Wells Fargo Real Time Quotes

Investors at Wells Fargo receive free real-time stock quotes, also called Level I quotes. However,

these are NOT streaming quotes—one has to refresh a webpage to see the current live quote.

Level II Quotes at Wells Fargo

Unfortunately, Level II quotes, which provide more in-depth information and used by professionals who

trade for living, are not available at Wells Fargo at any price.

Some of the firm's competitors do offer this useful service. >Charles Schwab

customers receive Level II data at no charge. Charles Schwab also charges $0 for stock and ETF trades.

Free Level II at Charles Schwab

Open Schwab Account

Banking Features

If you thought WellsTrade would be a good pick for cash management needs because of its parent company, you need to think again. The brokerage arm doesn't provide any standard banking features with an investment account. You can request checks and a debit card, but they are only available if you choose the Wells Fargo command account as your core position; and this costs $100 per year.

One workaround is to open a savings or checking account with Wells Fargo and then link the bank account to your WellsTrade account. You'll be able to access both of them with a single login. Wells Fargo's bank products aren't the best in the industry (they have monthly fees), and the bank has been hit with multiple scandals in recent memory.

Mutual Funds

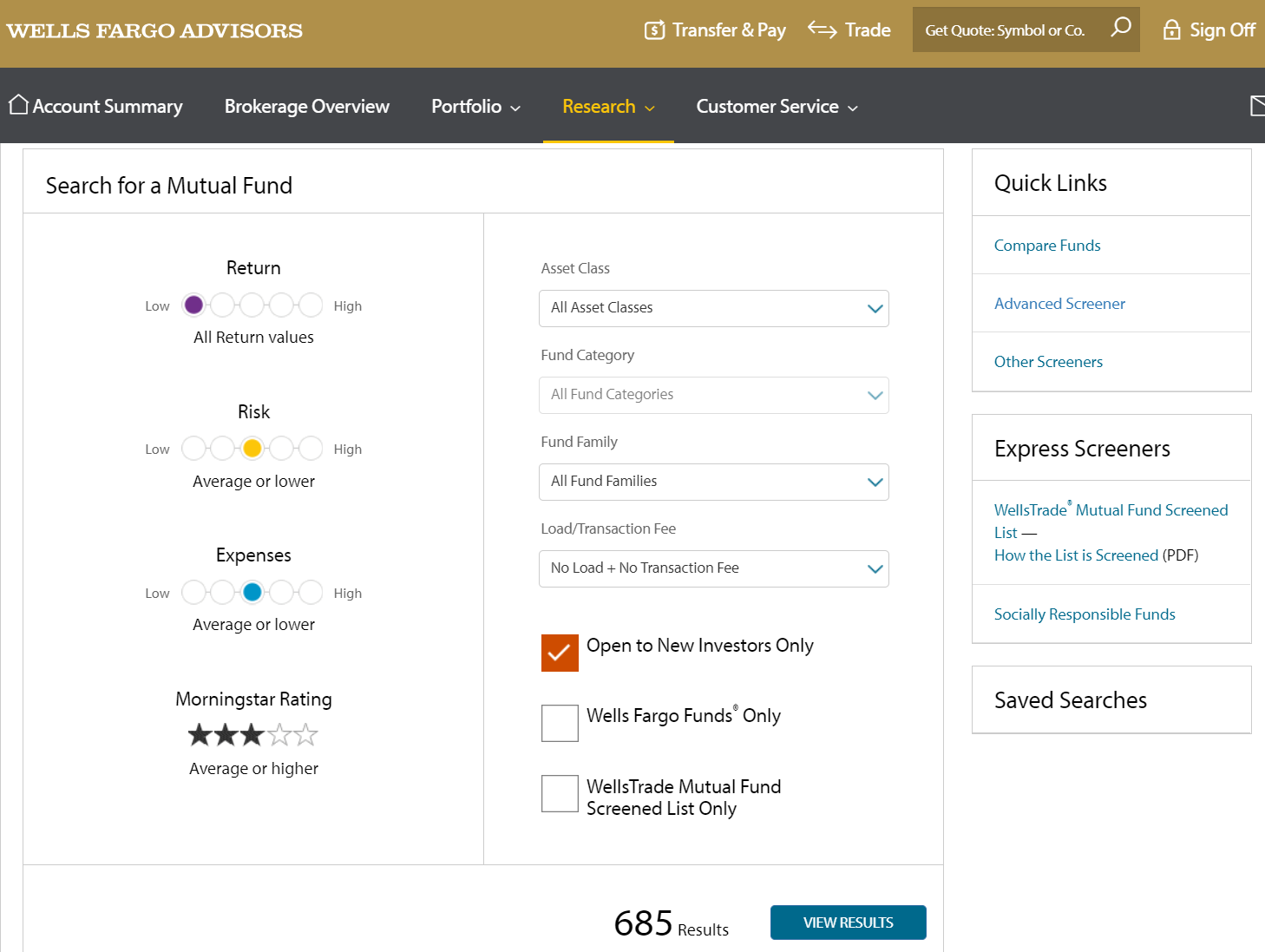

While we weren't impressed with WellsTrade's banking options, we did like its selection of mutual funds. Using its very effective screener, we

were able to find 9,232 securities available for purchase by new investors. Out of these, there were 2,203 funds that carried

neither transaction fee nor load.

The screener itself comes in basic and advanced modes. In the first, you can select Morningstar rating, return and risk values, and an expense ratio. It's also possible to search by fund family, category, and asset class.

With advanced mode, there are more options. For example, you can select the timeframe for a return history. It's also possible to select manager tenure, total assets, and minimum investment.

On the results page, funds are displayed in easy-to-read rows. They can be sorted vertically by a variety of characteristics, such as 10-year performance or Morningstar category. One feature we really liked was the ability to shuffle through columns by clicking on a link at the top of the results.

Clicking on a fund's ticker symbol will take you to the security's profile page. Here there is brief information on the fund in question. A portfolio section shows the top 10 holdings and asset allocation. We were impressed with the risk metrics shown. These include not just the standards like R-squared and the Sharpe ratio, but also less-well-known figures such as Kurtosis, Upside Capture ratio, and Skewness. They extend out to 20 years, which should help long-term investors.

ETFs

WellsTrade's ETF performance doesn't quite live up to its mutual fund showing. The first thing we noticed is that WellsTrade doesn't offer any exchange-traded funds without commissions. Of course, all US-listed funds are available for trading.

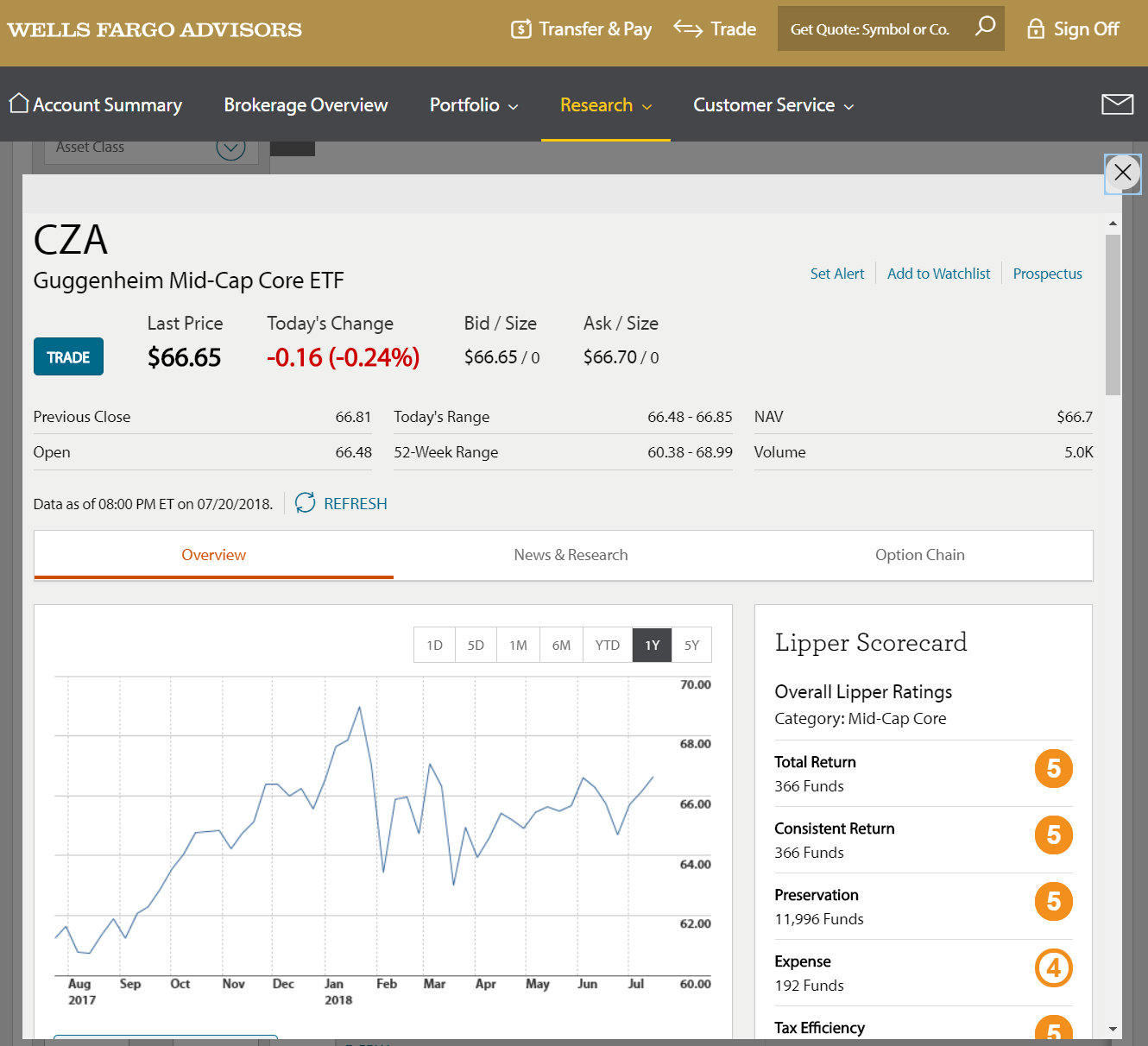

The ETF screener is similar to the mutual fund screener. It's possible to search by Lipper rating, tax efficiency, and expense ratio. Other criteria include market cap and 3-year return history. When we clicked on advanced screener, the criteria were the same as on the basic version, another tumble in the ETF category.

The results page wasn't quite as good as what we found on the mutual fund screener, either. ETF results only display the categories you choose on the screener, for example. It is possible to sort these.

On an ETFs profile page, there is a very handy Lipper Scorecard. This shows ratings for several categories on a scale of 1 to 5, and they come in multiple time frames. There is also information on investment objective, return history, sector allocation, fund manager, ticker symbol, and geographic exposure. Option chains are also available for funds that have them.

|