Extended-Hours Trading Time at Citi Bank

Citibank does not offer pre-market and after hours (also known as extended hours) trading.

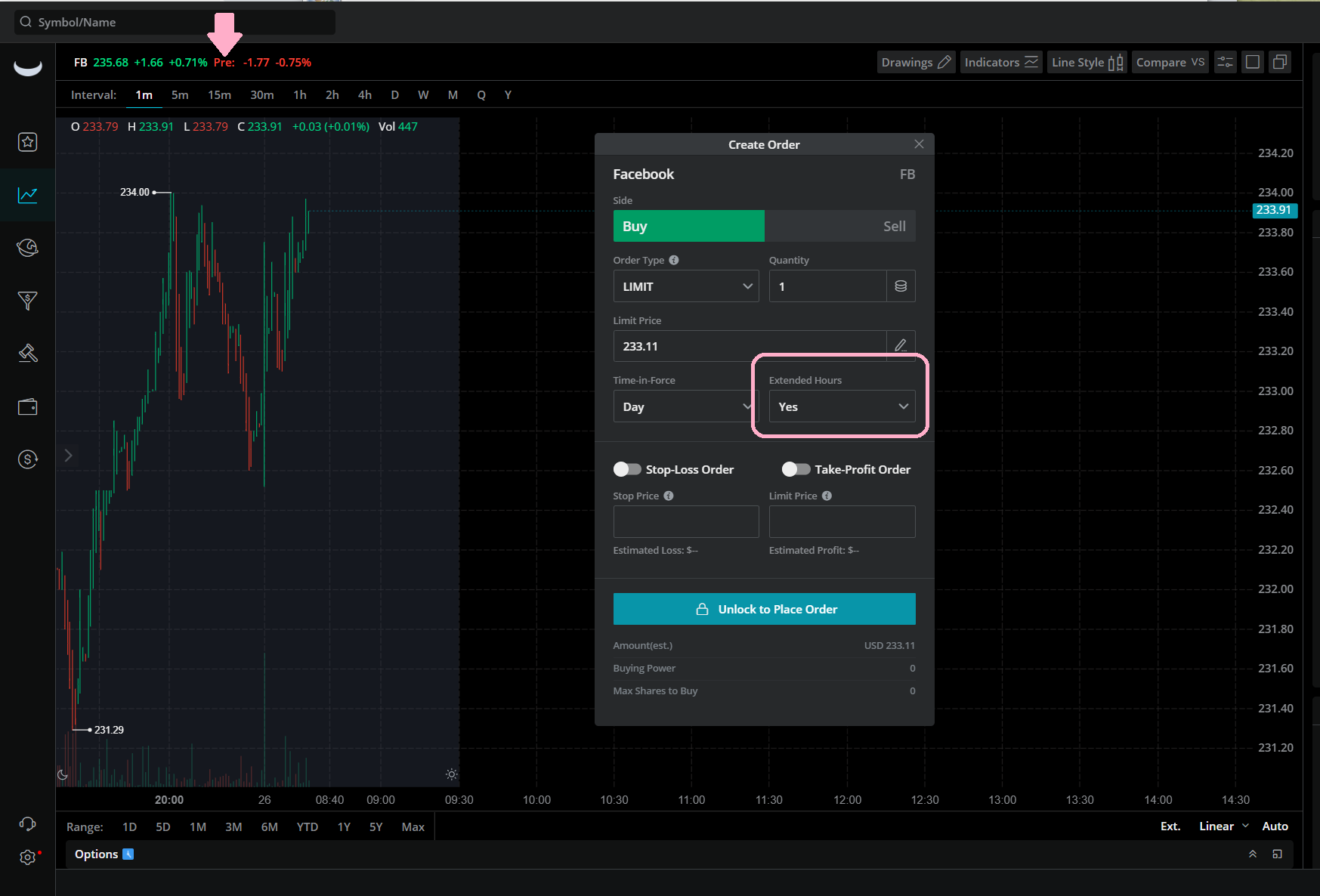

In contrast, a $0-commission broker Webull

has 4:00 AM till 8:00 PM extended hours session, best trading tools, and

more products for investing.

Try Webull For Free

Open Webull Account

Overview of Webull

With hundreds of technical indicators in its advanced trading system thinkorswim, Webull would certainly be a wise choice by technical traders. But

what about value investors who prefer to stick to a security’s fundamentals? Would Webull be a good option for these types of investors? Let’s check

out if Webull is a good broker for value investors using fundamental analysis.

Research Tools

Webull has a large assortment of research tools that fundamental analysts need in order to evaluate securities. For example, the broker offers independent equity reports from multiple third parties, such as TheStreet.com, Vickers, Credit Suisse, MarketEdge, CFRA, Ford Equity Research, and more. These publications come in pdf format and can be downloaded at no cost.

More detailed information is available on a stock’s profile page on the Webull website. An Earnings tab displays quarterly results, stretching back 4 years. Positive and negative surprises are noted, along with the company’s most recent EPS. The difference from consensus, in percent, is also stated. The broker displays the date for a stock’s next earnings announcement.

A Fundamentals tab displays information from the three major financial statements that fundamental analysts frequently use: cash flow statement, income statement, and balance sheet. Information from previous quarters is displayed, and the results are shown in GAAP earnings. Other important pieces of information on this tab includes the level of short interest in the stock, the percent of shares held by institutions, and the growth or decline in dividends, revenue, and EPS.

Other data on the Webull site that will be important to fundamental analysts include market news and company events. These articles are updated frequently and appear on a stock’s information page. The broker also shows a stock’s market cap, P/E ratio, Price/Book ratio, Price/Sales, PEG ratio, and shares outstanding.

An excellent peer comparison section also appears on the Charles Schwab site. This shows a stock’s major competitors and compares all of them on a range of metrics, such as dividend yield, P/E ratio, 52-week change, and beta. Tesla, for example, is compared against Ford, GM, and the electric car company ZAP.

Commissions, Fees, and Account Requirements

All stock and ETF trades with the broker cost $0, while options are 65¢ per contract.

Buy-and-hold investors will also benefit from Webull’s no-fee accounts. A brokerage account comes

with no annual fee, no maintenance fee, and no inactivity fee. There is also no fee to close an account. A

retirement account can be closed at no cost. The brokerage house does not require a minimum deposit to open

a retirement or non-retirement account.

Webull charges $25 for using a live broker to place a trade over the phone. Using the company’s

automated phone system is $10 cheaper. The $0 price is for orders placed online.

Most fixed-income products are on a markup and markdown basis. This means you won’t be charged a commission

for buying and selling bonds, but Webull increases the price of a bond purchase and decreases the

price of a bond sale as compensation. U.S. Treasury bonds are $25 at auction.

Open Webull Account

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

Customer Service

Value investors may benefit from good long-term customer support. Webull has more than 100 branch locations throughout the United States. The broker also has customer service reps on the phone 24 hours a day, 7 days a week. The firm’s website has an extensive self-help section with long FAQ’s ranging from account transfers to tax forms.

Dividends and Cash Management Tools

Dividends that are paid on securities held at Webull can be used to purchase additional shares at no charge, or they can be deposited as cash into the brokerage account’s core position. Checks and a debit card can be linked to this core position to easily make withdrawals. The broker does not charge for these features, either.

Exchange-traded and Mutual Funds

Value investors who look for bargains in ETF’s or mutual funds will find good resources at Charles Schwab. The broker’s screener returns nearly 12,000 mutual funds that are available for purchase, with almost 4,000 having no transaction fee and no load. NTF funds cost $49.99 if they are liquidated less than 180 days after purchase. There is another $49.99 charge at Webull—if a fund carries a transaction fee, the charge will be levied on both the buy and sell sides.

There is a good screener for exchange-traded funds on the broker’s website as well. All ETFs are

commission-free. An ETF section on the Charles Schwab website makes sorting through the securities quick and easy.

Analyst reports on ETF’s are available in pdf format from CFRA free of charge. A fund’s profile page shows

important fundamental data, including 52-week range, Morningstar return-risk metrics, tax-adjusted

performance, and sector breakdown.

Comparison

Unlike some online brokers, Webull has no account fees, and its pricing is great for both

buy-and-hold investors as well as active traders.

Best Retail Brokerage Recap

Retail investors who trade primarily using fundamental analysis will find excellent tools and pricing at

Webull. The free analyst reports on the broker’s website are especially useful.

Open Webull Account

Get up to 75 free stocks when you deposit money at Webull!

Open Webull Account

|