Wells Fargo vs Charles Schwab in 2024

|

Introduction

Both WellsTrade and Charles Schwab have affiliations with FDIC-insured banks. The similarities pretty much stop there, however. Brokerage services vary widely between

these two firms. We’re going to run these two companies through their paces and find out which one is better - Charles Schwab or Wellstrade?

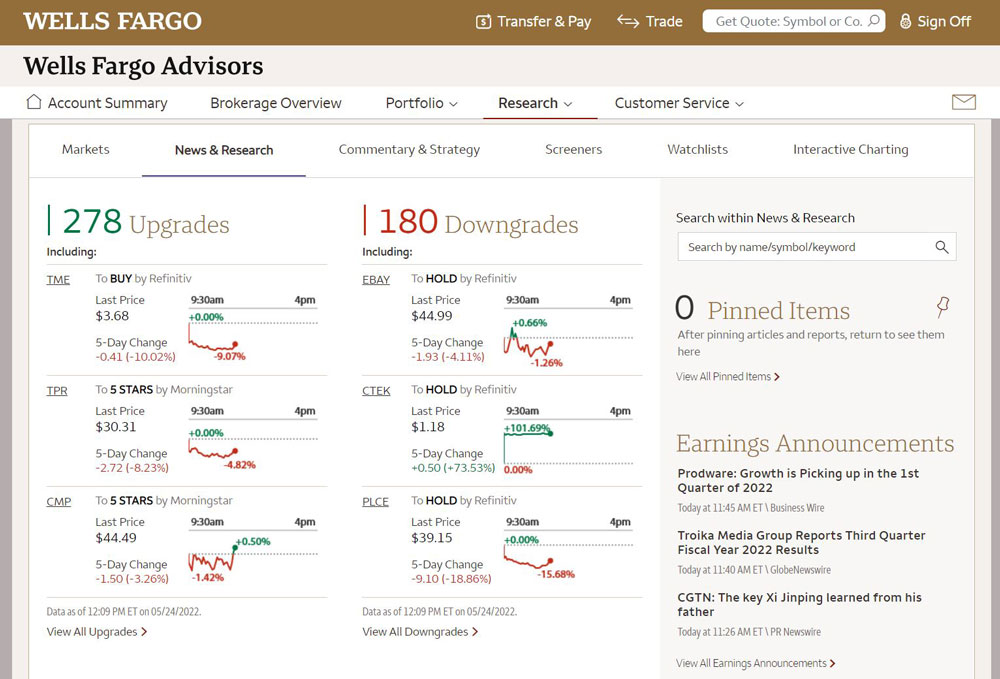

Research & Education

Schwab offers its customers a large variety of learning materials. An educational section on the Schwab website hosts many videos and articles on important investing topics, including retirement planning, taxation of securities, and more. Third-party equity reports are available free of charge. Market news from many different sources appears on the broker’s site, and effective screeners are able to search through the securities that Schwab offers.

The WellsTrade site also has market news, although the selection is smaller. There are screeners for stocks, bonds, and mutual funds; although the WellsTrade fund screener has fewer search variables than Schwab’s. Market commentary can be downloaded in pdf format free of charge, as can Morningstar (premium discount) equity reports.

Schwab has the better selection in this category.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Wells Fargo:

Open a Wells Fargo investment account.

Trading Tools

The Schwab website has a lot of information on it, but it’s still easy to navigate. There is a handy

trade bar at the bottom of the browsing window. It can display vital trade information for stocks and

ETF’s. A small pop-up graph also appears after clicking on ‘Chart’. Clicking on ‘Trade’ produces a

separate web page where an order can be placed. For traders who want something more advanced than the

website, the broker provides Thinkorswim, an advanced desktop platform that does not have any access

requirements.

The WellsTrade site doesn’t have a lot on it, which makes it easy to navigate. There is no trading bar, and the broker doesn’t offer an advanced trading platform. The website does have good charting tools. These include technical studies and multiple chart styles. A graph cannot be displayed the width of the monitor, however.

Schwab wins again.

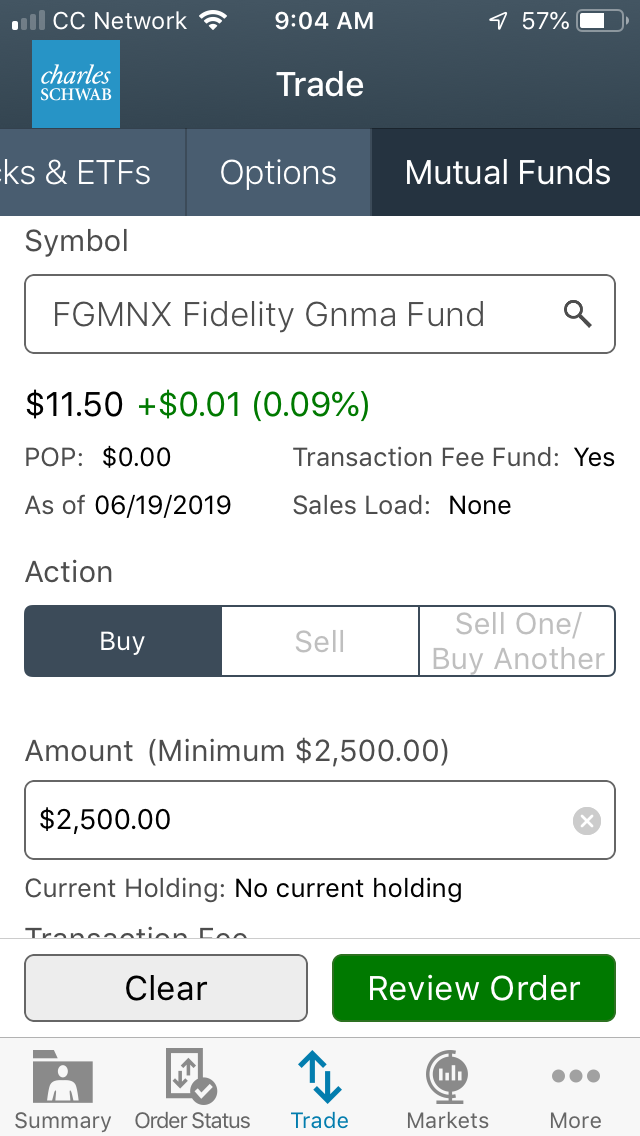

Mobile Apps

Schwab customers can place trades on Apple, mobile web, Kindle Fire, and Android devices. Several useful features are available, including check deposit and bill pay. Live streaming of financial news has returned to the Schwab app after a brief absence. The broker also has a platform for Apple Watch.

WellsTrade does not provide a mobile app for any Amazon device. Also absent is an app for Apple Watch. WellsTrade clients can buy and sell securities on Android and Apple phones and tablets. The broker’s app does come with some basic charting tools and option chains. The app can also place orders for mutual funds.

Schwab wins again.

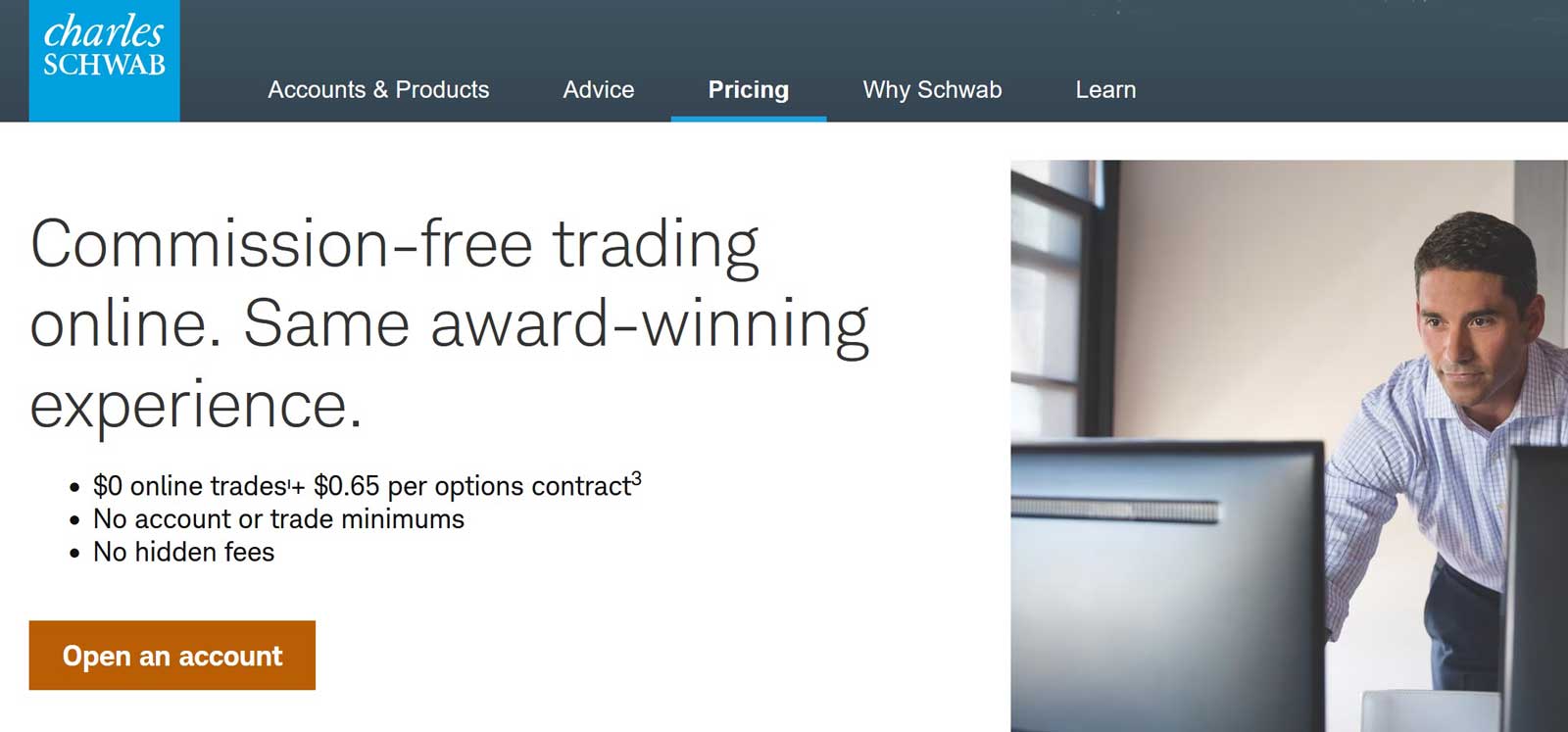

Commissions, Fees, and Account Requirements

ETF and stock trades at Schwab cost $0. Derivatives are 65¢ per contract. Using a live representative to

submit an order over the phone costs $25. New issues of bonds and CD’s are priced with a markup and markdown. Secondary issues cost $1 per bond with a $10 minimum per order and $250 maximum. A broker-assisted bond order costs an extra $25.

WellsTrade clients pay $0 for stock and ETF trades. Derivatives at WellsTrade cost $0.65 per contract.

Most fixed-income products are also priced on a markup/markdown basis at WellsTrade.

Schwab requires a $1,000 deposit to open a brokerage account. There are no on-going fees for the account.

WellsTrade has no minimum deposit requirement to open an account.

Overall, the better pricing schedule is at Schwab.

Mutual Funds and ETF’s

The mutual fund screener on Schwab's website shows over 6,500 products that are available for purchase.

On this list, more than 4,000 are OneSource securities, which carry no load and no transaction fee. If a fund at Schwab does have a transaction fee, it is $49.95 on the buy side only. The broker charges a short-term redemption fee of $49.95 if an NTF fund is sold in less than 90 days after purchase.

WellsTrade’s screener shows almost 10,000 funds that are open to new investors. Slightly more than

2,500 have no transaction fee and no load. Some of the available funds are Wells Fargo products.

The broker’s transaction fee is $35, and it’s applied on both the buy and sell sides. The firm does not have a short-term redemption fee.

WellsTrade does have some strong points here. We’ll call this category a draw.

Cash Management

WellsTrade is owned by Wells Fargo, one of the largest banks in the United States. Nevertheless, the broker-dealer doesn’t have very good banking options. A securities account doesn’t automatically come with cash management tools. Checks and a debit card can be added by request, but there is a $100 annual charge for them.

Schwab also has an FDIC-insured bank. It is much smaller than Wells Fargo, but offers more features.

A Schwab checking account comes with a Visa debit card and free checks. The broker reimburses all ATM

fees incurred with the card. A Schwab Bank account has no annual fee.

Schwab is the better option here.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Wells Fargo:

Open a Wells Fargo investment account.

Schwab vs Wells Fargo: Which is Better?

Charles Schwab won five categories, while Wells Fargo

failed to win a single category, and there was one tie. Schwab is the winner by a mile. Despite the outcome of this contest, WellsTrade would be a wise choice for

mutual fund investors.

|

Open Account

|

Open Account

|