Is LightSpeed Trading Safe?

Lightspeed Trading is a broker popular with traders of many kinds. As a broker and trading platform provider, Lightspeed provides a solid list of tools and services designed to help give investors an edge in the markets.

Is Lightspeed Trading safe? Can it be trusted? Let’s find out.

Is LightSpeed Trading Legitimate?

We can look at a few key details to decide if Lightspeed is a safe place to invest. Reviewing Lightspeed’s licensure with industry regulators, its insurance policies, and the customer reviews it receives are the easiest ways to see if the broker can be trusted.

Lightspeed is registered with the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), both leading regulatory organizations within the financial industry.

SEC is an independent agency of the U.S. Government tasked with overseeing the activities and transactions in the financial markets. FINRA is a private corporation that imposes regulations on brokers, clearing firms, and investors operating within the financial industry.

While these regulatory bodies have different structures, they both obligate brokers to follow stringent rules in order to stay in business.

Is LightSpeed Trading Insured?

To protect customer assets, Lightspeed has a membership with SIPC. SIPC insurance protects investors from any poor business decisions brokers may make.

With SIPC, securities in your brokerage account are covered up to $500,000. If you also have a cash balance, half of the original coverage amount (up to $250,000) can be used to protect your funds.

Better Business Bureau Ratings and Reviews

The Better Business Bureau (BBB) can often be a good place to look for customer opinion, but that is not the case for Lightspeed Trading, as there are no listed reviews.

The Better Business Bureau has given the broker a B- rating and does not accredit Lightspeed (companies must apply for and pay the BBB accreditation).

Top Competitors

Trustpilot Reviews

The reviews on Trustpilot provide insight into Lightspeed’s customer experience, but it is also limited, with only six reviews so far.

Most of the reviews have a five-star rating and focus on features like good customer service, fast and reliable execution, and a good set of tools for active traders.

All in all, investors appreciate the professional-level services that Lightspeed brings to the table.

Lightspeed Overview

Since Lightspeed Financial Services Group adheres to the rules and regulations set up by industry oversight organizations, we can safely say that the broker is not a scam.

Here are a few of the most notable features to help you decide if Lightspeed is right for you.

Available Securities

Lightspeed offers trading in stocks, ETFs, options, and futures.

Costs and Fees

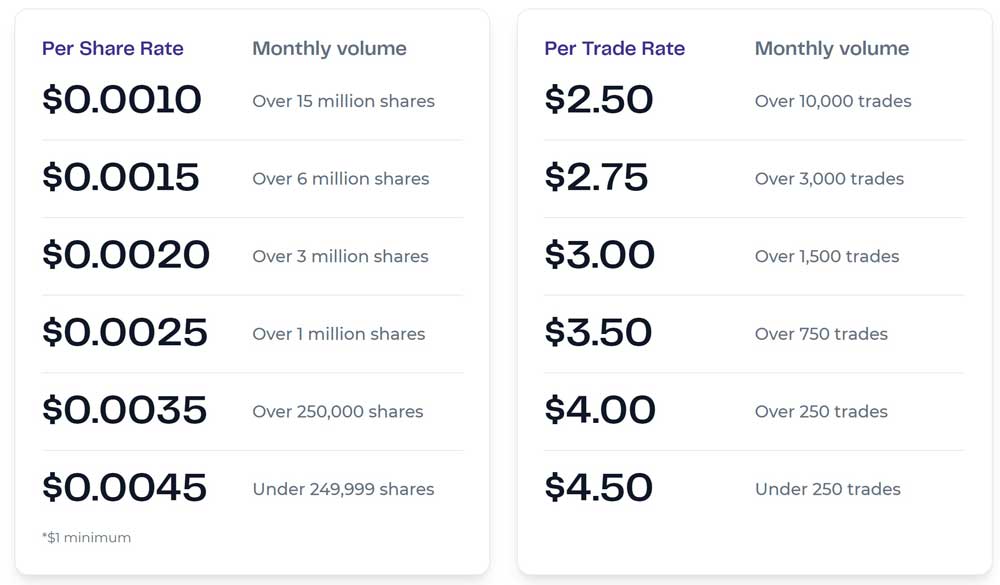

To unlock the cheapest commissions at Lightspeed, it is necessary to trade in large quantities and often. Trading commissions, margin rates, and option contract fees can all be significantly reduced. Reductions occur on a tiered system and are unlocked when new trade volume milestones are hit.

Platforms and Trading Tools

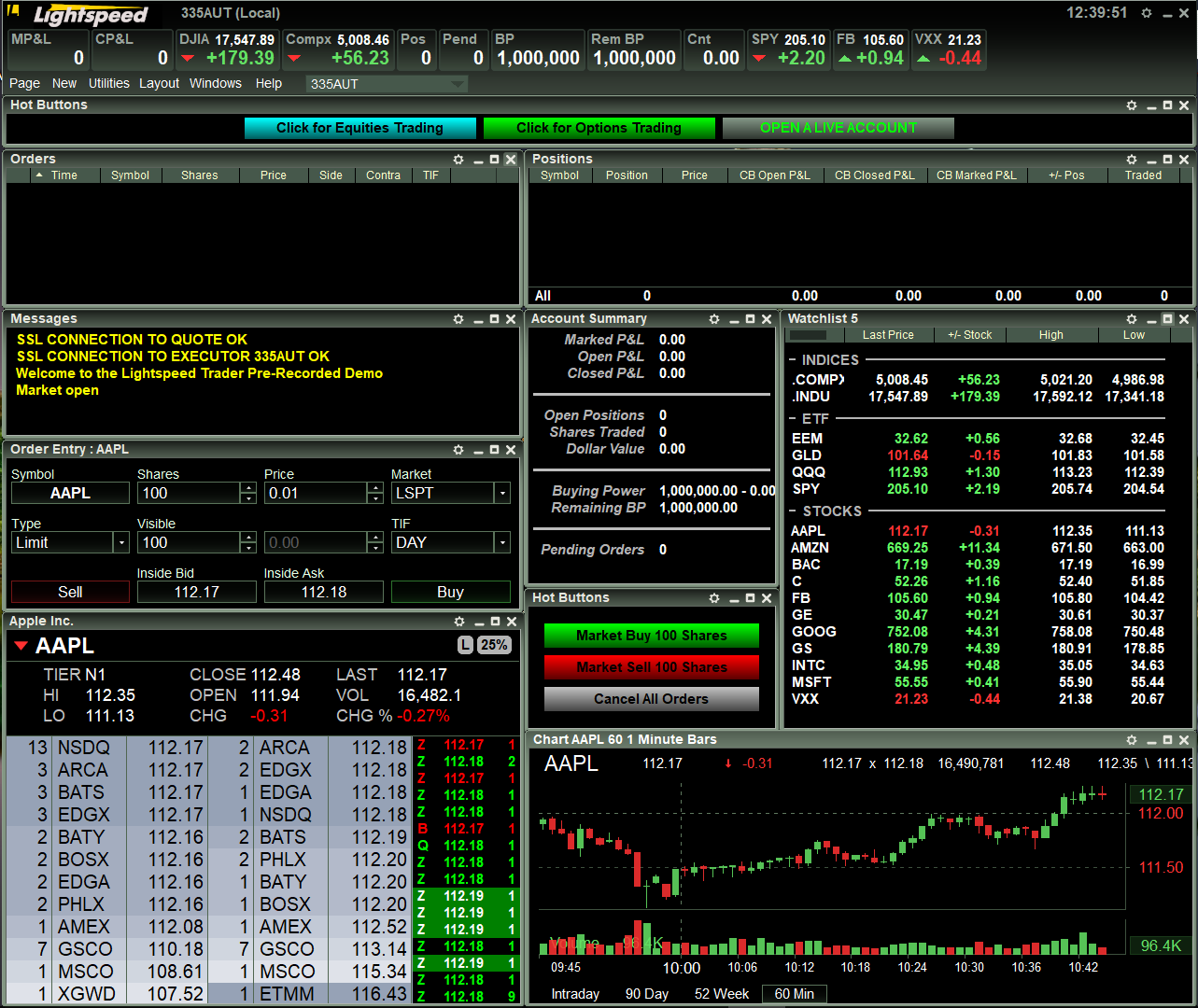

Lightspeed is well known for the versatility that it brings to the trading desk. No matter what kind of trading you plan on doing, Lightspeed has a platform built for it.

Lightspeed Trader: Lightspeed’s flagship trading platform is highly customizable and comes with multi-asset support, hotkey support, and much more. The monthly cost is $130, but trading commissions are deducted from the monthly fee.

Lightspeed Web & Mobile: Lightspeed’s web and mobile version of its flagship platform is fast and dependable but lacks some essential features such as multi-leg option support, Level II data, conditional orders, and customization. There is no monthly cost, but a minimum of $10,000 must be held in the account.

Sterling Trader Pro: Sterling Trader Pro is one of Lightspeed’s most popular platforms. It is designed to run smoothly on home computers but is very fast and feature-rich. The cost is $260/month, with a $25,000 account minimum.

Sterling Vol Trader: Sterling Vol Trader is a powerful platform offering several unique features not found anywhere else. Voice control, powerful risk analysis tools, and advanced ‘concept to order ticket’ workflow makes this platform popular with institutions and professionals. The cost is $600/month, with a $25,000 account minimum.

Eze EMS Pro/Eze EMS Express: Eze EMS is a full-featured trading platform offering multi-account and multi-asset access from one login. The cost is $350/month, with a $25,000 account minimum.

LightSpeed Trading Pros

Here are the most notable pros and cons of Lightspeed Trading.

- Direct access order routing

- Good selection of trading platforms

- Good selection of investment vehicles

- Low commissions

LightSpeed Trading Cons

- Advanced trading platforms are subscription based

- Some may view the account minimums ($10,000-$25,000) for the trading platforms as too large

Recommendations

Since Lightspeed is not a scam, you probably want to know what kinds of investors the broker caters to.

We recommend Lightspeed to active traders looking for trade execution that is as fast as it is reliable. Direct access routing, hotkey support, and a complete list of investible securities make Lightspeed a go-to option for many day traders. Lightspeed is also an appropriate option for investors with large portfolios, portfolio managers, and institutional investors.

Retail investors and those looking for a budget-friendly approach to investing can also take advantage of Lightspeed’s tools, but features are limited on the free trading software.

|