|

How To Withdraw Money Out of Wells Fargo Brokerage Account (2024)

How to withdraw money from Wells Fargo Brokerage account by ACH or wire transfer. What is Wellstrade's withdrawal limit and fee, and how long does it take.

|

How to Withdraw Your Money from WellsTrade

If you need to take cash out of a WellsTrade or Wells Fargo Advisors account, you’ve come to the right place. Just follow our user-friendly guide and you’ll be able to transfer money to an external (or internal) bank account without difficulty.

Withdrawing by ACH

The first option for a cash withdrawal is the Automated Clearing House. This fully electronic network is really easy to use, although a withdrawal may not show up in the receiving bank account until the next business day at the absolute earliest.

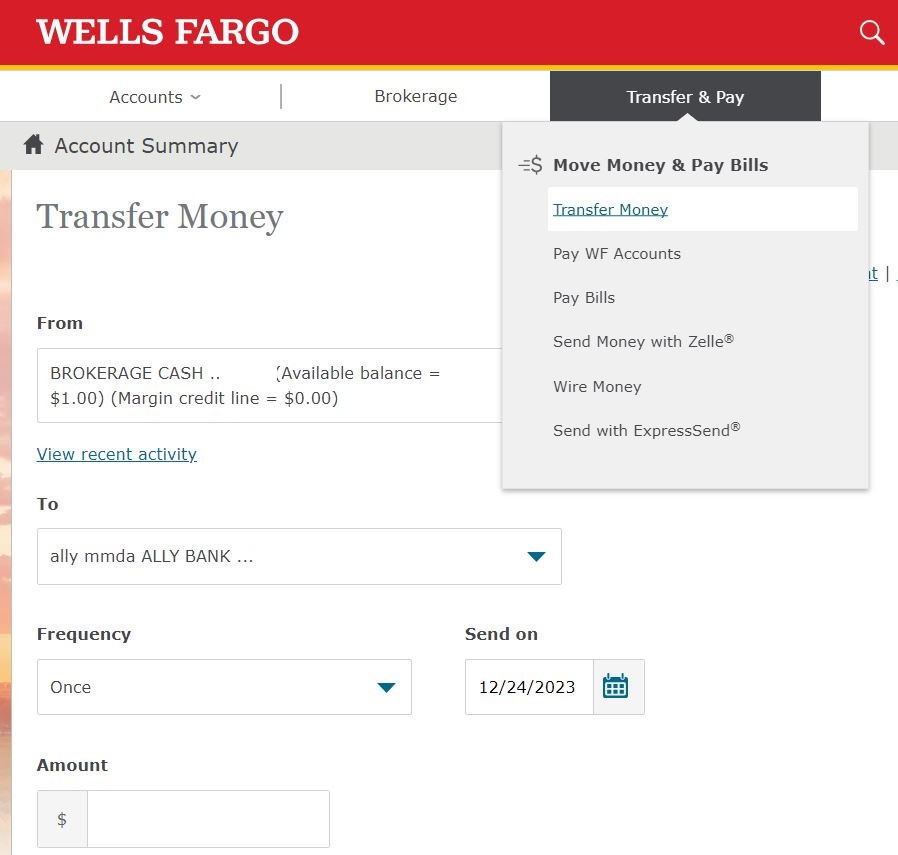

The first step to make an ACH withdrawal is to link a checking or savings account to the investment account. If you have a deposit account with Wells Fargo Bank, it will automatically be connected, so this step can be skipped. If you want to use an external deposit account at another financial institution, you’ll need to log into the Wells Fargo site and set up the connection. Under the Transfer & Pay tab on the website, select the link to transfer money. On the next page, there will be a link at the top to add non-Wells Fargo accounts. You’ll need to add the account and routing numbers for the external bank account.

Once the account is linked to the Wells login, it can be used to receive a transfer from a WellsTrade or Wells Fargo account, which could be a Wells Fargo Bank or Wells Fargo Advisors account.

To make a withdrawal after a savings or checking account has been set up, go back to the Transfer & Pay tab at the top of the site and select the Transfer Money link in the drop-down menu. This is the ACH transfer form. This time, you’ll want to skip over the link to add an account and fill in the details on the transfer form instead:

From:

From: Select the Wells Fargo account to withdraw from (‘Brokerage cash’ should be selected to move money out of a WellsTrade account)

To: Select the receiving account (besides the linked bank account, it’s possible to transfer cash from an investment account to a Wells Fargo credit card)

Frequency: If the receiving account is a bank account, select the frequency; it can be once, weekly, every two weeks, twice a month, or monthly; the only frequency for a credit-card transfer is once)

Send on: It’s possible to schedule a withdrawal for a future date

Amount: Self explanatory; there is a daily limit of $25k

Delivery: Next business day or 2 business days

When everything has been filled in correctly, review the details. If everything looks okay, submit the ACH request.

Withdrawing by Wire

To withdraw money by wire, go back to the Transfer & Pay tab at the top of the website and this time select the link to wire money. Follow the on-screen prompts to specify the receiving bank’s national location (many countries are available) and its routing number or SWIFT code (along with the account number). It’s possible to specify a Wells Fargo Bank account if desired. Enter the amount of the transfer and review the details. If everything looks right, go ahead and submit the wire request.

Wells Fargo has a daily limit of $25k for withdrawals by wire. There is also a 30-day rolling limit of $75k.

Best Brokers

Using the Mobile App

Besides the website, Wells Fargo’s mobile app can also be used to initiate a withdrawal by ACH or by wire. Look for the Pay & Transfer icon in the bottom menu. On the Pay & Transfer page, you’ll see icons for Transfer (for ACH movements) and Wire Money. In either case, the transfer form is the same.

Cost of Withdrawing

Wells Fargo charges nothing for an ACH withdrawal from any account. A wire withdrawal that is submitted through the website or mobile app also costs nothing. Using a representative over the phone or at a branch location to complete a wire request costs $30 (or $40 for an international wire).

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor