Robinhood IRA Accounts

Robinhood was the first online broker in the U.S. to offer $0 stock commissions. But now that most brokers have similar fee structures, how does Robinhood compare? This Robinhood IRA review will provide some insight.

Robinhood Advantages...

Low margin rates. Robinhood offers a competitive deal on borrowed funds.

Apple Watch app. A unique feature that some other major firms don’t offer.

No per-contract charges on options. Robinhood has removed assignment and exercise fees as well.

Robinhood Disadvantages...

Limited account types. No custodial, trust, or joint accounts are available.

Basic trading tools. Many advanced features are missing.

Customer support falls short. Numerous Robinhood users have expressed dissatisfaction with the service.

No mutual funds. Investors seeking mutual funds will need to look elsewhere.

Tradable Assets

Robinhood offers the following investments:

- Stocks

- Options

- Exchange-traded funds

- Closed-end funds

- A limited selection of over-the-counter stocks

- Cryptocurrencies (7 available)

While the crypto offering is notable, some other investment options like futures, forex, mutual funds, bonds, and precious metals are missing.

Customer Service

Customer service has been Robinhood’s weak point from the beginning. To keep commissions at $0, the company has had to cut costs, and customer support is one area where this is evident.

Robinhood offers 24/7 phone support at 650.940.2700.

However, there is no chat feature on the Robinhood website, and self-service options are limited. The only way to contact the broker is through the website at Robinhood.com/contact.

Robinhood has no physical locations and is unlikely to open any in the future.

Account Types

Robinhood only offers individual brokerage accounts. There are no options for trusts, custodial accounts, or 401(k) plans. Joint accounts are also not available.

Margin accounts are available, and every new Robinhood account is set up as a margin account.

There are no account fees or minimums, but Robinhood charges $75 to transfer an account to another broker.

The Cost of Trading

Robinhood doesn’t offer a wide range of services, but it also doesn’t charge much.

The broker has kept its promise of never charging commissions. All investments, including options trades, are commission-free. Even assignments and exercises are free.

Using a live agent to place an order is also free, if you can reach one.

Robinhood Gold is a premium margin account that costs $5 per month. It includes instant deposits over $1,000, Level II quotes, and Morningstar reports.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Mobile Platform

Robinhood offers a mobile app for both Android and Apple devices, though it’s not designed for tablets.

The app includes charting features, but they are basic. There are two display styles (line and candlestick), and no additional tools. The chart cannot be viewed horizontally.

During our analysis, we found both market-hours and extended-hours pricing. The app also provides trade data like volume, high and low prices, and the last trade price.

The platform also shows what other Robinhood users have bought. For example, on General Electric’s profile, you’ll see that traders also bought Westinghouse and Ford.

The order ticket on Robinhood’s mobile platform offers two choices: options and stocks. For options, the app asks whether you think the underlying stock will go up, down, or stay the same. Based on your answer, the app suggests short-term, mid-term, and long-term trade ideas. Some of these are multi-leg strategies like straddles and strangles.

The stock trading form offers four order types: market, limit, stop loss, and stop limit. Each limit order can be specified as either market-hours only or day plus extended.

Robinhood’s Apple Watch app offers a watchlist, a small graph, and trade confirmations.

Website

Robinhood’s website is similar to the mobile app. It has light and dark color themes that change automatically depending on whether the market is open or closed.

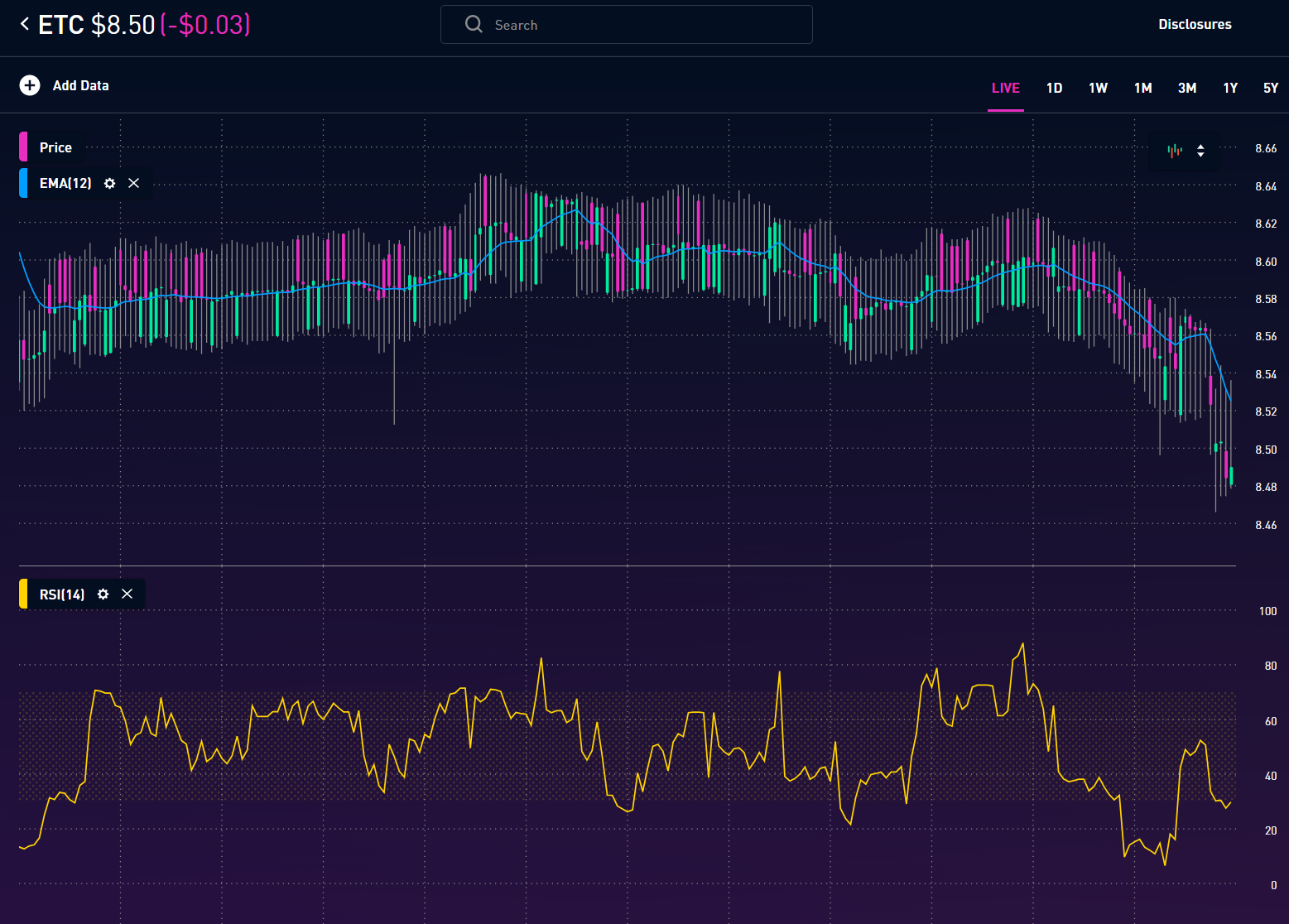

Charting on the website is slightly better than on the mobile platform. For example, a graph can be displayed horizontally, and there are a few technical indicators. We found four of them—not many, but they’re there.

A unique feature is the ability to adjust the size of the charting area vertically, which also changes the size of the indicator area.

The order ticket on the website offers one more trade type (trailing stop order) than the mobile app. The extended-hours option is also slightly different; you need to check a box to specify extended-hours execution.

Oddly, options can’t be traded from the chart space. Instead, you need to return to the stock’s profile page and click the “Trade Option” button. However, you can enter a stock order from a chart.

Another unusual aspect of Robinhood’s options trading is that only calls and puts are available. (The mobile app offers a few strategies.) The calls and puts aren’t displayed in traditional chains. It’s different, but not necessarily worse.

Digital Currencies

Now, let’s look at what is perhaps Robinhood’s most popular offering right now: cryptocurrency trading. Here are the coins available:

- Aave (AAVE)

- Avalanche (AVAX)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

- Compound (COMP)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

- Shiba Inu (SHIB)

- Steller Lumens (XLM)

- Tezos (XTZ)

- Uniswap (UNI)

- USDC (USDC)

Other coins, like NEO, Zcash, and Bitcoin Gold, have streaming data. The only time clients can’t trade coins is when the site is down for maintenance.

Robinhood doesn’t support coin withdrawals, so to withdraw your crypto, you must first sell it and then withdraw the cash. It’s also not possible to transfer coins into Robinhood.

While these limitations aren’t ideal, it’s a start. Robinhood says it plans to add more coins in the future.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Other Services

Robinhood offers a DRIP service for all eligible stocks and ETFs. However, there’s no auto investing in mutual funds at this time.

Comparison

Now, let’s compare Robinhood to its competitors. With most brokers offering some form of $0 pricing, Robinhood faces a lot of competition.

Most firms still charge per-contract option fees, including big names like Fidelity, Schwab, and E*Trade. Firstrade aligns with Robinhood by not charging per-contract fees.

When it comes to software, Robinhood falls behind most brokers. WellsTrade’s platform is just as basic as Robinhood’s.

While Robinhood doesn’t offer access to global stock exchanges, Schwab and Fidelity do.

Recommendations

Mutual Fund Investors: Charles Schwab and Firstrade are good choices.

Individual Retirement Accounts: Robinhood is the only broker to offer a 1% free IRA match.

Beginners: Robinhood’s user-friendly software is great for new traders.

Active ETF and Stock Trading: With a $0 commission schedule, plenty of stock and ETF resources, and a nice desktop platform, we recommend Webull.

Long-Term Investors and Retirement Savers: Charles Schwab offers financial planning services, branch locations, target-date mutual funds, and self-employed 401(k) plans. It gets our approval.

Small Accounts: With no minimums, no fees, and no opening balance requirement, Robinhood is a great choice.

Robinhood Review Summary

Robinhood excels in pricing, cryptocurrency trading, and cash management categories but falls short in active trading area.

Robinhood Promotion

Free stock up to $200 and 1% IRA match when you open an account.

Open Robinhood Account

Updated on 7/19/2024.

|