Thinkorswim Referral Code

Open Thinkorswim Account

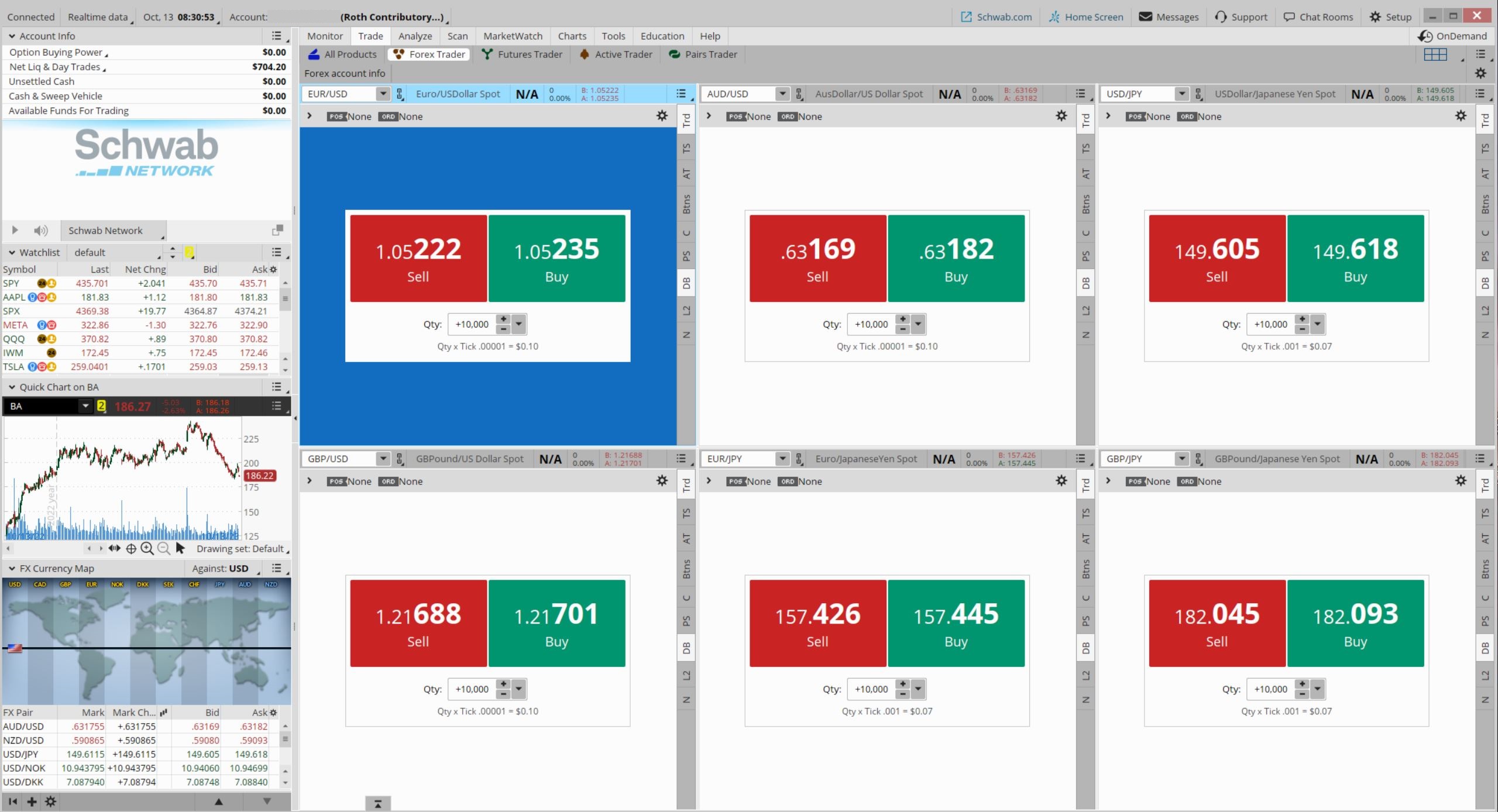

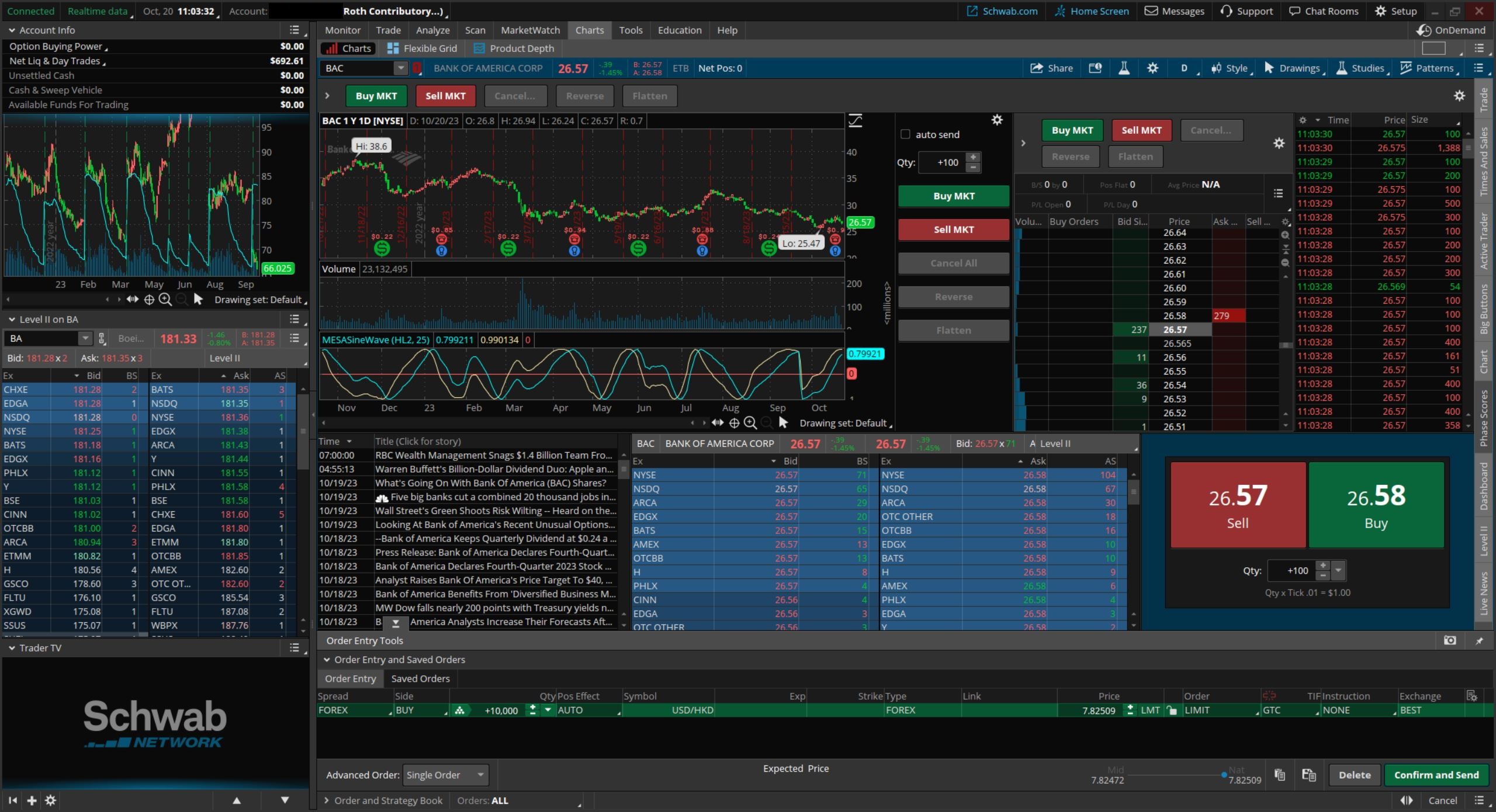

Overview of Charles Schwab Thinkorswim Platform

Compatible with both Mac and Windows operating systems, thinkorswim is one of the most advanced trading platforms on the market, and it’s entirely free.

There are no extra fees for using the software, unlike many other brokerages, and it’s unquestionably on par with institutional software. What’s unique about

thinkorswim, and this separates it from some other trading software offered by brokerages, is that it’s downloadable, which means it inherently has more

features. Having a program where an investor can logon to place trades is vastly superior to using a web browser to access a web-based trading platform,

and it comes with full customization.

Streaming of real-time data is smooth and seamless with no apparent memory leaks or issues loading data. Popping out and detaching level-II windows, customizing

and accessing 300 studies and strategies in the chart tab put the platform on a different level than its competitors.

The “Analyze” tab lets investors determine potential losses and profits, account for theta decay, and analyze the probability of profit for trades that haven’t been

submitted yet as well as analyze current account positions. Moreover, with thinkscript language, you can create and program your own technical analysis and studies.

In terms of the look and feel of the platform, there are specific options to adjust the font style/size, background color, and contrast to your liking.

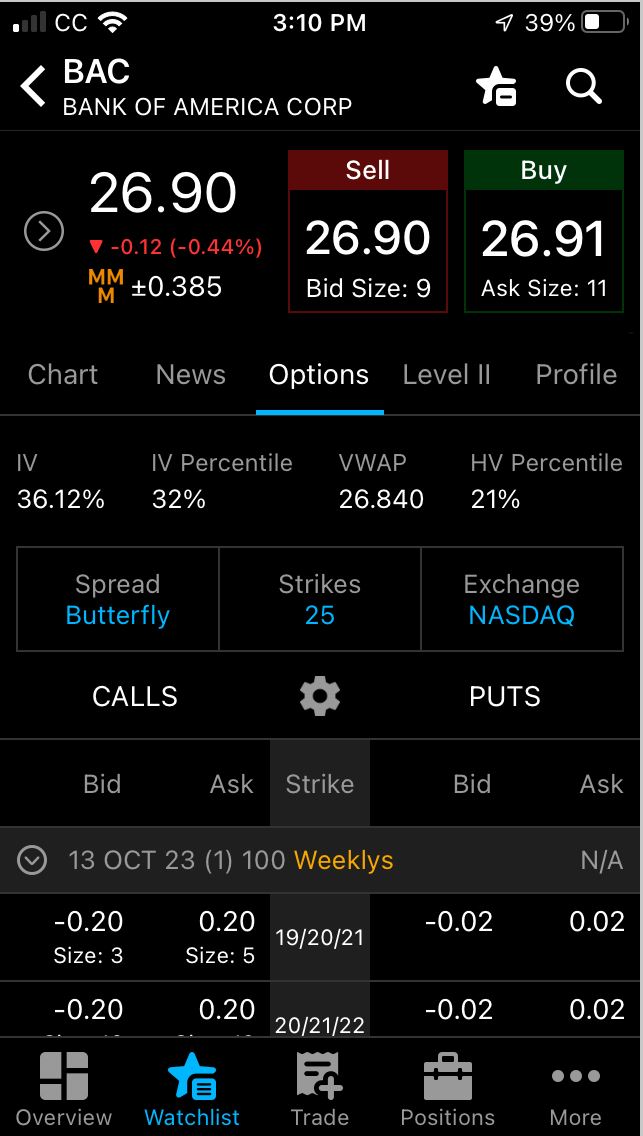

Mobile Applications

With one of the highest rated mobile trading apps in the Apple Store, the thinkorswim mobile application offers many of the same capabilities as the desktop version.

If an investor prefers the simplicity of trading from the Charles Schwab webpage, however, there is an additional app available designed by TD. Although futures

cannot be traded through the Charles Schwab mobile app, it offers smooth access to equity and option trading as well as research reports and live news.

No Hidden Fees

There are no software fees for using any of the services or trading platforms offered by Charles Schwab. Trade Architect, thinkorswim, and the Charles Schwab webpage

trading terminal are 100% free with no forced paid-subscription services for data or news. In fact, all the platforms are loaded with live,

free real-time level-II data for futures and equities.

Ease of Access to Different Investment Products

Between equities, funds, forex, and futures, Charles Schwab offers access to every type of investment

vehicle an investor could ever need. There are very few other brokers that offer access to all of these

assets.

With Charles Schwab, it’s extremely straight forward. All the tradable futures are listed in publicly available watchlists where the symbols, initial

margin requirements, tick value and tick size are displayed. Individual futures can be searched and traded by entering a forward slash and then the product symbol.

For example, Light Sweet Crude Oil is, “/CL”. For many other major brokerages, the symbols are not this straightforward and simple. The expiration month and other dashes and parentheses must be entered

further complicating and slowing down the trading process.

Commissions

While monthly trading volume and account size may ultimately determine the commission rates an individual investor can get, there are different levels of commission

rates available – if you ask. Current Charles Schwab commissions are $0 for stocks, and $2.25 per contract for futures.

Although these rates are not the lowest in the industry, you truly do get what you pay for (better technology, better customer service, diverse range of products for

trading, etc.).

Thinkorswim Referral

Get $0 trading commissions free Charles Schwab account.

Open Thinkorswim Account

Physical Branch Locations

Charles Schwab is not solely an online brokerage, they have over 100 branch locations in 34 states in the US. As opposed to many retail brokerages who conduct business

solely online, having a branch that clients can physically visit is reassuring and convenient when dropping off forms or asking for account assistance.

Best Brokerage Firm

For all the above reasons in 2024 we have rated Charles Schwab the

"Best Broker" for self-directed investors.

24/7 Customer Service

With a customer service rep always just a phone call, email, or live chat message away, investors and traders know that they can get the help they need

precisely when they need it the most with Charles Schwab. It can be 9:30 AM on a Tuesday in the middle of the market opening or 2:00 AM on a Saturday, someone from

Charles Schwab will be there to assist you. On top of this, Charles Schwab customer service representatives, and especially the trade desk, are extremely knowledgeable

and patient when helping clients. Not only can they assist with technical account issues, but they can also explain the nuances of complicated investment products,

and they’re available to do this 24/7.

Thinkorswim Referral Bonus

Open Thinkorswim Account

Updated on 7/2/2024.

|