Transfer from Wealthfront to Charles Schwab

To move a brokerage account from Wealthfront to Charles Schwab, complete the following steps:

First Step: It goes without saying that the first task is to

open a new securities account with Schwab. It could be either a self-directed or investment-advisory account. Because this will be an ACAT transfer, the names and addresses on the two accounts must match. The tax structures (such as individual taxable or Roth IRA), must match exactly as well. If these conditions are met on an existing Schwab account, it can be used.

Second Step: The Wealthfront account, which could be a Stock Investing Account or an Automated Investing Account, may need some prep work before it is sent over to Schwab. Either account type can be transferred into either account type (robo or self-directed) at Schwab. Open orders in the Wealthfront account should be closed out, and unsettled trades should settle before requesting a transfer.

Fractional shares cannot be sent through the ACAT network, so any of these will need to be liquidated by the account owner or by Wealthfront. Also, if you plan to go into a robo account at Schwab, everything will need to be liquidated because an automated account can only accept a transfer of cash.

Third Step: With the Wealthfront account ready, it’s time to get the Schwab account ready. The one task will be adding margin capability if a margin balance will be coming over.

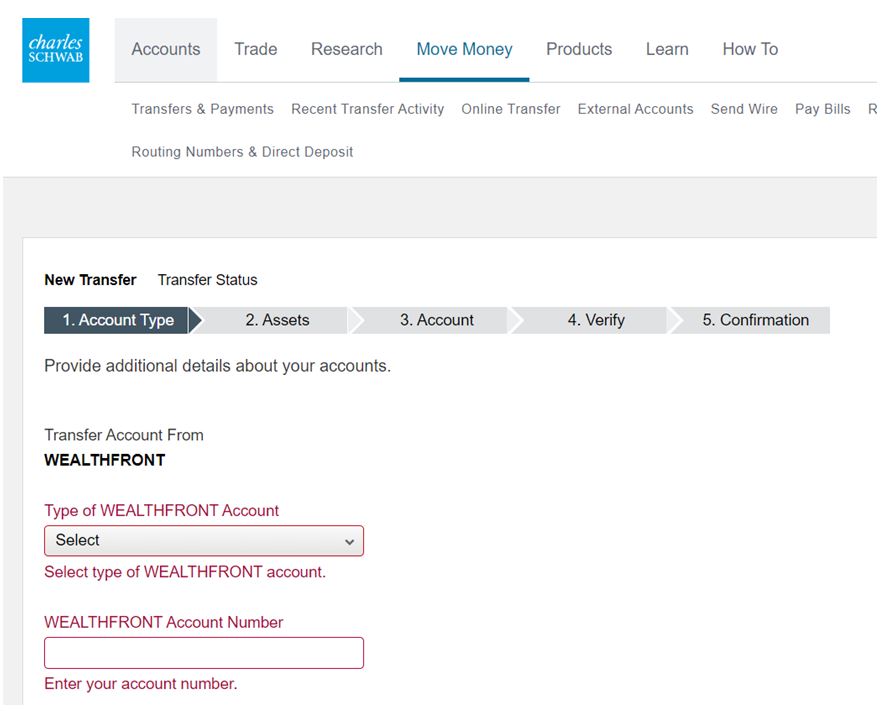

Fourth Step: Now it’s time to request the transfer. This is always done on the receiving side, which is Schwab in this case. After logging into the Schwab website, click on the Move Money tab in the top of the website and select Transfers & Payments in the drop-down menu that appears. On the next page, select the tile to transfer an account to Schwab. Search for and select Wealthfront as the outgoing brokerage firm and supply all requested particulars, including the account number on the Wealthfront account. When everything looks in proper order, submit the ACAT request.

An in-kind transfer, which is a transfer in which shares of securities are moved, can only be a full transfer from Wealthfront. A partial in-kind transfer is not possible out of Wealthfront.

Fifth Step: Monitor the status of the transfer. On the Transfer Account page we have already seen on Schwab’s website, there is a link for submitted transfers. Click on this link to see the progress of the transfer.

Free Charles Schwab Account

Open Schwab Account

How Long Will the ACAT Request Take?

Expect about a week and a half for the securities and cash from the Wealthfront account to arrive in the Schwab account. The latter firm may require an account statement from the former.

|