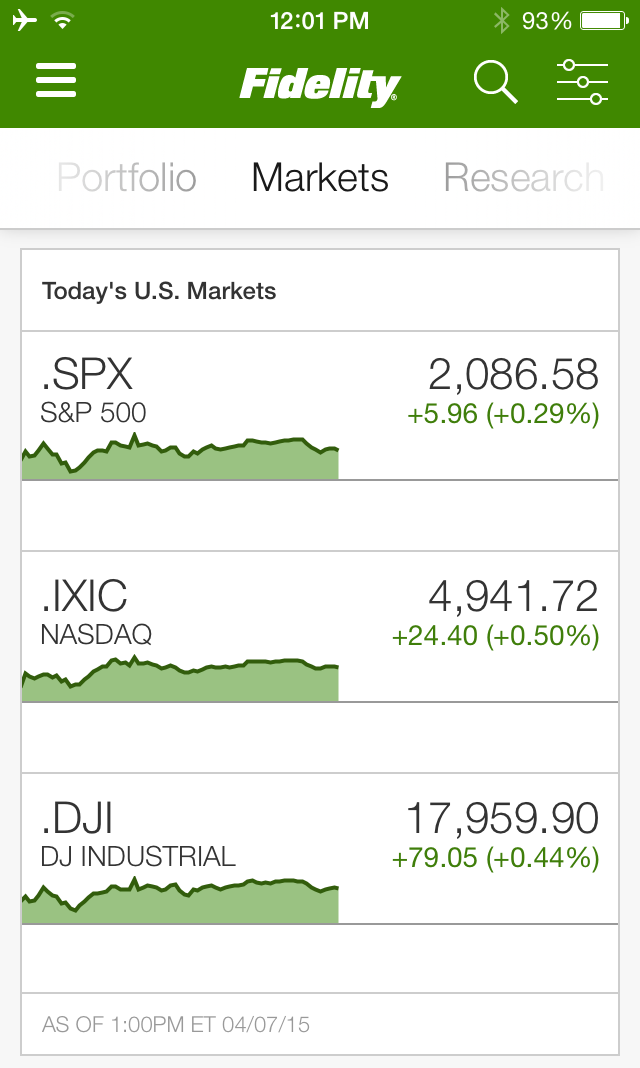

The Fidelity app permits the trading of options (calls and puts plus strategies) and mutual funds. Some features are similar to Webull; for example, there is a watchlist and an ACH transfer feature. But Fidelity also provides mobile check deposit. However, it fails to deliver a practice trading mode.

Overall, Webull wins here.

Other Tools

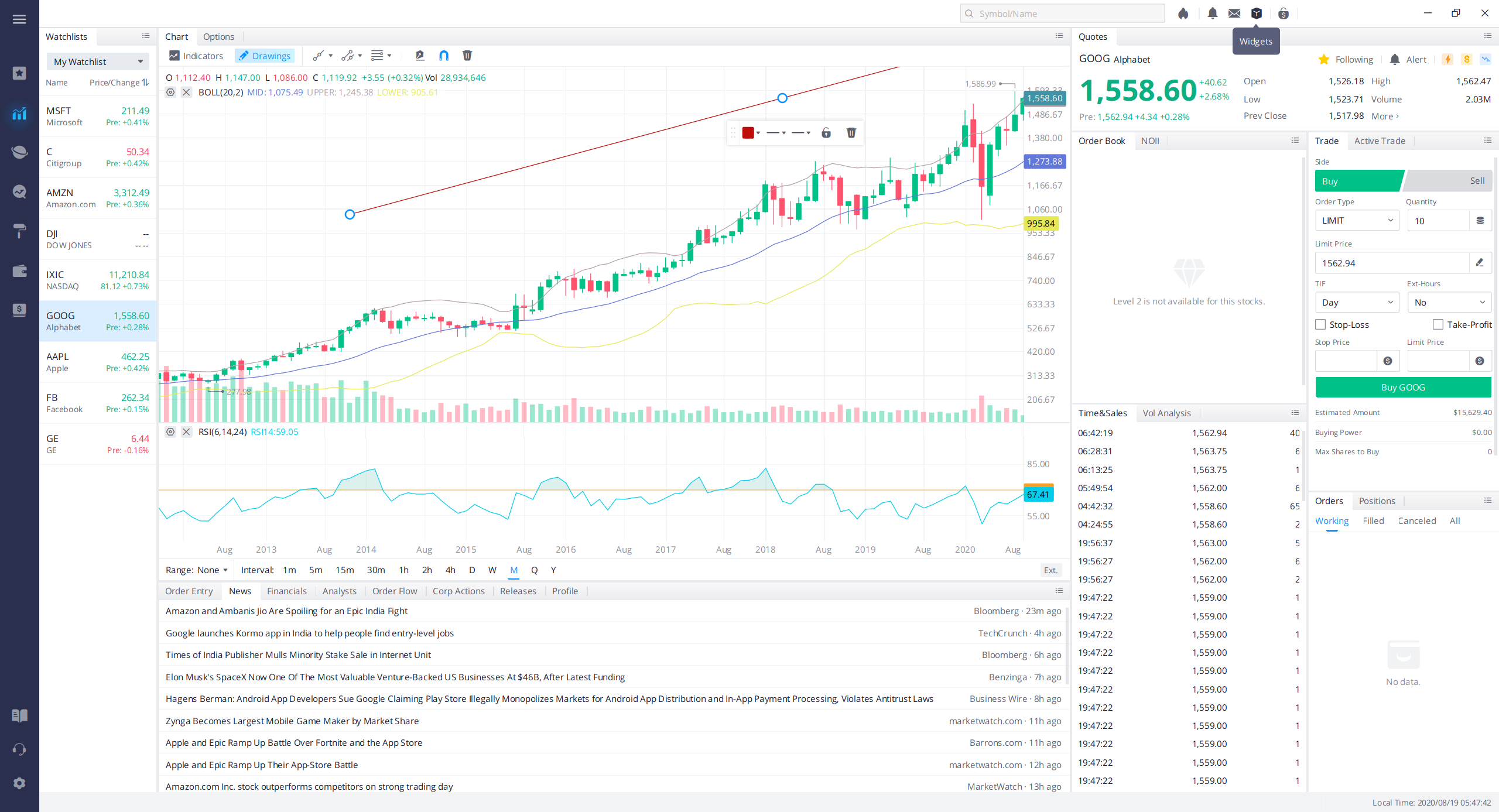

Both Fidelity and Webull offer desktop platforms. During our testing, we found both of them to be very sophisticated with great charting tools, market data, security screeners, and paper trading. Neither broker charges anything to use its desktop software.

Overall, it's a tie.

DRIP Service

Fidelity customers can easily sign up for the broker’s free DRIP service in order to automatically reinvest cash dividends.

Webull clients don’t have access to this service (another cost cutting measure), so Fidelity wins the category.

Investment Education and Research

Webull's mobile app and desktop platform offer a great deal in terms of learning resources. On the desktop platform, we found news articles from Reuters and other sources. Major stocks display analyst ratings (not reports), institutional holdings, ETF weightings, short interest, and press releases.

Research using financial statements is very good at Webull, thanks to graphical display of historical data, available on both the desktop platform and mobile app. Actual and estimated numbers for return on equity and other metrics are available. Other highlights include graphs of cash flow and a company’s balance sheet.

One thing Webull doesn’t offer is general investment education, which can be found at Fidelity. During our research, we discovered many materials on a wide range of investment topics, such as how to trade options and the basics of bond yields. In-person events are also conducted at some Fidelity locations. As for stock research, Fidelity has a very good screener along with free third-party reports.

We give this category to Fidelity.

Global Trading

Fidelity customers can add global trading to any taxable brokerage account. With this additional feature, it’s possible to trade on 25 foreign exchanges in several different currencies, including the South African rand, the Swiss franc, and the Polish zloty. Real-time market data is available on foreign securities.

The Webull mobile app offers ample information on foreign stocks. For example, we were able to find a stock profile on HSBC, a bank security that trades on the London Stock Exchange. The information is very detailed, including such issues as order flow and analyst ratings. Unfortunately, Webull does not permit the actual trading of these foreign securities at this time.

Fidelity wins here.

Incentives

Webull:

Get up to 75 free stocks when you deposit money at Webull!

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Recommendations

For retirement saving, we suggest Fidelity. Webull doesn’t have the level of retirement planning and financial

advice that Fidelity customers have access to.

New traders will definitely be better off at Fidelity as well due to its excellent customer service and large

selection of learning materials.

Because of lower commissions and margin rates, we do recommend Webull for stock, ETF, and options

traders on a budget.

Fidelity vs Webull Summary

Fidelity is obviously the overall top performer in this survey. Nevertheless, Webull would be a

good pick by active stock, option, and ETF traders who need the lowest possible trading

fees. This is especially the case now that Webull has a first-rate trading platform.

|