Robinhood vs WealthFront (2024)

Robinhood vs. Wealthfront: Highlights

• Robinhood has brokerage accounts, while Wealthfront offers investment-advisory accounts.

• Cryptocurrencies will be found only at Robinhood.

• Both investment firms offer margin for trading and cash withdrawal.

Wealthfront vs. Robinhood Introduction

Two very popular investing firms are Wealthfront and Robinhood. They are also very unlike each other. Take a look at our analysis of these two.

Investing

Robinhood offers self-directed trading in the following investment vehicles:

- Exchange-traded funds

- Stocks

- Options

- American Depository Receipts (ADRs)

- Real Estate Investment Trusts (REITs)

- Cryptocurrencies

There are no managed accounts at Robinhood, although the broker-dealer does offer point-in-time investment advice for IRAs.

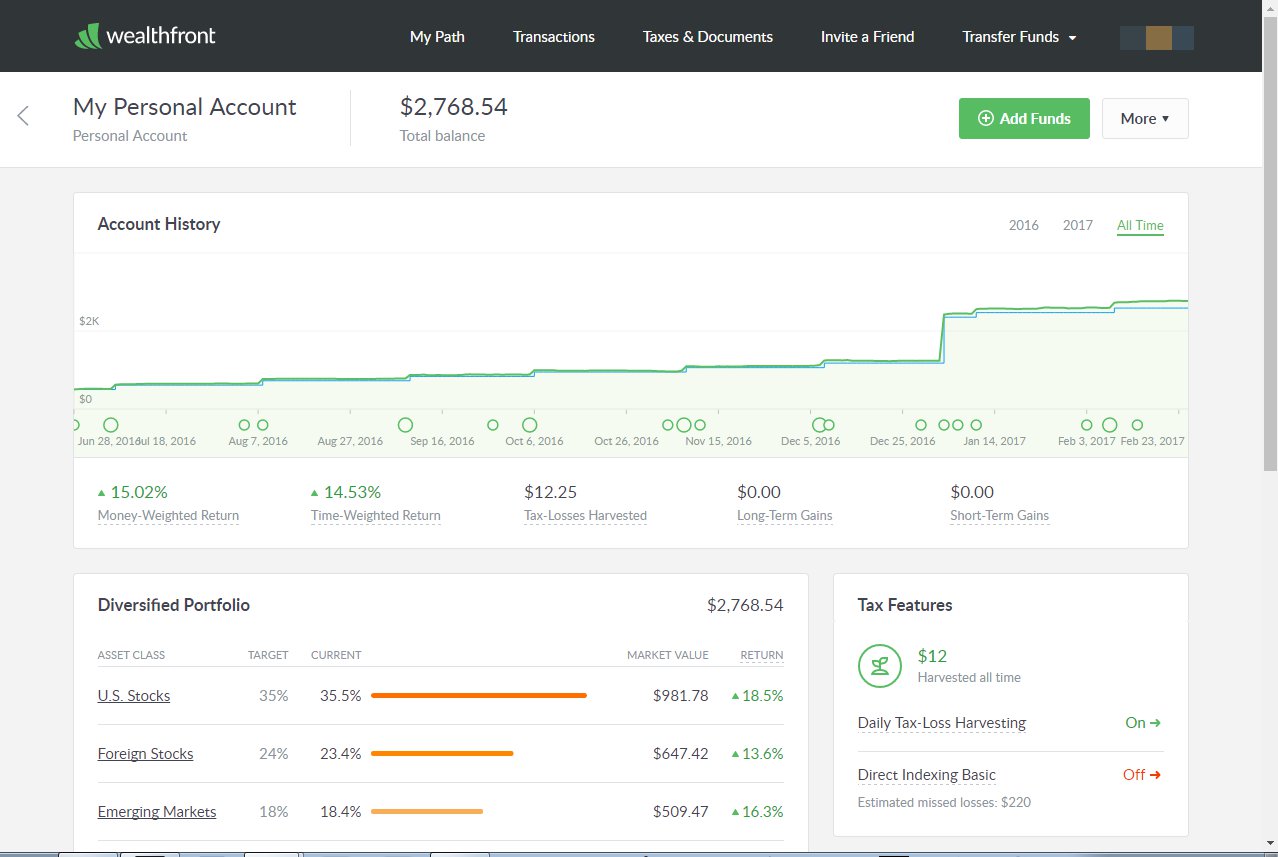

Wealthfront is pretty much the polar opposite of Robinhood. It offers only managed accounts. The company’s most famous program is its robo service that delivers automated trading in a short list of ETFs. Wealthfront also has a Stock Investing Account, which is a limited discretion account that allows its customers to invest in individual stocks. It’s not complete self-managed trading, however.

Like Robinhood, Wealthfront has both individual taxable and retirement accounts. Wealthfront goes a little further by offering joint accounts, trust accounts, and 529 plans.

Winner: Debatable

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Wealthfront: none right now.

Margin Services

Both investment firms in this survey offer margin trading. Robinhood has two pricing schedules. The

standard system costs 12% for borrowed funds. Customers

who opt for a Gold subscription (at $5 per month) pay just 8%, and the first $1,000 is free. In line with industry requirements, a margin account at Robinhood must have at least $2,000 in equity before it can use margin.

Wealthfront offers something called a Portfolio Line of Credit. It requires $25,000. But the cost of borrowing

is lower. Right now, Wealthfront's tiered margin schedule starts at 8.9% and drops to 6.7%. And no monthly fee is required to get these very low rates.

Winner: Once again, it seems disputable

Websites

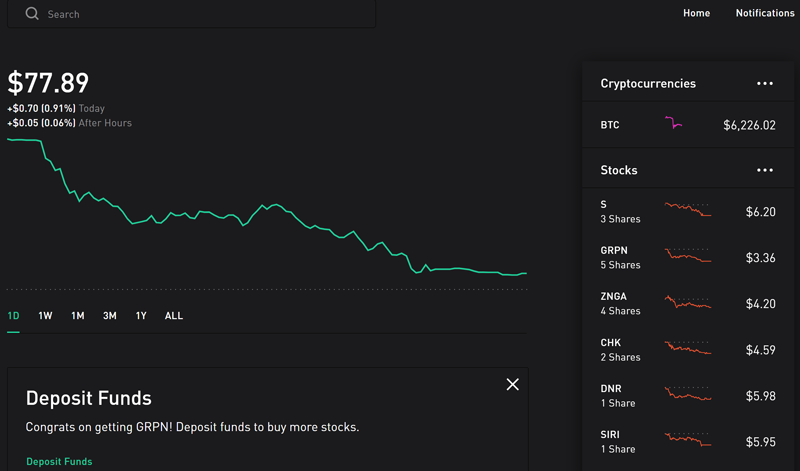

Trading begins at Robinhood with its user-friendly website. The software automatically displays an order ticket on every asset’s profile. The crypto ticket is a little slimmed down compared to the equity ticket, which has six trade types. The crypto order form only has three trade types (plus an option to send and receive digital currencies).

Option contracts have their own unique order system. Robinhood recently added derivative strategies to a Builder tool. It suggests a variety of option plays based on the sentiment of the underlying asset, such as bullish, bearish, volatile, or sideways. Examples include call debit spread and long straddle. It’s also possible to create custom trades, up to four legs.

Because Wealthfront doesn’t offer trading in options, it goes without saying that there are no derivative tools on its website. And because it doesn’t offer any brokerage accounts, there are no self-directed tools to speak of. Its site is very simple and emphasizes hands-off investing.

Wealthfront has added equity profiles for Stock Investing Accounts. These are very elementary, though, with few details and only simple charts. Line is the only format, and there is no full-screen mode. Robinhood’s profiles, by comparison, have more information and much better charting. Graphs can be displayed the full width of the screen, and there are some technical studies as well.

Winner: Robinhood

Mobile Apps

The software competition continues on the two firms’ mobile platforms, and we do find much the same situation on these trading systems. Robinhood’s app uses the same trade ticket from the website, although the reduced screen size means the ticket isn’t integrated this time. Instead, you have to tap on a Trade button at the bottom of the screen. Charts have the same tools, although this time a graph can’t be displayed horizontally. A discrete tab exists in the bottom menu for crypto trading, and the order form here has stop orders, which don’t exist for digital currencies on the website.

The Wealthfront app has the same unsophisticated tools we saw on its website.

Winner: Robinhood

Additional Services

IPO Access: Robinhood, but not Wealthfront, offers access to imminent equity launches.

Dividend Reinvestment Plans: Robo accounts at Wealthfront and self-directed accounts at Robinhood can enroll in free DRIP services.

Fractional Shares: Whole-dollar investing is available at both investment firms.

IRA Services: Roth and Traditional accounts can be opened at both companies. Only Wealthfront has the SEP account.

Fully-Paid Stock Lending: Only at Robinhood.

Winner: Robinhood

Promotions

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Wealthfront: none right now.

Our Recommendations

Small Accounts: Wealthfront requires $500 to open an automated account (and $1 for a Stock Investing Account). Robinhood requires nothing.

Stock and ETF Trading: Certainly, it is Robinhood.

Retirement Planning & Long-Term Investing: Because Wealthfront has trusts and 529 plans, we lean towards it.

Beginning Investors: Definitely a robo account at Wealthfront.

Robinhood vs Wealthfront Verdict

Beginners will do well at Wealthfront, while advanced traders should stick with Robinhood.