Charles Schwab PCRA Overview

A Charles Schwab Personal Choice Retirement Account is a self-directed brokerage account that is a part of an investor’s employer-sponsored retirement plan. Savvy investors who are looking for a wider variety of investment options could benefit from opening a Personal Choice Retirement Account (PCRA).

How Personal Choice Retirement Accounts Work

An investor’s retirement plan sponsor, i.e. the employer sponsoring the 401K plan, determines if an investor is eligible to open a PCRA. If an investor’s retirement plan has an option for a self-directed account, the investor decides what portion of their account balance will go into the PCRA. Depending on the plan, an investor could place their entire sum in the PCRA or only invest a portion and leave the remainder of their account balance inside the traditional 401k.

Investment Options

A self-directed brokerage account, such as the Schwab Personal Choice Retirement Account, allows an investor to trade investments that are outside of the retirement plan’s defined options. Most retirement plans feature a limited set of funds. Utilizing a self-directed account expands the list of investment options.

The plan sponsor will determine if an investor’s Schwab PCRA is limited to only mutual funds or includes securities and other investments.

Mutual Fund Options

The Schwab Personal Choice Retirement Account offers investors more than 8,800 different mutual funds. Investors enjoy a wide supply of no-transaction-fee funds inside the account.

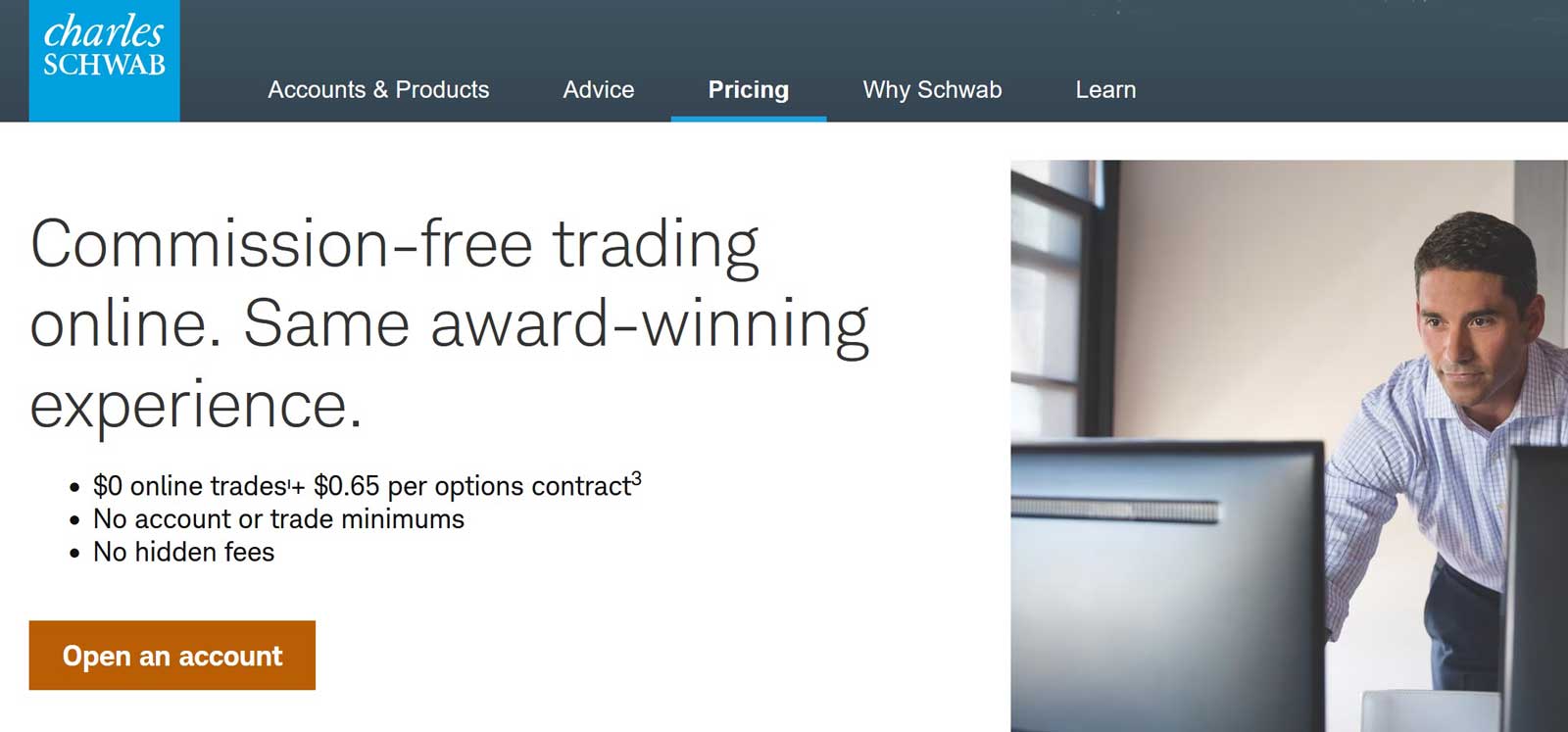

Schwab Personal Choice Retirement Account Fees

Schwab does not charge a fee to activate or maintain a PCRA. The investor’s retirement plan service provider may charge maintenance and other record keeping fees as a part of offering the self-directed account inside the retirement plan. Investors should consult their retirement plan documents or ask their service provider for fee details.

Schwab Personal Choice Retirement Account Transaction Fees and Commissions

The following is a summary of the transaction fees and commissions inside a typical Schwab Personal Choice Retirement Account. The exact PCRA fees and investment options may vary depending on the investor’s retirement plan.

These fees are for electronic trades. In most cases, broker-assisted trades are charged the electronic commission plus $25.

| Investments | Commissions |

|---|

| Stocks and ETFs | $0 |

| Stocks and ETFs broker assisted | $29.95 |

| US Over-The-Counter (OTC) Equities | $6.95 |

| Options | $0.65 per contract |

| Mutual funds | $49.95/$74.95 to buy, $0 to sell |

| Futures | $2.25 per contract |

| CDs, Corporate Bonds, Municipal Bonds, Government Agencies, Zero-Coupon Treasuries, including STRIPS and Mortgage-Backed Securities | $1 per bond, $10 minimum, $250 maximum |

| Commercial Paper and Foreign Bonds, Unit Investment Trusts | call for pricing |

| Investments |

stocks, bonds, mutual funds, futures, Treasury issues, options, CDs, insurance, ETFs, futures,

annuities, non-U.S. securities and ADRs, WEBs and Canadian foreign orders

|

| Charles Schwab minimum deposit to open account | $0 for cash account, $2,000 for margin account |

Get Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

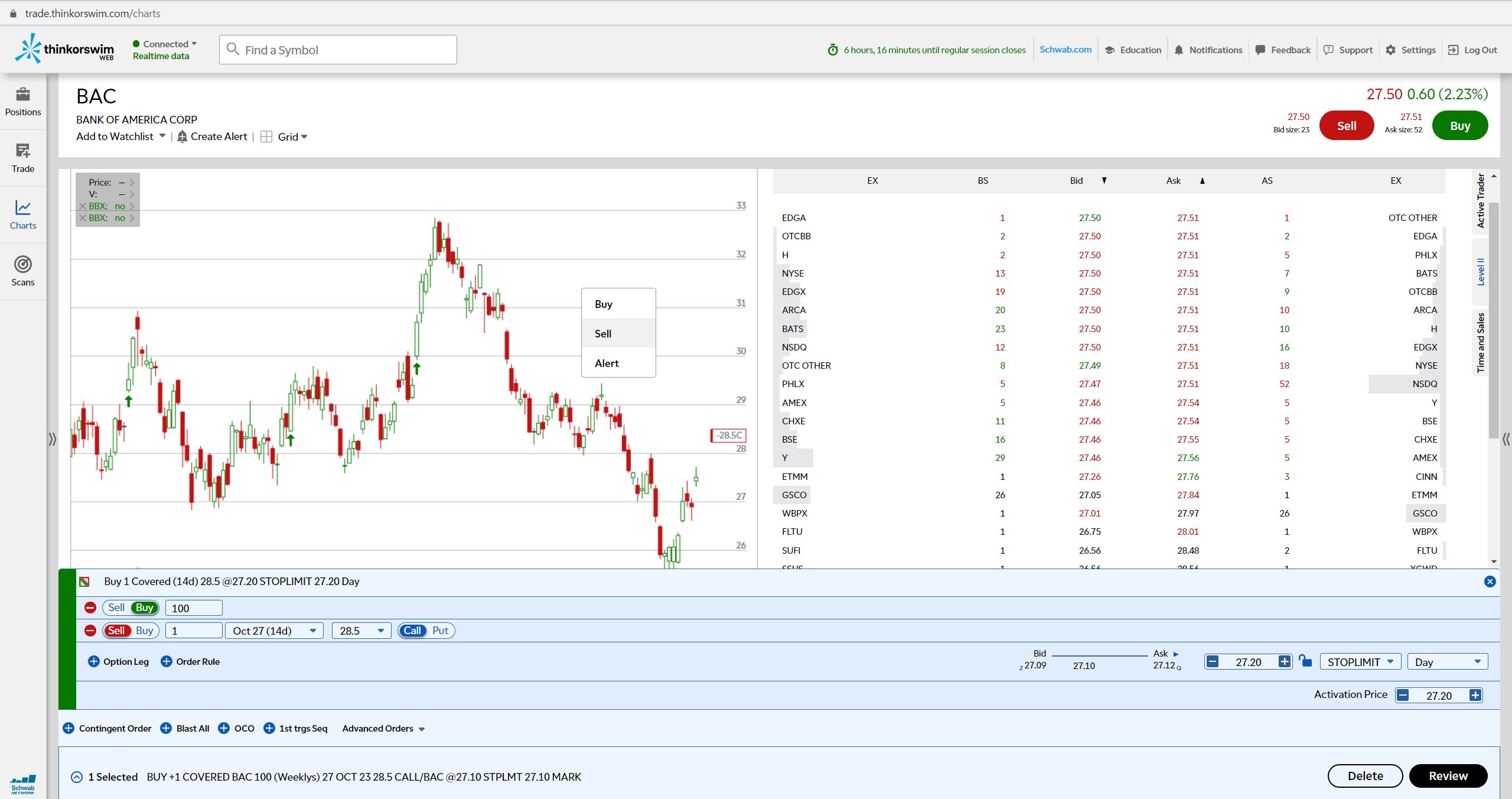

Making Trades

Executing trades online in a Schwab self-directed brokerage account is simple. Contributions to the account can be made through the investor’s payroll contributions or by transferring funds from the investor’s retirement plan. Contributions are deposited into a cash account the investor can use for trading once the funds are settled.

Trade orders can be entered with a couple of clicks using Schwab’s online system.

Investors can also place trade orders by calling Schwab’s PCRA call center. The center is open Monday through Friday from 9 a.m. to 7:30 p.m. Eastern Time.

Automatic Investing Options for Mutual Funds

Schwab Personal Choice Retirement Accounts also feature an automatic investing option for mutual funds.

The Automatic Investment Plan allows investors to make regular investments in select funds without fees or loads. Not all funds are eligible for the automatic investing feature.

To utilize the feature, an investor must already hold or purchase a minimum of $100 in a fund and provide instructions on how much and how often to make additional investments. Investors can choose from twice a month, monthly or quarterly.

Third-Party Management of a Personal Choice Retirement Account

Schwab PCRA representatives can provide assistance in how to use Schwab’s tools, but are not allowed to make specific investment recommendations. Schwab provides limited power of attorney (LPOA) forms for investors to use to authorize an adviser or another third-party to manage their account.

Research and Educational Tools

Schwab’s account portal features a robust research and education section. The research tools provide the experienced investor with access to the latest market reports and the ability to create watch lists for certain stocks. The education section features basic primers on the different investment instruments available inside a PCRA. The educational tools are exceptionally helpful to beginning investors who may be less experienced with investment products.

Charles Schwab PCRA Pros

A self-directed brokerage account provides investors with considerably more investment options than a traditional 401k. The additional options allow an experienced investor to finely tune their portfolio allocation while seeking the most cost-effective investment options.

Charles Schwab PCRA Cons

The extensive investment options available inside a self-directed brokerage account could be a disadvantage to the novice investor. Managing a self-directed account requires both knowledge of investment products and strategies as well the time to actively manage the account.

Get Charles Schwab Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Schwab Personal Choice Retirement Review Recap

A Schwab Personal Choice Retirement Account is an excellent opportunity for an experienced investor to add a self-directed brokerage feature to their existing employer-sponsored retirement plan. The main advantages of a PCRA are the wide variety of investment options and low-cost fee structure. Less experienced investors may not have the knowledge or time to manage a PCRA in a way to reap the full benefits of a self-directed brokerage account.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|