Is M1 Finance Safe?

If you are looking for a quick answer, then yes. M1 Finance is a perfectly safe solution for your investment needs. Nothing about the broker makes us think any scams are going on. While M1 Finance is certainly trustworthy, the broker is unique in its approach to investing. Some will like it, and others will not.

Keep reading if you want to learn more about what makes M1 Finance and why it is a safe place to invest.

Is M1 Finance Legitimate?

Regarding following industry regulations, M1 Finance ticks all the right boxes. The broker is registered with SEC (the Securities and Exchange Commission) and FINRA (the Financial Industry Regulatory Authority).

M1 Finance Promotion

Open M1 Finance Account

Is M1 Finance Insured?

Offering robust insurance programs is one of the ways that M1 Finance protects its customers. The broker provides SIPC and FDIC coverage.

M1 Finance BBB Reviews

Apart from adherence to industry regulations and ensuring that customer money is safeguarded, M1 Finance’s ability to provide a valuable (and trustworthy) service is another aspect that we should look at to see if the broker is worthwhile. The Better Business Bureau (BBB) can be a good place to check this.

Although the BBB does not accredit M1 Finance, the broker does hold an A- rating. The BBB rating is based on how the company handles customer complaints, how long the company has been in business, and what industry the company is in. According to its criteria, the BBB rating suggests that M1 operates within normal parameters.

Our M1 Finance Review

M1 Finance is different from your typical brokerage, and if you are curious about its services, it is a good idea to understand how the broker works.

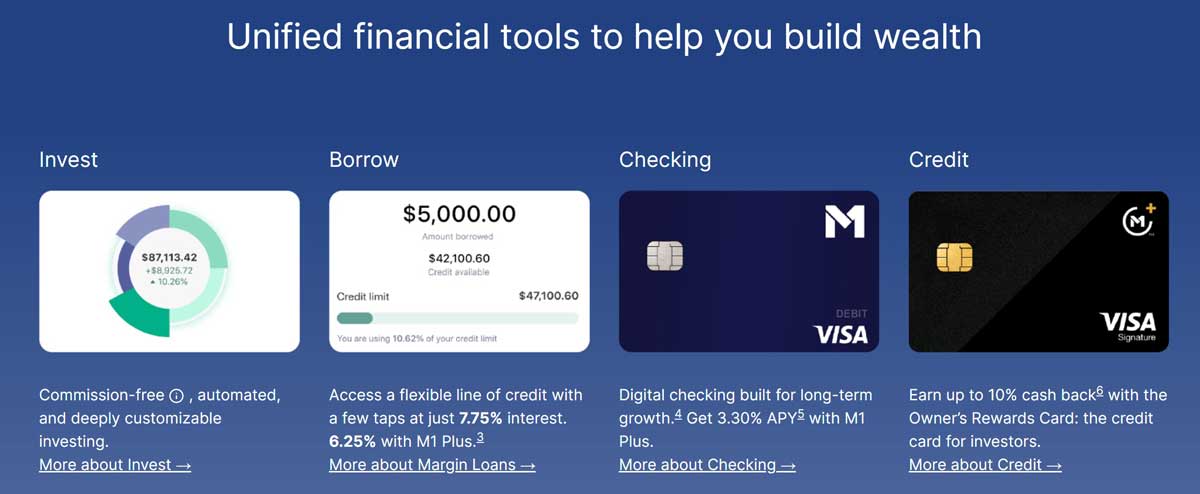

Investment Experience

M1 Finance focuses on a long-term investment approach and offers an experience that suits that approach well. Using a ‘Pie’ concept, investors can mix and match stocks, ETFs, sectors, and even other pies to create a diversified and dynamically balanced portfolio.

If you choose to build your own investment pie, you can select stocks and ETFs listed on U.S. exchanges. You can use individual securities to create ‘pie slices,’ or you can use entire pies as slices.

If you don’t want to go through the diversification process yourself, you can also opt for the ‘Expert Pies.’ Expert Pies are professionally designed and feature securities representing specific industries and strategies.

Rebalancing your ‘Pies’ is very easy; you can even move pie slices from one pie to another.

Cryptocurrency Pies can be created in the same way that stocks and ETF Pies are. However, to access cryptocurrency trading at M1, you will need to apply for it. A separate account will be opened for your cryptocurrency investments, and the crypto Pies you create will be held in that account.

M1 Finance Promotion

Open M1 Finance Account

Account Types

There are several different types of accounts available at M1 Finance. You can open one or several, depending on your needs.

M1’s regular brokerage account is an individual margin account, but few margin-based services are available. Selling stocks short, for example, is not a part of the M1 approach.

Joint accounts are also available and function just like individual brokerage accounts. The main difference with joint accounts is that the assets, taxation, and account belong to both of the people named on the account.

Retirement accounts in the M1 range are Traditional IRA, SEP IRA, Roth IRA, and Rollover IRA 401(k).

Trust and Custodial accounts are available for those looking to save for future generations.

Cash management accounts include savings and checking accounts. Both are high-yield and add useful tools to an M1 brokerage account.

Notable Features

M1 Margin Loans: If you have at least $2000 in your trading account, margin-based features are unlocked. One of these is the ability to take out a margin loan. You can use the loan for investing, personal spending, or debt consolidation, and M1’s standard margin rates apply.

Auto-investing: This feature allows you to set predetermined allocations for all new deposits. All the necessary transactions are handled automatically when new money is introduced to the account.

M1 Checking Account: M1’s Spend account offers an impressive 3.30% APY if you have a Plus membership. Funds in this account are FDIC-insured.

The Owner’s Rewards Card by M1: M1’s Debit card is connected to M1 Spend accounts and gives users up to 10% cashback.

M1 Savings Account: M1’s high-yield saving account offers up to 4.50% APY for Plus members saving for the long term. Funds in this account are FDIC-insured.

M1 Plus Membership

Several features are unlocked when you sign up with M1 Plus, but the premium service comes at a price. To subscribe to M1 Plus, you must pay a $3 per month fee.

As a member of M1 Plus, you receive lower margin rates, increased APY on saved cash, additional trade windows, and some generous cashback features on the M1 Spend account cards.

Costs and Fees

M1 does not charge commissions on trades, but there are other fees to be aware of.

The most significant fee is the annual charge for M1 Plus memberships. M1 Plus costs $3 per month.

- Crypto trades have a 1% spread on buys and sells.

- Wire transfers cost $25.

- ACATS (outgoing) $100.

- Inactivity fee is $20 (this fee kicks in on accounts that have less than $20 and 90+ days of inactivity)

- Regulatory fees (minimal)

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Promotions and Bonus Offers

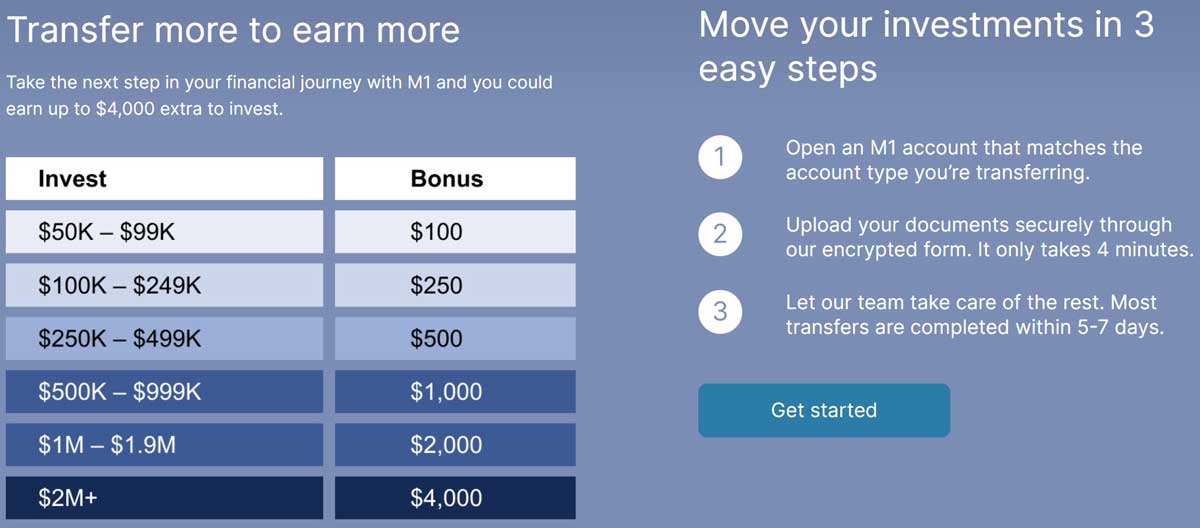

M1 Finance frequently updates its promotional content, but bonuses usually involve making deposits and bringing referrals to the broker.

M1 is currently running an ACAT transfer bonus and a referral bonus.

The referral program pays the referrer and the referee $10 after the referee opens and funds a new account. You can use the ‘Share Pie’ feature from within the mobile app to refer friends.

The ACAT bonus pays new customers on a tiered schedule from $100 to $4000. Payout amounts are based on the size of the newly transferred account.

M1 Finance Pros

The tools and services on offer at M1 Finance deliver simple, diversified investing, and the platform encourages long-term strategies. While some investors may view M1’s approach as positive, not everyone agrees. Here are the pros and cons as we see them.

- Good selection of account types, including trust, custodial, checking, brokerage, and IRA

- Good selection of securities

- Thematic investing makes it easier for beginners to make sound investment decisions

- Automated investing and portfolio rebalancing

- Pies offer an easy way to ‘visualize’ asset allocation

- Cashback program on debit and credit cards is generous

- No commissions

- Low fees

M1 Finance Cons

- No trading platform

- Limited trading times

- No access to leveraged investment vehicles

- Best features come with a subscription

Recommendations

M1 Finance is recommended for anyone looking for tools supporting a long-term, diversified investment approach. The Pie system is a somewhat unique feature that helps investors visualize the weight and significance of the securities they hold. M1 makes portfolio adjustment simple, and there are many stocks, ETFs, and themes to choose from.

Active traders and anyone looking for advanced trading tools and investment vehicles (like options, futures, Forex, bonds, CDs, etc.) would do better at another broker. There is no dedicated trading platform at M1, and the times you can buy and sell securities are pretty limited.

M1 Finance Promotion

Open M1 Finance Account

|