Transfer J.P. Morgan Chase to E*TRADE Or The Other Way in 2024

Transfer JP Morgan Account to E*Trade

Chase offers a solid brokerage firm that integrates well with many other Chase products, including a savings account, credit card accounts, and more. Despite its many pros, moving to another broker like E*Trade might serve you better. Or, perhaps, you want to move from E*Trade to JP Morgan Wealth Management.

Either way, we’ll show you how to transfer your funds and positions to your new broker.

Transfer JP Morgan to E*Trade

To transfer your JP Morgan investment account to E*Trade, there are two main ways to do it: manual and automatic.

Manual transfers involve getting your brokerage account into cash, transferring funds to your bank, and funding your new account.

Automatic transfers are handled through the ACATS system and are initiated from the new brokerage account.

Here’s how to do both transfer types.

E*Trade Promotion

Get up to $600 cash bonus at E*Trade.

Open Etrade Account

Manual Transfers

The first step is to liquidate your brokerage account manually. Then you must wait for the funds to settle in your account.

Settlement takes approximately three days (T+1). Once your account is fully funded and the funds have settled, you can transfer your balance to an outside bank.

Depending on your transfer type, you may need to wait up to one week before your funds become available in your bank account. For example, ACH transfers are the primary method of moving money at Chase, and they can take up to five business days to complete.

Wire transfers are faster (usually two days), but you must contact your financial advisor or the Chase service center (1-800-392-5749) to set up a wire transfer.

Once your transfer is complete and your account balance is at $0, you can request to close your Chase brokerage account. It's worth noting that there are no annual fees or account minimums for the standard brokerage account, so closing the account is unnecessary. However, many investors choose to close unused accounts.

Automated Transfers (ACATS)

To initiate an automated transfer from JP Morgan to E*Trade, the first step is

to open an account with E*Trade. The receiving broker will handle the ACATS transfer request, which in this case is E*Trade. When using ACATS, it is important to remember that the accounts involved in the transfer should be the same type—for example, retirement to retirement, individual margin to individual margin, and so on.

It is also important to ensure that the new account has the same permissions as the JP Morgan account. If you attempt to transfer securities, margin balances, or positions your new account is not approved for, the transfer will likely be reversed.

Best Brokers

Initiate an ACATS Transfer

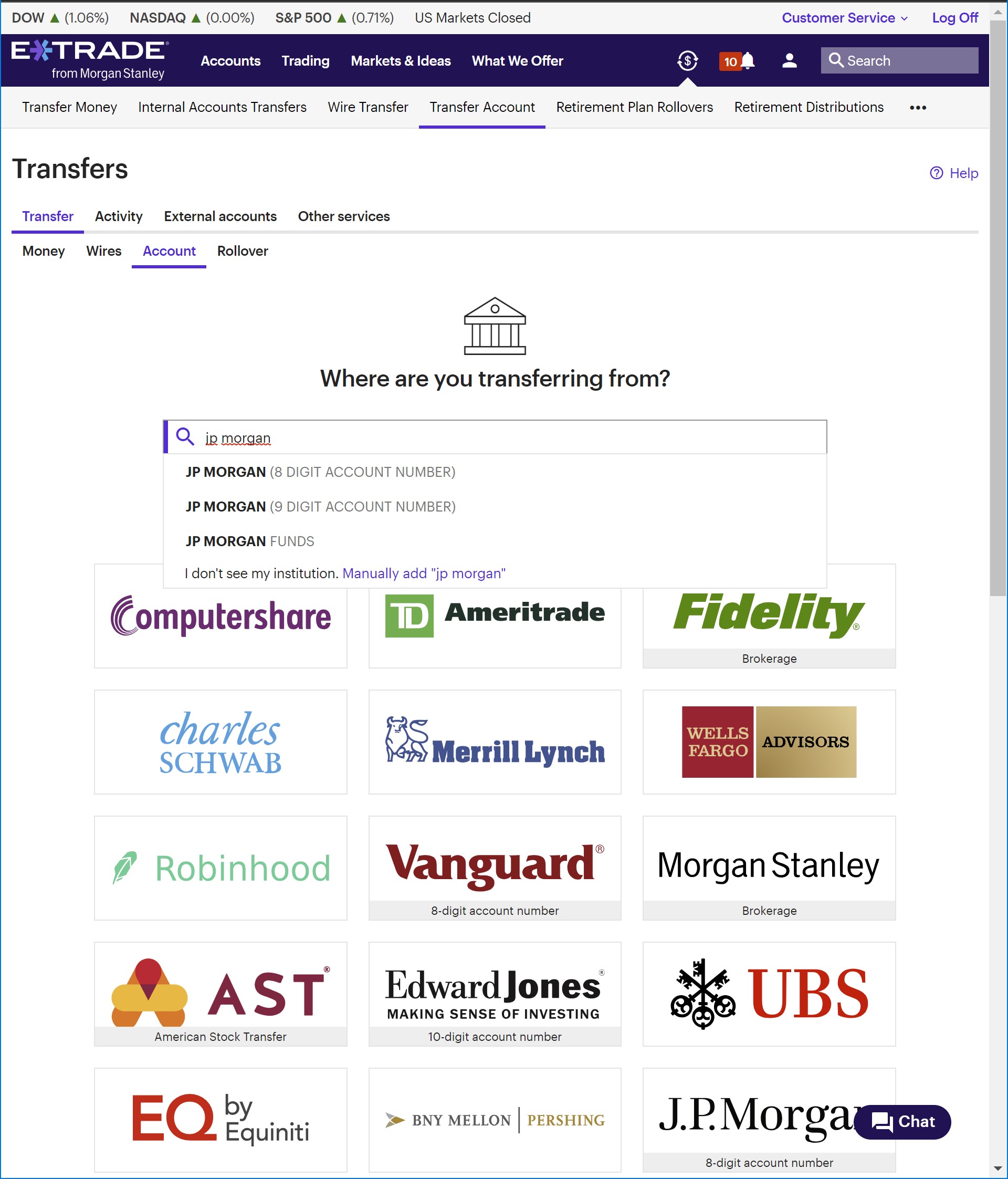

Once your receiving account is approved and open, you can initiate the ACATS process from your E*Trade dashboard.

To begin, click on the dollar sign icon located next to the alert icon (bell). Then select ‘Transfer Account,’ followed by ‘Transfer,’ and finally ‘Account.’

Enter the name of the sending broker (JP Morgan Wealth Management). Several options are available, so it's a good idea to have your JP Morgan account number ready to ensure a smooth process.

On the following pages, indicate the account types, external account numbers, and the estimated value of the transfer. Additionally, you must confirm that the same person owns both accounts, as this is a requirement.

Afterward, you can decide whether to initiate a full or partial account transfer.

The final step is to review and confirm your account transfer request.

Transfer Timelines

Transferring your account from JP Morgan to E*Trade or vice versa can take varying amounts of time, depending on the transfer method. Manual transfers can take up to two weeks due to the multiple stages of settlement needed, while ACATS transfers can take up to ten days. However, ACATS transfers are usually handled in a shorter period. The transfer time can be faster for simpler accounts and positions.

Transfer E*Trade to JP Morgan

You have two options to transfer your E*Trade account to JP Morgan: manual and automatic. For manual account transfers, you must first liquidate your assets, wait for settlement, and then transfer funds to a bank.

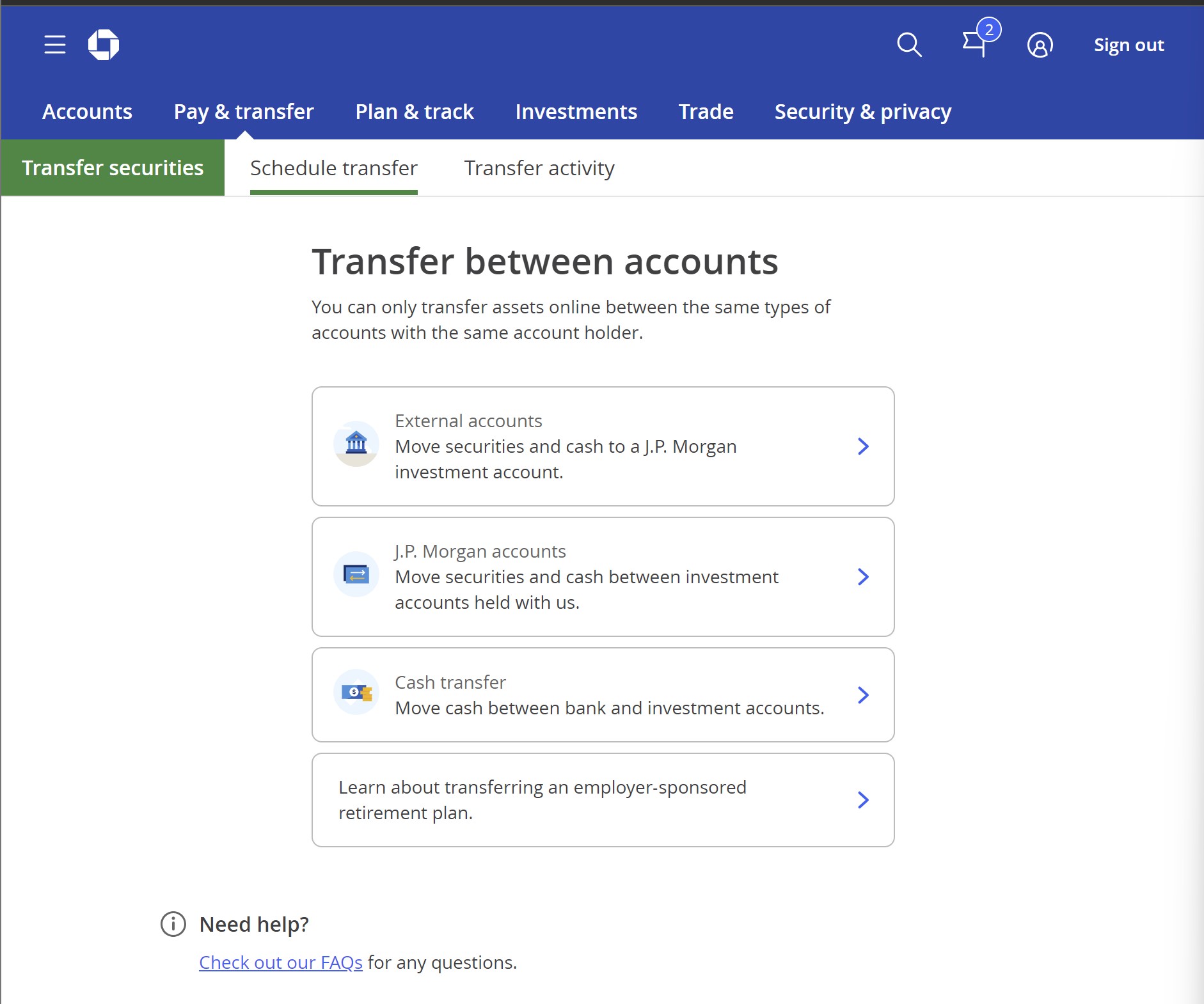

You must initiate the transfer from your Chase brokerage account for automated transfers. To do this, navigate to ‘Pay & Transfer,’ then ‘Transfer Securities,’ and finally click on ‘External Accounts.’

Chase will guide you through a set of similar steps to the ones we explained earlier. You must provide details about your E*Trade account and the securities you plan on transferring, then confirm the transfer process.

JP Morgan IRA Promotion

Get $0 stock commissions at J.P. Morgan.

Open Chase Account

|