|

Chase IRA Promotion For $700 in 2024

JP Morgan Chase IRA promotions,

special offers for opening a new ROTH, Sep, Simple, Rollover, or Traditional IRA investing account.

|

Chase IRA Promotion

Open Chase Account

Open Webull Account

Open Robinhood Account

JP Morgan Chase Promo Details

If you are considering opening a new investment account, Chase might be a great brokerage to consider. J.P. Morgan is offering a cash bonus of up to $700 for new accounts. This offer is for investors who open and fund one of three types of self-directed investment accounts. If a $700 J.P. Morgan account opening bonus appeals to you, keep reading for all the essential details.

J.P. Morgan’s cash offer is available when you open a new investment account and fund it with new money.

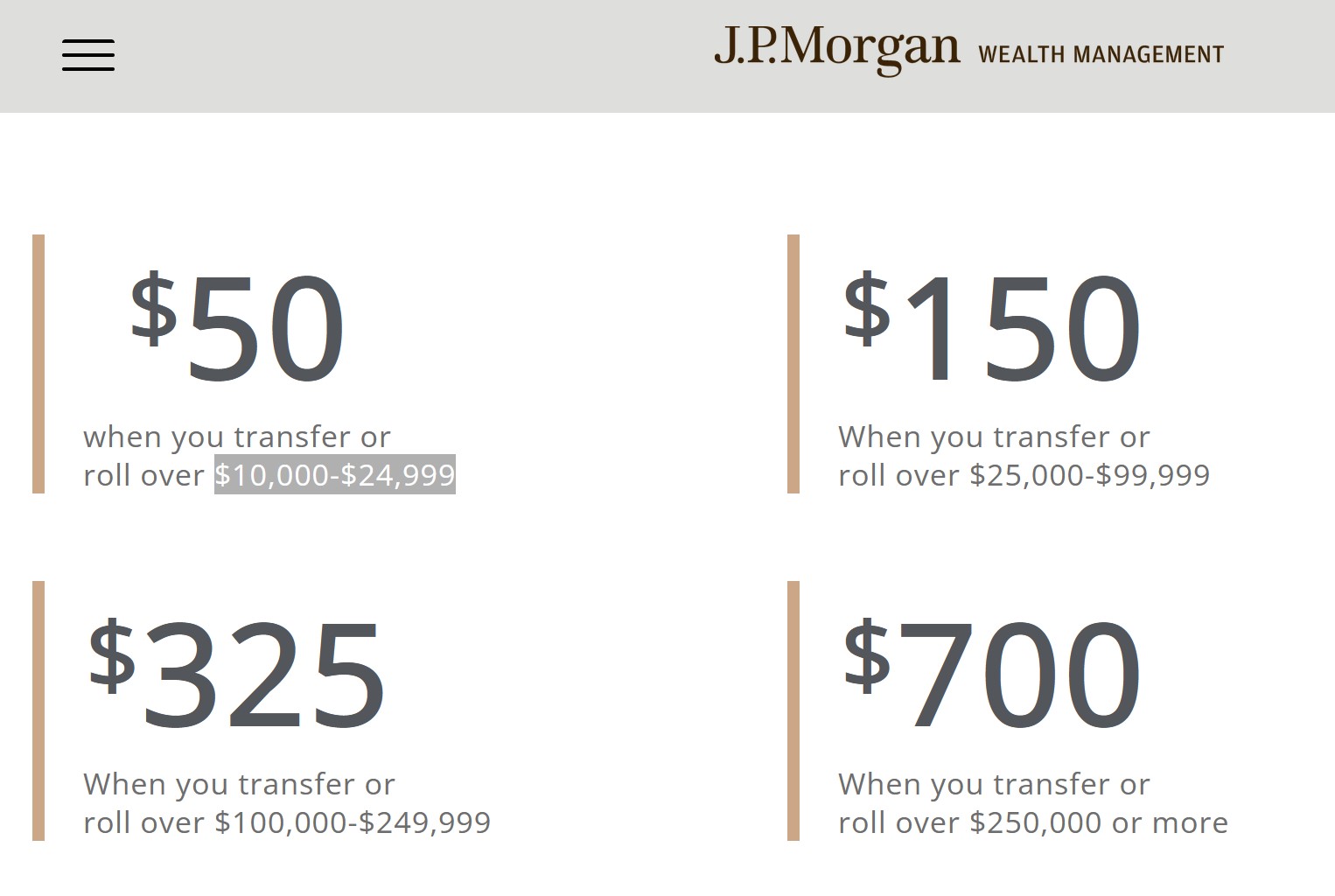

The bonus amounts are based on your deposit amount:

- $50 for a deposit of $10,000-$24,999,

- $150 for a deposit of at least $25,000,

- $325 for a deposit of at least $100,000, or

- $700 for a deposit of at least $250,000.

This could be the perfect time to transfer your investment or retirement account to J.P. Morgan. The broker offers a comprehensive array of investment resources and tools that empower investors to manage their financial future effectively.

Chase IRA Promotion Terms

The $700 Bonus Offer from J.P. Morgan is available until January 31, 2024, although it's likely that the promotion will be extended.

Funds must be deposited into the new Chase brokerage account within the first 45 days of opening the account.

You must keep the new funds in your Chase brokerage account for at least 90 days.

After the 90-day period, the J.P. Morgan's bonus cash will be credited to your brokerage account within 15 days.

To qualify, new accounts must be opened through the J.P. Morgan Wealth Management Bonus Page and not through any other channel. Here is the link:

Get $0 stock commissions at J.P. Morgan.

If you need more time to prepare for your new account, J.P. Morgan can send a promotion coupon via email.

This bonus offer cannot be combined with any other similar promotions from JPM if you have already received a bonus from a Chase checking account or a Chase Sapphire credit card account.

Steps to Collect Your Chase IRA Bonus

You can secure your J.P. Morgan cash bonus in three straightforward steps:

First, use the bonus offer link to go to the new account selection screen and start the application process by choosing the type of account you want to open.

Next, fund your new brokerage account. Chase accepts various funding methods including ACAT transfers, IRA rollovers, wires, checks, and ACH.

Note that the deposit can include both cash and assets, as long as the total meets the qualifying amount. Importantly, the funds must be 'new money' from outside of Chase and J.P. Morgan.

After your account is established and funded, simply wait 90 days to receive your cash bonus.

Qualifying Account Types

Three different accounts are eligible for this cash bonus: a self-directed investment account, a traditional IRA, and a Roth IRA.

The Self-Directed Investment account can be either a margin or cash account, providing direct access to financial markets, with no minimum balance requirements or account activity rules.

Both the Traditional and Roth IRA accounts are suited for trading and self-directed investing with a focus on retirement fund management, offering tax advantages either now or in the future, depending on the account type.

Chase IRA Bonus

Get $0 stock commissions at J.P. Morgan.

Open Chase Account

Updated on 10/1/2024.

|