|

Merrill Edge vs Acorns in 2024

|

Overview

Acorns tries to attract Millennial investors by offering a hands-off financial program. But could

a self-directed online broker like Merrill Edge actually be a better for the same

investors? Let’s find out.

Pricing

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Merrill Edge

|

$0

|

$19.99

|

$0.65 per contract

|

$0

|

$0

|

|

Acorns

|

na

|

na

|

na

|

$3, $5, or $9 per month

|

$3, $5, or $9 per month

|

Promotion Links

Acorns:

Get Acorns absolutely free and a $20 bonus.

Merrill Edge: Get $0 trades + 65₵ per options contract at Merrill Edge.

What Assets Can Be Traded?

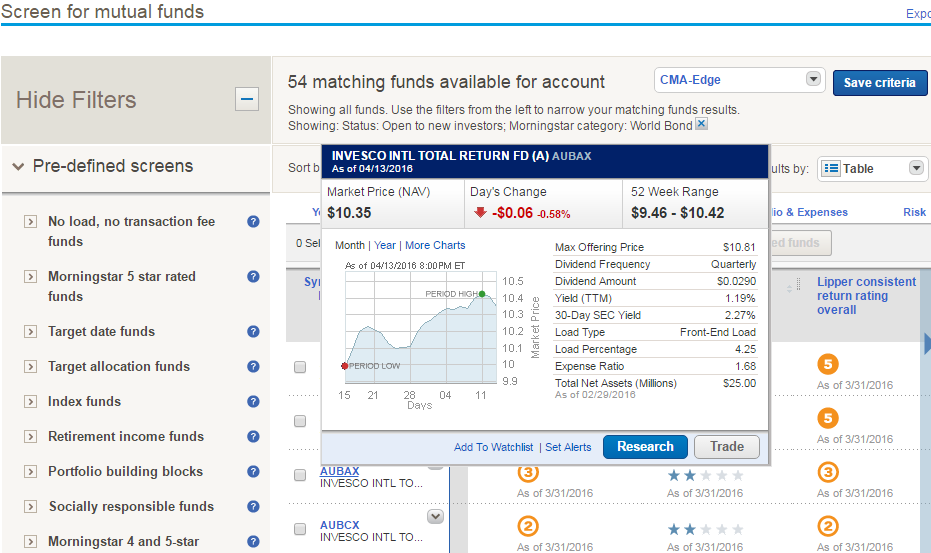

At Merrill Edge, traders have access to the following list of investments:

- Stocks, including over-the-counter stocks and penny stocks

- ETFs

- Closed-end funds

- Options

- Bonds and other fixed-income securities

- Mutual funds

Acorns offers:

That’s it for now. In fact, Acorns only provides 12 exchange-traded funds. Remarkably, this is actually an increase from a previous total of 6.

Winner: Merrill Edge

What Investment Services Are Available?

Merrill Edge offers both self-directed accounts (where the account holder makes all trading decisions) and managed accounts (where Merrill Edge will make trading decisions on behalf of the customer).

The second option comes in 2 varieties: low-cost and traditional. The former is just 0.45% of account value per year with a $5,000 minimum investment amount. The second option costs 0.85% with a $20,000 minimum. It comes with a one-on-one, in-person relationship with a human advisor.

And then there’s a third option available through Merrill Lynch. It’s the most expensive of the three but comes with a wider selection of investment products and strategies. Rates and minimums are usually negotiated. They have been reported around $250,000 or more at roughly 2%.

Self-directed accounts at Merrill Edge have no on-going fees or minimums.

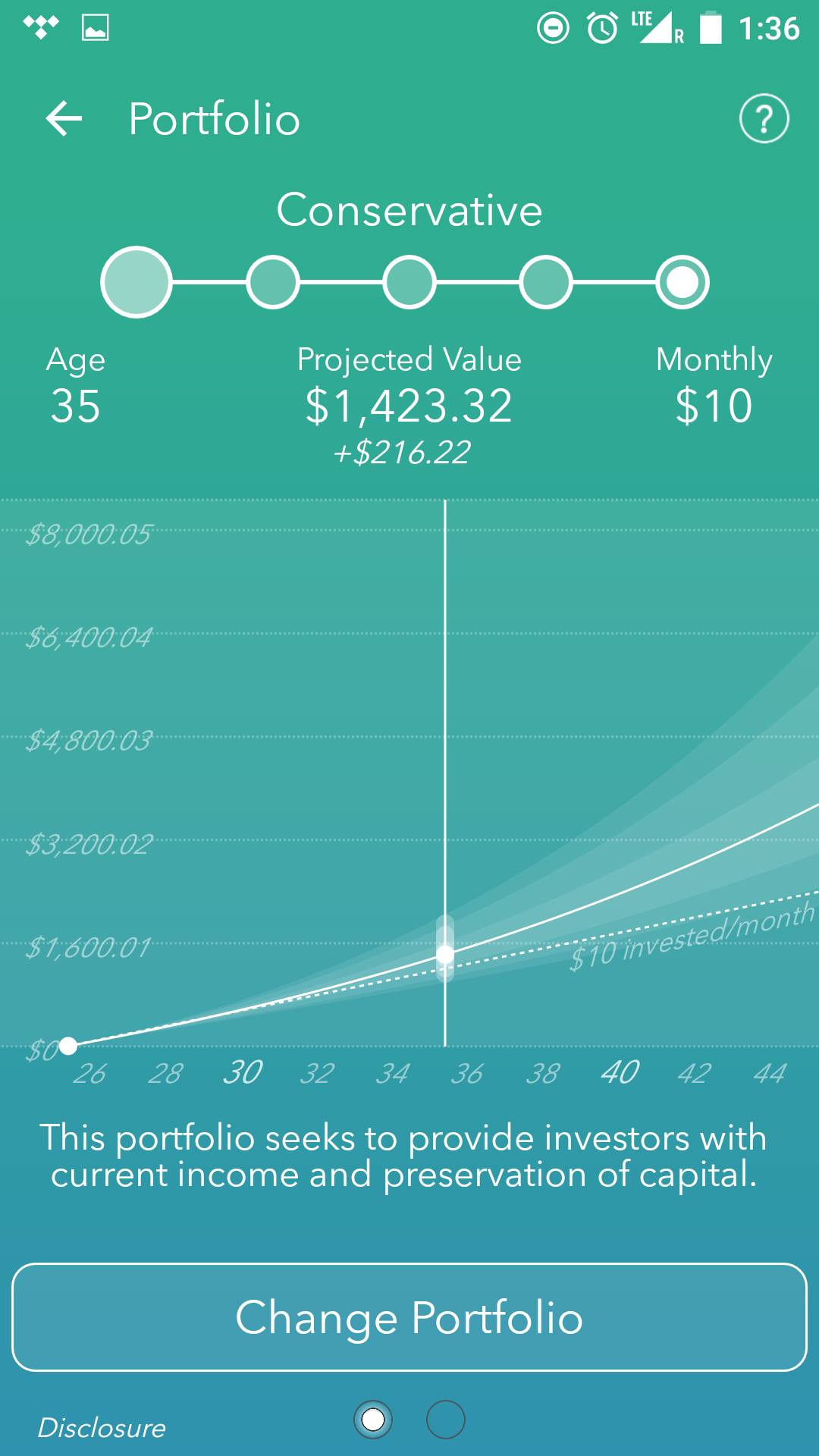

Acorns only provides robo accounts. Software programs make all trading decisions using the 12 ETFs the broker offers. This is a slightly different system than Merrill’s low-cost managed account. It’s not a robo system; accounts are managed by human advisors.

Winner: Merrill Edge

And What About Software?

Merrill Edge clients get to use a simple website that provides many worthwhile features. Although the broker-dealer unfortunately has eliminated a trade bar that used to appear on its website, the site itself still is very good. For example, an order ticket offers the following features:

- Stop, limit, market, and trailing orders

- Day and GTC for duration choices

- Extended-hours trading option

Merrill Edge users who want the most powerful tools can use the broker’s desktop platform for free. Called MarketPro, it comes with many professional-level features, including:

- Full-screen charting with several tools

- Level II quotes

- Recognia technical analysis

- Alerts

- Merrill Lynch security reports

- Economic calendar

- Advanced option tools

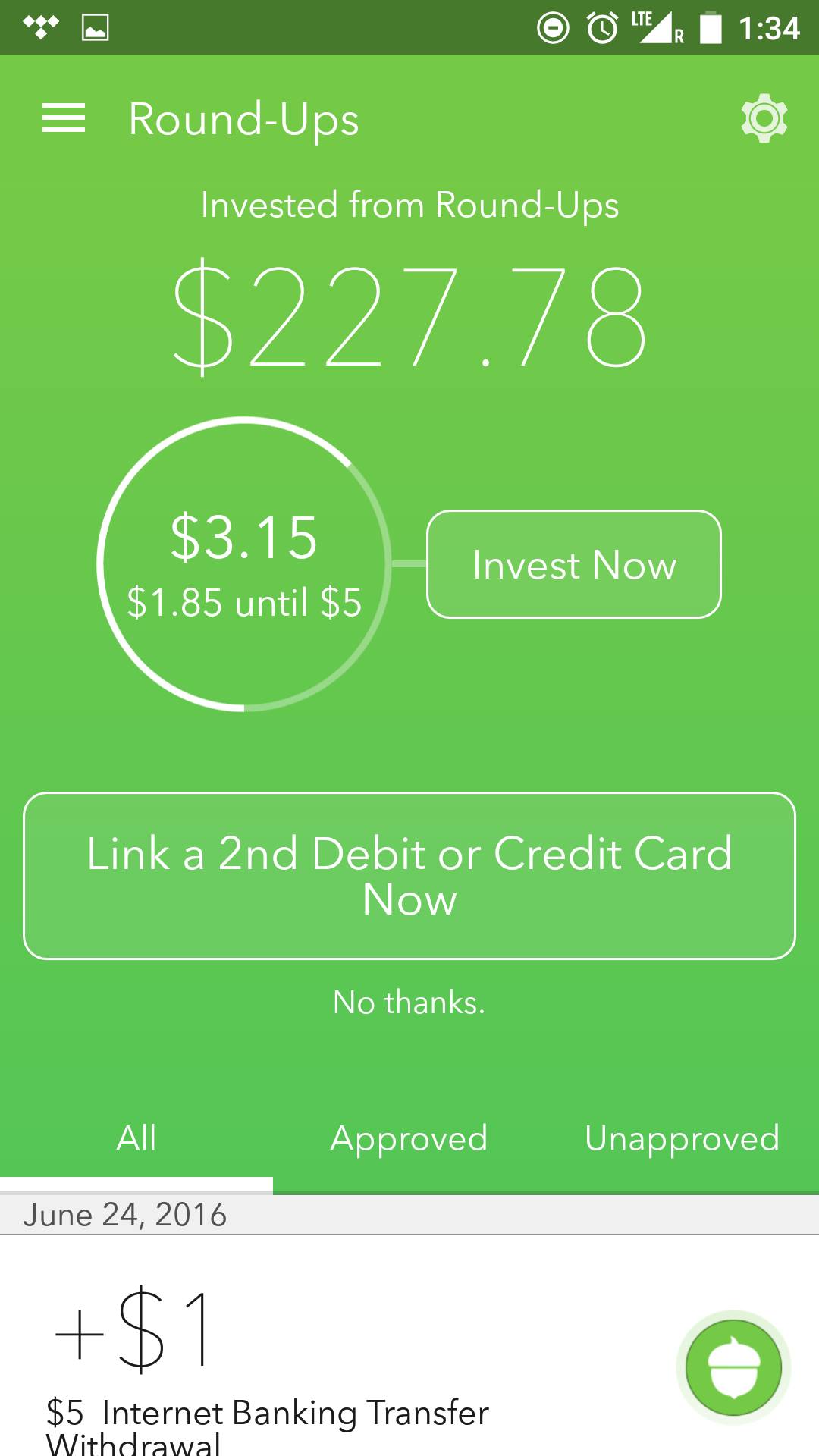

Because Acorns doesn’t offer any self-directed accounts, it doesn’t have any trading tools. During our probing, we found a user-friendly website with account management tools. These let Acorns users connect bank cards and monitor investment performance.

Both firms offer mobile apps as well, which have similar features; although Merrill’s app doesn’t quite measure up to MarketPro.

Winner: Merrill Edge

What Cash Management Tools Do the Two Brokers Offer?

Here’s a great topic. Acorns is known for its debit card, but Merrill Edge is owned by Bank of America, one of the largest banks in the world.

For $3 per month, Acorns users get a checking account that comes with a debit card. It’s a

specially-designed Acorns card with special glass and tungsten in it. The account offers unlimited ATM fee refunds. When Acorns customers shop at certain locations using either an Acorns card or a linked card from an external account, they earn small deposits into their investment accounts.

Merrill Edge customers can add checks and a Visa debit card to an existing brokerage account. Doing so doesn’t create a separate checking account. The debit card gets fee-free ATM withdrawals only at Bank of America machines. There is no charge for either the checks or the debit card. Moreover, Merrill offers free online bill pay.

A Bank of America checking account can also be linked to a Merrill Edge account.

Winner: Draw

Other Services

Dividend Reinvestment Program: Both Merrill Edge and Acorns offer auto dividend reinvesting.

IRAs: You can open an Individual Retirement Account at either firm. Merrill Edge offers more IRA types.

Automatic Mutual Fund Investing: Merrill offers this.

Winner: Merrill Edge

Now, Our Recommendations

Beginners: Merrill Edge has 24/7 customer service, which Acorns lacks. Moreover, we like Merrill’s educational materials better. Although Acorns caters to newbies, we recommend Merrill Edge.

Retirement Savers and Long-Term Investors: Merrill Edge.

ETF and Stock Trading: Merrill Edge by a mile.

Small Accounts: Merrill Edge.

Round-Up Investing: Instead of paying a monthly fee to send spare change to an Acorns account, it makes more sense to us to save the change and at the end of the month make one transfer (for free) to a Merrill account and use the funds to make an investment into a mutual fund. Some have $0 or $50 subsequent minimums.

Promotion Links

Acorns:

Get Acorns absolutely free and a $20 bonus.

Merrill Edge: Get $0 trades + 65₵ per options contract at Merrill Edge.

Merrill Edge vs Acorns - Outcome

Although young people may pick Acorns, more serious investors should choose Merrill Edge instead.

|

Open Account

|

Open Account

|