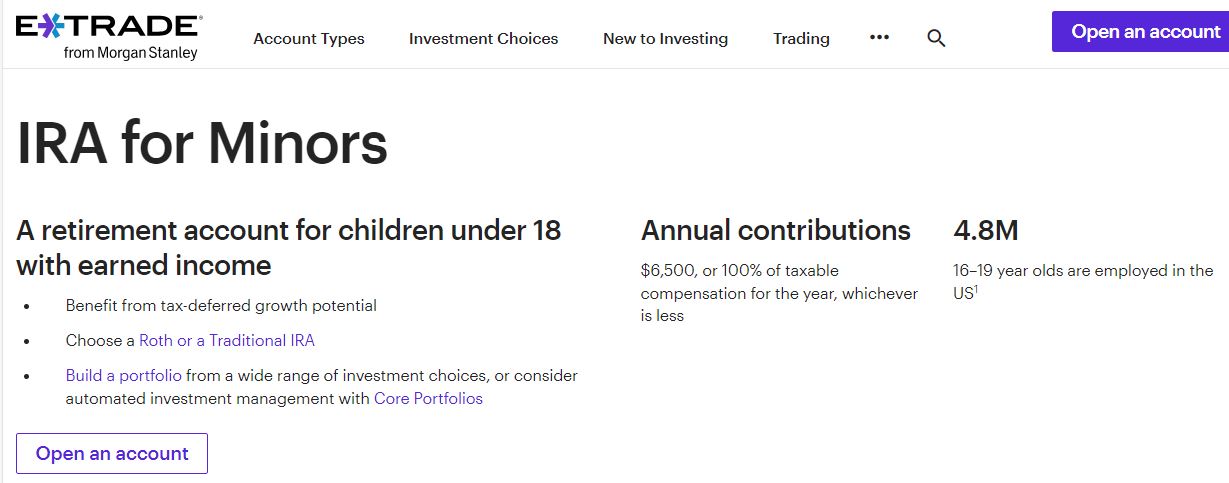

E*Trade’s IRA for Minors

Tax-deferred investing is not just for adults. With E*Trade’s IRA for Minors, young people can save money for retirement and more, all at very little cost. Read on for the details.

IRA for Minors Overview

An Individual Retirement Account for Minors is just what it sounds like: an IRA for kids. Like any other IRA, earned income is required, which means the adolescent must have some type of job.

At E*Trade, an IRA for Minors can be opened in either Roth or Traditional format. In either case, the same annual contribution level exists (currently, that’s $6,500 per year).

Opening an IRA for Minors at E*Trade

With E*Trade’s mobile app or website, it’s possible to open a juvenile IRA. On the mobile app, just click on the little guy in the upper-left corner. Doing so will generate a menu that has a link to open a new account. Tap on this link, and you’ll see a list of accounts. At the top, there is a drop-down menu for account category. Select retirement here. Next, scroll down until you see the section for IRA for Minors. Tap on the link to start the application.

On the website, you’ll need to ignore the purple button at the top of the site to open an account. The IRA-for-Minors application won’t be found here. Instead, scroll down to the bottom of the page and look for the link to open an account (it is under the ‘Quick Links’ heading). On the next page, look under the ‘Brokerage’ tab for the IRA-for-Minors account.

Either route, website or mobile app, produces the same digital application, which is provided in a partnership with DocuSign. If you don’t care for this system or find it too difficult, E*Trade does have a pdf application for the IRA for Minors. It is a fillable form, which means no handwriting is required, except at the very end, where a signature is required. Once the form is completed, images need to be created with a smartphone, scanner, or some other device, and these need to be submitted to E*Trade. The website has a convenient upload tool, and so does the mobile app.

Potential Investments in an IRA for Minors at E*Trade

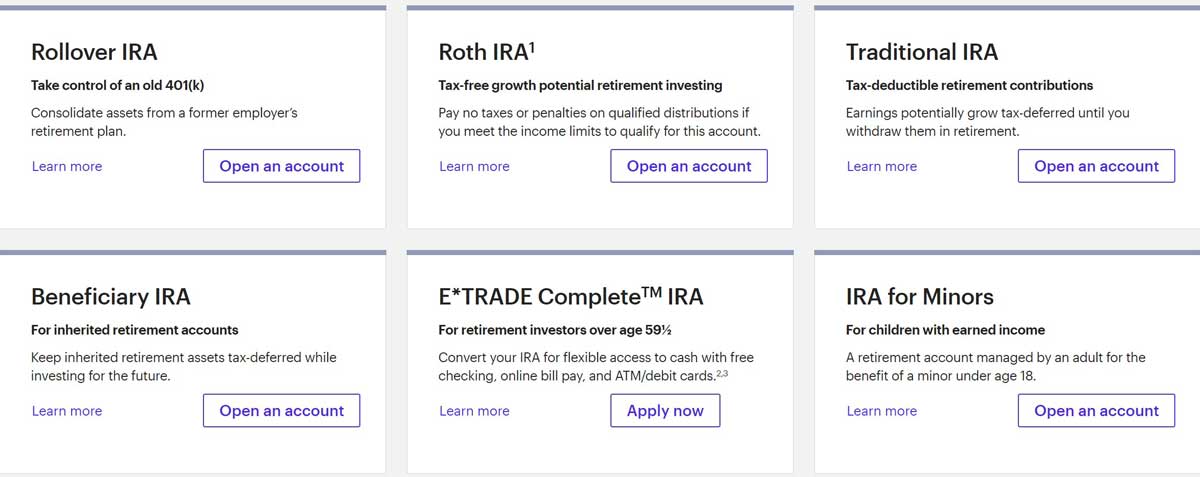

An IRA of any type at E*Trade has the same investment lineup that taxable accounts have access to. Available assets include bonds, options, stocks, futures contracts, and funds (mutual, exchange-traded, and closed-end). These asset classes assume the IRA for Minors is opened as a self-managed account. It is also possible to open the IRA for Minors in robo mode where a software program will pick ETFs for the account.

Pricing Schedule for E*Trade’s IRA for Minors

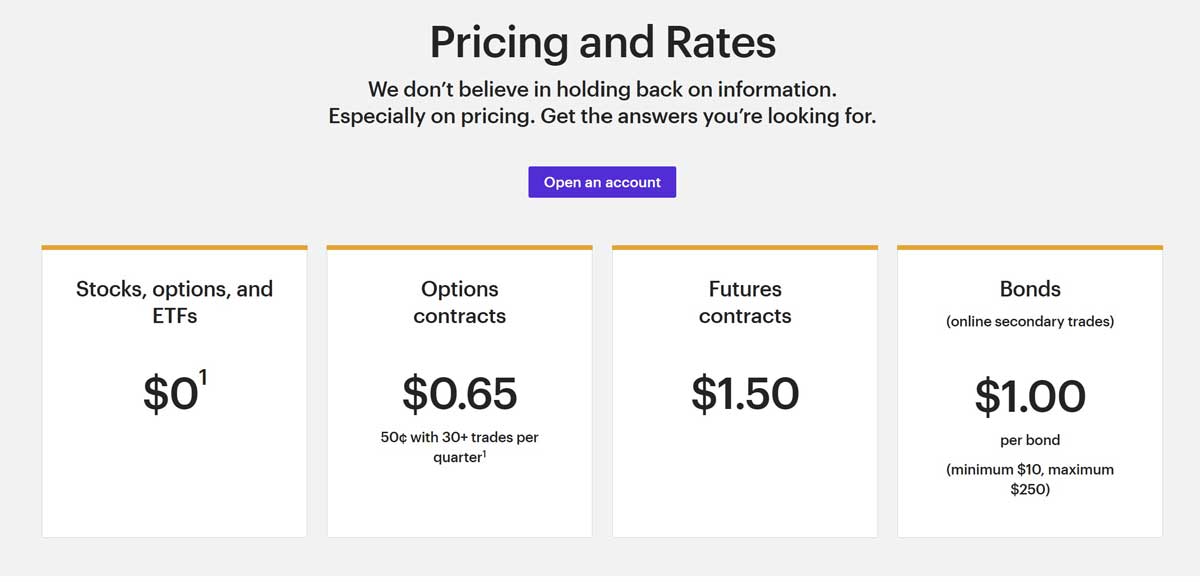

One of the great features of E*Trade’s retirement account for children is its fee schedule. There are no ongoing account fees of any kind for brokerage IRAs—no annual, maintenance, low-balance, withdrawal, or inactivity charges. A robo IRA will cost 0.30% per year. An IRA can be opened with any deposit or no deposit at all, which makes the whole thing super convenient.

Once the adolescent IRA is open, it will be subject to E*Trade’s standard commission schedule, which means zero commissions on stocks, ETFs, and mutual funds.

Transferring an Existing IRA for Minors to E*Trade

An existing IRA for Minors at another investment firm can be transferred into the same account type at E*Trade. On E*Trade’s main mobile app, tap on the Menu icon in the bottom menu. Next, select the Transfer link near the top of the page. On the next page, scroll down and tap on the link to transfer an account. Be sure to specify an IRA for Minors (with the correct tax structure, Roth or Traditional) as the account type at the old investment firm.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Taxation of an IRA for Minors

An IRA for Minors is taxed the same way that other IRAs are taxed. This means funds can be withdrawn penalty free for a variety of uses beyond retirement. For example, funds can be withdrawn before age 59½ without the standard 10% penalty from the IRS when the money is used for qualified educational expenses (income taxes do have to be paid on any earnings that are withdrawn from a Roth for this purpose, however, and a Traditional setup will see income taxes on both earnings and contributions). A first-time home purchase is also on tap.

Charles Schwab’s Custodial Account as a Substitute

The major disadvantage of the IRA for Minors account is the requirement of earned income on the part of

the child. This policy is eliminated with the custodial account. With this account type, any amount can be contributed with or without earned income, and there is no annual contribution limit, either.

A custodial account can be opened at Charles Schwab with zero fees and zero minimum deposit requirement. Schwab offers both the UGMA and the UTMA account, which means residents of all 50 states, Puerto Rico, and the U.S. Virgin Islands can get in on the action.

Schwab’s account application can be accessed on either its website or mobile app. A custodial account can be opened through either channel, and the form takes just a few minutes to fill out.

Free Charles Schwab IRA Account

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

Updated on 2/1/2024.

|