Unfortunately, Robinhood does not offer Individual (Solo) 401K or any other self-employed accounts at

this time. There are only

Traditional IRA and ROTH retirement accounts on the Robinhood. For a $0 commission Individual (Solo) 401K provider, see

Charles Schwab Brokerage.

Free Charles Schwab Account

Open Schwab Account

Free Robinhood Account

Open Robinhood Account

Overview of Charles Schwab's Individual 401(k)'s

If you're self-employed individual and don't have access to a company-sponsored 401(k) plan, you may

want to think about opening a solo 401(k). Several online stockbrokers offer this type of retirement account. In particular, Charles Schwab does, and the account's fee schedule is very competitive. Let's take a look underneath the hood.

Opening an Individual 401(k) at Charles Schwab

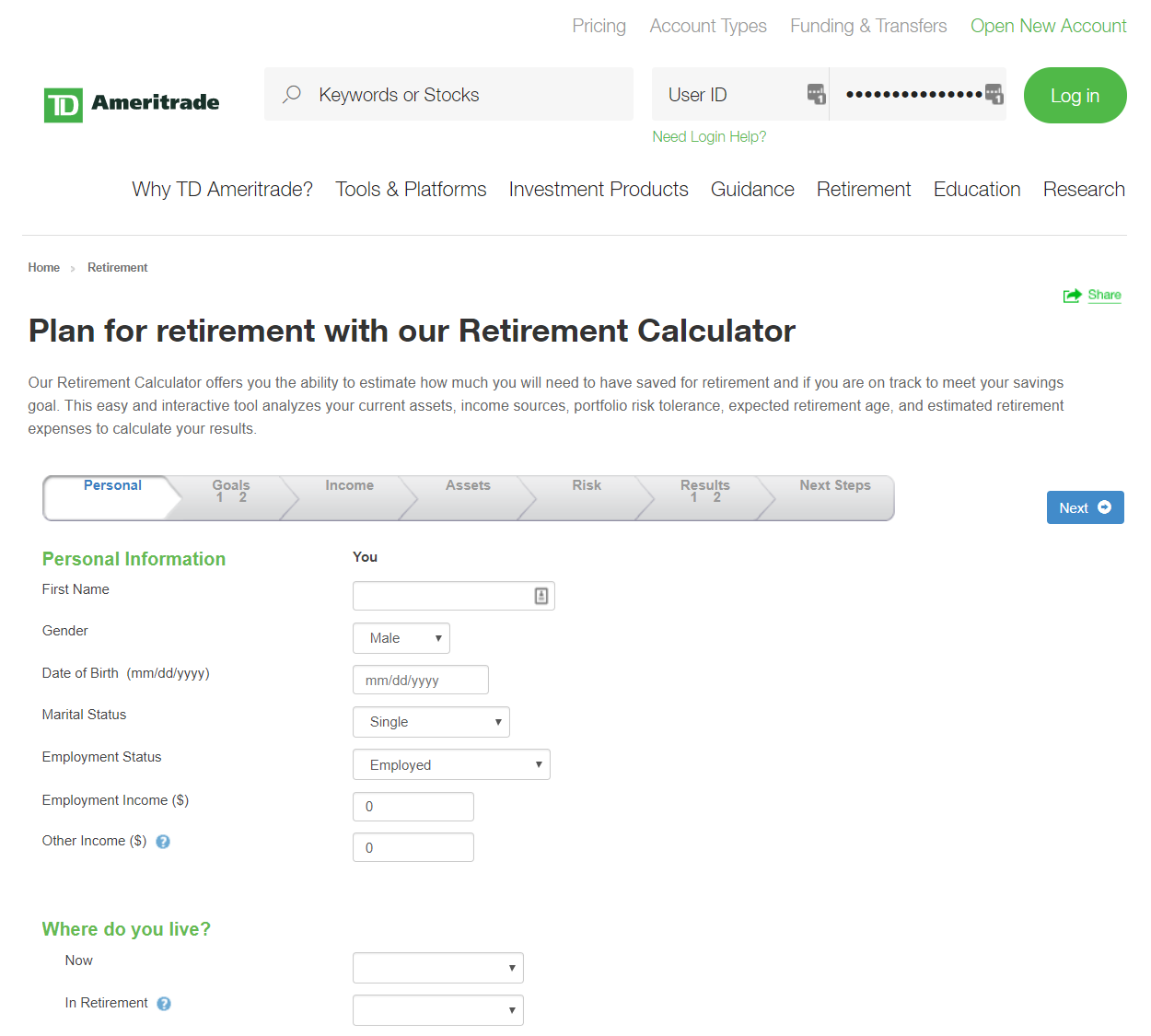

Charles Schwab has a great website, and self-employed 401(k) can be opened on-line. Just

navigate

to the website, then hit "Invest Now" button. In the list of accounts on the left, select

Retirement, then Individual 401(k), and after that Open an Individual 401(k) Account.

You'll be presented with online forms and of course you'll need to fill them out.

Areas where you'll need to pay special attention are the naming of a trustee, eligibility service

requirement, and whether you want the plan to be used for loans in the future.

Roth v. Traditional

You can open either a Traditional 401(k) or a Roth 401(k). The Traditional variety allows for pre-tax contributions, meaning that elective deferrals are taken out of your paycheck before they go into the 401(k); and this reduces your tax liability. Don't forget that withdrawals will be taxed because you didn't pay tax on the funds originally.

The Roth 401(k), like the Roth IRA, accepts contributions after they have been taxed; so these contributions aren't tax deductible, as is the case with a Traditional 401(k). But withdrawals are tax free.

Under IRS guidelines, if you open a Roth 401(k), you also have to open a Traditional 401(k). You're not required to make any contributions to the Traditional account, however. But it will be in your Charles Schwab on-line account if you ever want to make contributions to it in the future.

Charles Schwab Individual 401(k) Specifics

The U.S. government has established certain rules for self-employed 401(k)'s, and these regulations of course apply to a plan held at Charles Schwab. There is an $19,500 annual limit on employee deferrals. If you're over 50, you get an extra $6,000 per year.

You can also contribute as the employer. While wearing this hat, you can contribute up to 25% of compensation. The maximum you can put in a solo 401(k) in 2024, including both employee and employer funds, is $58,000.

Charles Schwab Individual 401(k) Fees

Surprisingly, there is no annual fee for a 401(k) plan held at Charles Schwab, nor is there any charge to close one. Moreover, there is no inactivity charge, low balance costs, or other on-going fees. Paper statements do cost $2 each, but the stockbroker offers an e-statements. Paper and electronic trade confirmations are always free.

The same commission schedule that applies to taxable accounts at Charles Schwab also applies to non-taxable

accounts. This means $0 stock and ETF trades.

Charles Schwab also has 4,200 mutual funds that have zero loads and no transaction charges. In total, the broker-dealer has 11,544 funds. If you sell an NTF fund less than 180 days after you buy it, Charles Schwab will hit you with a $49.99 charge. The company's charge for transaction-fee funds is also $49.99.

Retirement Resources

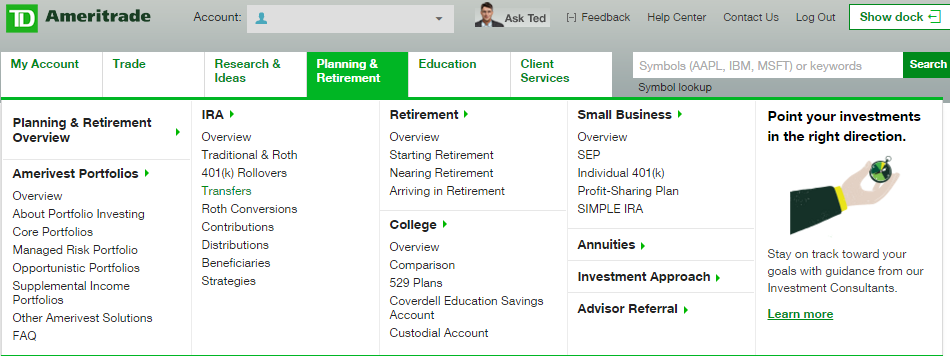

The Charles Schwab website has a great educational section. There are articles and videos that cover a lot of territory. For instance, I found resources on fixed-income ETFs and stop loss orders.

If you need help using some of the trading technology Charles Schwab offers, you can find videos that demonstrate how to use a platform or trading ticket in the educational section. A bond ladder would be ideal for a retirement account, and there's a video describing how to build one.

Charles Schwab's mutual fund screener returns 219 target-date mutual funds, most of which are also no-load, no-transaction-fee securities. Some of the fund families are BlackRock, T. Rowe Price, and American Century.

Despite all the great resources Charles Schwab offers, if you still aren't confident enough to do your own account management, you can turn your 401(k) over to an in-house investment advisor, who will make trading decisions for a small fee.

Charles Schwab Individual 401K Review Judgment

Charles Schwab brings a lot to the table if you're looking for a brokerage firm to help you save for retirement. Besides its generous 401(k) policies, which are some of the best you can find, you can also use some great trading technology to buy and sell equities. If you have other accounts at Charles Schwab, you are able to access them from a single login.

Open Charles Schwab Account

Open Schwab Account

|