Charles Schwab Promotion

Open Schwab Account

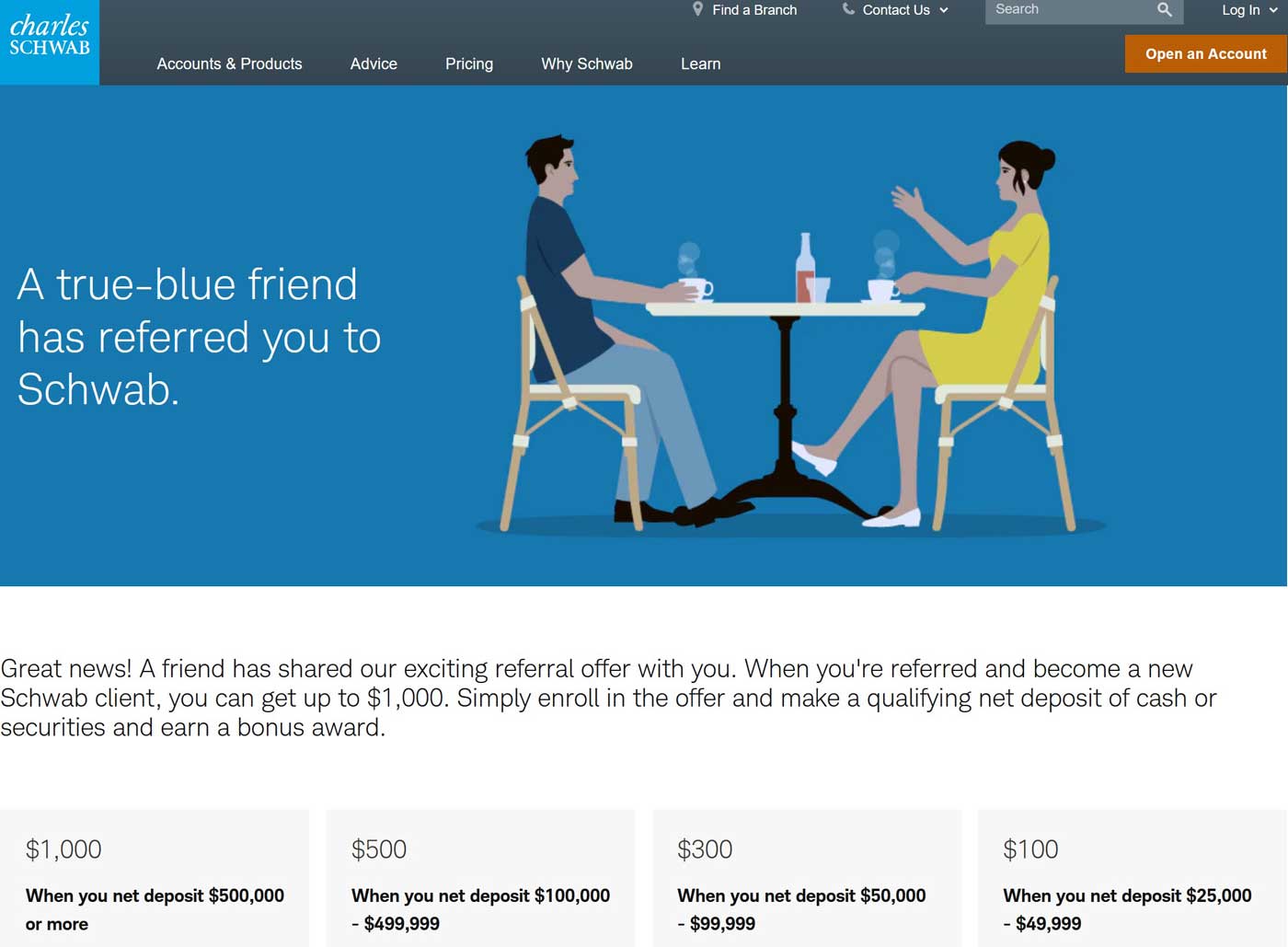

Charles Schwab Referral Bonus

Use this referral link:

https://www.schwab.com/client-referral?refrid=REFER6QWRF

Charles Schwab Bonus Details

| Schwab Bonus | Deposit or Transfer |

|---|

| $1,000 | $500k+ |

| $500 | $100k - $499.9k |

| $300 | $50k - $99.9k |

| $100 | $25k - $49.9k |

Opening a New Charles Schwab Account

The new account registration process is well-designed and very fast: it typically takes 10-12 minutes to complete an application.

When it's done, users are free to immediately login and explore the website.

New customers using this Charles Schwab promotion can link to their bank account and fund the brokerage account right away: no micro-deposit verification required.

How Long Does Charles Schwab Application Take?

The account opening process at Charles Schwab usually takes about a day, although it can take up

to 3 days. According to Charles Schwab, if the process takes more than a day for any reason,

it is most likely due to the account creation team confirming some of the information provided

in the application.

Is It Free To Open Charles Schwab Account (Brokerage or IRA)?

Yes, it's completely free to create a Charles Schwab brokerage or a retirement account. Minimum initial

deposit for new Schwab clients is $0 for cash account, but $2,000 is required for margin account.

Charles Schwab Funds

Charles Schwab is a widely used discount brokerage firm that often times ranks at the top of the reviews for online trading accounts. Charles Schwab caters to those investors who are the take charge; do-it-yourself types who love to plan their own financial futures and take control of their financial lives.

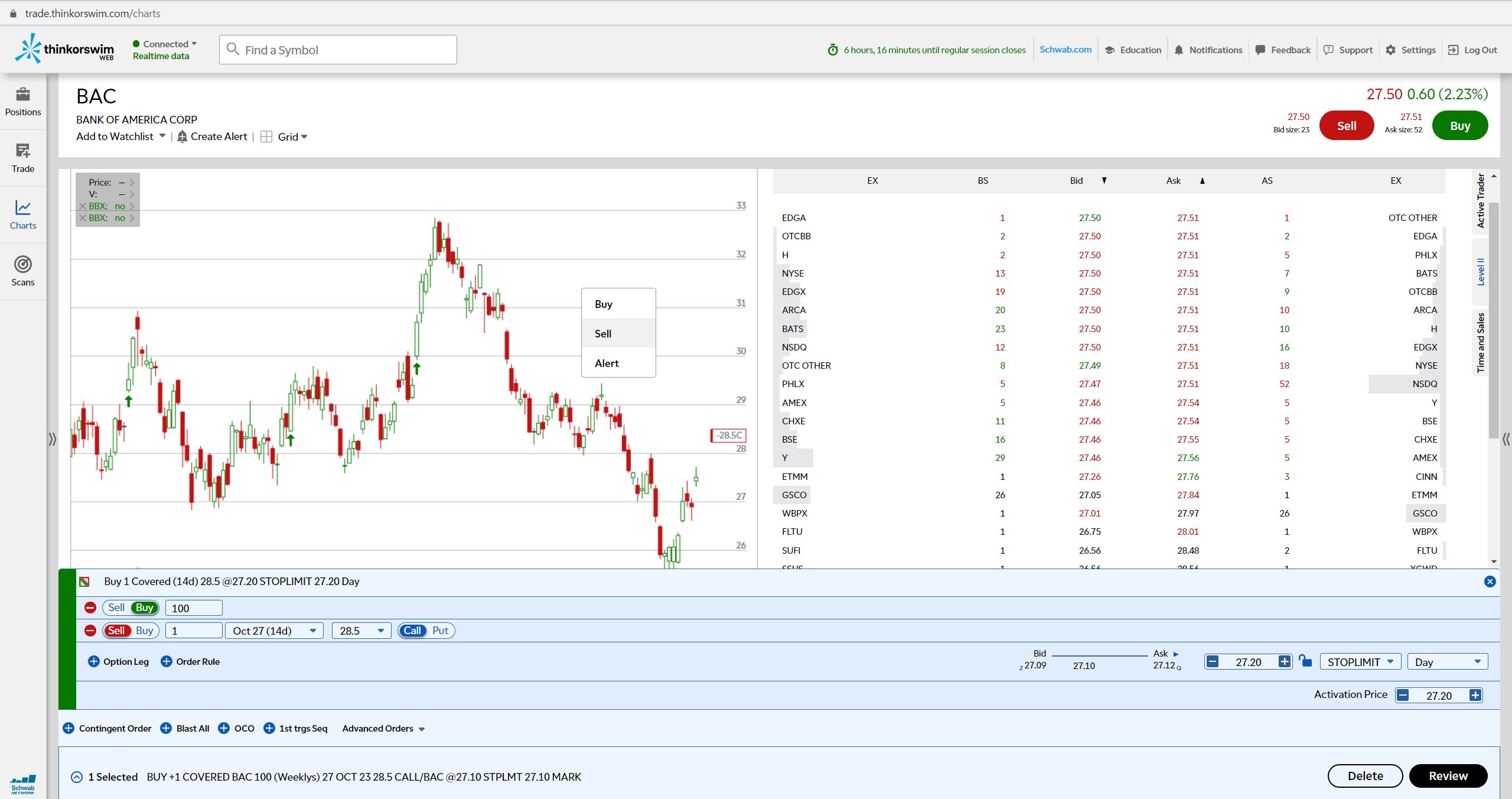

Most Charles Schwab clients are savvy in the area of stock and ETF (Exchange Traded Fund) research. They know how to read and interpret the third party research that Charles Schwab provides, and they know how to implement what they’ve gathered from this information into a workable investing plan.

Of course, the goal of these account holders is to maximize wealth through buying low and selling high. While this goal of realizing capital gains is shared by most investors, the average Charles Schwab account holder goes about his goal with the short term in mind. In other words, while most investors subscribe to the long term, buy-and-hold strategy, most Charles Schwab owners are just the opposite: they are traders by nature and their length of holding an investment is usually short term. Most of the time, Charles Schwab traders are buying and selling once the trade is profitable.

Because of this trading nature, Charles Schwab has its commission structures designed to cater to keeping costs low for frequent round-trip, buy/sell trades. Commissions can be as low as $0 for on-line equity trades. For the retail trader, Charles Schwab is an inexpensive alternative to a more expensive full service broker, which may charge up to $100+ for the same trade.

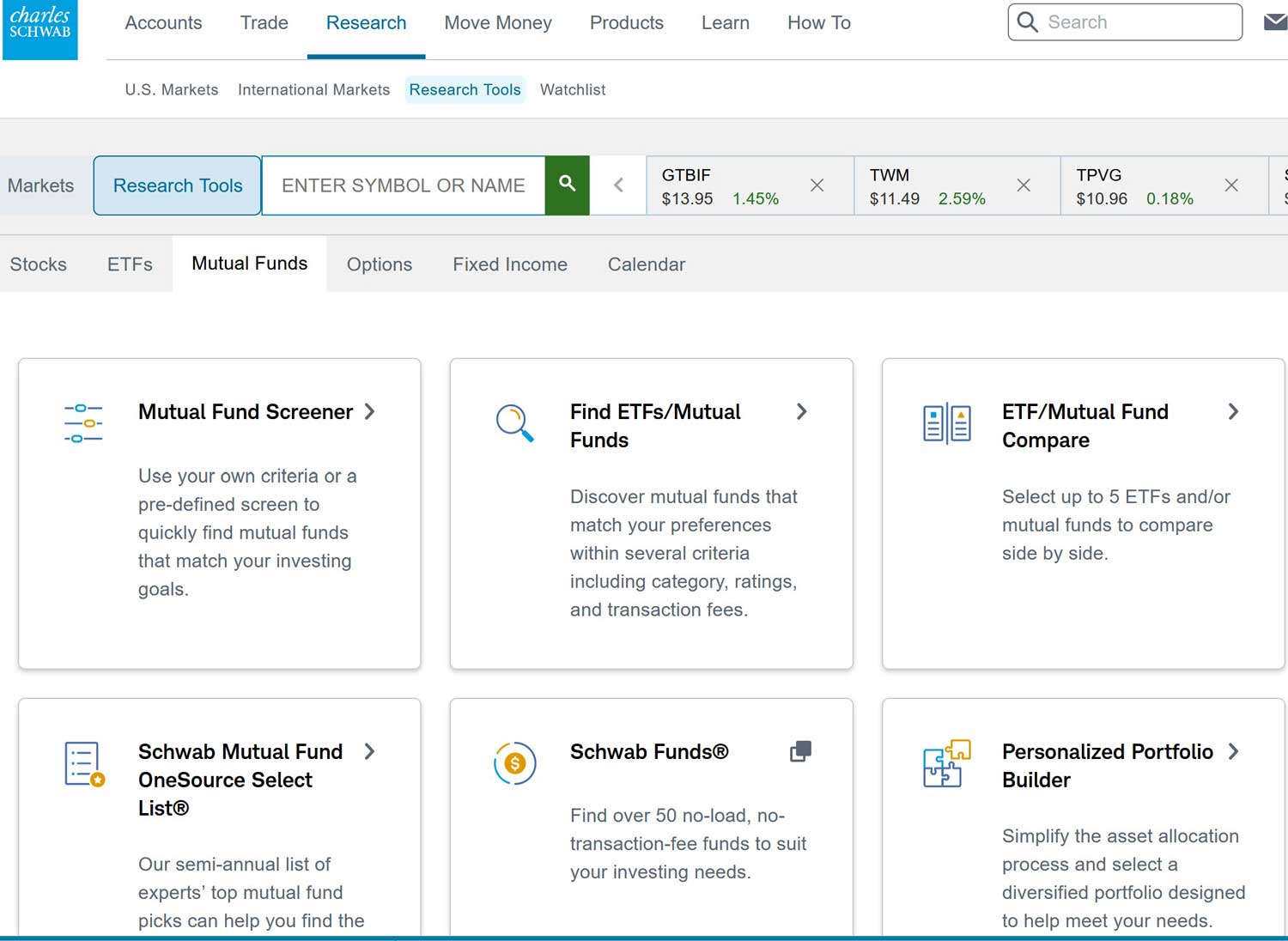

While Charles Schwab is inexpensive for equity trading, it can be quite expensive to trade mutual funds. Account owners can purchase the usual A, B, or C share mutual funds from a variety of mutual fund families in their account, while Charles Schwab collects the commissions that would normally be paid to full service brokerage houses and their financial advisors.

On the other hand, if the Charles Schwab account holder wishes to buy No-Load mutual funds from such well known and popular fund companies such as Vanguard and Fidelity, the account owner can. With a No-Load fund purchase, an account holder saves on sales charges, but pays a whopping $49.99 commission to Charles Schwab per trade!

While this $49.99 commission may look very steep, there is in fact a logical payoff to the purchase of

the No-Load fund. A $5,000 purchase of a No-Load fund at Charles Schwab at a cost of $49.99 will pay for itself in one year. This is because the normal load for a C-Share loaded fund is 1% per year, year after year. At the same time, if your full service broker puts you in an A-Share, you will break even with a No-Load fund and the $49.99 trade fee at about an $850 fund purchase.

To sum up, even at the $49.99 commission of No-Load Mutual Funds, Charles Schwab offers its mutual fund investors a breakeven/payoff levels come at l

ow dollar levels of purchase amounts.

Charles Schwab IRA Promotion

Open Schwab Account

Updated on 10/1/2024.

|