|

Merrill Edge in Europe (2024)

Is a brokerage account at Merrill Edge available in Europe (Germany, UK, Hungary, France, Poland, Spain, Austria, Italy, Sweden and other countries)?

|

Is Merrill Edge Available in Europe?

If you are a Merrill Edge fan in a European country such as Germany, Poland, or France and want to

use their investment services, you are out of luck. This is because the broker is currently only

available to those residing in the U.S.

Alternatives to Merrill Edge in Europe

For European investors, we recommend opening an account with these American brokers:

ZacksTrade Website

Open ZacksTrade Account

Merrill Edge Pros

- Outstanding support for penny stock traders.

- Free trades.

- Full integration with Apple Watch.

- Tremendous advantages for Bank of America customers and those wanting to use Bank of America products.

Merrill Edge Cons

- Expensive managed portfolio service and personal advice is not competitive on prices.

- No commission free mutual or index fund options.

- Advanced trading platform, MarketPro, is available to clients with total combined balance of $50,000+, or making 15 trades per quarter.

- Mutual funds subject to self-directed short-term redemption fee of $39.95 if held less than 90 days.

Merrill Edge Overview

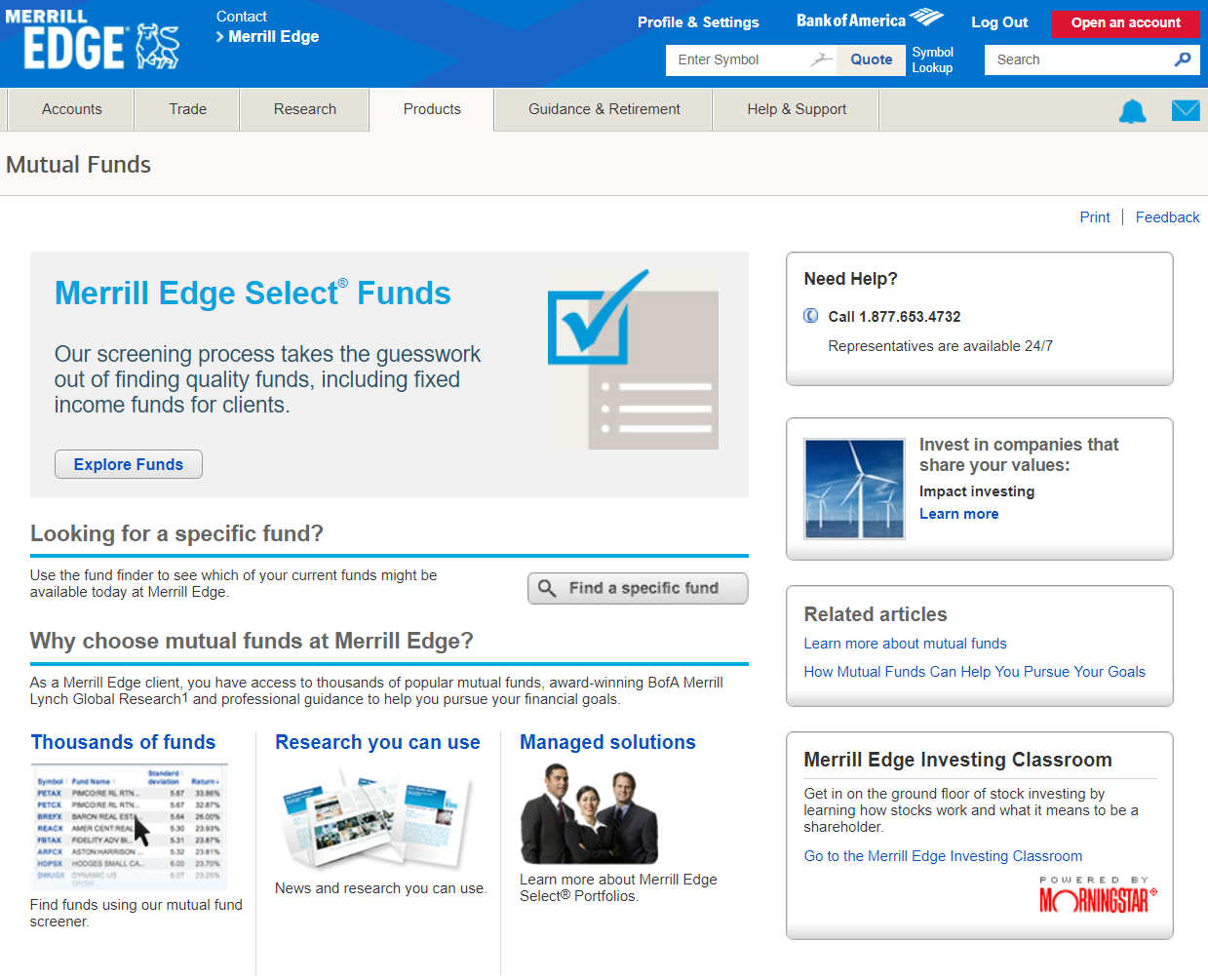

If you log into your Bank of America account, read any emails from them, or check the Bank of America mobile application, you'll likely come across advertisements for Merrill Edge. Merrill Edge has launched an aggressive marketing campaign to attract investors away from competing brokerages. Merrill Lynch, the wealth management division of Bank of America, initially gained recognition in the 1980s by offering personalized wealth management advice to retail customers and high net worth individuals. As retail investors sought alternatives to high fees, Merrill adapted and began providing services that eventually evolved into the Merrill Edge platform.

Does Merrill Edge offer compelling features for moderate to high net worth individuals? Are their screening tools truly powerful? What advantages does Merrill Edge provide to investors seeking a fusion of ETF stability and the performance of value investing? We have conducted research, analyzed the platform, and presented our findings in the Merrill Edge review (link provided above).

Regarding online advice, Merrill Edge's offerings are similar to those of other major brokerage services. Investors can access investment calculators, tools, and resources to analyze their portfolio holdings and determine if they are on track to meet their financial goals. The platform also provides access to a substantial database covering essential personal finance topics, such as creating and funding an emergency fund.

One area where Merrill Edge stands out is in its stock screening utilities, which surpass those offered by other brokerages, particularly Vanguard. Value and fundamental investors can efficiently screen stocks based on user-generated criteria, set up automated search functions, and conduct industry and individual ticker level research. For investors looking to build portfolios consisting of individual stocks and ETFs, Merrill Edge's online research toolbox makes the platform highly appealing and worth exploring further.

The brokerage also excels in providing general personal financial advice to customers who subscribe to their regular newsletters. These emails cover fundamental personal finance topics, including saving for retirement, building an emergency fund, saving for a house down payment, and other relevant subjects for those starting their financial journey. Many of these newsletters are accompanied by action plans and checklists that help investors get started in the right direction.

|