TIAA and Charles Schwab Comparison

TIAA caters to medical, government, and academic employees; but these investors could open a brokerage account at Charles Schwab. The latter broker

offers a lot of enticing services that TIAA has a hard time competing against. Here’s the lowdown:

Investing in Funds

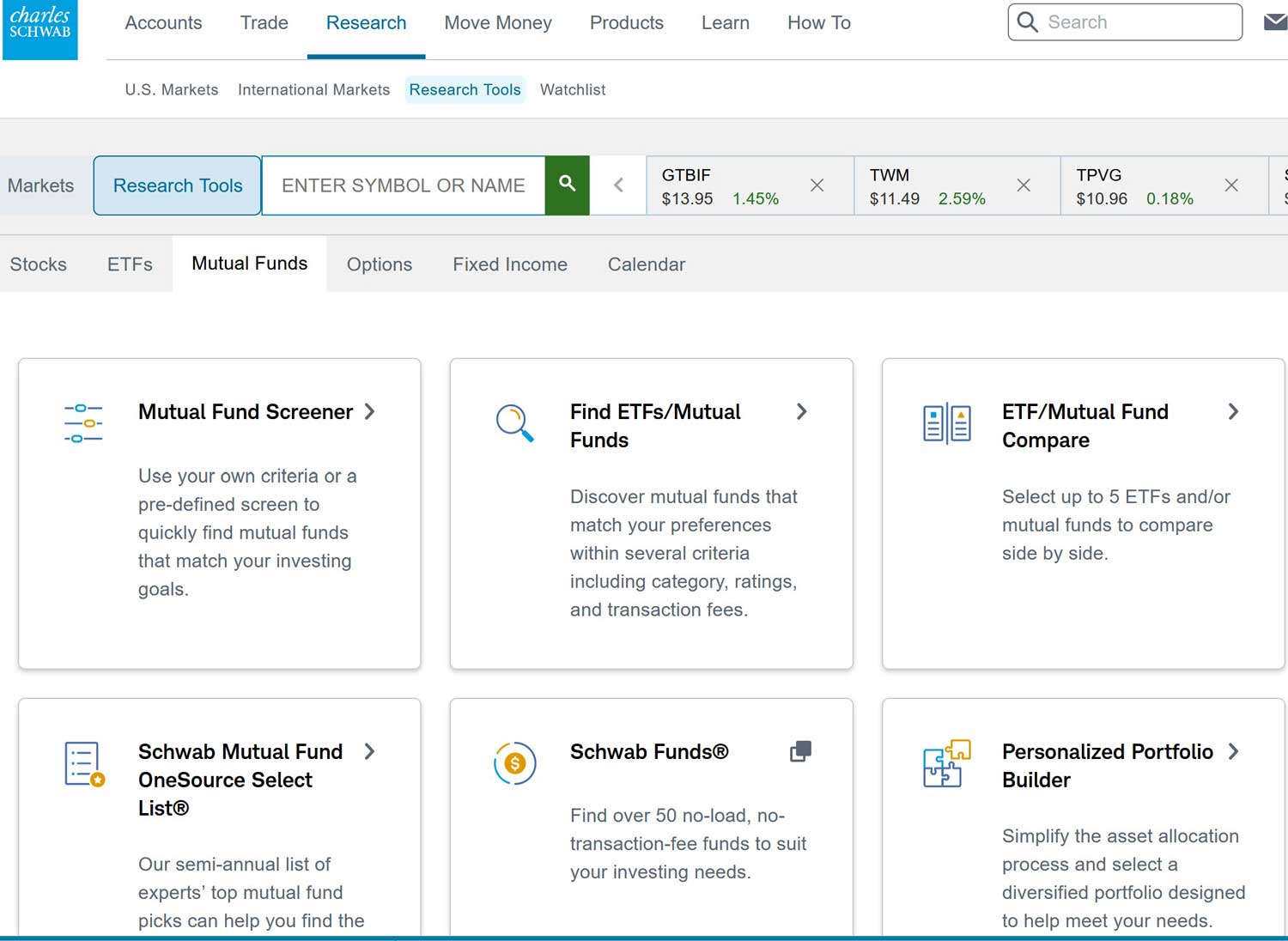

Using Schwab’s mutual fund screener, we identified 5,819 total mutual funds available to new investors. This is a rather small list; although 3,404 do offer no transaction fees and no loads. One really nice service on the Schwab website is free access to the OneSource Select List, a collection of approximately 175 funds that are pre-screened for their projected outperformance by Schwab investment advisors.

For ETF traders, Charles Schwab offers all exchange traded funds with zero trading fees.

TIAA offers both mutual and exchange-traded funds. On the mutual side, the broker provides more than 6,500 products. Unfortunately, we can’t tell you how many of these are no-load, no-transaction-fee securities because the broker’s screener doesn’t incorporate the ability to search for these characteristics.

Schwab wins this category.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

TIAA:

Open a TIAA investment account.

Financial Education & Research

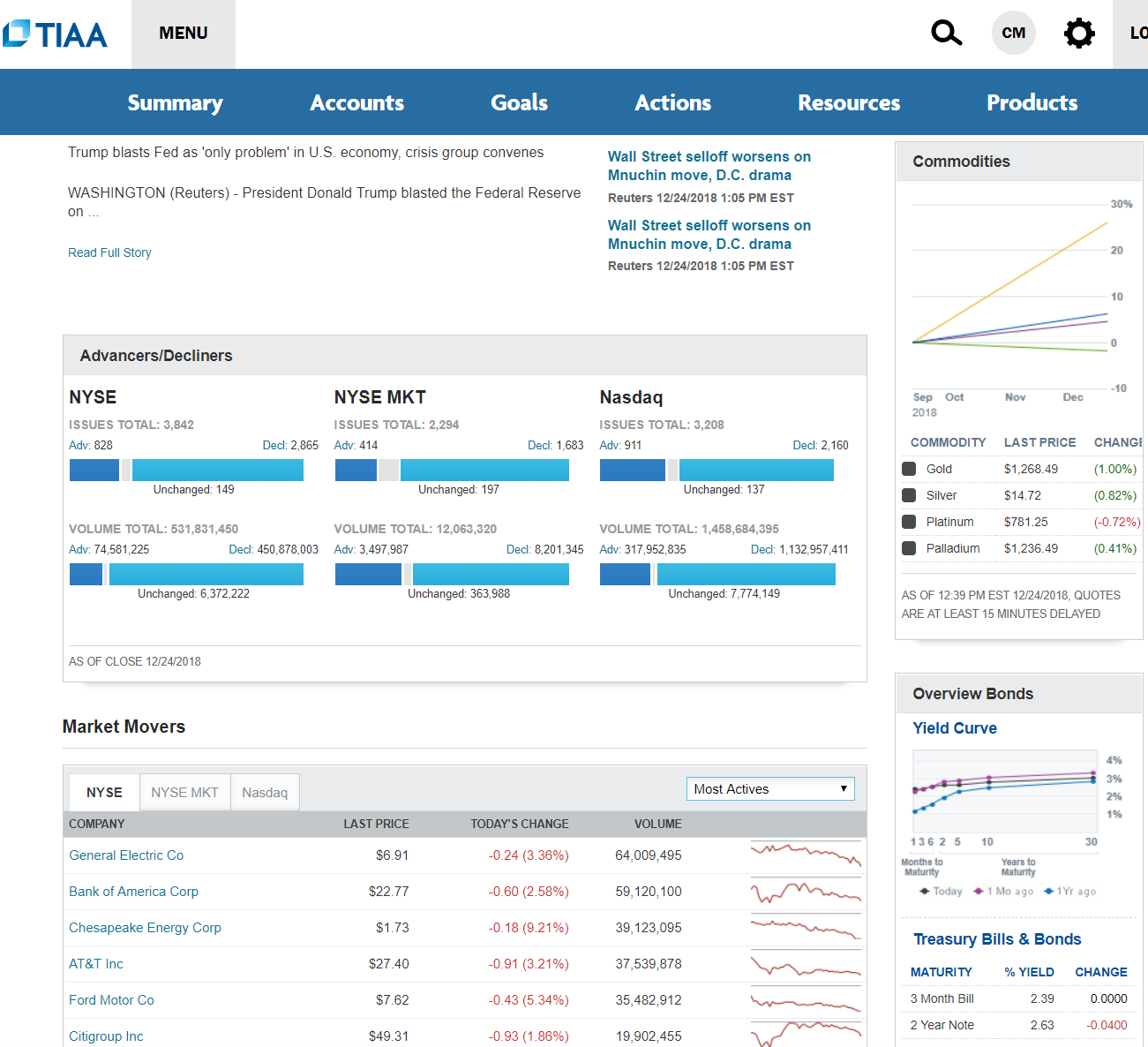

During our investigation, we found lots of educational resources on Schwab’s website. They can be found under ‘Research’ in the top menu. Most of them are under the sub-heading of ‘Learning Center,’ although the broker’s resources are scattered throughout its website.

We found articles, videos, and webcasts on all sorts of topics, such as option trading, technical analysis, commodities, and market trends. Besides these learning materials, we also found a discussion board on the Schwab website that can be used by the broker’s customers.

Schwab has really good screeners that can search for investments based on many criteria. Profile pages for securities include lots of information, including free equity reports. For instance, we found 9 reports for Citigroup.

TIAA customers also have access to many educational articles. The brokerage firm’s website offers news articles, an income planner, retirement calculators, and more. TIAA’s articles tend to have less information than Schwab’s. TIAA’s security screeners are good, but they lack the same level of search criteria that Schwab delivers. As for security profiles, TIAA provides less information than its rival. This is most notable in the realm of stock reports. For Citi, we found just one research report.

TIAA’s security screeners aren’t quite as usable at Schwab’s. As mentioned in the fund section, TIAA’s don’t have the ability to look for NTF status, whereas Schwab’s do.

In the realm of funds, Schwab’s website has very extensive information, such as a search box for Schwab research reports. Data on the top performing ETF categories is presented along with money market news. TIAA’s fund center offers a comparison tool, a screener, and that’s about it.

We definitely like Schwab better here.

Trading Software

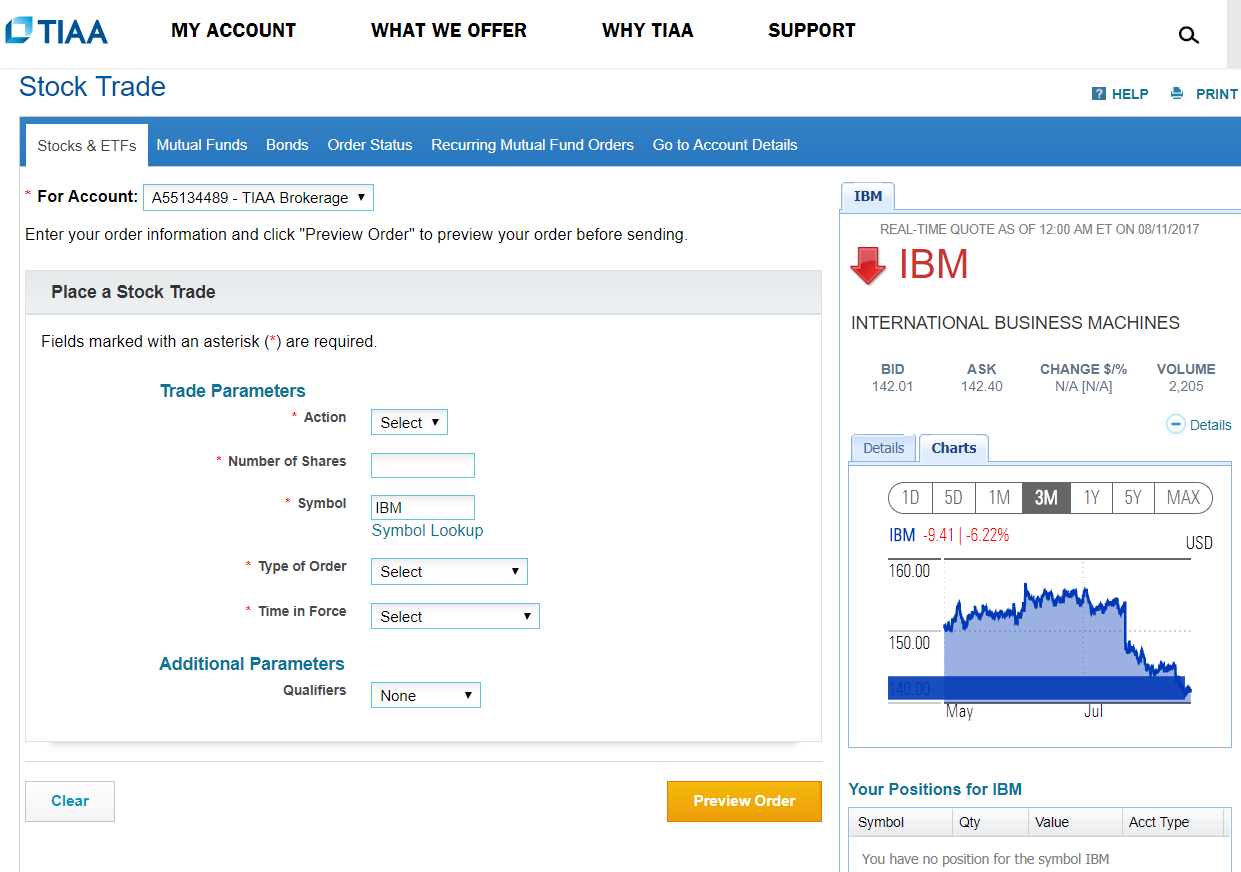

TIAA customers can buy and sell securities on the company’s website. TIAA does not have a browser or desktop trading system. Charting on the website is somewhat basic, but does come with multiple graph styles, a few technical indicators, and two company events. The trade ticket is also very basic. A trade bar is able to provide security data, but not submit an order.

In a few areas, Schwab is similar to TIAA. Schwab offers a trade bar that isn’t able to submit orders directly, for example. But Schwab has both a browser and desktop system. Charting is very advanced on both platforms, with tick-by-tick data on the browser program and full-screen mode on the desktop. The latter system comes with Level 2 quotes and direct-access routing free of charge. The desktop software also offers a simulated trading mode, which TIAA’s elementary software doesn’t have. The browser platform offers complex order types, which are also available on the desktop system.

TIAA fails again.

Mobile Platforms

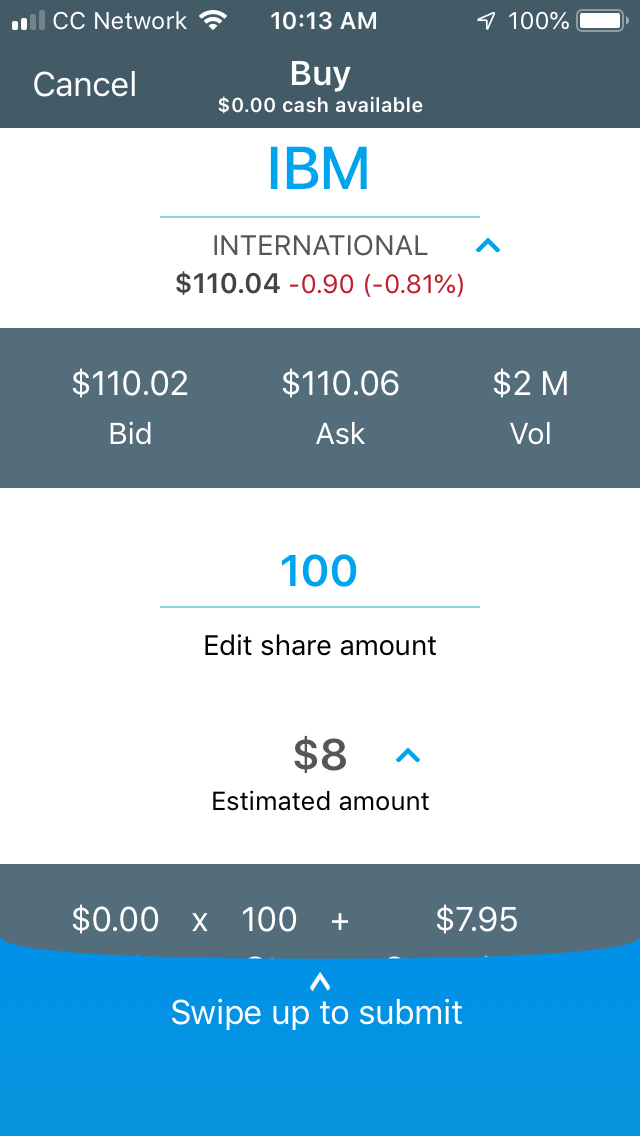

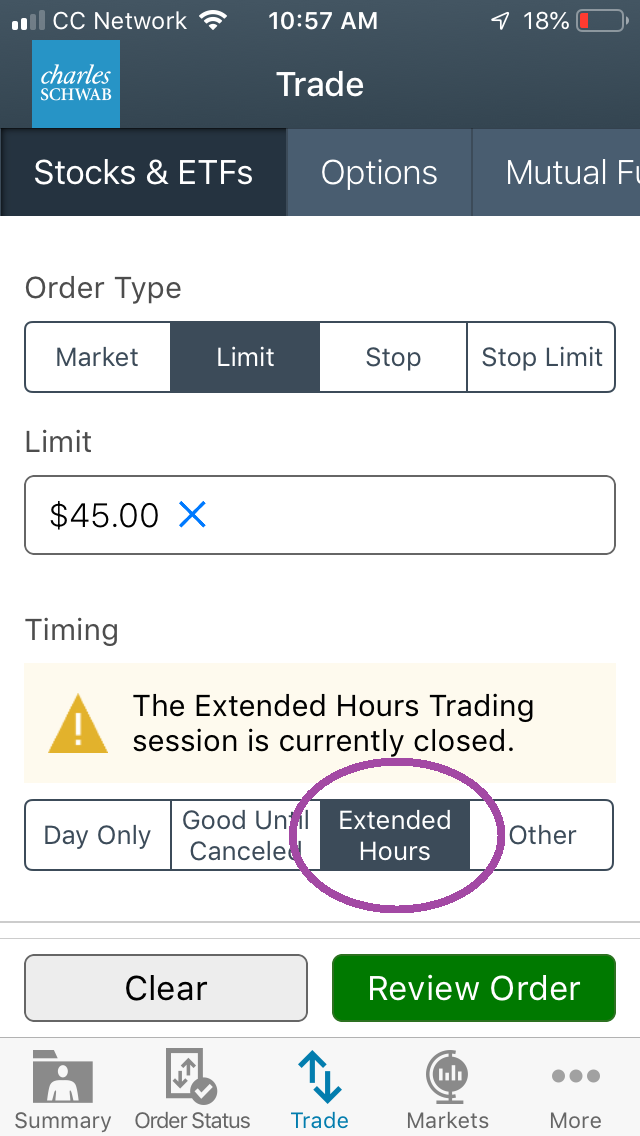

Schwab’s app comes with a live feed of CNBC, and there is no charge for the service. We also found bill pay, mobile check deposit, and funds transfer. Options and mutual funds can be traded on the platform. Schwab’s trade ticket is rather simple with no complex order types. One highlight is extended-hours trading. Charting is pretty good with horizontal viewing and several tools. Market indexes are shown along with news articles and an audio market commentary, courtesy of Schwab.

TIAA’s app has no option chains, and it strangely doesn’t offer any charting capability. We also couldn’t find a check deposit feature, funds transfer, or any video financial news. We did find account value on the dashboard, and that’s about it besides the order form. It is very elementary, but oddly manages to be difficult to use. Mutual funds can be traded on the app, one of the few highlights.

Schwab is the victor here.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

TIAA:

Open a TIAA investment account.

Recommendations

For day traders and others who need the most sophisticated trading software, we will suggest Schwab over TIAA. Although TIAA’s trading tools function well enough for basic order entry, they are not designed for active trading.

For options trading, we also recommend Schwab for the same reason.

In the realm of portfolio management, we’re going to propose Schwab once again. Although TIAA offers investment advice, its services don’t quite measure up to Schwab’s, which start at a 0.00% price structure.

For alternative investments, Schwab seems to have the edge because of its futures trading service, which TIAA doesn’t offer.

For banking customers, we also suggest Charles Schwab over TIAA. Schwab’s unlimited global ATM fee rebate program outperforms TIAA’s more limited service.

TIAA vs Charles Schwab: Which is Better?

TIAA failed in every category we looked at. While TIAA manages

to attract a lot of clients, it doesn’t give them as much as Schwab can.

Free Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

|