Investments

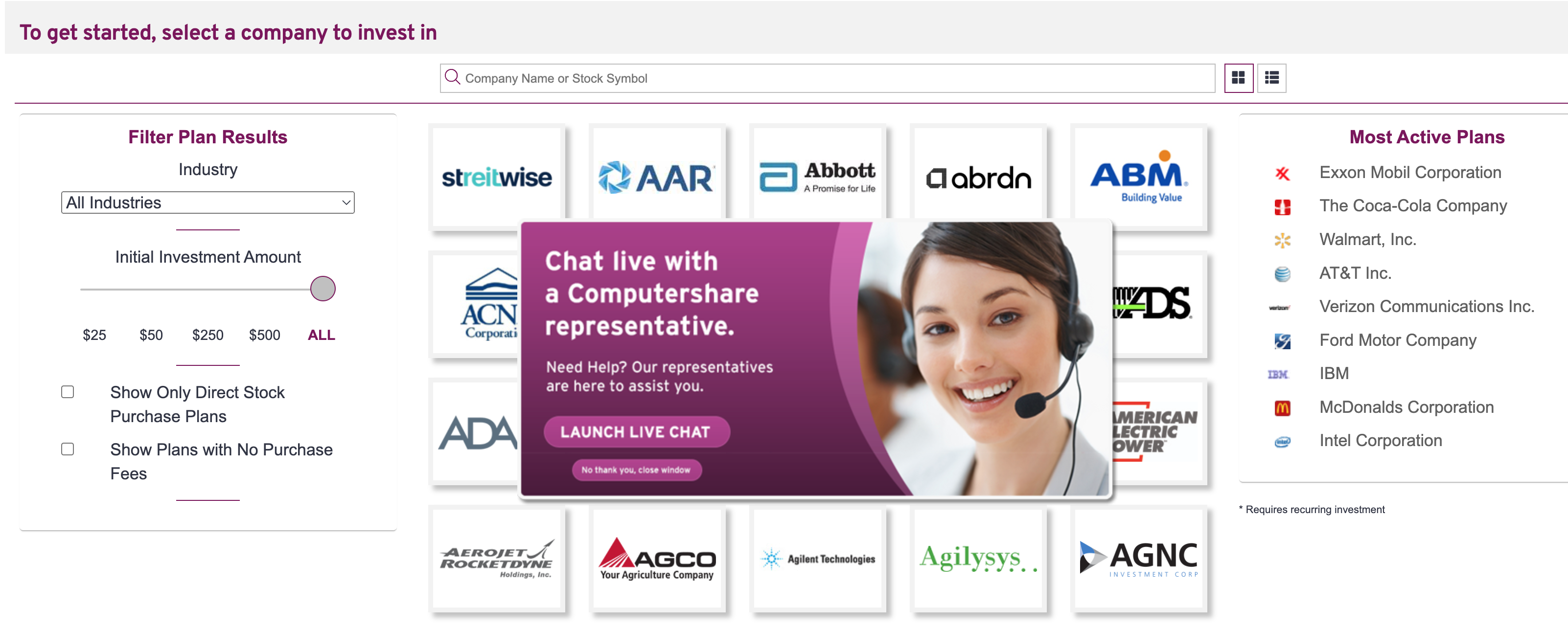

Of the three, ComputerShare has the most limited investment selection and availability. Investors are limited to buying and selling only stock offered directly from enrolled companies.

In other words, if ComputerShare is not a company’s stock transfer agent or the company does not participate in a Direct Stock Purchase Plan (DSPP), you cannot purchase shares in that company.

Not only does ComputerShare only offer a limited selection of stocks, but you cannot invest in any other asset classes. No bonds, mutual funds, or options, and definitely no crypto.

This makes ComputerShare the best for an investor only interested in a non-diversified portfolio consisting of only individual stocks… assuming ComputerShare offers the stock under a DSPP.

Charles Schwab offers a full suite of standard options that satisfy most investors’ needs, whether beginner or advanced. With Charles Schwab, you can trade:

- Stocks and ETFs. Charles Schwab also offers over-the-counter (OTC) stocks, commonly known as “pink sheet” or penny stocks, although these incur additional fees.

- Standard options contracts like puts and calls, and the platform allows options traders to select advanced strategies.

- Mutual funds.

- Fixed-income assets like bonds and certificates of deposit (CDs). Both have high minimums, so a newer investor interested in bonds may be better served through a fixed-income ETF.

- Futures and FOREX through a partnership with Charles Schwab Futures and Forex LLC. Futures and FOREX and advisable only for sophisticated investors, but by making this available, Charles Schwab targets the full spectrum of possible investors.

Charles Schwab does not offer direct crypto investing, although users can invest in crypto-centered ETFs or even Bitcoin futures. Charles Schwab also does not allow for fractional purchases, meaning that initial stock buys must be in whole share quantities. Only reinvested dividends are eligible to buy fractional shares.

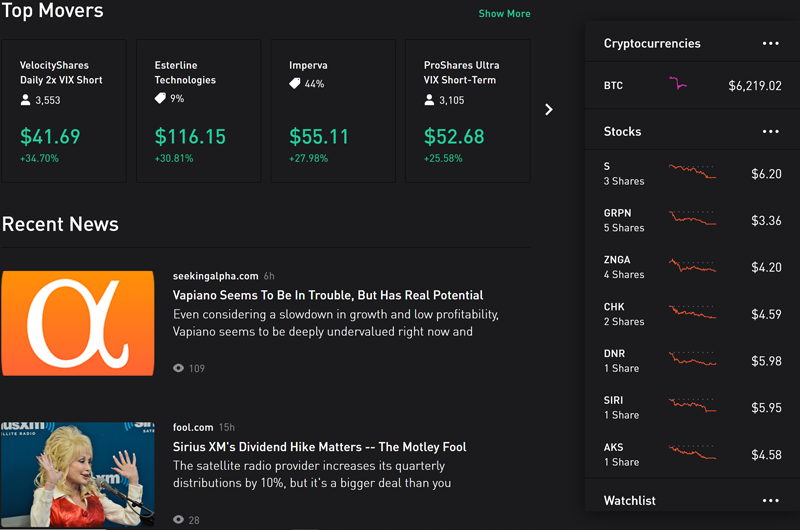

Robinhood sets itself apart from the others as one of the only brokerages to offer many direct crypto investing options. From Robinhood’s main app, you can navigate to a selection of about a dozen popular coins that trade 24/7.

Robinhood also allows fractional share trading, options, OTC stocks, and even some foreign stocks. The downside? Robinhood does not offer many standard investment classes like mutual funds, bonds, or CDs.

Costs

ComputerShare is, by far, the least wallet-friendly investment option. Since ComputerShare acts as an intermediary between investor and company, rather than a brokerage, many fees are involved that today’s brokerages don’t charge.

The complete fee schedule is extensive, but nearly all investors can expect to pay:

$25 wire transfer fee for account funding.

$50 annual service fee.

A $15 flat transaction fee for all purchases and an additional $.03 per share purchased.

When selling, another $25 per transaction and $.04 per share.

All told, ComputerShare’s lengthy fee schedule makes active trading nearly impossible, so ComputerShare is best for higher-net-worth individuals who want to buy and hold stock over a long period.

Charles Schwab has primarily done away with excessive fee structures like most brokerages. There are no minimum or account maintenance fees, and stocks/ETFs trade commission-free.

Some mutual funds have an additional cost, depending on who manages the fund, and all options contracts are charged a $0.65 fee per transaction (buy or sell) which can add up quickly for an active options trader. You will also have to pay a $75 fee to transfer your account to another brokerage.

Robinhood broke the mold with its commission-free fee structure, but the novelty wore off as so many other mainstay brokerages did the same. Today, users still enjoy commission-free trades, but alternative fee structures like payment for order flow (PFOF) brought negative press to Robinhood after conflict of interest concerns arose during the Gamestop era.

Today, so many brokerages offer no or low-fee trades that Robinhood must compete in other areas to attract customers, like crypto offerings and app functionality.

Robinhood offers a Gold tier for investors for $5 a month, which unlocks Morningstar research reports, instant depositing, and a relatively low 5% margin rate to increase buying power.

Open An Account

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Websites

ComputerShare’s website is acceptable in terms of navigability and ease of use. Many younger investors may be turned away by the initial registration difficulty, which takes longer than most brokerages. The DSPP stock purchase process is also somewhat lengthy, though the site does an excellent job of walking you through each step:

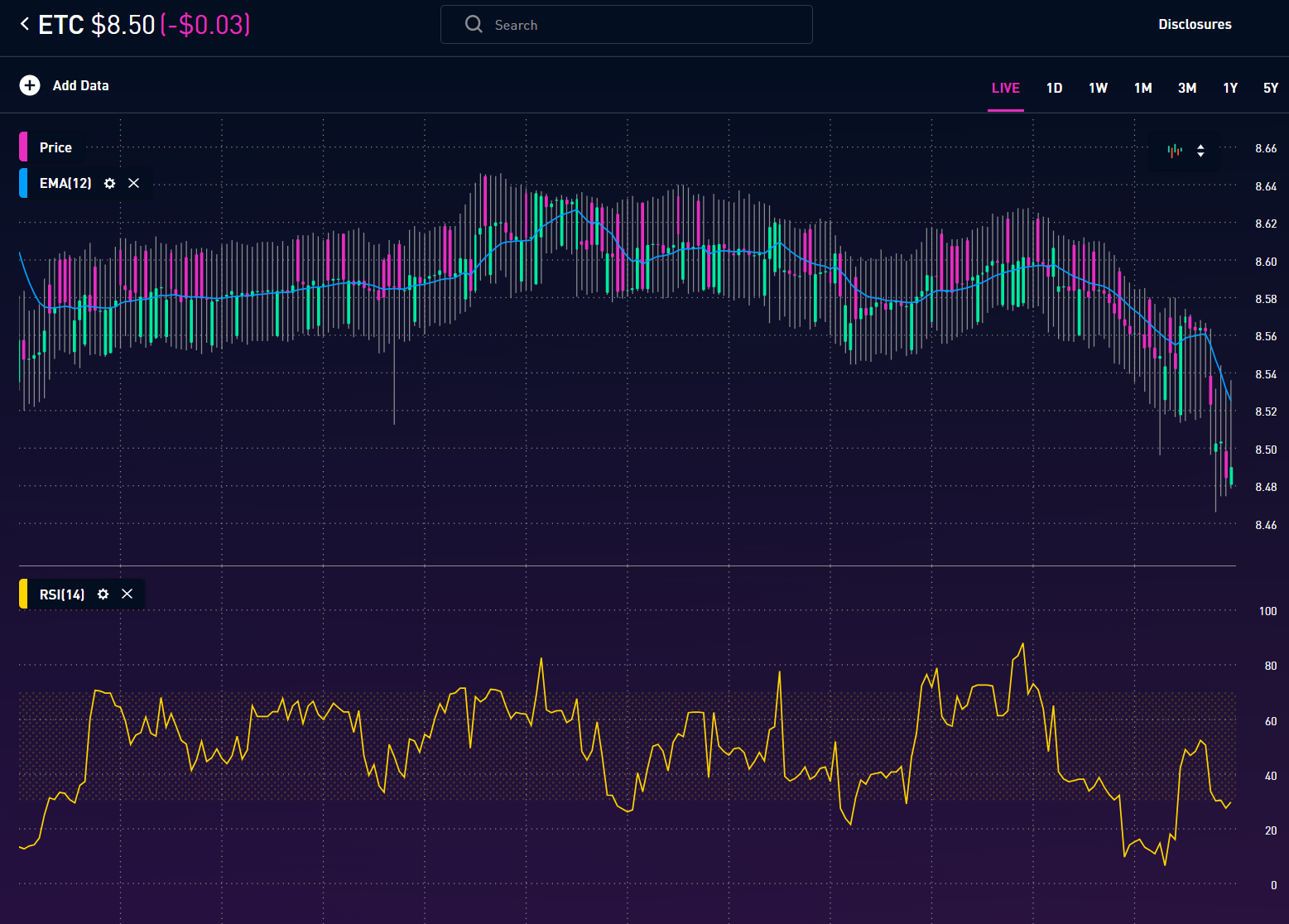

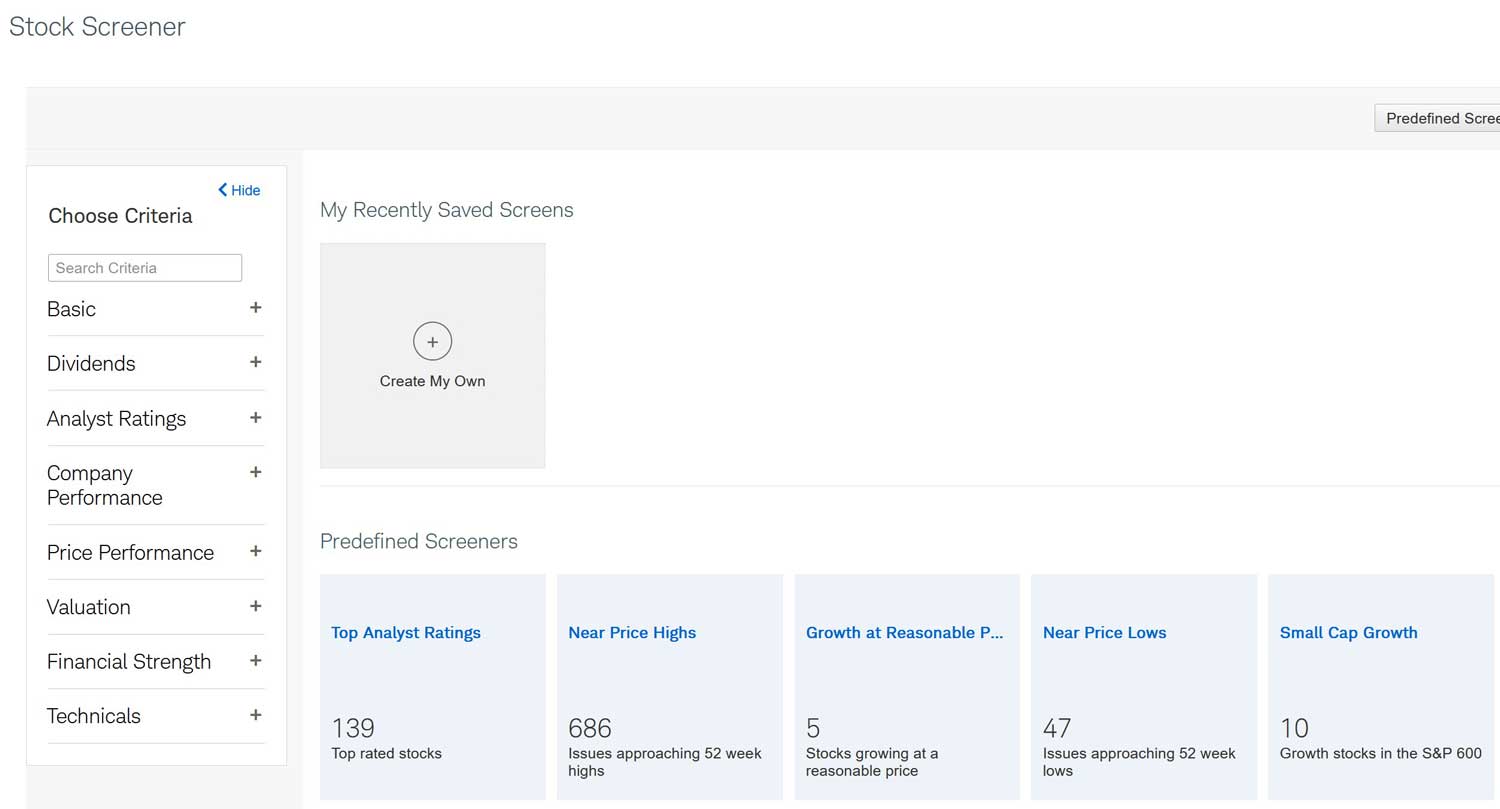

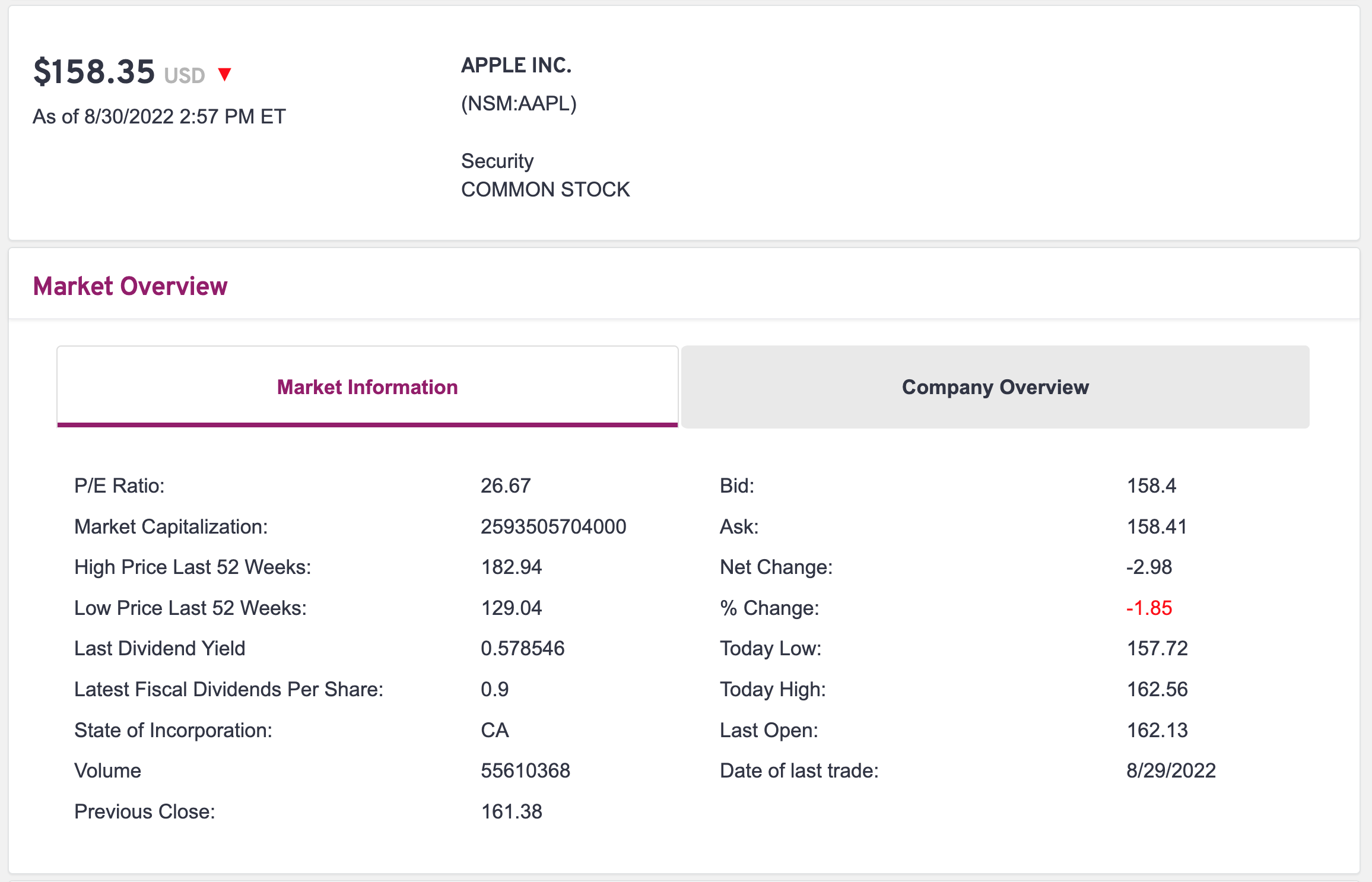

Charles Schwab’s website offers full investing and trading functionality, and there is very little to dislike about the platform. Stock research is simple, and each company’s page offers in-depth stock analysis, including valuation, fundamentals, and even analyst research. You can also buy or sell stocks directly from the company’s page through Charles Schwab’s SnapTicket technology.

Robinhood is an app-based brokerage, and its website mirrors this ethos. The website is functionally the same as the app and offers all of the same features in an accessible, easy-to-navigate way.

Mobile

ComputerShare does not offer a US-based app – the only authorized and official ComputerShare Investor Centre app is only available in Australia. Consider this if you check for an official app on either the Google Play or Apple App Store.

Several apps appear to be sponsored or affiliated with ComputerShare, but a glance at the poor reviews reveals that all are nonfunctional or scams designed to steal your information.

Suppose you are in Australia and access the ComputerShare Investor Centre app. In that case, you may also be disappointed – the app only lets you monitor your account balance and portfolio holdings and does not enable buying or selling stock.

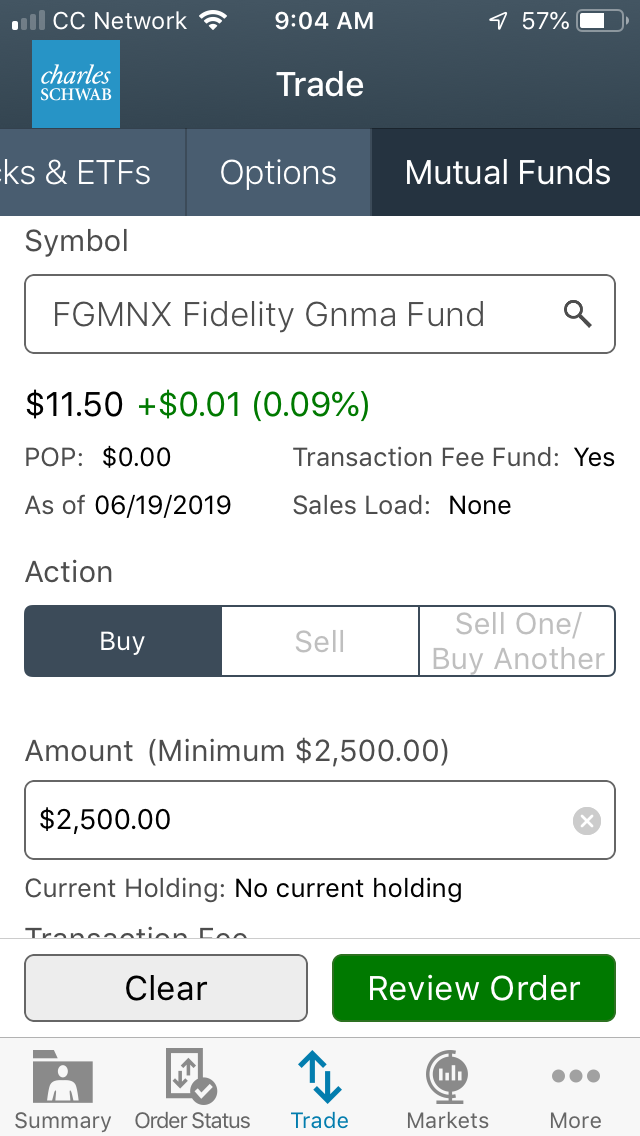

Charles Schwab’s app is functional and practical when you’re on the go but does not offer the full complement of the website's options or navigation. From the app, you can check your portfolio status and buy and sell stocks, ETFs, and options.

However, mutual funds and other assets can only be purchased and sold on the main website. Building more complex options strategies is somewhat tricky on the app due to the sheer scope of data and lag in accurately pricing individual options. If you’re setting a limit order, it is better to go slightly above or below the current price to account for this lag.

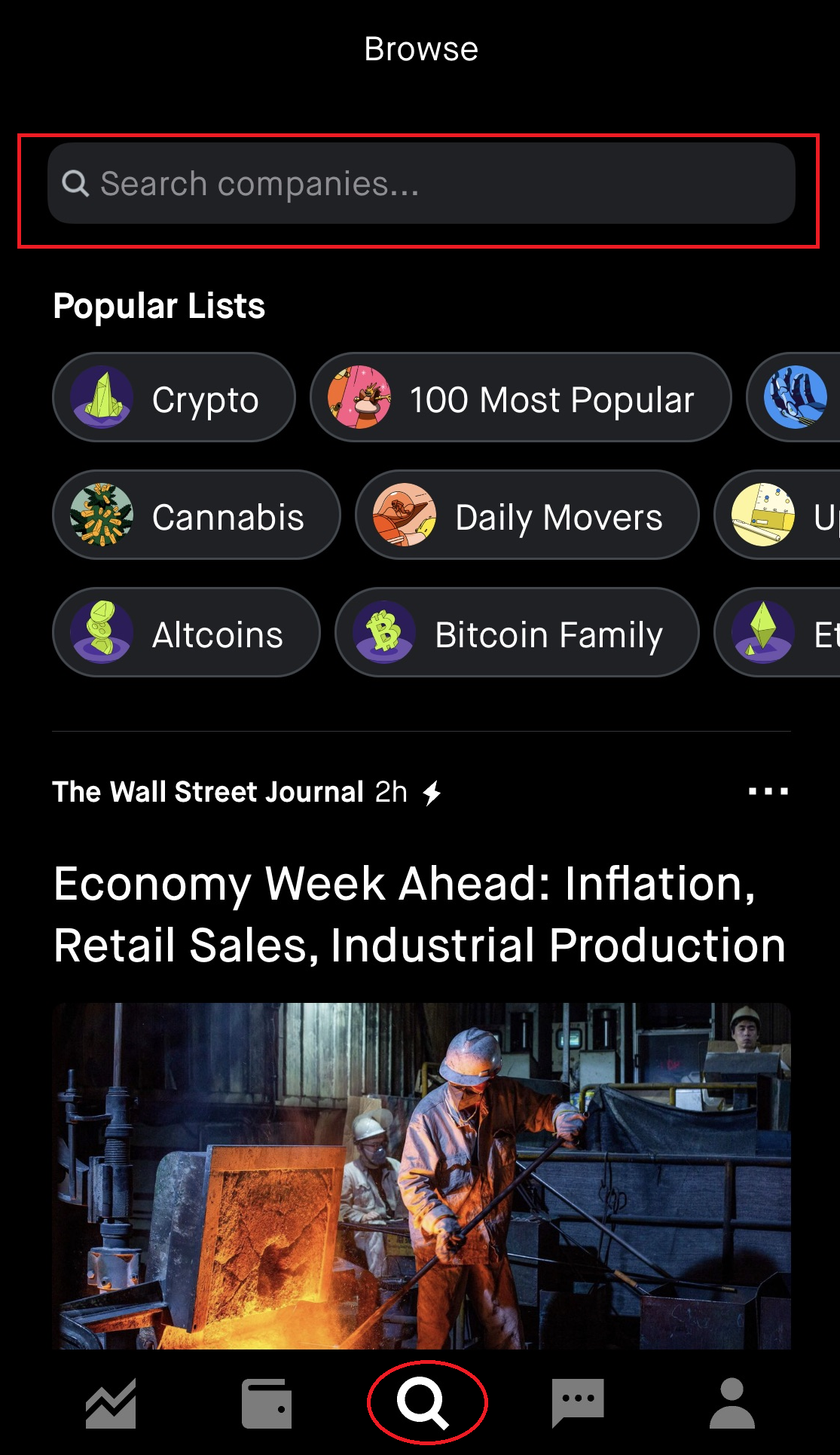

Mobile functionality is a high point for Robinhood. Robinhood’s entire structural foundation is built around mobile accessibility, and its easy-to-navigate app demonstrates this commitment. All asset class offerings are immediately available, and transactions are simple to execute – it almost feels like a mobile game app more than a stock trading resource! Robinhood has the best app among these three, and the company’s commitment to the platform cements its place as the industry app leader.

This is especially noteworthy when trading options – instead of navigating to an individual option page, as in Charles Schwab’s app, you can price and trade options directly from the main stock page, saving time and money in the event of increased volatility.

Additional Features

ComputerShare offers some essential stock research resources, but none beneficial to either beginner or advanced investors. The information is very basic and generally hinges on the nuts and bolts of a stock, like the current price and price-to-earnings ratio. There are no analyst reports or deep analytic pieces.

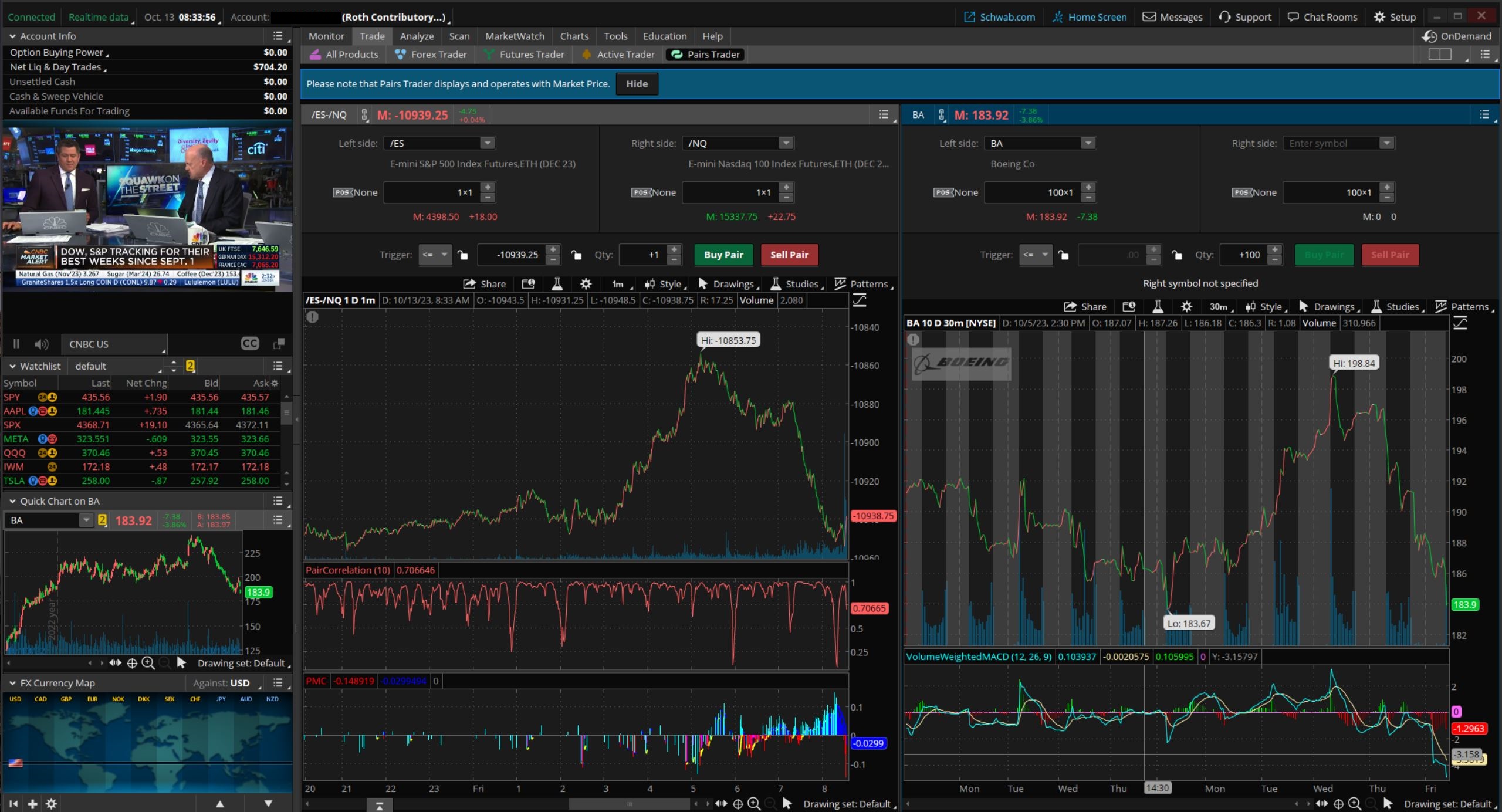

Charles Schwab offers many valuable tools and resources to new and advanced investors. In addition to

research tools, analyst reports, and a basic education center, one free offering sets Charles Schwab

apart: its thinkorswim (ToS) platform.

Dedicated and made for active, advanced traders, the ToS platform offers advanced stock screening tools and technical indicators on the chart. You can also quickly buy or sell stock directly from the chart to capitalize on quick price momentum. ToS also has a practical but slightly less functional app than the software platform.

The software is also not intuitive for new investors, but Charles Schwab offers a robust education center dedicated to learning ToS. The big ToS draw for new investors? You can switch the platform to “paper trading mode,” or fictional money and trading on live (or past) stock charts. This lets you develop and test different strategies without putting real money on the line.

Robinhood focuses on maintaining an easy trading platform, and the sparse additional resource offering reflects that tradition. Robinhood does offer some education and research tools, but they are mostly restricted to the most basic education topics for the newest investors. Research tools are also basic, focusing primarily on company basics and news. Robinhood Gold offers advanced analysis tools managed by the industry leader in stock research,

Morningstar.

Open An Account

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Robinhood: Free stock up to $200 and 1% IRA match when you open an account.

Recommendations

Beginner

For the newest investor or trader, Robinhood is an excellent entry into the market. Its intuitive interface and simple navigation make buying and selling stock simple. For some, it's almost too simple, and many have expressed concerns that the full accessibility of Robinhood leads to poor financial decisions.

This may be true, but like most things in life, you need to take responsibility for your education. If you don’t understand the mechanics behind your trades, you should pause and seek education before trying advanced strategies.

A motivated beginner interested in a more holistic portfolio that includes fixed-income assets and mutual funds is well-served by choosing Charles Schwab. While the overall experience is less intuitive, the education center makes up for the increased difficulty. The usage difficulty is an additional barrier to preserving capital rather than funding ill-advised, risky trades.

Advanced

Charles Schwab is far and away the best option for most advanced investors. Charles Schwab offers many staple asset classes that Robinhood and ComputerShare do not, like fixed-income vehicles and mutual funds. Additionally, the advanced options strategy builder and advanced thinkorswim platform make Charles Schwab a one-stop shop for advanced investors. Their educational center bridges the gap between inexperienced beginners and those looking to take their portfolio to the next level.

ComputerShare is acceptable for an advanced investor, but only for one with specific traits. If you’re relatively high-net-worth and want to buy and hold stock for a long time without worrying about it, then ComputerShare is a viable option, even if it isn’t the best.

IRA

Although Charles Schwab is the only full-spectrum IRA provider among these three, it would be the best no matter what, based on all other factors. Much like trading stocks and options, Charles Schwab optimizes the IRA investing experience and makes it parallel a standard investment account so having both under the same umbrella is not confusing. The process of starting and transferring an IRA is also easy. I was a previous customer of Charles Schwab and wanted to fund a new Traditional IRA with an old company’s 401(k). I told Charles Schwab the plan, and they handled all direct communication with the 401(k) servicer and transferred the entirety to my new account in about a week.

Conclusion

Overall, Charles Schwab is the clear winner among the three. Robinhood is great for an investor interested in learning how to trade. Still, anyone interested in a more all-encompassing experience, rather than just trading for fun, will outgrow the service. Charles Schwab bridges the gap well between beginner and advanced investors and is a great platform to stick with for life.

ComputerShare has merits, but the legacy platform and high fee structure make it a niche-use case for only a select class of investors. If you don’t see yourself as buying large, multi-thousand-dollar quantities of individual stocks and holding onto them for decades, ComputerShare is not the service for you; again, though, Charles Schwab fills the gap between even advanced, lower-net-worth investors and those with multi-million dollar portfolios who want more active management than what ComputerShare offers.

Open Charles Schwab Account

Open Schwab Account

Open Robinhood Account

Open Robinhood Account

|