|

Buy Gold and Silver on Wells Fargo (2024)

Can I buy or sell precious metals, silver and gold bars, coins, bullion, gold ETFs and

precious metals mutual funds on Wells Fargo? Does Wells Fargo sell gold?

|

Can I Buy Gold at Wells Fargo?

Are you looking for a place to trade silver and gold? If so, WellsTrade and its sister company Wells Fargo Advisors may be worth a shot. Only certain methods can be used to trade precious metals at these two firms, however.

Important Takeaways

• WellsTrade offers some, but not all, methods to gain exposure to gold and silver.

• ETFs that hold silver and gold are available at both WellsTrade and Wells Fargo Advisors.

• Wells Fargo Advisors offers the same precious-metals securities WellsTrade does plus futures contracts on gold and silver.

• Gold-mining stocks are available at WellsTrade and Wells Fargo Advisors.

Silver and Gold Bullion on Wells Fargo

Neither Wells Fargo Advisors nor the online discount firm WellsTrade offers access to physical gold or silver. Bars and coins, for example, are not available for purchase.

Wells Fargo Gold and Silver Futures Contracts

Futures contracts are not available at WellsTrade, although some programs at Wells Fargo Advisors do offer access to futures contracts or managed futures funds, and these products could create the possibility of investing indirectly in precious metals.

Precious-Metals ETFs at Wells Fargo

Both WellsTrade and Wells Fargo Advisors offer trading in exchange-traded funds, and a small group of these securities hold physical precious metals. There are no securities or futures contracts in these funds, so they are completely invested in gold and/or silver.

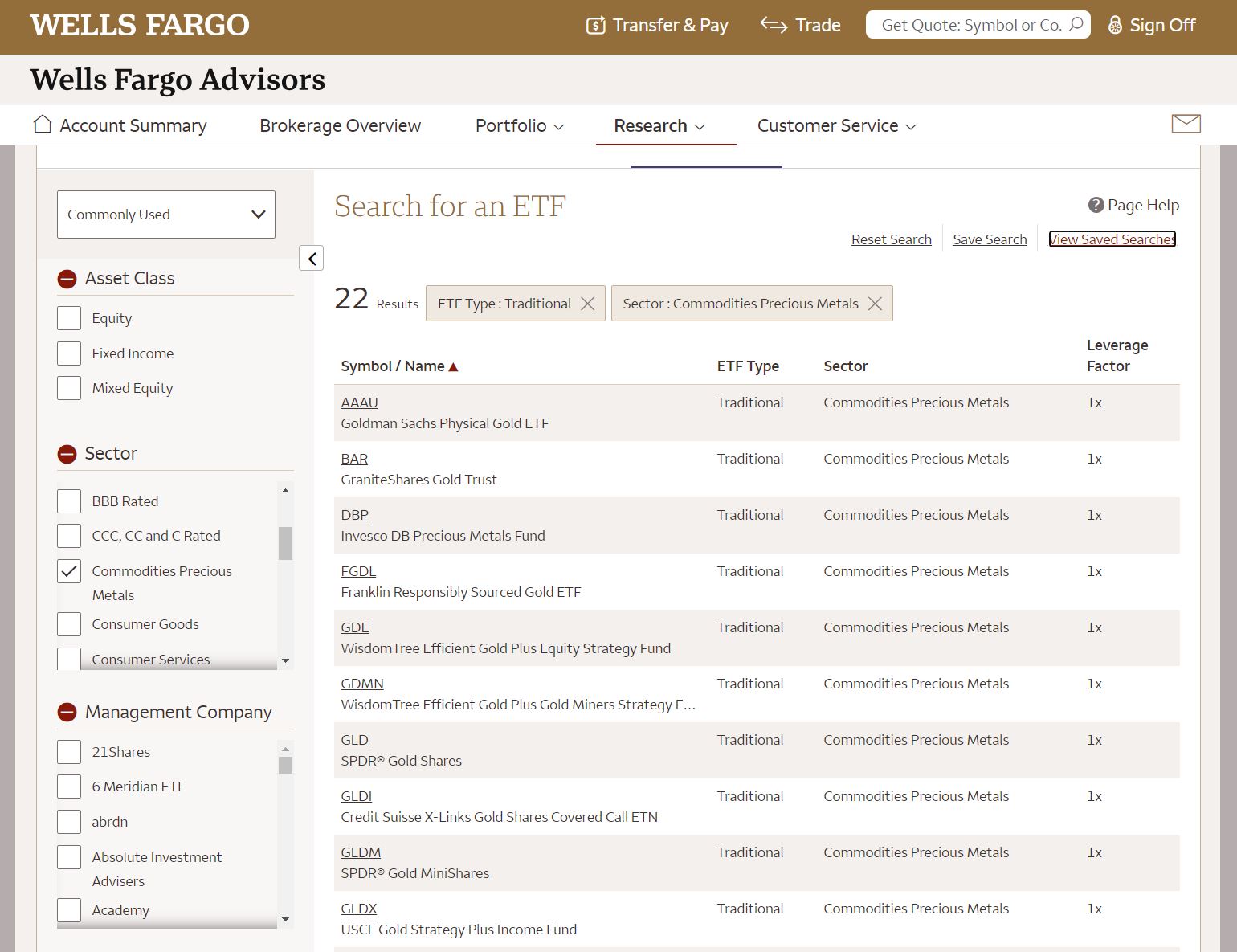

To find these ETFs, hover over the Research tab in the top menu of the WellsTrade site. A drop-down window will appear. Here, click on the link for Screeners. On the next page, select the ETF screener. Now, you’ll see the search engine for exchange-traded funds.

There are several search categories. In the field for Sector, put a tick in the checkbox for “Commodities – Precious Metals.” When we did just this, we received 22 results. Within the list we found GLD, the famous SPDR® Gold Shares Fund.

According to WellsTrade’s profile for this fund, it has an expense ratio of 0.40% per year with a market cap of $57 billion. That’s a lot of gold, which is stored in HSBC Bank’s vaults in London.

Then there is SLV, another precious-metals fund we found in the group of 22. This ETF is sponsored by iShares and holds strictly silver—about $9.9 billion of the stuff. WellsTrade’s profile for the silver fund shows mixed ratings from Lipper, with 1 being the lowest grade for preservation and 4 being the highest for tax efficiency.

Gold-Mining Stocks

There are thousands of stocks that trade on the American exchanges, and a few hundred of these are mining stocks. Their operations are devoted to digging up gold and other precious metals. These companies present yet another method to play the precious-metals market. Their shares can be traded in a brokerage account at WellsTrade or Wells Fargo Advisors.

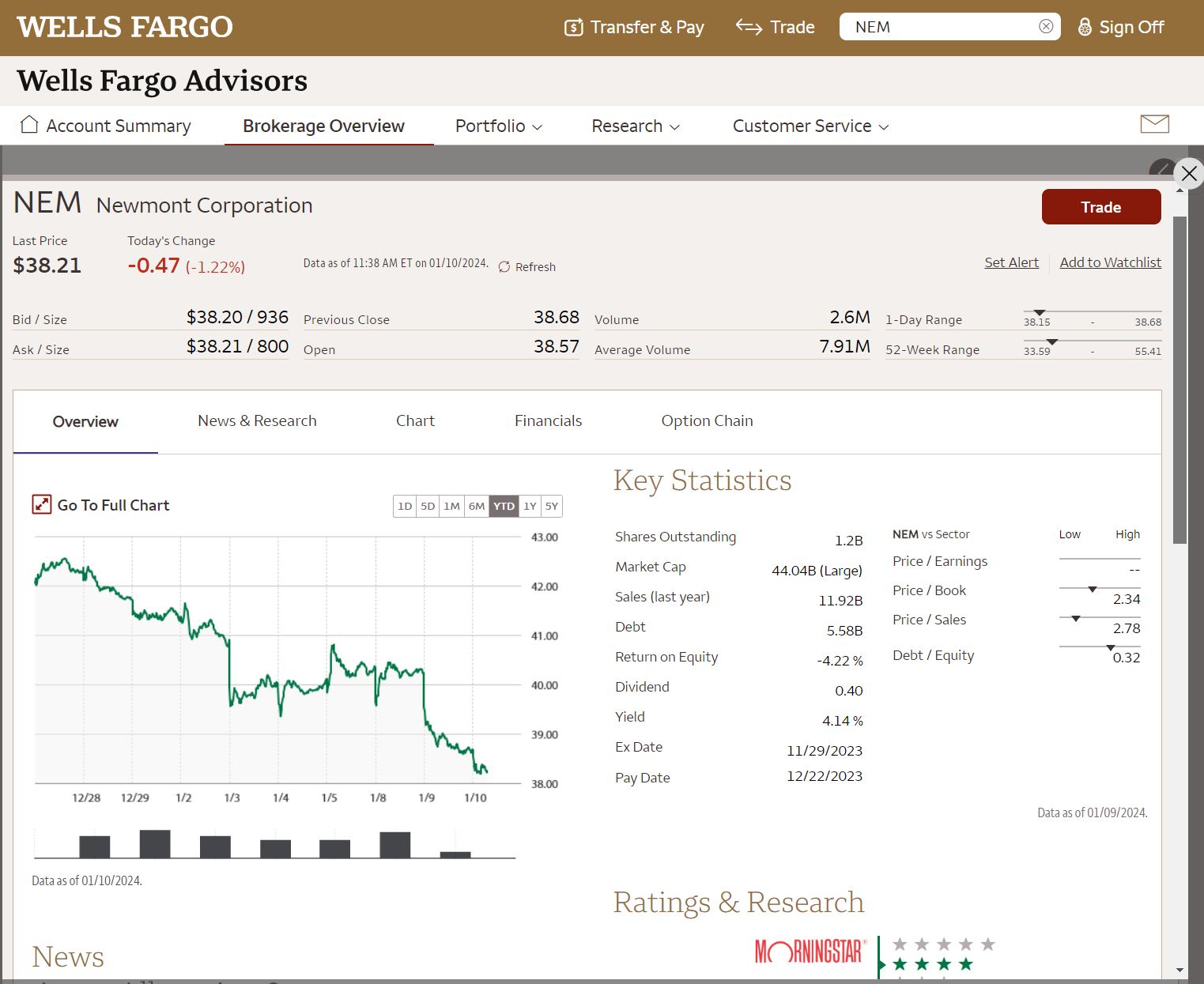

Using WellsTrade’s equity screener, we found Newmont Corporation. Trading on the New York Stock Exchange with ticker symbol NEM, the stock has short interest of 1.84% and a beta below 1.0, meaning that it is less volatile than the S&P 500.

WellsTrade’s profile on NEM shows a buy rating from Refinitiv and 4 stars out of 5 from Morningstar.

Wells Fargo and Competitors

Options on Gold and Silver Products

Many of the gold and silver securities trading on the U.S. exchanges have vibrant option markets with thousands of contracts trading on each underlying asset. WellsTrade does not offer spread trading, although single legs of calls and puts can be bought and sold. On a stock’s or ETF’s profile, look for the Option Chain tab to pull up a list of the available contracts. For Newmont, we found tens of thousands of contracts.

Commissions on Precious-Metals Assets at Wells Fargo

WellsTrade is now a zero-commission broker, so trades of gold miners and precious-metals funds will cost nothing if they are placed online. Option contracts are 65¢ when traded online.

Trades of futures contracts and managed futures inside a brokerage account at Wells Fargo Advisors will be assessed a commission disclosed at account opening. If they are held inside an advisory account, there will be a 2% management fee per year for said positions.

Updated on 1/13/2024.

|