Charles Schwab Reimbursing ACAT Transfer Fees

Officially, Charles Schwab does not reimburse an account transfer (ACAT) fee for moving

a brokerage or IRA account from another brokerage company. However,

if you open a

Charles Schwab account, and then contact a customer service asking if they will refund a transfer

fee if you move your account, they will often agree.

As an alternative, Robinhood will

reimburse up to $75 of your current broker’s transfer fee

if your transfer is at least $7,500.

Free Charles Schwab Account

Open Schwab Account

Free Robinhood Account

Open Robinhood Account

Charles Schwab - Best Place to Open an IRA

At Charles Schwab customers get flat rate $0 commission on every internet equity trade, regardless of

their account balance or how many shares they buy or sell. This rate applies even to stocks priced under $1 (penny stocks). There are 4,051 NTF or no transaction

fee (commission free) mutual funds available at the firm, and clients pay $49.99 for funds not in the NTF program.

Charles Schwab Mutual Funds

There are over 13,000 mutual funds for investors to buy and sell at Charles Schwab. The broker has 4,051 funds that have no transaction fee.

Almost 2,000 of these also have no load. The broker's website has a very useful screener than scans through all of these funds based on criteria the

user selects. These can include Morningstar rating, gross expense ratio, manager tenure, NAV return, and much more. Beyond the screener, Charles Schwab

also offers a wide selection of educational videos on mutual funds. Subjects include how to choose a fund, how to compare one to a model portfolio,

and how to use the broker's Premier List of funds.

The minimum investment amount at Charles Schwab for mutual funds ranges from zero to $5 million. It depends on the specific fund. The required minimum

for a fund in an IRA also varies based on the particular product. Charles Schwab does not impose any fees for small balances in a fund. Transaction-fee

funds will set investors back $49.99. Regrettably, this charge is applied to both the sell and buy sides. If a no-transaction-fee fund is held for less

than 6 months, a short-term fee of $49.99 is charged.

IRAs

Charles Schwab charges no special fees for Individual Retirement Accounts. There are no setup fees, inactivity fees, or annual fees. An IRA can be

opened with any amount. There are several IRA types to choose from: Traditional, Roth, SIMPLE, SEP, Rollover, and Minor (in both Roth and Traditional

formats).

The Charles Schwab website has excellent IRA tools and resources. There are good videos on retirement topics, such as income during retirement, making

withdrawals from a retirement account, and retirement for beginners. Articles discuss choosing a retirement account for a small business, figuring the

minimum amount needed for retirement, and making withdrawals after age 70½. The broker also a selection of tools and calculators. A very useful one

is an IRA selection wizard. Another is a retirement planner, which determines the amount investors need to save each year to adequately prepare for

retirement.

Open Charles Schwab IRA

Open Schwab Account

Charles Schwab Website/Trading Platform/Tools

Website

Charles Schwab's website is more advanced than the websites of all other brokers. It is incredibly well-designed, has intuitive menus, and users can easily

find all the resources they need. There are many valuable functions. Users can reach out to customer service, research securities, plan for

education costs, and much more.

SnapTicket is a convenient trading ticket that appears at the bottom of the browser. Placing trades for stocks, ETFs, and options is fast and simple with SnapTicket. The tool displays vital information, such as volume and most recent trade price.

The website also has excellent tools for research and education. Among others, investors can find information on bond trading or retirement planning.

The broker has very useful information on IPO's and trading ideas.

Thinkorswim

Thinkorswim is Charles Schwab's crown jewel of trading platforms that has many useful features. For example, the platform has a practice trading system

called paperMoney where users can practice trading with a virtual currency. Along with stocks, ETFs, mutual funds, and options, investors could also

trade on futures and forex markets which very few other brokers offer.

Charting tools on the platform are second to none. There are several drawing, technical, and pattern tools. Regression lines, evening star, and Fibonacci arcs are a few examples. A chart is

detachable, which allows it to fill the monitor.

Thinkorswim has a very professional feel to it, compared to Schwab's thinkorswim and most other broker platforms, which are simpler and have fewer features.

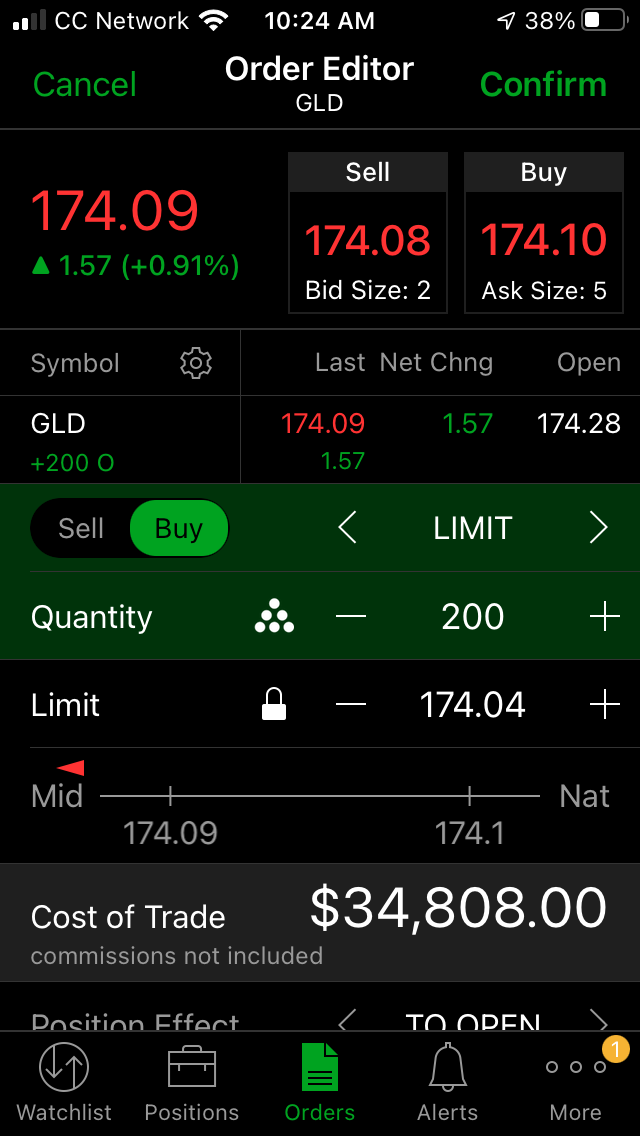

Mobile Trading

Charles Schwab customers can trade with phones, tablets, and now even watches. The broker offers three apps for phones and tablets. There is a standard

app, a Mobile Trader app, and a Thinkorswim app. They can be used on iPhone, iPad, and Android devices. The broker also has an app for Apple Watch.

The regular app is also compatible with Windows 10. Available features include order placement, funds transfer, and mobile check deposit. The apps have

a high, 4-stars rating at Google Play and iTunes stores.

The Thinkorswim mobile app has outstanding trading tools. The charting tools are the best in the industry on a mobile platform. A paper trading system

is also available on the app.

Schwab Transfer Fee Reimbursement

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Updated on 7/2/2024.

|