Charles Schwab vs Fidelity vs Vanguard in 2024

Discount stock broker comparison: Vanguard vs Charles Schwab and Fidelity Investments. Brokerage, IRA

account fees and commissions. Which broker to choose?

Overview of Schwab, Fidelity, and Vanguard

Three very popular brokerage houses in the United States are Fidelity, Schwab, and Vanguard. If you're a self-directed investor, you've probably heard of them. They have enormous reserves of customer assets and millions of accounts. Here's a rundown on these powerhouses. Let's see if we can find a winner.

Fees

| Broker Fees |

Stock/ETF

Commission |

Mutual Fund

Commission |

Options

Commission |

Maintenance

Fee |

Annual IRA

Fee |

|

Charles Schwab

|

$0

|

$49.95 ($0 to sell)

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Fidelity

|

$0

|

$49.95

|

$0 + $0.65 per contract

|

$0

|

$0

|

|

Firstrade

|

$0

|

$0

|

$0

|

$0

|

$0

|

|

Vanguard

|

$0

|

$20

|

$1.00 per contract

|

$20*

|

varies

|

Services

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Vanguard:

Open a Vanguard investment account.

Mutual Funds

All three broker-dealers are known for their mutual funds, so they will perform well here. But there are important differences among them; so let's take a look.

Vanguard offers over 16,000 funds that are open to new investments. We counted roughly 2,000 that came with zero transaction fee and zero load. Vanguard manages its own lineup of mutual funds. They make up about 100 of the 7,200. All of Vanguard's funds come with no load. If purchased at Vanguard, they also have no transaction fee. Funds sold too quickly incur a $50 short-term redemption fee.

Schwab comes in around 5,800 funds; so it's a little smaller than Vanguard. But when it comes to no-load, no-transaction-fee products, it actually beats Vanguard at 3,400. Similar to Vanguard, it imposes a $49.95 short-term trade fee.

Fidelity surpasses both its rivals here with a list of 10,800 funds. It also provides 3,700 no-load, NTF funds, which is also the largest in our survey. Its short-term redemption charge is the same as Schwab's.

ETF’s

As top firms, of course these three giants offer trading in ETFs. But their performance may surprise you in some areas. For example, Vanguard doesn't have the best ETF research materials, and Fidelity and Schwab both have ETFs that meet and even surpass Vanguard on expense ratios.

All brokers in our review now offer all exchange-traded funds with zero commissions.

This category is a tie.

Customer Service Channels

This category is often-overlooked but shouldn't be. Whenever you need a competent human being to solve a problem in your account at 3 am, you'll realize the importance of customer service.

Speaking of 3 am, Vanguard doesn't provide any service at this time. The company's hours are from 8:00 in the morning until 10:00 in the evening, with no hours on the weekend. There isn't an online chat tool on the Vanguard site, nor does the company provide foreign language service or branch locations.

Moving to Fidelity, we see a marked improvement. The brokerage house is open all hours of the night and day, including weekends. Fidelity's website has an online chat function some hours of the day, and a brick-and-mortar location is probably nearby you in the closest large city. Fidelity does have a few global offices but doesn't offer much in terms of foreign languages.

Schwab does offer service in languages besides English. These include Chinese and Vietnamese. We also liked the company's large network of branches (larger than Fidelity's) plus 24/7 phone support. The broker has on-line chat but failed to answer a test question of ours during a chat session.

Overall, Schwab appears to offer the most here.

See All Broker Promotions »

Trading Software

Now we come to a topic that's very important if you plan to pass on portfolio management and make your own trades. All three brokers provide trading software, and here again Vanguard is going to underperform.

During our testing, we found Vanguard's website to be difficult to navigate at times, although a search box in the upper-right corner does help some. There is no trade bar on the site, nor is there is a browser platform, nor is there a desktop program. All trading is done on simple web pages.

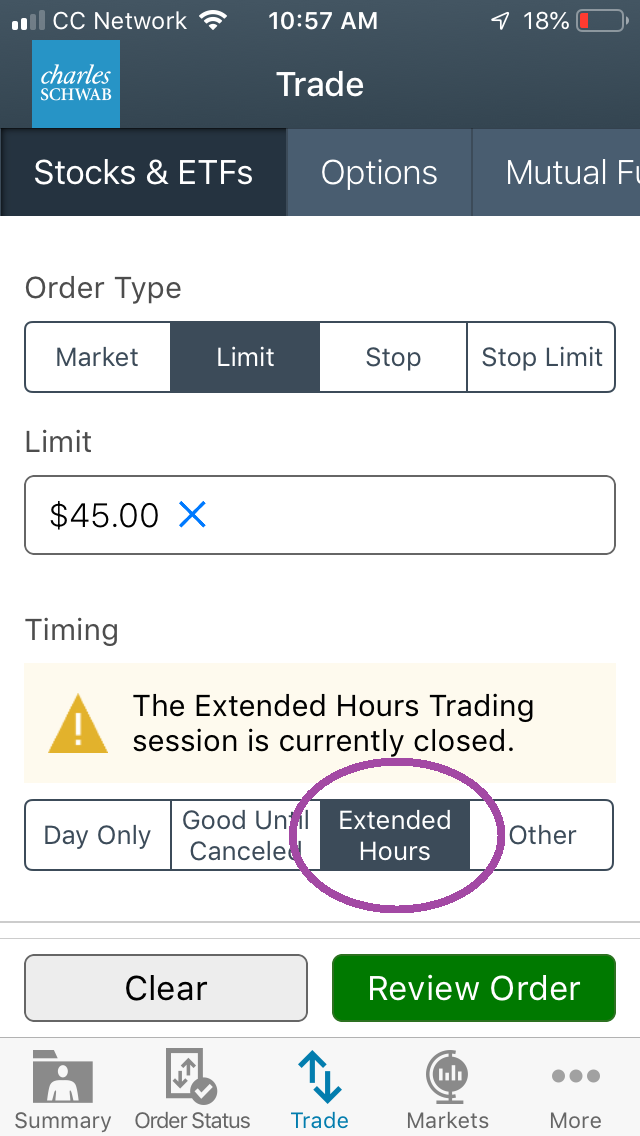

Moving on to Schwab, the situation changes drastically. The broker-dealer's website is easier to browse through (thanks to an updated top menu), and there's lots of helpful info here. There is a trade bar that sits at the bottom of the browser, but it is rather limited in what it can do. Schwab used to have a really nice browser-based platform, but the software hasn't kept up with browser updates. The website's trading capability may satisfy some investors, though. If not, there is thinkorswim.

thinkorswim is Schwab's flagship desktop program. It comes with a lot of great features, including Level II data and technical analysis. We especially liked the incorporation of direct-access routing, which will please many active traders.

Schwab faces tough competition from Fidelity here. The latter provides a pop-up style trading ticket on its website, which itself is very good. We liked all the trading and educational resources it offers.

Although there isn't a browser platform with Fidelity, there is a very good desktop system called Active Trader Pro. Like Schwab’s platform, Active Trader Pro boasts direct-access routing. It also provides very good charting and advanced order types. We counted over 60 technical studies, and right-click trading makes buying and selling from charts a breeze.

Both platforms stream financial news. We found Fidelity’s software to be more customizable than Schwab’s.

Overall, it’s pretty close here between Fidelity and Schwab.

Cash Management

Banking tools are available at all three brokerage firms. As with some previous categories, we found Vanguard’s service to be the least attractive. Called VanguardAdvantage, the broker’s banking service requires a minimum of $500,000 in assets. On top of this rather objectionable policy, the company also charges a $30 annual fee and $9.95 for check reorders. These can be evaded by keeping at least $1,000,000 with Vanguard. ATM fees are only reimbursed at PNC cash machines.

With Schwab, things start to look much better. The brokerage house offers a free checking account that has no minimums. It is FDIC-insured (unlike VanguardAdvantage) and provides unlimited ATM fee rebates around the world.

Fidelity offers something called the Cash Management Account. This is technically a securities account, although free cash balances can be swept into multiple program banks that provide FDIC insurance. It offers free checks and a Visa debit card. US-based ATM charges are reimbursed.

Schwab has the advantage here in terms of global ATM fee rebates, while Fidelity offers up to five program banks for a maximum protection of $1,250,000. Schwab only offers the standard $250,000.

Education and Research

While all three brokers under investigation offer learning materials, we found Vanguard’s website the hardest to navigate. It primarily offers resources in article format, although there are some videos available.

Fidelity has a much better organized educational section that includes infographics and self-guided courses. Schwab’s site also has a lot of information on financial topics, although we thought Fidelity did a better job of organizing and presenting information in a more user-friendly format.

Recommendation

Due to Vanguard’s poor performance in many important categories, we can only recommend the broker to

investors interested mostly in Vanguard-family products.

For mutual fund investors, we suggest Charles Schwab. Besides its large list of funds, the company’s website

has very good fund resources. These include fund profile pages, charts, graphics, and lots of useful

information.

We can go with Schwab for ETF’s due to the large list of funds Schwab offers. Its elimination of short-term redemption fees also will benefit many traders.

We also can propose Schwab for traders who are looking for the overall best customer service experience. With a large network of branch locations, most American investors (and a few overseas as well) should live within driving distance of an office.

For trading tools, we definitely don’t recommend Vanguard as the broker’s software looks like it was

created in the 90’s. For desktop and laptop traders, we suggest either Schwab or Fidelity, each of which

has a very good platform. If you plan to trade on a mobile device, go with Fidelity. We liked its mobile

app better than Schwab’s.

If you plan to travel overseas, take a Schwab debit card with you. No better alternative can be found. If you plan to stay Stateside, go with Fidelity, who offers a higher level of FDIC protection.

Visit Websites

Charles Schwab: Get $0 commissions + satisfaction guarantee at Charles Schwab.

Firstrade: Get up to $250 ACAT rebate and $0 commission trades.

Fidelity: Get $0 trades + 65₵ per options contract at Fidelity.

Vanguard:

Open a Vanguard investment account.

Schwab vs Fidelity vs Vanguard Judgement

Vanguard comes out as the least attractive broker of the three. Even in the fund category, where it

has traditionally excelled, it lost to either Fidelity or Schwab. These latter two brokerage firms

receive an overall tie in this survey. And with similar commission schedules, you can’t go wrong with either one.