|

Fidelity vs Wells Fargo

Wellstrade versus Fidelity Investments—which brokerage is better in 2024? Compare IRA/Roth accounts, online investing fees, stock broker mutual fund rates, and differences.

|

Overview

Investors looking for a good value in brokerage services might consider Wells Fargo and Fidelity

Investments. Both firms have a variety of financial resources that stretch beyond investing. This

article will compare the two brokers against each other, and see if one can be considered the better choice.

Trading Tools

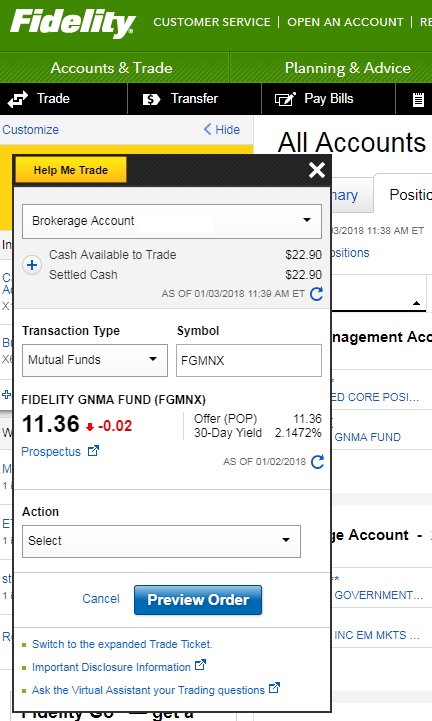

Fidelity customers can trade on the broker's website using a simple trading ticket that appears in the browsing window. It is not at the bottom of the browser. After clicking on 'Trade' on a security's profile page, the trading ticket appears in the left-hand side of the screen. Customers will also benefit from good charting tools. A graph can be displayed full screen. There are over 20 technical indicators and a few drawing tools. A security's price history can be compared to a stock or index. Fidelity also operates an advanced platform called Active Trader Pro. It does come with frequent trader requirements. Fidelity also is one of the few brokers with an app for Apple TV.

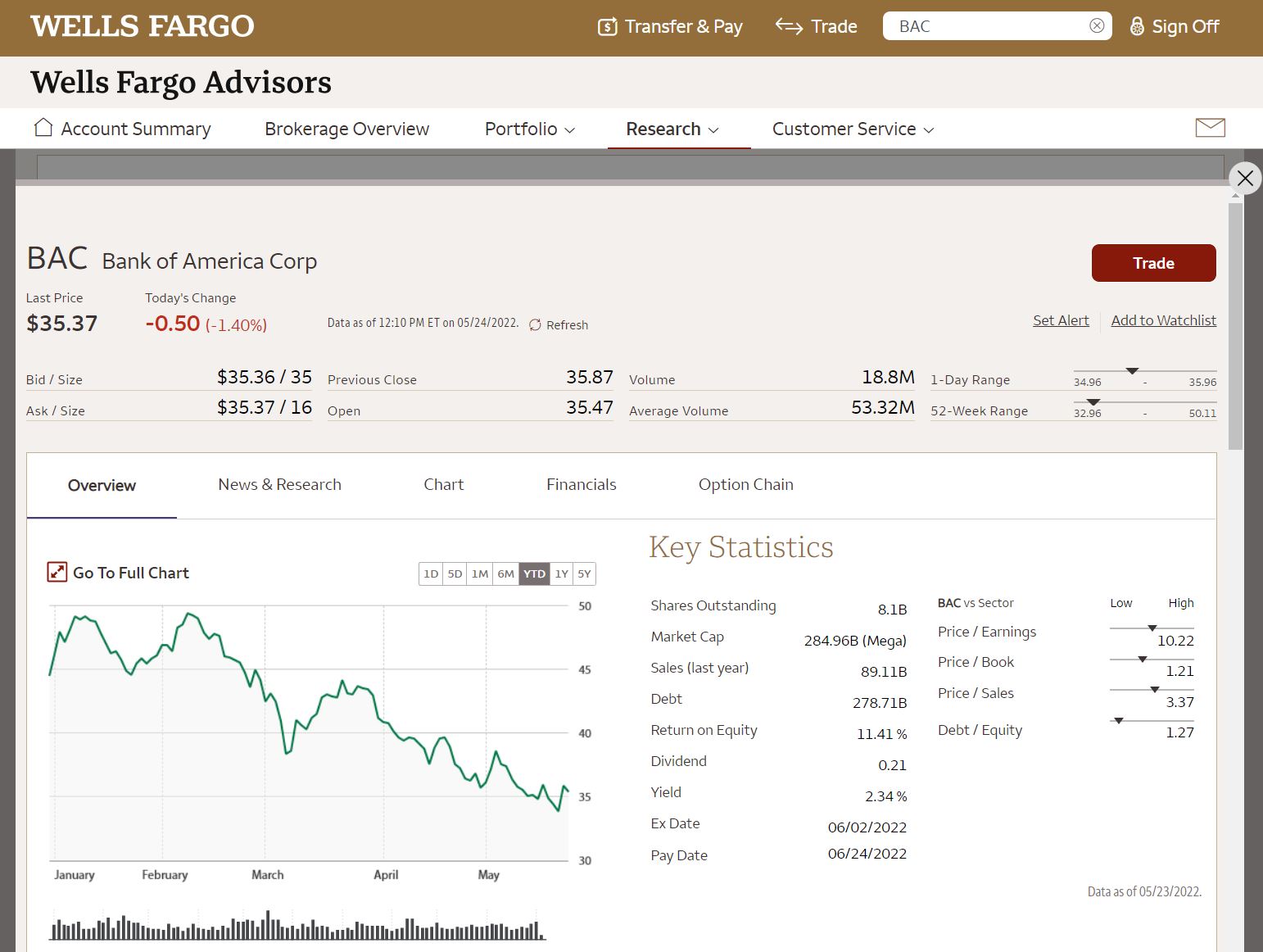

There is no trade bar on the Wells Fargo website. Interactive charting is available. A graph has a few more technical indicators than the Fidelity software. It also has a few more style options for how the price action is displayed. Disappointingly, a graph cannot be blown up full screen, nor does the broker provide an advanced platform. There is a portfolio analyzer on the WellsTrade site. It appears as if it's a basic attempt at a desktop platform. Trades cannot be entered on it.

Fidelity wins the first category.

Mobile Trading

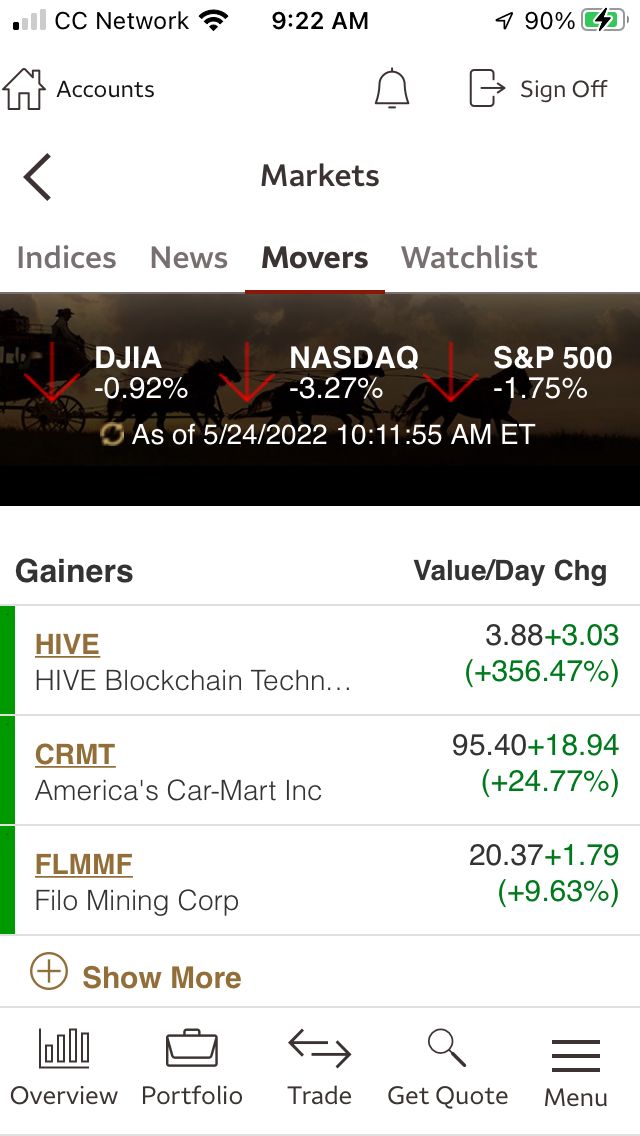

Fidelity customers who are too busy to trade on a desktop can simply use the broker's mobile app.

It's available for Android, Apple, as well as Windows Phone. There is also a platform for Apple Watch. Many functions can be performed, including transferring funds, paying bills, and placing trades. Customer service can also be contacted. The Fidelity app streams Bloomberg financial news free of charge in HD.

WellsTrade also offers an app. It is available on Apple, Android, as well as Windows Mobile. The iPhone app seems somewhat slow to load pages. The platform provides current market news and up-to-date account information. Users can also deposit a check and look over a watchlist. Simple charting is available. However, it doesn't display technical studies, comparisons, or events. There is also not any video news on the WellsTrade app.

Fidelity wins here for its free live streaming of business news.

Research and Education

Traders will find an excellent library of research and educational materials on Fidelity's website. Stock reports can be accessed at no cost. The firm maintains webinars, videos, and articles that discuss many investment topics.

While Fidelity has a screener for stocks, WellsTrade strangely does not. The broker does offer many articles by Wells Fargo in pdf format. These cover market news and stock analysis. A stock's profile page also displays recent upgrades and downgrades from equity analysts.

Fidelity wins again.

Commissions and Account Requirements

WellsTrade charges $0 for stock and ETF trades. Option contracts at the broker cost $0.65 per contract. Using a

human representative to make a trade over the phone is an extra $25.

ETF and stock transactions are assessed a $0 commission at Fidelity. Options are 65¢ per contract. The broker charges an extra $25 for executing a trade over the

phone with a live agent.

A securities account at WellsTrade can be opened with $0. Fidelity requires a minimum deposit of $2,500. There are no on-going maintenance, inactivity, or annual account fees at either firm.

This is a draw.

Fund Trading

Fidelity clients have access to more than 11,500 mutual funds. Approximately 1,800 of these carry

no transaction fee and no load. WellsTrade offers slightly more than 10,000 mutual funds. Roughly

2,600 are no-load, no-transaction-fee products.

Wellstrade wins.

Customer Service

Fidelity can be contacted by email or phone 24 hours a day, seven days a week. The firm also has

on-line chat. Customers who prefer in-person service can find a Fidelity representative at one of

the broker's 180 locations throughout the U.S.

WellsTrade customers can talk to an agent over the phone any time of the day. On-line chat does not exist. The broker does not have a network of retail locations like Fidelity does, although it does offer investment advisors for a fee in several U.S. cities.

WellsTrade fails again.

Alternatives

Fidelity vs Wells Fargo Summary

Fidelity Investments won all categories except three. Obviously, Wellstrade needs to improve in

some areas. Nevertheless, the brokerage firm may be a good choice for Wells Fargo Bank customers.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|