Robinhood Paper Trading

Robinhood does not offer demo accounts (also known as simulated or paper trading).

For a 100% free paper trading, we recommend

Charles Schwab practice account.

Get Charles Schwab For Free

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Overview of Thinkorswim vs Robinhood

Robinhood caters to budget-conscious traders by offering free commissions. Charles Schwab, on the other hand, provides quality investment services including its advanced desktop software Thinkorswim. Let’s take a look at the opportunities available to traders at both firms.

The Cost of Trading at Robinhood

The brokerage industry’s lowest possible commission schedule can be found at Robinhood. The broker

has reached the very bottom of the scale by offering zero dollar commissions. Yes, that’s right.

Trades at Robinhood are free. All stocks, options, cryptos, and ETF’s listed on the major American exchanges cost $0 to buy and sell.

This ultra-low commission schedule comes at a price, however. There is very little trading

technology available to the firm’s customers. Robinhood does not offer a desktop trading

platform, for example.

Cost Comparison

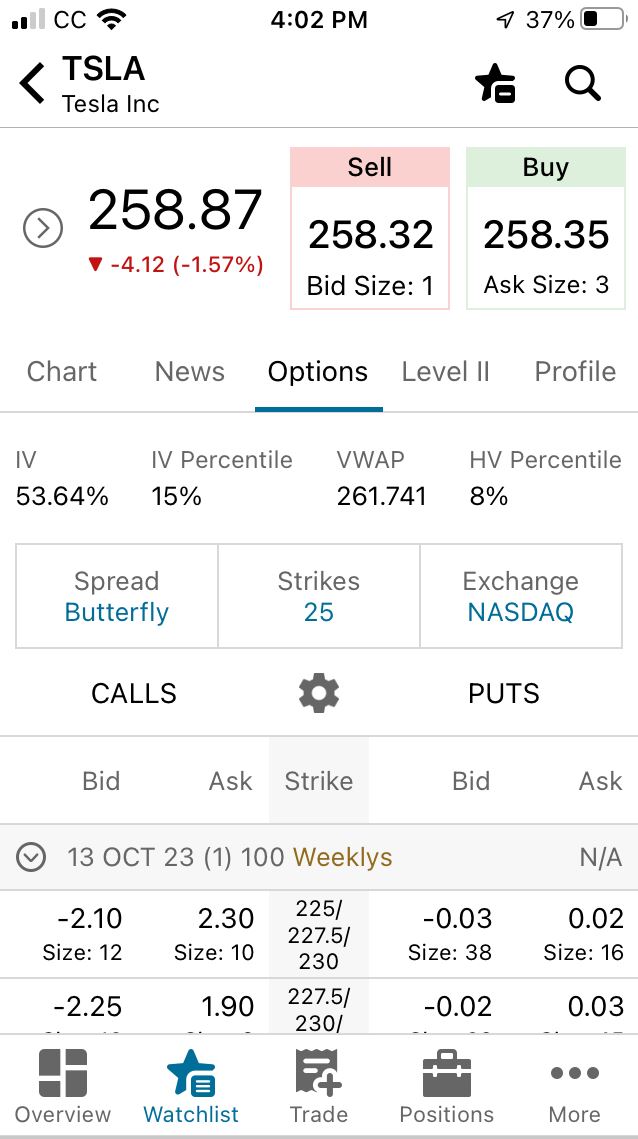

Robinhood’s Trading Tools

So where do Robinhood traders submit orders? On the broker’s mobile app, which is compatible with Apple and Android devices. Charting on the app is rather simple. Line is the only format available for a graph,

for example. There are also no technical studies or comparisons.

The app also doesn’t provide much in terms of security research. There is limited financial information. The past few earnings releases and the current P/E ratio are

shown. News articles that relate to the company can be accessed as well. The app also has a link to the company’s most recent conference call.

Many features are missing on the primary platform that Robinhood provides. These include streaming business news, which other brokers, including Charles Schwab, do

provide; and mobile check deposit, which would be a convenient method of moving funds into the broker.

Robinhood does have a mobile app for Apple Watch, and trades can be entered on it. The platform can be used to submit limit and market orders for any stock or ETF. The broker recently added stop limit, stop loss, and GTC orders to the platform’s capability. Robinhood released an app for Android watches.

What’s Missing at Robinhood

While Robinhood touts its unbeatable commission schedule, there are many features that are completely

missing from the broker. Mutual funds are unavailable at the firm, an asset that many customers

must sorely miss.

Bonds cannot be traded at Robinhood, because the broker doesn’t offer them. Same with futures and forex. Customer service isn’t 24/7, and in fact, the company doesn’t even have a toll-free number.

Promotions

Thinkorswim/Charles Schwab: Get $0 commissions and ACAT fee reimbursement.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Trading on Thinkorswim at Charles Schwab

So how does Robinhood compare to Schwab and its advanced platform Thinkorswim? It’s like the

difference between day and night. Thinkorswim is a desktop program, which, as we have seen, Robinhood does not offer. On top of that, Thinkorswim has many advanced features, including a very sophisticated charting application. There are 400 technical studies on TOS, one of the largest sets among online brokers. There are also many drawing tools and graph styles. Some of the more exotic ones include Fibonacci time ratios and regression lines.

Besides stocks and ETF’s, Thinkorswim offers trading in options, futures, and forex.

There are some screeners on Thinkorswim that can scan for options, ETF’s, and stocks. Robinhood has no screeners. Charles Schwab’s stock search tool can look at many criteria, including market cap, bid size, dividend yield, book value per share, and many other variables.

Other Trading Tools

A mobile version of Thinkorswim is available to use on Apple and Android devices. It is able to trade futures and forex, in addition to stocks, ETF’s, and options. Amazingly, many of the desktop version’s advanced charting features are incorporated into the mobile software. Users can watch CNBC in standard definition; and European and Asian versions are also available.

Charles Schwab has launched something else that Robinhood doesn’t have: a connection with Amazon’s Alexa. Charles Schwab Skill works with the Amazon’s AI to return market information and stock quotes. It works with more than 75,000 ticker symbols. For example, you could say, “Alexa, ask Charles Schwab for the stock price of Amazon.”

Like Robinhood, Charles Schwab provides a platform for Apple Watch. Actually, the broker has two versions, one of which can create orders. The other is able to get detailed equity quotes, view watch lists, and track indices.

More Charles Schwab Services

Beyond technology, Charles Schwab provides many more services that Robinhood

fails to deliver. The broker offers a

robo-advisory service that costs just 35

basis points. Human advisors are also available for less than 1.00%. Charles Schwab provides customer service around the clock and manages a nationwide network of

branch locations. With stocks trades at $0, and option contracts at 65 cents, the broker offers a

lot at an ultra-low cost.

Promotions

Thinkorswim/Charles Schwab: Get $0 commissions and ACAT fee reimbursement.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Robinhood vs Thinkorswim Recap

Robinhood and Charles Schwab offer different levels of service with different pricing schedules. While

Robinhood customers get the lowest commissions, they don’t get adequate trading tools or an acceptable

range of securities.

|