Transfer Fidelity to JP Morgan Chase or Vice Versa (2024)

How to Transfer from Fidelity to JP Morgan Chase or Vice Versa

Among the myriad financial resources the Internet has created in recent years is the ability to transfer brokerage accounts between rival firms. If you have a securities account with Fidelity or J.P. Morgan Investing and want to be at the other location, keep reading.

Transfer from Fidelity to J.P. Morgan Chase

If you follow the steps below, you shouldn’t have any problems getting your assets from one brokerage firm to the other using the ACATS network.

First, you’ll need to open a brokerage account with J.P. Morgan Investing.

An existing one could work if it has the same name on it as the outgoing account with Fidelity and is the

same account type. It’s not possible to transfer a custodial account into a joint account, for example.

Second, the Fidelity account must be fully prepared for the upcoming transfer. Fidelity now offers cryptocurrencies, and these assets cannot be moved through the ACATS system, which is what we’re using here. Any mutual funds in the Fidelity account that aren’t available at J.P. Morgan Self-Directed Investing will need to be handled in the same manner.

While option contracts generally can be moved, contracts with less than a week of life in them should not be transferred.

Fractional shares of stocks or ETFs cannot be moved through the ACATS network. These can be self-liquidated before the transfer. Otherwise, Fidelity will do it at the time of the transfer.

Third, the account at J.P. Morgan Investing needs to be prepared. This includes adding options privileges if any contracts will be coming over.

Fourth, a transfer request should be made with the incoming brokerage house, which is J.P. Morgan Investing here. This is really easy to do on the broker’s website. Click on the Pay & transfer tab at the top of the website and select Transfer securities from the drop-down menu.

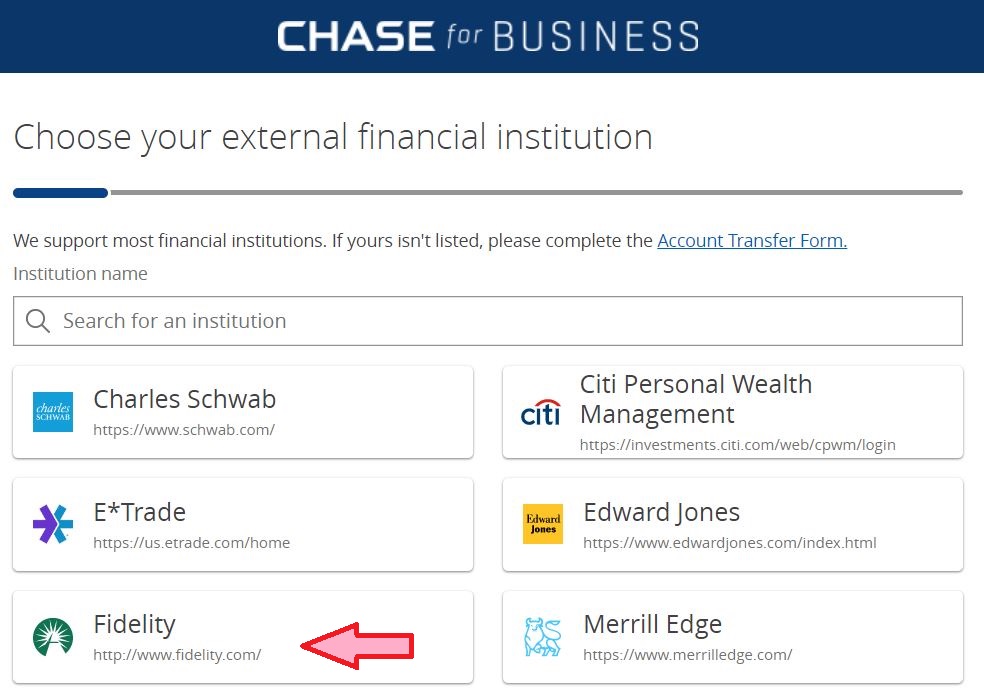

On the next page, look for the link to connect an external investment account. This link will present several popular brokerage firms as possibilities. Fidelity is among them. Click on Fidelity’s logo. It’s possible to connect the Fidelity account through login credentials or an account number. If the second option is selected, J.P. Morgan Investing will require a Fidelity account statement dated within 6 months.

It’s possible to do a full or partial transfer into a J.P. Morgan Investing account. A full transfer will close the Fidelity account, while a partial transfer will leave it open. The web-based form described above only works for a full transfer. A partial transfer requires a hard-copy form.

JP Morgan Chase Promotion

Get $0 stock commissions at J.P. Morgan.

Open Chase Account

Transfer from J.P. Morgan Chase to Fidelity

To move a brokerage account in the opposite direction, follow the basic guide above, replacing each firm with the other.

Although Fidelity offers trading in all of the asset classes that J.P. Morgan Investing has, it’s possible that specific mutual funds won’t be available. It’s best to check with Fidelity to make sure specific funds can be moved in.

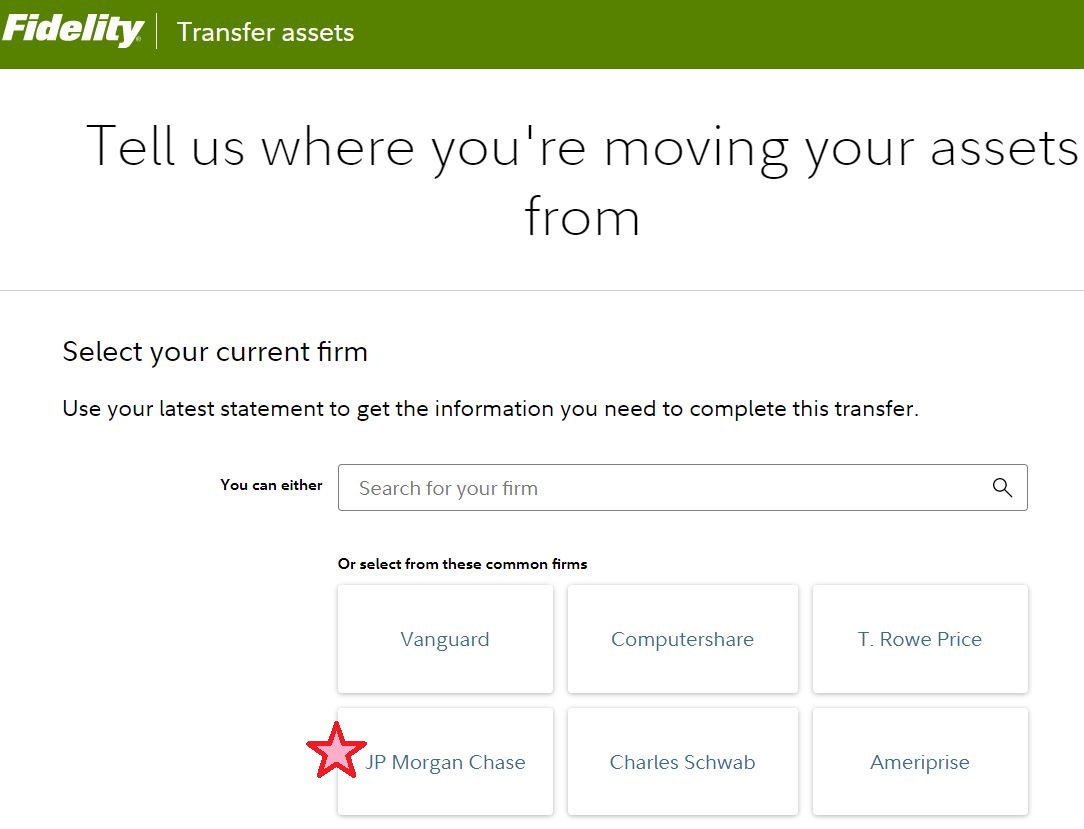

To submit a transfer request with Fidelity (the incoming broker in this situation), log into the website and click on the transfer link in the top-left corner of the site. On the next page, select the link in the drop-down menu to transfer an account to Fidelity. On the next page, there will be some information about transferring accounts. In the middle of the page, there is a blue button to start a transfer. Click on this to get a list of potential outgoing brokerage firms. “JP Morgan Chase” is one of them. This is the one you want. Follow the on-screen prompts and submit the request.

Best Alternatives

Transfers Involving Robo Accounts

Both Fidelity and J.P. Morgan Investing offer automated-investing accounts. It is possible to transfer into or out of a robo account with either firm. However, both companies will only accept and send cash into and out of an automated account. This obviously can involve the sale of holdings, which could trigger tax consequences. Be sure to consult with a licensed tax professional before taking this step.

Cost of Transferring

Fidelity charges nothing to accept or send an ACATS transfer. J.P. Morgan Investing charges $75 for a full outgoing account transfer. Fidelity will refund this fee if the transfer is valued at $25,000 or higher.

How Long Does an ACATS Take?

Expect about a week and a half for a full or partial transfer. Cash from a sale of fractional shares may arrive a few days later. If any mistakes are made along the way, the time to completion will increase.

|