|

Is TradeZero a Scam? Is TradeZero Safe and Legit? TradeZero Review.

|

Is TradeZero a Scam?

Have you ever thought about opening a brokerage account with TradeZero? Perhaps you’re curious about TradeZero’s credibility and security? If so, read on, as we’ve done the research and have the answers to your questions!

Who owns TradeZero?

TradeZero America was co-founded in 2019 and is currently owned by Daniel Pipitone. Started with partner John Muscatella, TradeZero America is a broker-dealer based online that offers commission-free trading (like Firstrade).

In 2015, TradeZero started with TradeZero Inc., an offshore online broker based in the Bahamas and providing access to U.S. markets for non-U.S. citizens.

Both companies are currently privately held. According to FINRA’s BrokerCheck site, direct owners and executive officers include Jeffrey Howard Curet (COO), Michael S. Haupt (CEO), Christopher Meyers Jr. (PFO), and Antony Carmine Naccarelli (CCO).

Background

TradeZero Inc. and TradeZero America both began with the goal of delivering a highly professional trading service with commission-free stock and options trading.

Compared to other commission-free services (such as Robinhood), TradeZero offers an expansive suite of resources as well as trading options, making it more suitable for experienced investors and day traders.

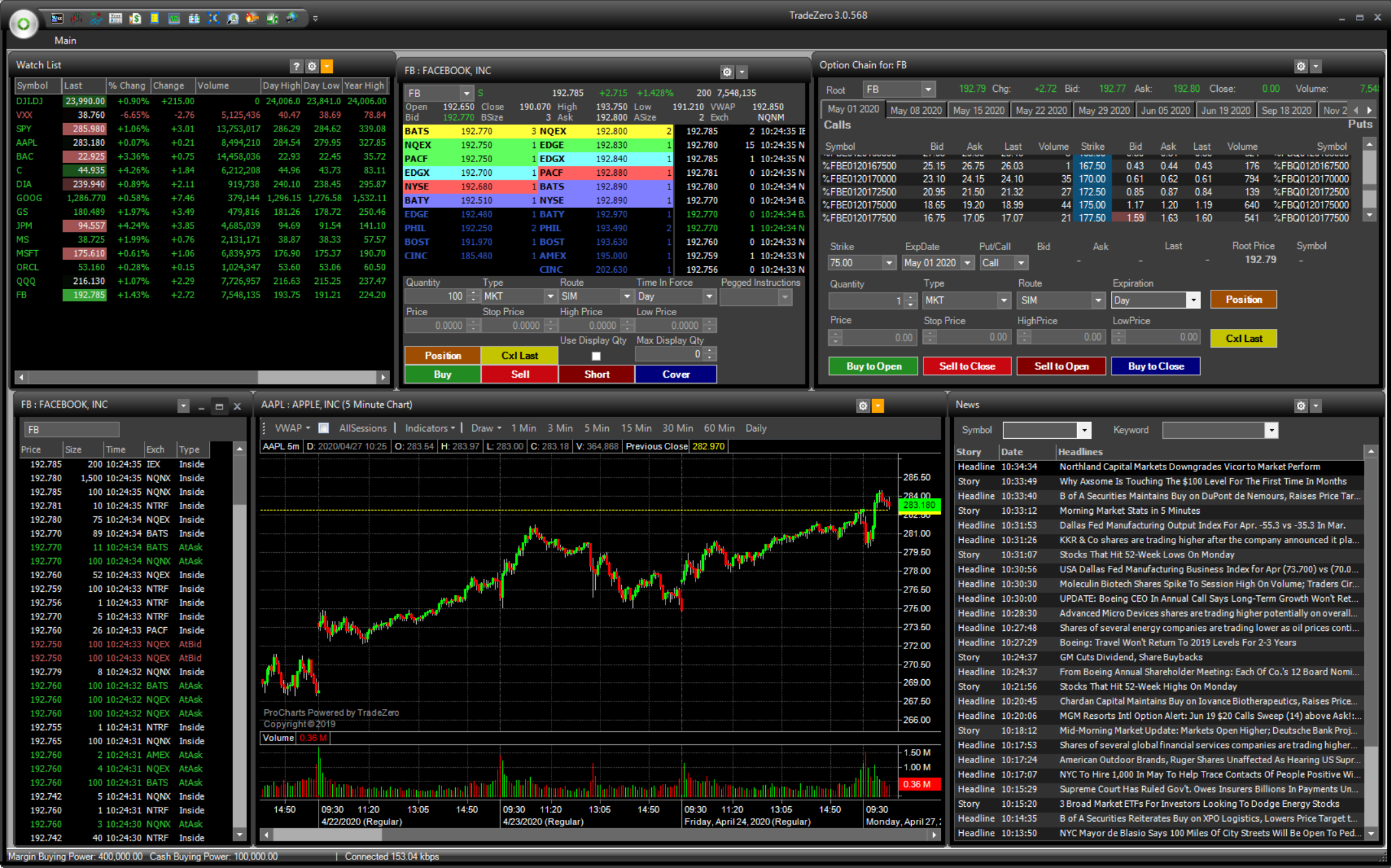

TradeZero currently offers four trading software options to its clients: ZeroPro, ZeroWeb, ZeroFree, and ZeroMobile.

On its website, TradeZero touts its 24/7 customer service, free limit orders, state-of-the-art trading software, up to 6-to-1 leverage, and no pattern day trading rules.

Is TradeZero legitimate?

TradeZero America is regulated by the U.S. Security and Exchange Commission (SEC) and incorporated in the state of Delaware. Their Reporting File Number is 008-69736.

TradeZero America is also registered as a brokerage firm with FINRA (Long Island district office) and its CRD# is 282940. TradeZero America does not currently have any disclosures filed with FINRA.

TradeZero Inc. is regulated by the Securities Commission of the Bahamas.

TradeZero Inc. and TradeZero America are both legitimate online broker dealers. TradeZero America reported an increase of 500% in its trading volume in 2020. New accounts increased by 600% while short selling grew by 300%.

Top TradeZero competitors for U.S. investors

Is TradeZero secure/insured?

Both TradeZero America and TradeZero Inc. are SIPC members and provide up to $250k of coverage per account.

In terms of digital security, such as encryption, TradeZero does not share any information on their site. If you are concerned about this, it would be advisable to contact TradeZero directly.

Is TradeZero accredited by the Better Business Bureau?

No, TradeZero is not accredited by the Better Business Bureau (BBB). To gain this accreditation, businesses must apply, and it is likely that TradeZero has not applied.

TradeZero does not currently have a profile of any kind on the BBB website, and there is thus no rating or number of complaints.

Wrapping up: Is TradeZero a Scam?

TradeZero is not a scam. Although quite new as a broker compared to many household names (like Schwab, TD Ameritrade, Fidelity, etc.), your money is insured and protected with both TradeZero America and TradeZero Inc.

If you are looking for a low-cost broker dealer that appeals to active traders, TradeZero may be a good option for you. Just know that you cannot use TradeZero Inc. if you are a U.S. citizen. If so, you will need to use TradeZero America instead.

Ultimately, if you begin investing with TradeZero, you can rest assured that your money is as safe with them as with other broker-dealers, though perhaps slightly less sure given their lack of pedigree.

Top TradeZero competitors for Non-U.S. investors

|