Fidelity IRA Review

For retirement saving, Fidelity Investments is hard to beat. Not only does it offer a large suite of IRA services, it also has a great deal of self-directed and advisory tools that retirement accounts can really benefit from.

Fidelity IRA Overview

Fidelity offers six IRA versions. They are SEP, SIMPLE, Roth, Traditional, Minor, and Inherited. The inherited account can have the Roth tax structure if desired. The Minor account is available only in Roth format.

Multiple IRAs can be opened at Fidelity under a single tax ID number, and they can all be managed, along with associated taxable accounts, with a single login.

Fidelity IRA Minimums and Fees

Fidelity does not impose any fees or minimums on its Individual Retirement Accounts. There is no minimum balance requirement for an IRA, and no deposit is required to open one. The account is free of any ongoing fees like annual, maintenance, and closeout fees.

Like other discount brokers, Fidelity has moved to $0 commissions for online trades of U.S.-listed stocks and ETFs. This great pricing schedule applies to IRAs.

Tradable Assets

Generally speaking, the same range of investment vehicles available to taxable accounts is available inside a tax-deferred account like an IRA, at least in self-directed mode. This list at Fidelity includes the following:

- Option contracts

- Funds (mutual, exchange-traded, and closed-end)

- Stocks (including the OTC marketplace and some foreign exchanges)

- Bonds and other fixed-income instruments

Using Fidelity’s mutual fund screener (available on its website but not its mobile app), we found exactly 460 target-date mutual funds. These are funds designed for retirement saving. They become more conservative in their investments as the date of retirement (the target date) approaches.

IRA Modes at Fidelity

An IRA at Fidelity, like any account, can be opened as either a self-directed or managed account. The latter is available in multiple formats. There is a robo service and several old-school packages.

Although IRAs themselves have no fees at Fidelity, there is a charge for any type of portfolio management an IRA signs up with. The automated program, which is called Fidelity Go®, costs 0.35% annually once the account’s balance reaches $25,000. Below that level, the service is free.

The list of tradable assets mentioned above only applies to self-directed accounts. Managed accounts have fewer choices. The robo service only trades a small selection of Fidelity mutual funds with no expense ratios.

Opening an IRA at Fidelity

Opening an Individual Retirement Account with Fidelity in either robo or self-directed mode is really simple on either the broker’s website or mobile app. On the website, look for the link to open a new account at the top of the site. On the next page, links for Roth and Traditional accounts are displayed at the top. For other types of IRAs, you’ll need to click on the link to display all available accounts.

On the mobile app, tap on the More icon (represented by three dots) located in the bottom menu. On the next page, scroll down to the link to open an account. Follow the instructions, and your new account will be open in no time.

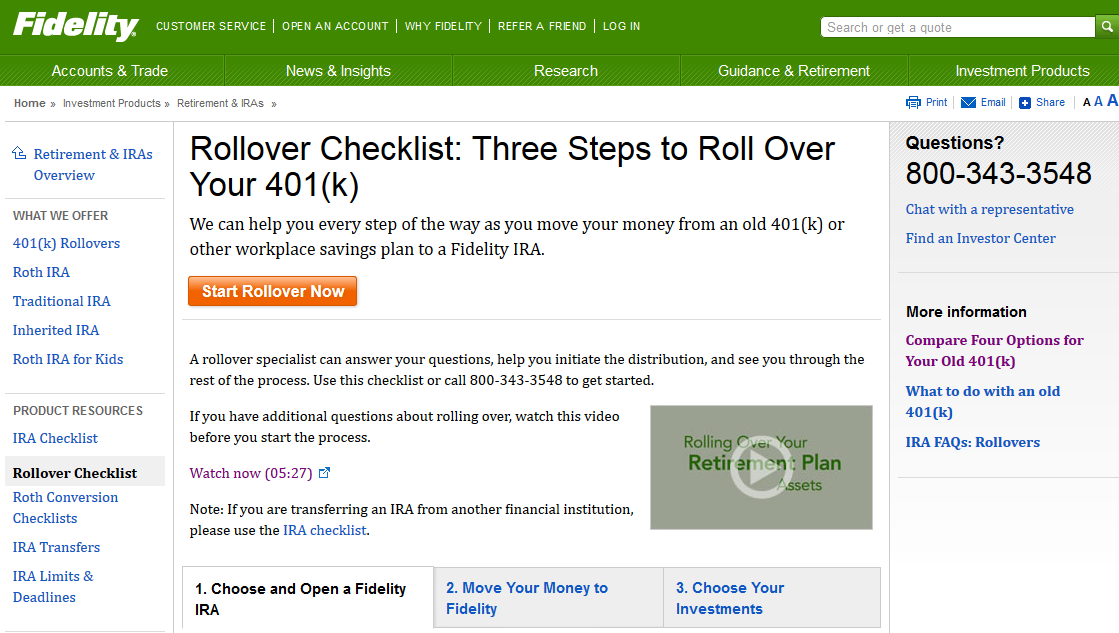

Fidelity Rollover Service

Fidelity offers a discrete link to open a Rollover IRA. This link appears on both the website and mobile app in the list of available accounts to open.

The way this works is that an old employer’s retirement plan is moved into the IRA with Fidelity, which is why it’s called a Rollover account. The retirement account with the previous employer could be a 401(k) or other Qualified Retirement Plan.

To start the rollover process, simply click on the button or link for the Rollover IRA and follow the on-screen instructions. If you have an existing IRA at Fidelity that was not opened as a Rollover account, it can nevertheless be used to rollover a Qualified Retirement Plan from the previous employer. To start the transfer process, simply contact the HR department at the old employer and request a rollover of the account’s assets into the IRA with Fidelity.

The 401(k) specialists with the previous employer should send any necessary paperwork to the following address:

- Fidelity Investments

- ATTN: Corporate Rollovers Department

- 100 Crosby Parkway KC1H

- Covington, KY 41015-0037

If the previous employer liquidates the account and sends cash into the IRA at Fidelity, a check can be used. It should be made payable to “Fidelity Management Trust Company, FBO [your name].” The check should include the Fidelity IRA account number on the memo line.

Cash can also be wired into the IRA at Fidelity. The plan administrator with the employer’s plan will need this information:

| Wire funds to | J.P. Morgan Chase, NY |

|---|

| Routing number | 021000021 |

| For credit to | National Financial Services LLC |

| Account number | 066196–221 |

| For the benefit of | List all owners on the Fidelity account (for IRAs, also include contribution type here). |

| For final credit to | Your account number (letters included if applicable) |

| Address | 383 Madison Avenue

New York, NY 10017 |

If your 401(k) is managed by Fidelity, you can do the rollover yourself through your NetBenefits® account.

IRA Transfer

It’s a lot easier to move an IRA from a second brokerage house into Fidelity. This type of transfer circumvents any possible employer and involves less paperwork. It is called a trustee-to-trustee transfer because the IRA is moved from one firm to another.

To perform this type of account transfer, you simply need to open a Fidelity IRA and then request a transfer of assets from the old IRA. This can be accomplished on Fidelity’s website or mobile app.

On the website, hover over the Accounts & Trade tab in the top menu. In the drop-down window, click on Transfers. On the next page, select the link to deposit, withdraw, or transfer money.

On the following page, click on the From field and select “Transfer an account to Fidelity” from the drop-down menu. Fill in the requested details and submit the request. A statement from the second brokerage firm may supply some of the details you will need, such as the account number for the IRA.

The transfer form can also be found on Fidelity’s mobile app by going to the Transact page (look for the icon in the bottom menu) and selecting the Transfer link. On this transfer page, tap on the From field and select “Transfer investments from another firm” in the drop-down menu. Doing so will produce the same transfer form we have already looked at.

Note that transferring a Roth IRA into a Roth IRA or a Traditional IRA into a Traditional IRA has no tax consequences because the account types are the same. Converting from Traditional to Roth, however, could have tax implications. Be sure to speak with a licensed tax professional before making any type of IRA transfer.

It’s possible that the outgoing brokerage firm will charge a transfer fee to move the IRA over to Fidelity. Fidelity will reimburse this fee if the transfer is valued at $25,000 or more.

Contributions and Withdrawals

Once the IRA at Fidelity is open and ready to go, it’s super easy to contribute money to it and make withdrawals. On the front end, Fidelity offers several methods to fund an IRA. These can be accomplished on the website or mobile app.

On the website, a good place to start is the Transfer link in the top-left corner of the site. Click on this and you’ll get the transfer choices that are available on the website using this tool. These are ACH and PayPal. Money can be moved into an IRA using either method. It’s also possible to send money via wire or an internal transfer from another Fidelity account.

On the mobile app, there is a digital tool to deposit a paper check. Look for it under the Transact tab we have already seen. It’s also possible to perform an ACH deposit on the app, although the PayPal option isn’t available.

Besides a one-time deposit, it’s also possible to establish a monthly deposit schedule. Fidelity’s software automatically keeps track of the total contributions an IRA has received during the calendar year.

A withdrawal from a Fidelity IRA can be done online. As with the deposit side of things, a bank must be linked to the Fidelity account first (select the option to do this in the drop-down menu in the list of available accounts if needed). A maximum of $100,000 can be withdrawn from a Fidelity IRA in a single day.

It’s possible to put an IRA into lockdown mode so that no assets can be withdrawn. To do this, go to the Security Center on the website (available under the Accounts & Trade tab) and follow the instructions to turn it on.

Limited Margin

An IRA with any broker can never be a full margin account due to federal regulations. Some brokerage firms do offer limited margin, however. Fidelity is one of them. Adding limited margin to an IRA will allow the account to trade with unsettled funds, which means day trading is possible.

Adding limited margin to an IRA is easy on Fidelity’s website. Go back to the Accounts & Trade tab. This time, click on Account Features. On the next page, expand the Brokerage & Trading section and click on the link for limited margin. Follow the instructions to add this useful feature to the IRA.

Retirement Advice

IRA customers who sign up for Fidelity’s robo program get free phone calls with financial advisors. A minimum account balance of $25,000 is required. It may be worth it as retirement planning is one of the specialties of these human advisors.

Traditional wealth management is also available. There are several packages to choose from, and some

of them come with a dedicated human advisor capable of working with retirement issues. Expect to pay

more and deposit more, though. You can compare Fidelity’s rates to what the best priced

financial advisors in your area charge.

Retirement Education

Self-directed investors who decide to go it alone will be in good hands, thanks to Fidelity’s large library of IRA resources. These will be found on the website in multiple locations. A good place to begin is on the retirement planning page, which will be found under the Planning & Advice tab.

Under the News & Research tab, there is a section on saving for retirement. It will be found under the personal finance sub-heading. Here are some example articles and videos we found:

- Getting started with IRAs

- Traditional or Roth account? 2 tips to help you choose

- 7 things you may not know about IRAs

Finally, the Fidelity website has a page of several calculators and tools, some of which are designed for IRAs and retirement planning.

Best IRA Accounts

Other Financial Services

Fidelity has annuities that IRAs can purchase. Also up for grabs are policies for long-term care insurance and life insurance.

Fidelity IRA Review Assessment

With so many IRA tools and resources, Fidelity hands down is one of the best places to open an IRA.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|