Transfer From Fidelity to E*Trade in 2024

How to Move a Fidelity Account to E*Trade

If you have a brokerage account at Fidelity but want to give E*Trade a try, you can move your account without having to sell anything or make any withdrawals, at least in some situations. Read on for the details.

Transfer Overview

Fidelity and E*Trade accept and receive ACAT transfers, so this is the network that will be used to move an account. The system is fully electronic, which means the process is much easier than it used to be. Gone forever are the days of physically moving paper stock certificates!

Both investment firms have managed and self-directed accounts. A robo or self-directed account at Fidelity can be transferred into a self-directed or robo account at E*Trade. If an automated account is involved on either end of a transfer, there will be some caveats.

For example, if a Fidelity automated account goes into either account mode at E*Trade, the mutual funds inside the account will have to be liquidated because those funds aren’t available at E*Trade.

If you’re going into a robo account at E*Trade, any assets in a Fidelity self-directed account will need to be liquidated, too, and in fact, any funds in a Fidelity robo account will need to be liquidated because E*Trade’s digital advisor doesn’t use Fidelity mutual funds.

Obviously, it’s easiest to go from self-directed to self-directed. But there’s a caveat there, too. E*Trade does not offer trading in foreign stocks. Any of these securities will need to be handled in one of three ways:

(1) Exit the positions.

(2) Perform an internal transfer to move them to a second Fidelity account.

(3) Do a partial transfer to E*Trade and leave the holdings behind.

The same three options should be consulted with any other positions that can’t be moved to E*Trade for any reason.

First Step

If you’re still reading, you might as well go ahead and get that E*Trade account open. You will need

to do this because the Fidelity account doesn’t actually move. Instead, the assets inside the account

are moved into the account at E*Trade. So that’s the first step: open an account at E*Trade. An existing one will work if it has the same name on it as the Fidelity account. It also must be the same account type, such as custodial account.

Opening an E*Trade account is very easy in most cases (401k plans take a little more paperwork). Just

head over to the broker’s application page and look for a button to open an account. Most accounts can be opened online without any physical paperwork.

Open E*Trade Account

Get up to $600 cash bonus at E*Trade.

Open Etrade Account

Second Step

After submitting the application for the E*Trade account, log into the Fidelity account and start preparing it for the upcoming migration. This could possibly entail several tasks. For example, options that expire in less than a week should not be moved. These will need to be handled using one of the three methods discussed in the overview section.

Also, mutual funds and OTC stocks can be tricky in these transfers. Although E*Trade offers trading in them, it’s possible that a specific holding won’t be transferrable. It’s best to check with E*Trade before starting the transfer on these assets.

Life insurance and annuities, both of which are available at Fidelity, cannot be transferred to E*Trade under any circumstances.

Third Step

Now it’s time to get the E*Trade account ready to go. If you have a margin loan or debit balance coming over, the account must be margin approved. Also, options will require options approval and the correct option level.

To add these trading privileges to an E*Trade account that doesn’t currently have them, hover over the Customer Service link at the top of the website and click on the second Customer Service link in the drop-down menu of choices.

On the next page, you can upgrade to margin and options trading. Look for the appropriate links under the section to submit online requests.

Fourth Step

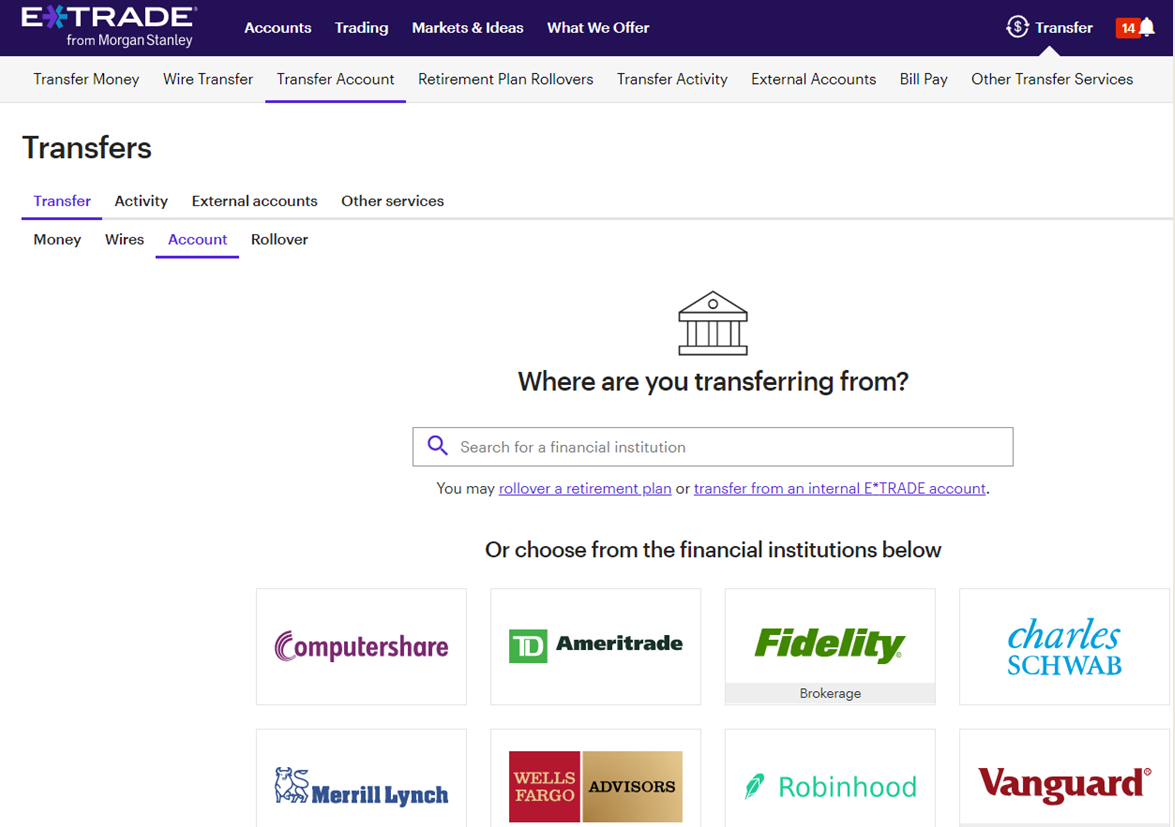

The transfer point for an ACAT transfer into E*Trade is E*Trade’s website. After logging in, look for the Transfer link at the top of the site. Hover over it with your cursor and look for the link to transfer an account in the drop-down menu.

E*Trade displays a collection of brokerage logos as possible outgoing firms. Click on the Fidelity logo to prefill some data. Follow the on-screen prompts and submit the transfer.

ACAT Timeline

E*Trade reports a timeframe of about 5 to 10 business days for an incoming ACAT transfer to complete. This assumes everything is done correctly. If any assets need to be liquidated first (as in the case of a robo account transferring in), then the timeframe could be longer.

One other issue is cash generated from the conversion of fractional shares of stocks and ETFs. If this liquidation is performed by the brokerage firm, the cash may arrive a few days after the securities do (in the case of a self-directed account transfer). Because Fidelity offers fractional-share trading in stocks and ETFs, this issue is of particular importance.

E*Trade Alternatives

Tracking the Transfer

After you have submitted the transfer request, E*Trade’s website will record it. Go back to the Transfer link at the top of the site. This time, in the drop down menu, instead of clicking on the transfer account link, select the “Transfer Activity” link. This will produce a new page with a list of recent transfers. Each one will have its own reference number just in case you need to reach out to customer service with any questions.

Cost

E*Trade doesn’t charge anything to receive a brokerage account transfer, and Fidelity charges nothing for an outgoing account transfer. Easy enough.

If you want to actually make money doing this, E*Trade has a special right now that pays out a cash bonus for an incoming transfer valued at a minimum level. The payout begins at $50 for an incoming transfer of at least $5,000 and caps out at a $3,500 payout for a transfer of $1.5 million.

|