How to Transfer Accounts between M1 Finance and Schwab

Getting an investment account from M1 Finance to Schwab or from Schwab to M1 Finance is easier than you think. With the Automated Customer Account Transfer Service (ACATS), it is now a rather simple process.

Transfer From M1 Finance to Schwab

Step 1: Consider the potential cost of an ACATS transfer. M1 Finance charges $100 for every outbound transfer and an additional $100 if the transfer closes a retirement account. Transferring a Traditional IRA, for example, will cost $200. Schwab might reimburse this fee.

Step 2: If the potential fee doesn’t bother you,

get that new securities account open at Schwab. We do mean “securities account” as any cryptocurrencies, which aren’t securities, can’t be moved through the ACATS network. It can be either a robo or self-directed account. In either case, it will need to have the same tax structure (such as SEP IRA or joint account) and have the same name on it.

Step 3: Prepare the Schwab account for the upcoming transfer. Margin trading must be added if there’s a margin balance in the M1 account that will soon be transferred.

Step 4: Prepare the M1 Finance account. This step will be a little more involved. All trades need to settle, and any open orders need to be eliminated. If you have any cryptos at M1 Finance, these will need to be sold off, left behind in a partial transfer, or moved to a second M1 account not involved with the transfer.

If you plan to move the M1 account into a robo account at Schwab, everything will have to be sold off because Schwab’s Intelligent Portfolios program will only accept a transfer of cash.

Step 5: With both accounts ready to go, it’s time to pull the trigger. If you’re transferring into an automated account, it may be better to sell everything and push the cash from the M1 platform into the new Schwab account. If you’re moving securities, you’ll need to opt for the ACATS system.

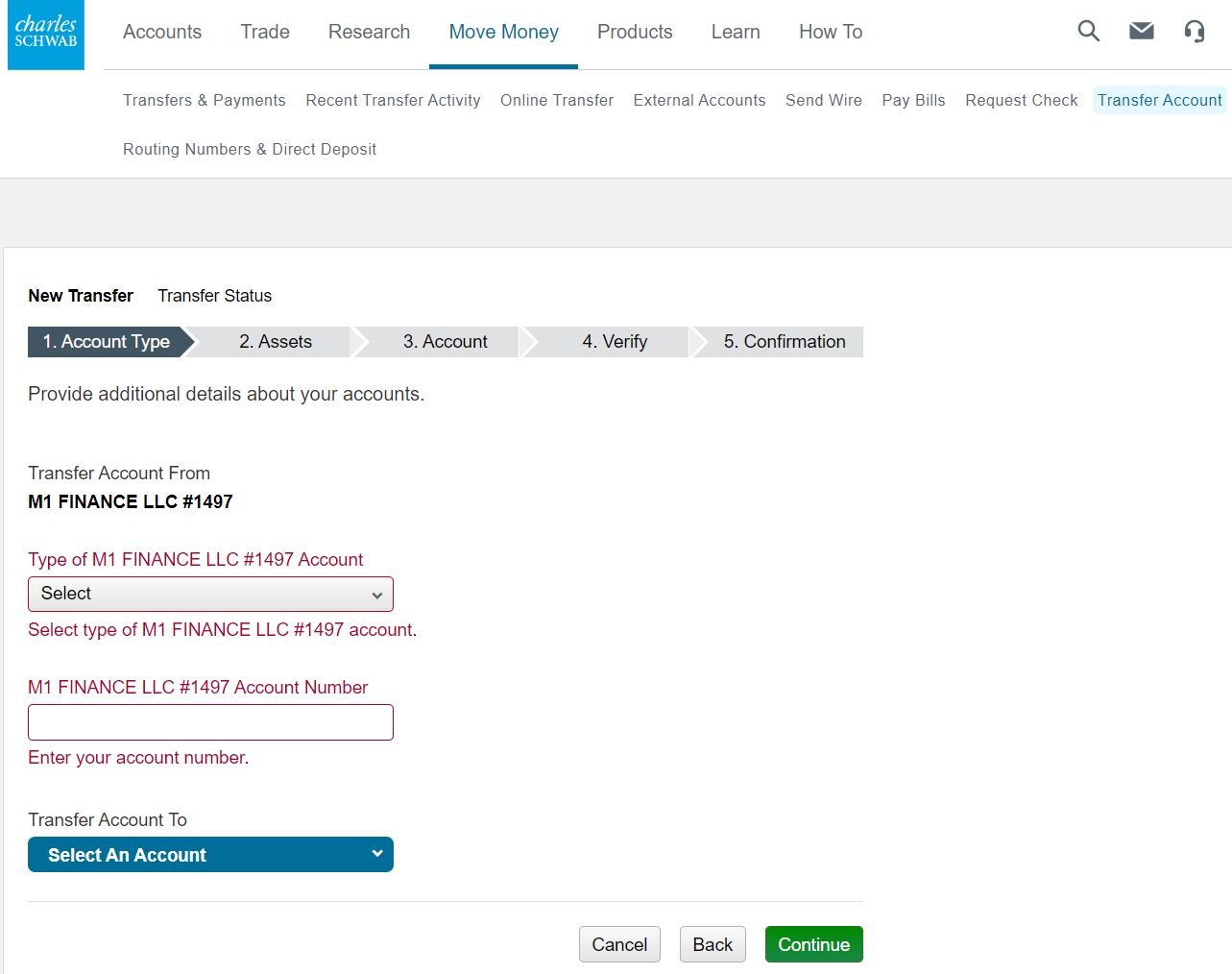

To perform an ACATS transfer, log into the Schwab site and click on the Move Money link at the top. In the drop-down window, select the link for transfers and payments. On the new page that appears, select the tile to transfer an account. You’ll need to search for the outgoing brokerage firm by DTC number. If your M1 account begins with the letters GM, you should use code 1497. Any other account number should use code 0158. Use either code in the search field to find the outgoing broker. When completed, submit the transfer request.

Free Charles Schwab Account

Open Schwab Account

Transfer From Schwab to M1 Finance

Step 1: Once again, mull over the cost of the transfer. Schwab charges $50 for a full account

outgoing transfer and $0 for a partial. M1 Finance does not refund other firms’ transfer fees.

Step 2: If Schwab’s fee policy is tolerable for you, it’s time

to get an M1 Finance account open. Follow the same rules mentioned in the previous section regarding names and account types.

Step 3: The M1 Finance account needs to be adequately prepared. Trust accounts are eligible for margin, although M1 does require a signed margin agreement for this.

Step 4: The Schwab self-directed account also has to be prepared. This could be much more involved as many assets at Schwab are not available at M1 Finance. For example, M1 Finance does not offer trading in bonds, mutual funds, short positions, futures, options, or foreign stocks. These assets will have to be handled in the same way as cryptocurrencies.

Although a robo account can be moved out of Schwab, Schwab will only send cash out of this account mode. It is possible to send cash through the ACATS network, although it’s simpler to sell everything and move the cash through an ACH transfer. Remember that selling securities in a taxable account or withdrawing cash from a tax-deferred account could have tax consequences. Be sure to visit with a tax advisor.

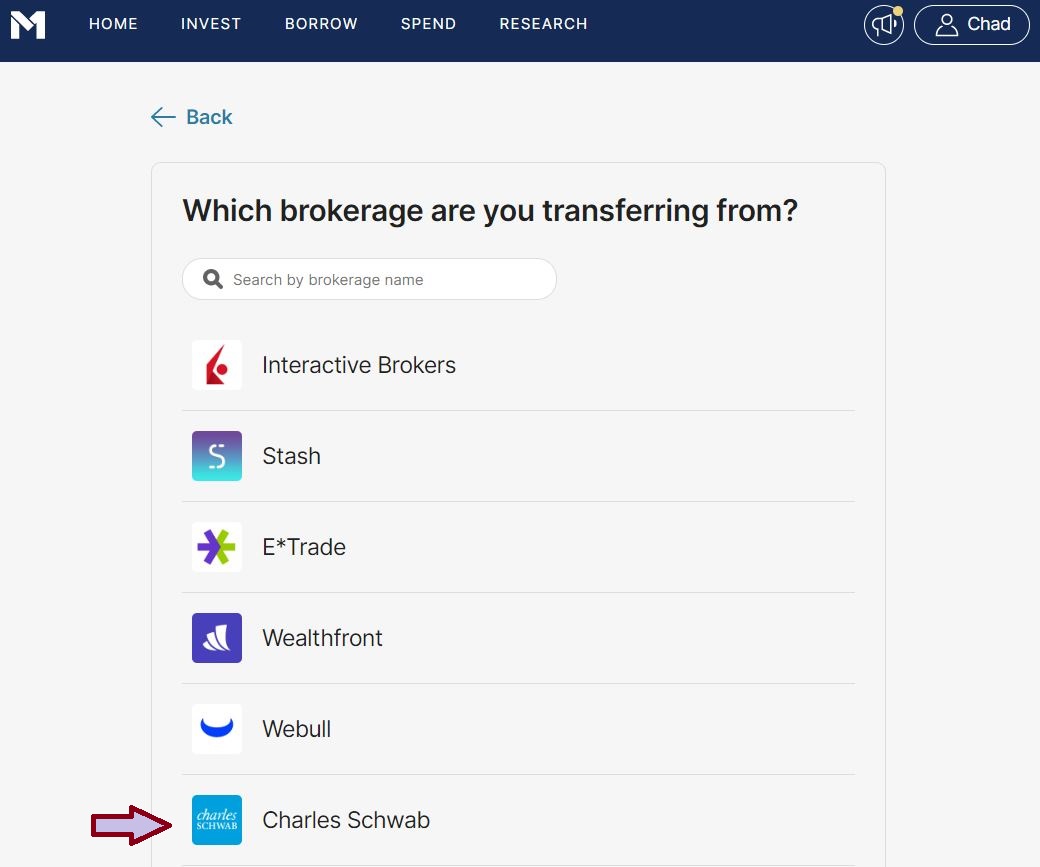

Step 5: Request the transfer. This is easy enough on the M1 Finance website. Click on the Move Money button on the dashboard after logging in. On the next page, click on the link to transfer an account from another brokerage. You can request either a full or partial transfer on the first screen.

On the next screen, you need to specify the outgoing investment firm. Schwab’s name and logo automatically show up, so click on the pre-populated link. Follow the prompts and submit the transfer.

M1 Promotion

$250 cash bonus for making a $10K deposit at M1 Finance.

Open M1 Finance Account

How Long Does a Transfer Take?

Schwab reports a time to completion of 5 to 16 business days on its website for an incoming transfer. Going in the other direction, M1 Finance predicts about 5 to 7 business days.

|