Prudential Financial IRA Overview

Prudential is a well-known financial company that specializes in investment management, insurance and other financial products. Prudential was founded in 1875 and it is a Fortune 500 and Global Fortune 500 company. The Corporate Equality Index from the Human Rights Campaign gave it a 100% rating. They named one of the ‘100 Best Companies for Working Mothers’ and one of the ‘Best Places to Launch a Career’. This company has also provided more than $450,000 worth of Prudential CARES Volunteer Grants to 444 volunteer groups across the world.

Prudential Financial is a Fortune 500 company based out of Newark, New Jersey. Traded on the New York Stock Exchange (NYSE: PRU), Prudential Financial employs over 49,000 people across 40 countries. Their services include insurance products, wealth management, fund management, and retirement plan solutions. As of the end of the Q3 2017, Prudential had close to $1.3 trillion in assets under management and $3.7 trillion in gross life insurance.

Prudential IRA Options

Prudential offers the following IRA Options:

| Minimum | Maximum |

|---|

| Roth IRA |

No Minimum |

$5,500/year |

| Traditional IRA |

No Minimum |

$5,500/year |

| SEP IRA |

No Minimum |

25% of compensation

(up to $52,000) |

| SIMPLE IRA |

No Minimum |

$12,000 (if under age of 50) or

$14,500 (if older than 50) |

| Rollover IRA |

No Minimum |

No Limit |

They have a standard selection of IRA accounts including SIMPLE, traditional, rollover, Roth and SEP. The ‘catch-up’ contribution limit for Roth and traditional IRAs is $1,000 per year and $2,500 per year for SIMPLE IRAs.

Prudential IRA Fees

The fees at Prudential are similar to fees at other investment firms and brokers. There is an account maintenance fee of $15.00 and an annual fee of $15.00. However, those fees are waived if the funds in the IRA exceed a specific amount. There are no other fees that are associated with IRA accounts at Prudential.

Planning

Prudential provides a wealth of retirement planning resources to its clients. In order to open an IRA, investors can work with a financial advisor to choose the right account and investments for that account. In addition, they have a retirement planning calculator that allows investors to quickly create an estimated retirement plan based on their expenses and savings. There is also an in-depth IRA guide that discusses the features of various IRA accounts and how each different account will affect retirement savings.

Availability

Prudential has a mobile site that allows investors view their accounts, research investment opportunities and read various retirement and investment planning guides. Investors cannot actively manage their investments with this mobile site.

Website Usability

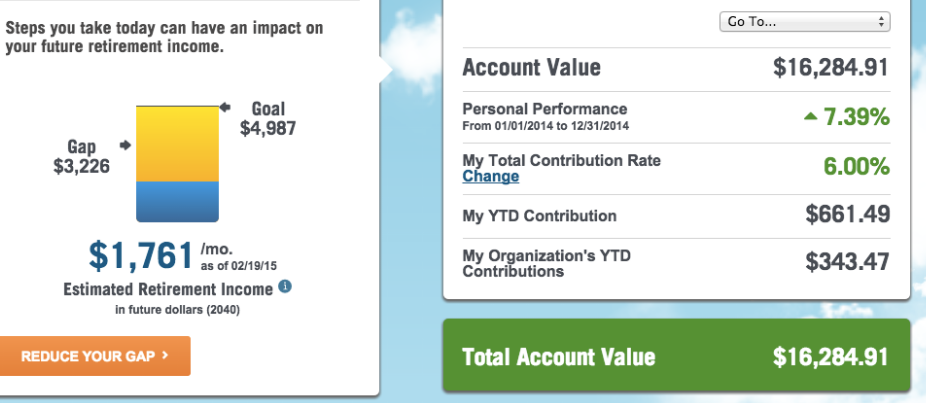

Prudential’s landing page is modern and easy on the eye. The main page has a snapshot of the account’s value, year-to-date performance, and an estimated retirement income chart. This view is very simple, but it contains almost everything a customer needs to quickly check on their account.

Drilling a little deeper reveals a wealth of options and information that a customer can use to control their account. One very useful section allows users to see current and past performance of the available funds. This lets users get a quick feel for which funds best suit their investment style.

The individual performance pages also hold the fund prospectuses, manager information, and fund objectives. All of this information can certainly help users make the best investment decisions for their situation.

The only negative about the Prudential website is that, aside from a few pages, most of it is somewhat outdated. The performance page, for example, looks like it was last updated in the early 2000s.

Customer Service

Customer support can be reached Monday through Friday from 8AM to 9PM ET via telephone. For retirement counseling and planning, investors can call the IRA Brokerage Service telephone number Monday through Friday from 8AM to 9PM ET. Customer support is also available through email or in-person support during normal business hours. Prudential support representatives are responsive and professional.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Security

Prudential offers the highest level of security that is available. Prudential protects client funds and accounts with powerful software that encrypts all sensitive information. In addition, there are a variety of privacy and verification protocols that are used to prevent any unauthorized access to client accounts.

Performance

Prudential’s performance was reviewed in comparison with the higher costs associated with Prudential’s “expertise”. Overall, 49 strategies that have at least 3 years of performance history, which include both current funds and funds no longer in existence, since inception against its current Morningstar assigned benchmark to see just how well each has delivered on their perceived value proposition. The data that was found is shown below in respect to the fund performance over time.

55% (27 of 49 funds) have underperformed their respective benchmarks or did not survive the period since inception.

45% (22 of 49 funds) have outperformed their respective benchmarks since inception, having delivered a POSITIVE alpha

2% (1 of 49 funds) have outperformed their respective benchmarks consistently enough since inception to provide 95% confidence that such outperformance will persist as opposed to being based on random outcomes.

On average, an investor who utilized an equity strategy from Prudential experienced a 1.21% expense ratio, a 0.84% 12b-1 fee, a 5.50% max front load, and 3.86% max deferred load for those strategies that have 12b-1 fees, front loads, and deferred loads associated with them.

Similarly, on average, an investor who utilized a fixed income strategy from Prudential experienced a 0.83% expense ratio, a 0.47% 12b-1 fee, a 4.06% max front load, and a 5.00% max deferred load for those strategies that have 12b-1 fees, front loads, and deferred loads associated with them. These expenses can have a substantial impact on an investor’s overall accumulated wealth if it is not backed by superior performance.

Top Alternatives

Prudential IRA Review Verdict

Like many of the other financial institutions, a deep analysis into the performance of Prudential has yielded a not so surprising

result: active management is likely to fail the majority of investors. We believe this is due to market efficiency, costs, and

increased competition in the financial services sector. As we always like to remind investors, a more reliable investment strategy

for capturing the returns of global markets is to buy, hold, and rebalance a globally diversified portfolio of index funds.

|