Review of Wells Fargo IRA Account

Wells Fargo is mostly known for its global banking services. But it has a lesser-well-known discount broker here in the United States that offers low commissions on several investment vehicles. Can it compete with the titans of the industry? We’re fixing to find out.

Bulls Point Out...

New commission schedule. WellsTrade has responded to the brokerage price war by introducing a new pricing schedule.

Large list of mutual funds. Along with a good fund screener.

Free research from Wells Fargo Securities. Plus other educational resources.

Bears Point Out...

Software is very basic. And some tools are missing altogether.

A few investment vehicles are completely absent. WellsTrade is a securities-only broker.

Customer service needs improving. WellsTrade lags behind its competitors here.

WellsTrade Pricing and Minimum Deposit

| Investments | Commissions |

|---|

| Stocks and ETFs | $0 |

| Stocks and ETFs (broker assisted) | $25 |

| Options | $0.65 per contract |

| Mutual funds | $35 |

| Auction of Treasury Bills, Notes and Bonds | $0 per transaction |

| Investments | stocks, options, mutual funds, bonds, ETFs |

| Wellstrade minimum deposit to open account | $0 |

| Fees | Wellstrade fees |

Available Accounts

WellsTrade offers cash and margin brokerage accounts. It also offers tax-deferred Individual Retirement Accounts. Varieties include Roth, traditional, and SEP.

Although there is no 529 plan at WellsTrade, the Coverdell Education Savings account is available. So is a self-employed 401(k).

Customer Service

WellsTrade has customer service reps available on the phone all hours of the day and night, including weekends and holidays. Unfortunately, we didn’t find an online chat feature (either human or robo) on its website. Moreover, there is no internal messaging feature, which means phone service is it.

To make matters even worse, WellsTrade does not have any branch locations. The broker’s customers can make deposits at Wells Fargo Bank locations, but that’s the extent of the service for investment customers. While some Wells Fargo Bank locations do offer investment advice, they do not offer any type of general customer service.

While many roadblocks appear in the various channels of potential avenues of service, the WellsTrade site has a customer support section with a few do-it-yourself functions. These include a password change tool, a list of forms, and a tax center.

Tradable Assets

WellsTrade clients can buy and sell closed-end funds, exchange-traded funds, mutual funds, stocks, option contracts, and fixed-income securities. The latter product can only be traded over the phone. Stocks include OTC and penny stocks, but not foreign investments.

Missing at WellsTrade are the following assets: cryptocurrencies, contracts for difference, forex, futures, and precious metals.

Cash Management

Although WellsTrade is owned by Wells Fargo, the low-cost broker doesn’t have any notable cash management features. Strangely, there is no FDIC-sweep service. Instead, free cash balances are protected by the SIPC. Moreover, WellsTrade doesn’t offer checks or a debit card.

An alternative is to open something called the Wells Fargo command account. This does come with checks and a debit card, but there’s an annual fee for the service.

Perhaps the best option here is to open a bank account with Wells Fargo and then link it to a WellsTrade brokerage account. Inside a WellsTrade login, it is possible to transfer funds between accounts, send money using Zelle, and use a bill pay service. Another great service is a free FICO score.

If you choose not to open a Wells Fargo Bank account, an external deposit account can be linked to a brokerage account. On either the broker’s website or mobile app, funds can quickly be transferred via the ACH system.

Portfolio Management

WellsTrade was slow to roll out a digital advisory program. It’s actually a hybrid service, combining human advisors who create portfolios and a software program that chooses the right one for each customer, monitors positions, performs tax-loss harvesting, and rebalances accounts.

There is a $10,000 minimum, which is pretty steep by today’s standards. Moreover, the cost is 0.50%

per annum, another above-average figure. You can compare these rates to what the best priced

financial advisors in your area charge.

On the plus side, clients of the portfolio management service can call one of the company’s human

advisors free of charge.

Commission Schedule

WellsTrade offers $0 commissions on stocks, closed-end funds, and ETFs.

This assumes they’re traded online or over the phone with the broker’s automated system. Placing a trade over the phone with the help of a WellsTrade associate costs $25.

One thing WellsTrade didn’t do was eliminate its 65 cents per option contract charge. Once again,

there’s a $25 surcharge for using a live agent.

Transaction-fee mutual funds cost $35. U.S. government debt costs $50 per transaction, while other fixed-income investments are priced on a markup/markdown basis.

Closing an IRA costs $50, and so does transferring any type of account to another brokerage firm.

Fund Resources

Fund traders will find some helpful resources on the WellsTrade site. Fund profiles provide decent amounts of information, including 52-week range, bid-ask spread for exchange-traded funds, performance history, key stats, sector allocation, top 10 holdings, geographic exposure, and recent news.

Option chains are available for ETFs that have open interest. Perhaps best of all is Lipper ratings free of charge.

On the mutual fund side, Morningstar ratings are used instead of Lipper. Many important pieces of information are displayed for mutual funds, including transaction fee status, minimum investment, Morningstar style box, top holdings, asset allocation, and risk measures, such as R-squared and the Sortino ratio.

Screeners for both mutual and exchange-traded funds will be found under the ‘Research’ tab in the top menu. They are available in both advanced and basic mode. Search variables include load status, fund family, analyst ratings, turnover ratio, 12b-1 fees, and return history. A handy trade button is displayed in the search results.

Using the mutual fund screener we found 8,801 products, of which 2,078 were no-load, no-transaction-fee funds.

Trading Tools

Now we come to actual trade placement. As already mentioned, bond trades must be placed over the phone. For everything else, there is a website—and we do mean explicitly a website. There is no desktop software or browser platform.

The website is pretty simple without a lot of clutter. The advantage with this setup is that the site is easy to use and navigate. The downside is that many tools are missing.

For example, there is no trade bar on the site. Instead, orders are placed on basic web pages. Although there’s not much to them, there is a help icon on the order ticket. Clicking on this produces a pop-up window with order type explanations.

There are limit, market, stop, and stop limit orders available. We didn’t find trailing, OCO, or other advanced types.

Bid and ask sizes are displayed along with last trade price. A refresh icon can be used to update

all these details. Unfortunately, there is no trade ticket for extended hours. This is because

WellsTrade does not offer extended hours trading.

At the top of the site is a search field. Typing in a company name or ticker symbol produces a small drop-down menu with several features. A security here can be added to a watchlist, alerts can be set, option chains can be selected, and a trade can be started. It’s also possible to click on ‘Details’ to go to a more thorough profile.

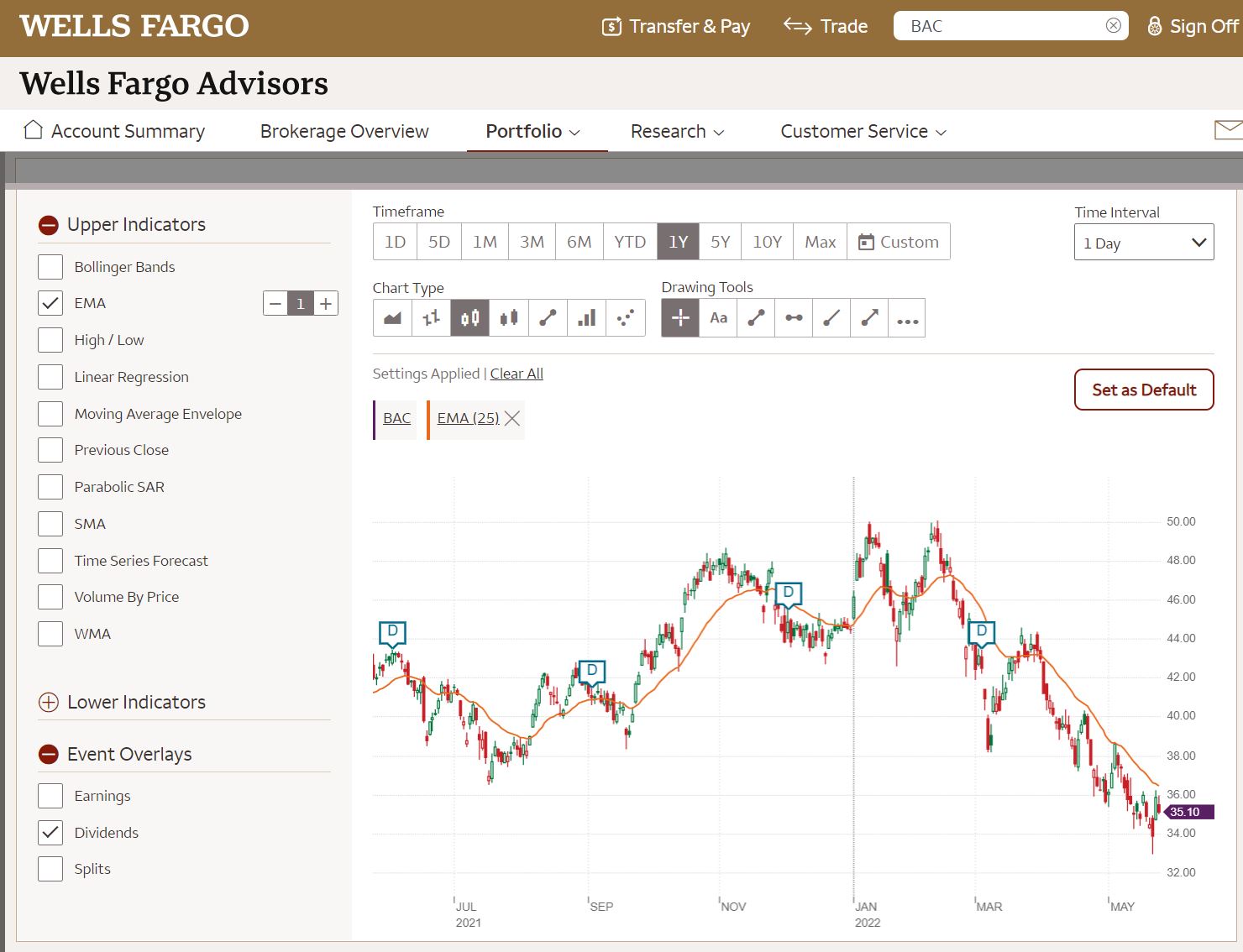

On a security’s profile, a chart can be expanded from a smaller version. On the full-size edition, there are technical indicators, event overlays, multiple graph styles, and several chart styles. One weakness is the inability to display a graph the width of the computer screen.

Mobile App

WellsTrade customers do get to use a mobile app. But it doesn’t quite have all the features we wanted to see. For example, there isn’t a mobile check deposit tool (the service is available on the same app for banking customers).

Stock profiles on the app show a small chart that can be rotated horizontally. But there are no tools of any kind in this mode.

Alerts can be established and a stock can be added to a watchlist. Option chains (for calls and puts only) can be viewed as well.

The platform’s order ticket offers the same features as the website’s except that there’s a calculator on the mobile app that can convert a dollar amount to number of shares.

Security Analysis

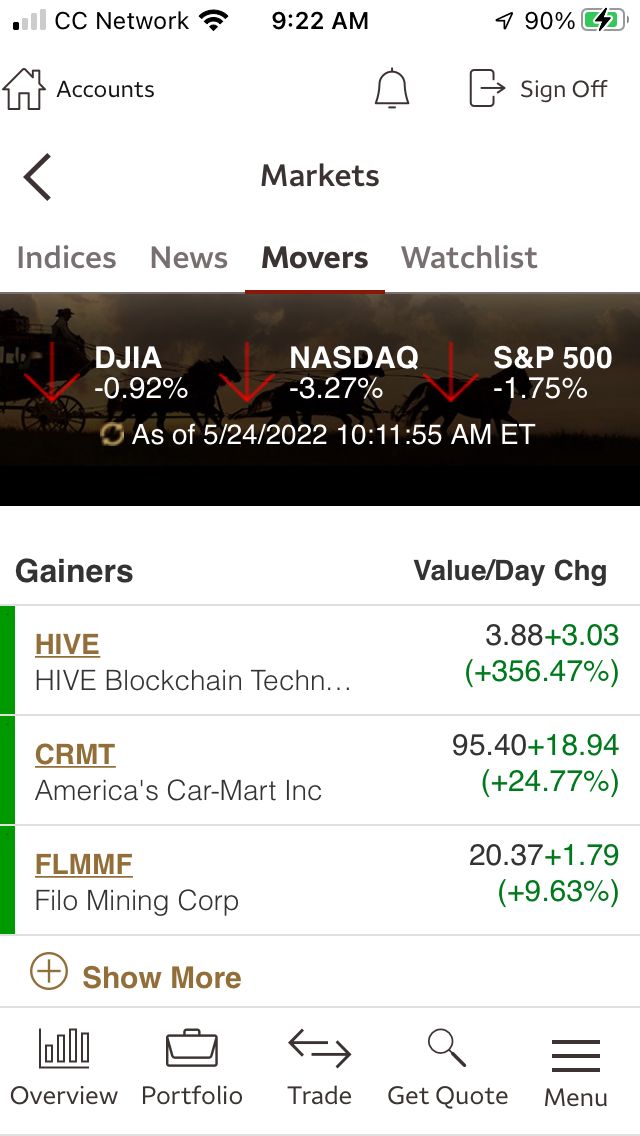

For education and security research, WellsTrade offers a good amount of information. A few resources are located on the mobile app. These include market indexes, news articles, and brief trade data.

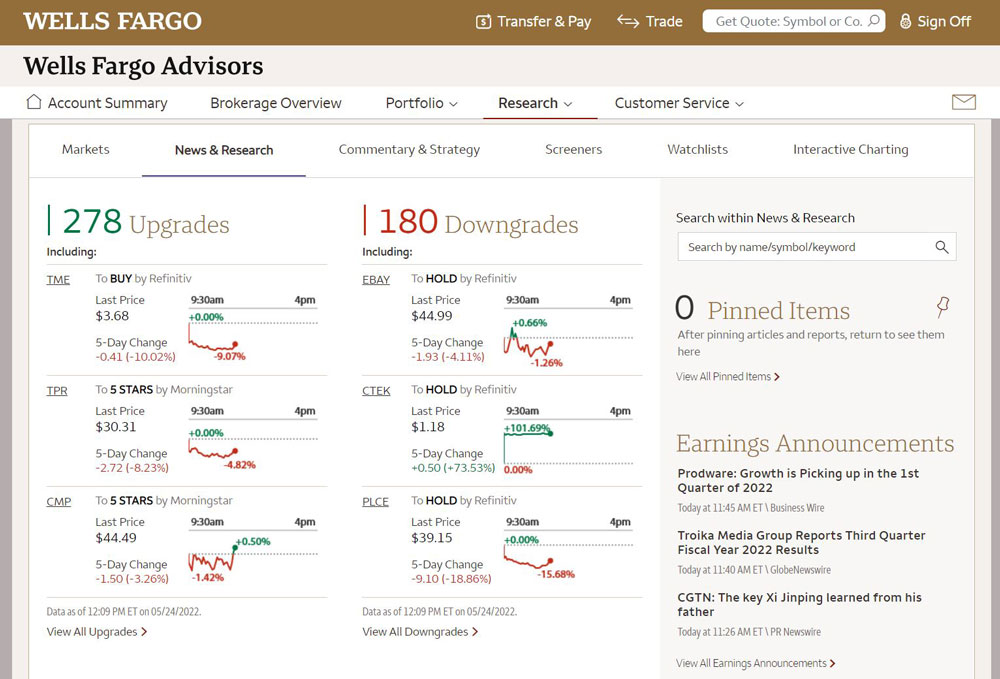

The lion’s share of information will be found on the website. During our inquiry, we located earnings announcements, analyst upgrades and downgrades, sector and industry news, and market commentary from Wells Fargo Advisors and Wells Fargo Investment Institute.

Other Services

Our brokerage firm under investigation does not provide extended-hours trading. This is a major

failure.

Stocks and ETFs are eligible for the broker’s free DRIP service. However, traders have to call in to enroll securities because there is no method to sign up using the WellsTrade site.

Lastly, WellsTrade does offer periodic mutual fund investing.

Comparison

WellsTrade is one of the few brokerage firms to have a base charge for options trades. Schwab, E*Trade, and Fidelity don’t have one.

The lack of a browser platform, desktop trading system, or web-based trade bar puts WellsTrade at a serious disadvantage compared to Interactive Brokers and TD Ameritrade.

Last year, WellsTrade had over 9,000 mutual funds. Obviously, its list has shrunk, and it’s now smaller than several of its rivals.

Some online discount brokers don’t offer human financial advice. These firms include Firstrade and Wealthfront.

Recommendations

Mutual Fund Investors: Although we do like WellsTrade’s mutual fund services, they underperform

Charles Schwab’s.

Individual Retirement Accounts: The lack of several IRA choices, such as SIMPLE, Minor, and

Inherited options, makes us suggest Charles Schwab instead.

Beginners: WellsTrade’s research materials are not geared towards new investors, but

Fidelity’s are.

Active Stock and ETF Trading: Webull

and Merrill Edge have desktop platforms. Webull also has lower margin rates, virtual trading and

$0 options commissions.

Long-Term Investors and Retirement Savers: WellsTrade does have a good selection of

target-date mutual funds. Moreover, access to old-school financial planners (and Wells Fargo Advisors)

is a major advantage.

Small Accounts: Small traders would be better off at

Firstrade.

WellsTrade IRA Review Verdict

To answer our original question regarding WellsTrade’s ability to compete with major players in the

industry, we did not get a resounding yes. The broker underperformed in most categories and failed

to hit a noteworthy home run anywhere.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Updated on 7/19/2024.

|