Accounts for Minors at Moomoo

Moomoo does not offer an investment account (also known as custodial account) for anyone

under the age of 18. To open a custodial account for a minor, head over to one of the largest brokerage houses

called Charles Schwab.

Free Charles Schwab Account

Open Schwab Account

Moomoo Investing Review: A Powerful and Feature-Packed Trading Platform

Moomoo Investing, developed by Futu Inc., is a comprehensive trading platform that aims to provide users with a powerful and feature-packed investing experience. In this review, we will explore the key features, benefits, and potential drawbacks of Moomoo Investing.

One of the standout features of Moomoo Investing is its extensive range of investment options. The platform offers commission-free trading for stocks, options, and ETFs, which is a significant advantage for active traders looking to minimize costs. Additionally, Moomoo Investing provides access to pre-market and after-hours trading, allowing users to take advantage of market opportunities beyond regular trading hours.

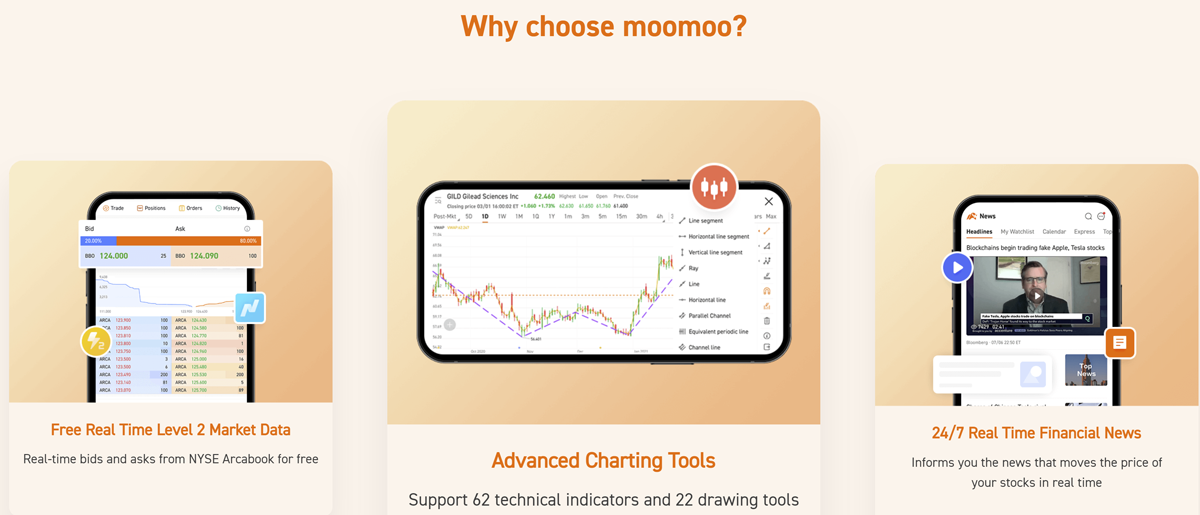

The platform also offers a variety of research and analysis tools to help users make informed investment decisions. Moomoo Investing provides real-time market data, news, and financial statements, empowering users with the information they need to stay updated on the latest market trends. The platform also offers technical analysis tools, such as customizable charts and indicators, allowing users to conduct in-depth technical analysis.

Another notable feature of Moomoo Investing is its social trading community. The platform integrates a social network called "Moomoo Community," where users can interact with fellow investors, share investment ideas, and gain insights from experienced traders. This social aspect adds a collaborative element to the platform, which can be beneficial for both beginners and experienced investors seeking to exchange knowledge and strategies.

Moomoo Investing also provides a comprehensive selection of educational resources. The platform offers educational materials, including video tutorials, webinars, and articles, to help users enhance their investing knowledge and skills. This commitment to education is particularly beneficial for novice investors who are looking to learn the ropes and develop a solid foundation in investing.

Furthermore, Moomoo Investing offers a user-friendly interface that is designed to be intuitive and accessible. The platform is available as a mobile app for both iOS and Android devices, allowing users to trade and monitor their investments on the go. The app's clean and organized layout makes it easy to navigate, even for users who are new to investing or trading.

In terms of security, Moomoo Investing takes user protection seriously. The platform employs encryption technology to safeguard sensitive user information and utilizes strict security measures to prevent unauthorized access. Additionally, Moomoo Investing is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), which provides an extra layer of protection for user assets.

While Moomoo Investing offers numerous advantages, there are a few potential drawbacks to consider. The platform is primarily focused on self-directed trading, which means it may not be the ideal choice for investors who prefer personalized advice or guidance from financial advisors. Additionally, Moomoo Investing is currently only available to residents of the United States, which limits its accessibility for international users.

In conclusion, Moomoo Investing is a powerful and feature-packed trading platform that caters to both beginner and experienced investors. With its commission-free trading, extensive investment options, research tools, social trading community, and educational resources, Moomoo Investing provides a comprehensive and user-friendly investing experience. While it may not be suitable for investors seeking personalized advice or international users, Moomoo Investing excels in providing a robust platform for self-directed traders.

Free Moomoo Account

Open Moomoo Account

|