|

Is Fisher Investments a Scam in 2024?

Is Fisher Investments a scam? Is it a safe and legitimate firm? Fisher Investments BBB rating, complaints. Is account SIPC/FDIC insured?

|

Is Fisher Investments a Safe and Legitimate Firm?

Not only is Fisher Investments safe and legitimate, but it's also one of the most known financial advisory

firms in the country. But they aren't the best for everyone - so some customers get a bad taste in their mouth from the service and claim that Fisher Investments is a scam.

History of Fisher Investments

Fisher Investments was founded in 1979 by Ken Fisher and incorporated in 1986. Fisher was the company's CEO until 2016, when he stepped down and passed the torch to Damian Ornani. Fisher Investments focuses on a fundamental belief in capitalism and the benefits of the free capital market. They believe supply and demand are the sole determinants of securities pricing today and fight to get the best positioning in that tug-of-war for their clients.

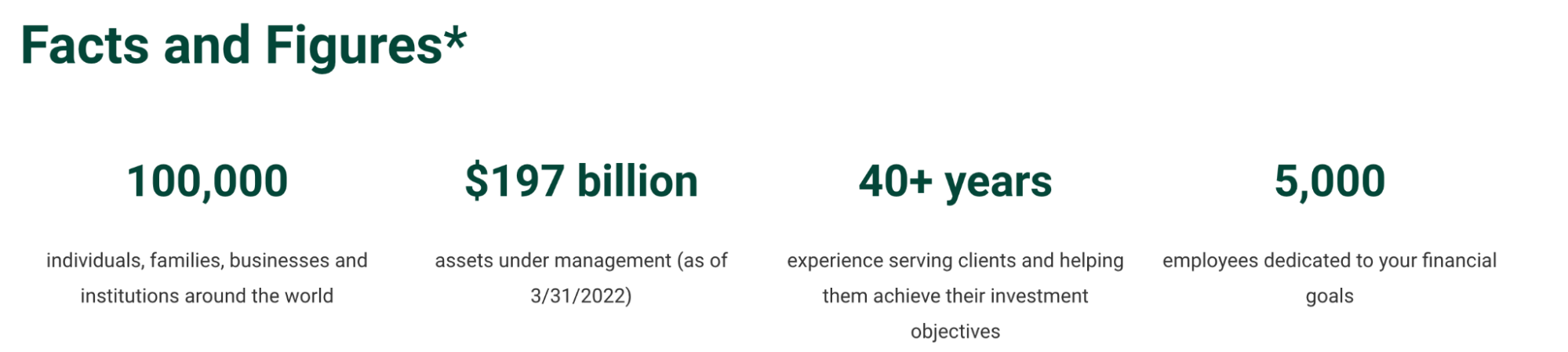

This company has been on the scene for nearly fifty years, paving the way for itself amongst the other giants. They have served over 100,000 clients and continue to gain more with every day that passes by.

What Does Fisher Investments Do?

Fisher Investments focuses on financial services and products like:

● Personal wealth management for the benefit of the individual

● 401(k) services for future preparation

● Institutional investing, including strategies and responsible investing tactics

They also offer a resource library, insights, and contact information for all the access and assistance a person or company could want.

Fisher Investments has been around for a long time, ensuring it is a legitimate and safe option for clients in need. Fisher Investments participates in other investment networks and initiatives like Principle for Responsible Investment and Japan's Stewardship Code, further proving their reliability and credibility.

You can feel safe using Fisher Investments. They are a legitimate company with a long history of assisting clients with successful investing and financial habits.

Is Fisher Investments a Scam?

Fisher Investments is about as far from being a scam as you could be in their field. Some individuals may have poor opinions of the company, but that doesn't take away from its legitimacy.

Investing involves risk, whether personally managing your wealth or working with a professional institution.

High risk does not mean scam.

If you want to learn more about Fisher Investments and what they offer customers, head to their website. You can check out their "About Us" section to learn more about their background and verify other public information. You can also contact them if you want to know more about what Fisher Investments can do for you without paying anyone. They are not a scam, and their professionals stand ready to act.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Is Fisher Investments SIPC/FDIC Insured?

SIPC/FDIC-insured firms are another way to verify a company's safety and stability but aren't the sole yardsticks to measure a company. Is Fisher Investments SIPC/FDIC insured?

Federal Deposit Insurance Corporation (FDIC)

The US Government runs the FDIC - the Federal Deposit Insurance Corporation. This system ensures the stability and safety of funds inside FDIC-insured institutions and banks. It helps to ensure the money stays in one place, even if something happens to the capital.

Unfortunately, FDIC rules don't apply to Fisher Investments. FDIC insurance primarily applies only to traditional banking services like certificates of deposit, savings, and checking accounts, not investment or speculative banking options.

Securities Investor Protection Corporation (SIPC)

The SIPC, or Securities Investor Protection Corporation, is another line of defense. It's private, but the government mandates SIPC to oversee firms selling investment products. They will help investors claw back capital if the firm falls apart due to fraud or managerial negligence.

Fisher Investments falls under SIPC insurance, but clients must remember that SIPC doesn't give back cash lost through investing, only money misappropriated or used for fraudulent purposes.

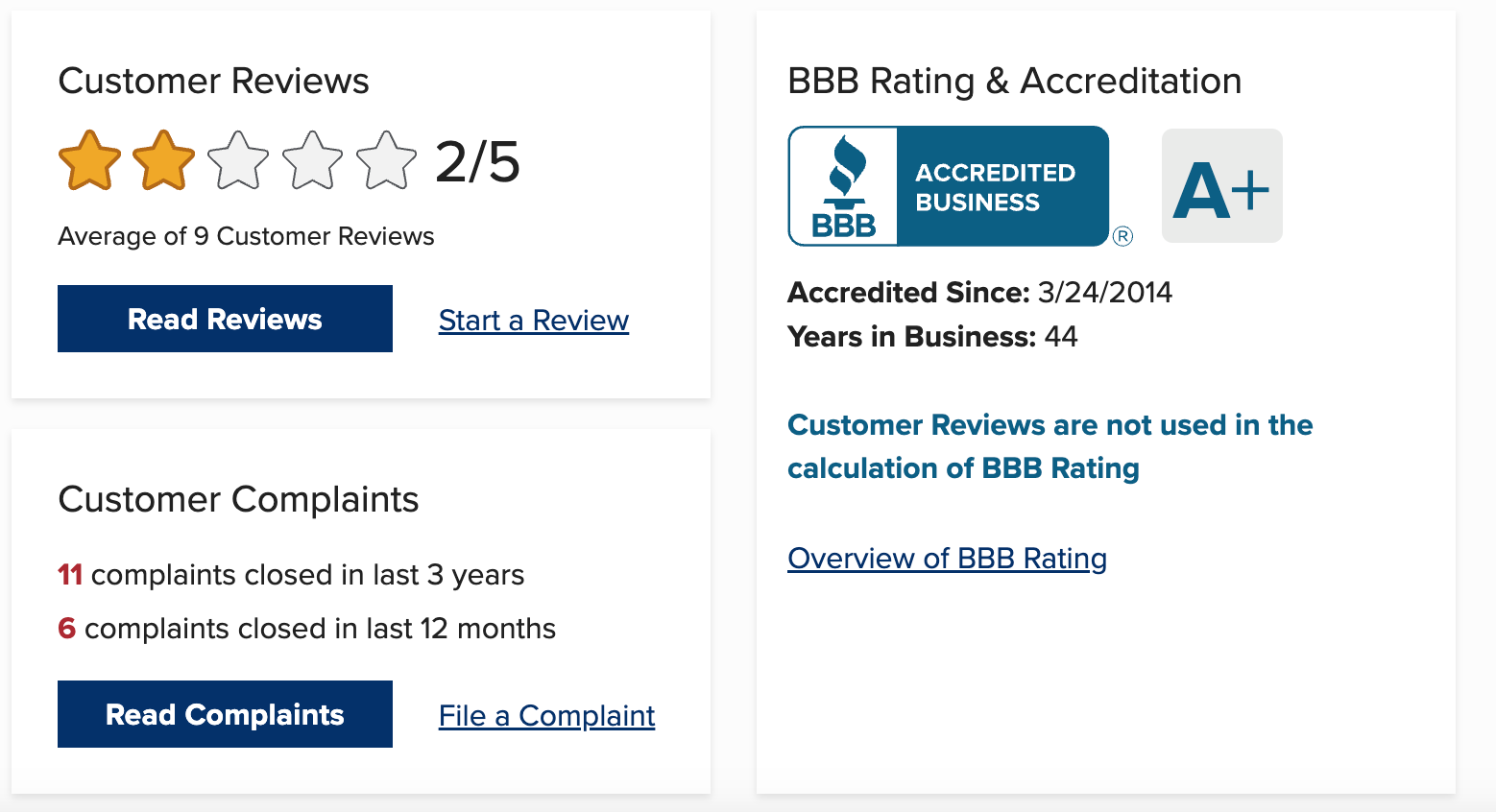

Fisher Investments BBB Reviews

Some issues in the BBB reviews for Fisher Investments could steer interested parties away. Although they have an A+ in accreditation, the company has a ⅖ star rating. However, it's critical to note there are only eleven total complaints from thousands of customers. Most of these have been closed and resolved.

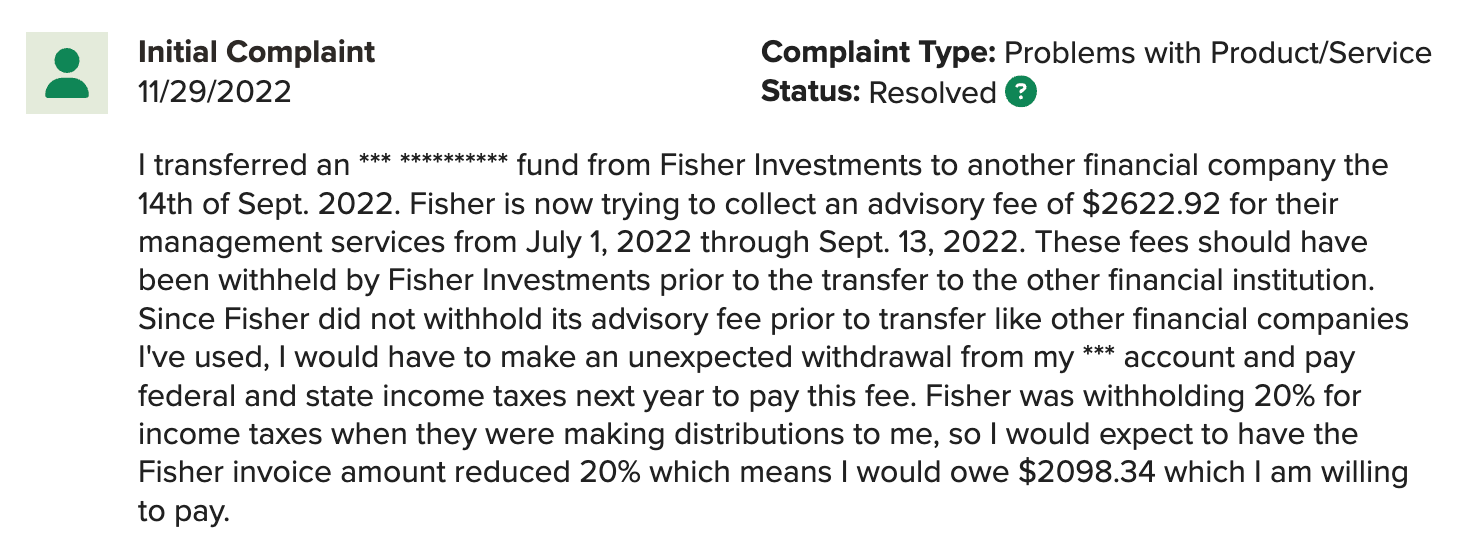

Here are a few of the most common complaints against Fisher Investments:

● Unexpected fees and expectations

● Phishing and scam emails

● Concealed critical information

The most common complaint was about unexpected fees.

There are several unfortunate bad reviews like these. However, by balancing the number of complaints with the customers, this service seems decent for prospective clients who understand the benefits that Fisher Investments provide.

Is Fisher Investments Legit?

Fisher Investments is legitimate. It's a prominent figure in the investment world, endorsed by plenty of official companies and customers. They are not supported by the FDIC but are SPIC insured. There are some poor reviews of their services, but these are from clients who misunderstand the core purpose of Fisher Investments. The company may not be as safe as other options concerning risky investing. Still, it is a legitimate service for wealthier clients interested in a bespoke, customized investing experience.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

|