|

Largest IRA Provider Companies in 2024

The largest IRA provider companies to open a retirement investing account (Traditional, ROTH, SEP, or SIMPLE).

|

Fidelity Pricing

| Investments | Commissions |

|---|

| Stocks and ETFs | $0 |

| Stocks and ETFs broker assisted | $29.95 |

| Options | $0.65 per contract |

| Mutual funds | $49.95 to buy; $0 to sell. $49.95 if sold within 2 months |

| Bonds and CDs (new issues) | on a net yield basis |

| Bonds and CDs (secondary issues) | $1.00 per bond ($250 maximum) |

| Investments | stocks, bonds, mutual funds, options, commercial paper, UITs, ETFs |

| Fidelity minimum deposit to open account | $0 ($0 for Rollover IRA; $2,500 or $200 per month for ROTH and Traditional IRA) |

Fidelity Advantages

Of all brokerage firms, Fidelity is one of the best values. Offering stock and ETF trades for just $0 and options for just 65¢ per contract, investors not only get low commissions, but also 24/7 customer service. Clients who prefer in-person service won't be disappointed with the firm, either. Fidelity has more than 180 branch locations across the United States. These offer seminars that cover a wide range of topics, including global investing, annuities, and charitable giving. New investors will benefit from the broker's website, which has a wealth of financial education. These resources include videos, articles, self-guided courses, webinars, and infographics. They cover many important topics, ranging from ETF valuation to retirement accounts.

Mutual fund investors will find much to be pleased with at Fidelity. There are over 11,500 mutual

funds available for purchase. Roughly 1,800 of these come with no load and no transaction fee.

The broker's screener is able to narrow these choices down based on a variety of criteria. These

include Morningstar rating, fund family, expense ratio, and return history. A screener's results

can also be sorted based on any of the search criteria. For investors who prefer exchanged-traded

funds, Fidelity offers all of the free to trade.

Investors who would like some assistance in deciding what to invest in will be in good hands with

Fidelity. Professional investment advice and portfolio management are available. Clients who need assistance with education savings or retirement planning also have good resources here. Several education accounts are available, including UGMA/UTMA accounts and the 529 plan. Retirement savers can open a wide variety of Individual Retirement Accounts. The firm also offers services for 401(k) plans. Life insurance and long-term care planning resources are also on the Fidelity website. Throw in an excellent cash management account, and this broker is a great all-around financial services company.

Fidelity Review

Continue Fidelity Review

Fidelity Promotion Offer

Get $0 trades + 65₵ per options contract at Fidelity.

|

|

Charles Schwab Pricing

| Investments | Commissions |

|---|

| Stocks and ETFs | $0 |

| Stocks and ETFs broker assisted | $29.95 |

| US Over-The-Counter (OTC) Equities | $6.95 |

| Options | $0.65 per contract |

| Mutual funds | $49.95/$74.95 to buy, $0 to sell |

| Futures | $2.25 per contract |

| CDs, Corporate Bonds, Municipal Bonds, Government Agencies, Zero-Coupon Treasuries, including STRIPS and Mortgage-Backed Securities | $1 per bond, $10 minimum, $250 maximum |

| Commercial Paper and Foreign Bonds, Unit Investment Trusts | call for pricing |

| Investments |

stocks, bonds, mutual funds, futures, Treasury issues, options, CDs, insurance, ETFs, futures,

annuities, non-U.S. securities and ADRs, WEBs and Canadian foreign orders

|

| Charles Schwab minimum deposit to open account | $0 for cash account, $2,000 for margin account |

Charles Schwab Advantages

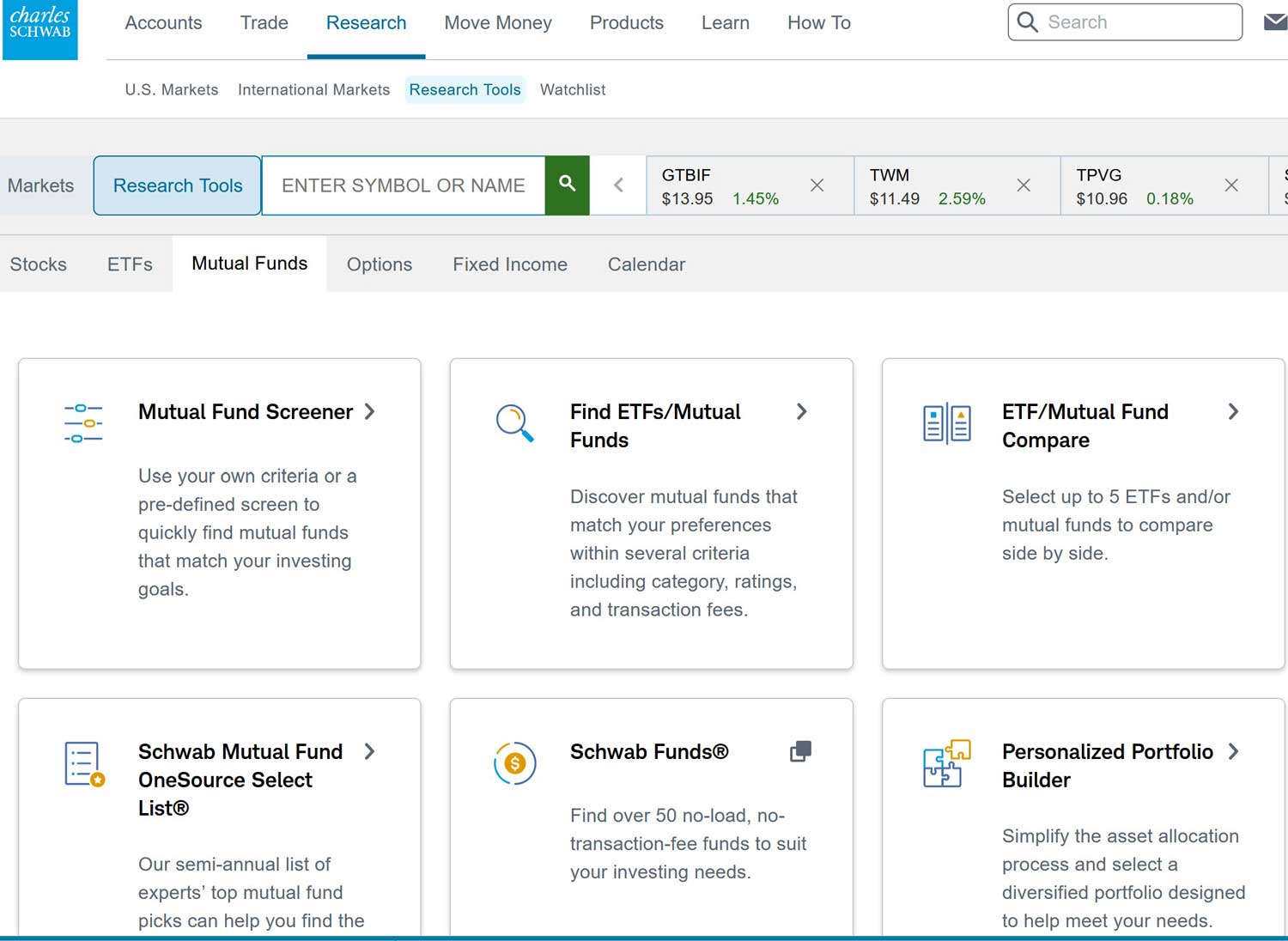

Schwab offers a decent selection of mutual funds. The broker's clients can choose from 5,100 mutual funds. Of these, over 3,100 come with no load and no transaction fee. The broker's selection of mutual and exchange-traded funds that are free to trade is one of the largest in the industry. Despite its emphasis on fund trading, the broker is also a good choice for equity traders. Stocks are $0 per transaction, and options are an additional 65¢ per contract.

Besides trading securities, customers can also do a lot of research and learning on the Schwab website. The broker offers many good educational resources, including articles, videos, and live webinars. There is also futures information from Schwab's subsidiary, optionsXpress, which provides trading in futures contracts. The Schwab website has a helpful community forum where clients can discuss trading issues and economic news. A Schwab representative is available to answer any account-related questions. Learning the broker's advanced desktop platform, thinkorswim, is a breeze with the firm's educational videos and webinars. The trading system only requires a $1,000 account balance to use and is more user-friendly than TD Ameritrade's advanced system. Besides a desktop platform, the broker also offers a useful mobile app, a simple web-based platform, and an app for Apple Watch.

Schwab also has good customer service options. A representative is available 24 hours a day, 7 days a week. The broker provides service over the phone and through an on-line chat system. Some representatives are able to speak Mandarin and Cantonese. For customers who need in-person service, there are over 325 Schwab branch locations throughout the United States. Customers can also open a retirement account or an FDIC-insured bank account with the broker, making Schwab a convenient one-stop financial solution.

Charles Schwab Review

Continue Charles Schwab Review

Charles Schwab Website

Get $0 commissions + satisfaction guarantee at Charles Schwab.

Open Schwab Account

|

|

TD Ameritrade Pricing

| Investments | Commissions |

|---|

| Stocks and ETFs | $0 |

| Stocks and ETFs broker assisted | $25 |

| Mutual funds | $49.99 to buy, $0 to sell |

| Treasuries at auction | $25 |

| All other bonds and CMOs, CDs | on a net yield basis |

| Futures | $2.25 per contract plus exchange & regulatory fees |

| Forex | Non-commission currency pairs trade in increments of 10,000 units (and do not contain a "#" symbol suffix). There are no additional fees or charges. |

| Investments | stocks, mutual funds, ETFs, bonds, CDs, UITs, futures, and forex |

| TD Ameritrade minimum deposit to open account | $0 |

TD Ameritrade Closed Its Doors

TD Ameritrade Advantages

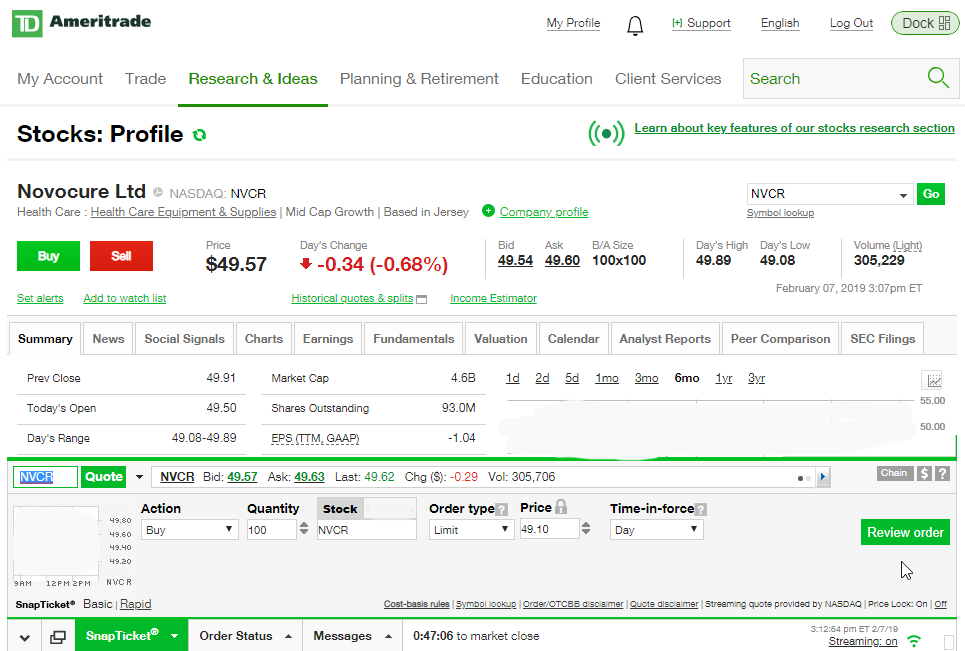

New investors who would like to practice trading before committing real money should check out TD Ameritrade's

Paper Trade. This is a paper trading platform that allows users to experiment with a wide variety of orders, such

as trailing stop, one triggers other, and stop on quote. Equities can be sold short on the platform, and futures

can also be traded. It's a great opportunity to try out different products and trading strategies.

Even better, it's free all the broker's customers. The system starts with $100,000 of virtual currency, and the

account balance details change as orders are completed. This allows the user to see the impact that certain trades

have on brokerage account balances.

The broker's charting software is very sophisticated. It appears within the web browser. A chart can be detached

and blown up full screen to show greater detail. There are many technical studies available, including linear

regression trendline, acceleration bands, and time series forecast. Drawing tools are part of the chart's

capabilities. These include channels, resistance lines, and pitchforks. A graph's duration can be shown anywhere

from 1 day to 10 years. The time interval can be as fast as tick-by-tick. The software is fully customizable. A

chart can be printed or saved. The price history of another security can be overlaid for comparison.

The TD Ameritrade website has some great search tools for futures. For example, Idea Hub searches thousands of

available futures based on bullish or bearish sentiment and generates a probability graph. A trade button

automatically fills an appropriate trade ticket. Futures research and educational resources are also

available on the TD Ameritrade website. Useful educational videos help traders learn how to use all of these tools. Investors

who would like to try out the broker's great features can get $0-commission trades simply

by opening a new account and making a deposit.

Find a Financial Advisor

If you are looking for a professional money management service in your area, you can

find a Financial Advisor on the Wiser Advisor.

Try Wiser Advisor

Updated on 10/3/2024.

|