Ally Invest Reimbursing ACAT Transfer Fees

Unfortunately, Ally Invest does not reimburse ACAT (transfer) fee for moving

an investment account from another firm. As an alternative, Webull will

reimburse up to $100 of your current broker’s transfer fee

if your transfer is at least $2,500.

Webull Promotio

Open Webull Account

Ally Invest Refunds ACAT Transfer Fees

If you’ve been thinking about transferring a brokerage account to Ally Invest, but have hesitated due to your current broker’s transfer fee, get ready to start moving.

Ally Invest will reimburse any transfer fee (up to $75) charged by the

outgoing brokerage firm when the transfer is sent electronically through the Automated Customer Account

Transfer (ACAT) Service. This promotion is valid for one transfer per customer, and a minimum of $2,500

must be moved. Moreover, the ACAT request must be sent within 15 days of creating the new Ally Invest

account.

Ally’s rebate cannot be applied to termination or maintenance fees charged by the old brokerage firm. It could take up to a month for Ally to issue the rebate to the new account.

Making the Transfer

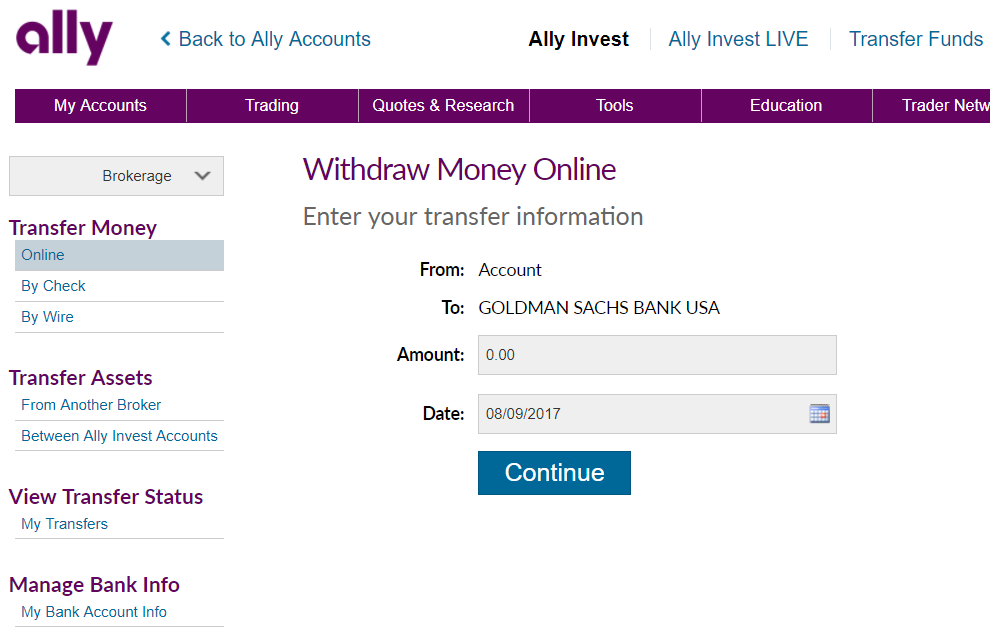

To transfer your old brokerage account to Ally Invest, you’ll first want to open your new Ally Invest account. Once you’ve done this, log into your new account and click on My Accounts in the top menu. In the drop-down menu that appears, click on Transfer Funds and then select Transfer an Account.

On the next screen, Ally’s website will lead you step-by-step through the transfer process. Everything is done electronically for your convenience. If you prefer the old-fashioned way, you can fill out this paper transfer request form and then mail it to Ally.

The names on both accounts must match. And Ally Invest does not accept the transfer of penny, worthless, or foreign securities.

Transfer from M1 Finance to Ally Invest

Thanks to an all-electronic transfer system, moving a brokerage account today from M1 Finance to Ally Invest is fairly painless. There are four basic tasks you’ll need to complete to get the job done.

First Step: Consider the cost of a brokerage account transfer. M1 Finance charges $100 for an outgoing transfer. Ally Invest will reimburse the fee, but only if your transfer is worth at least $2,500.

Second Step: Open a new Ally Invest account. This step is only necessary if you don’t have an existing Ally Invest account that matches the one you have at M1 Finance (the outgoing and receiving accounts must be of the same type and have the same name on them).

Third Step: Get your M1 Finance account ready. Although this part of the journey can require a great deal of effort when moving from some brokers, because M1 Finance only offers trading in stocks and ETFs, it shouldn’t be that difficult. Fractional shares will be automatically converted to cash.

If you plan on doing a full account transfer, open orders will need to be closed. Also, you need to let all trades settle.

If you want to transfer a margin debit, it will have to meet Ally Invest’s margin policies, and of course, your Ally account will have to have margin approval.

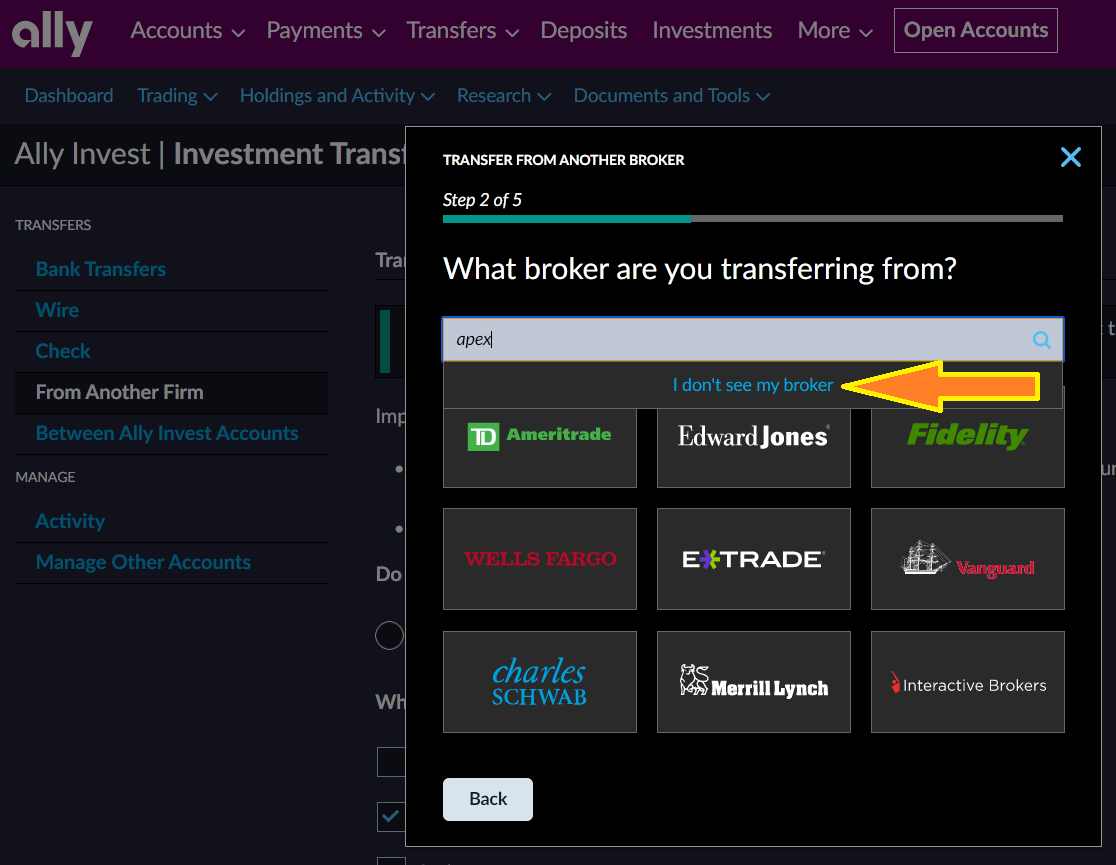

Fourth Step: Submit a transfer request. This fourth and final step will be accomplished on the receiving broker’s website. Click on “My Accounts” in the top menu inside your Ally Invest account and choose “Transfer an Account.” On Ally’s ACATS form, neither M1 Finance nor its clearing broker Apex Clearing Corp is listed as a potential outgoing broker. You’ll need to type something in the search field and then click on “I don’t see my broker.” At that point, you’ll be able to enter the details manually. The DTC number is 0158.

You’ll be able to select either full or partial transfer on the virtual transfer form. Remember that with a partial transfer, your M1 account will remain open.

Updated on 7/2/2024.

|