Thrift Savings Plan

Whether federal jobs are needlessly gobbling up taxpayer money or they are a necessary part of the United States’ bureaucracy is always up for debate. However, the federal worker’s

Thrift Savings Plan (TSP) is undeniably one of the best retirement plans available. It is available to civilian government employees, members of the armed forces, and any beneficiaries who might have inherited TSP funds.

Opening an Account

New civilian employees will find that they are automatically enrolled in the program at a contribution rate of 3%. Even if these individuals opt off contributing, their agency will always put in 1% of their salary. The agency contribution will increase up to a max of 5%, capping out when the investor contributes 5%. These non-employee contributions will vest two to three years after an individual begins working, depending on their position. Those in the armed forces will not receive matching contributions except in special circumstances.

Once an initial deposit is invested in the Thrift Savings Plan, it will automatically be invested in a ‘Lifecycle Fund,’ based on the age of the participant. However, the investor can easily change this designation.

Investors should pay close attention to the option of investing funds pre-tax, through the Traditional plan, or after tax, through the Roth. Depending on a participant’s marginal tax rate and financial situation, one might be more advantageous than the other. Participants may also choose to split contributions between the two options. Either way, employees can contribute up to the maximum allowed ($18,500 for 2023). Any matching funds paid by the federal government will pass directly to the Traditional plan.

Investment Options

The TSP has a very pointed and simple investment plan. Investors can choose between ten separate funds. The safest fund is the G Fund, which is composed entirely of risk-free U.S. government securities. Its ten-year return is currently 2.63%, the highest return being in 2007, at 4.87%.

The next series of funds are all indexes. The F fund is composed entirely of bonds from various industry sectors. Its stated goal is to match the Bloomberg Barclays U.S. Aggregate Bond Index. The ten-year return of the F fund beats the G fund, at 4.59%. However, it did experience one year of net loss in that same time period, for a loss of 1.68% during 2013.

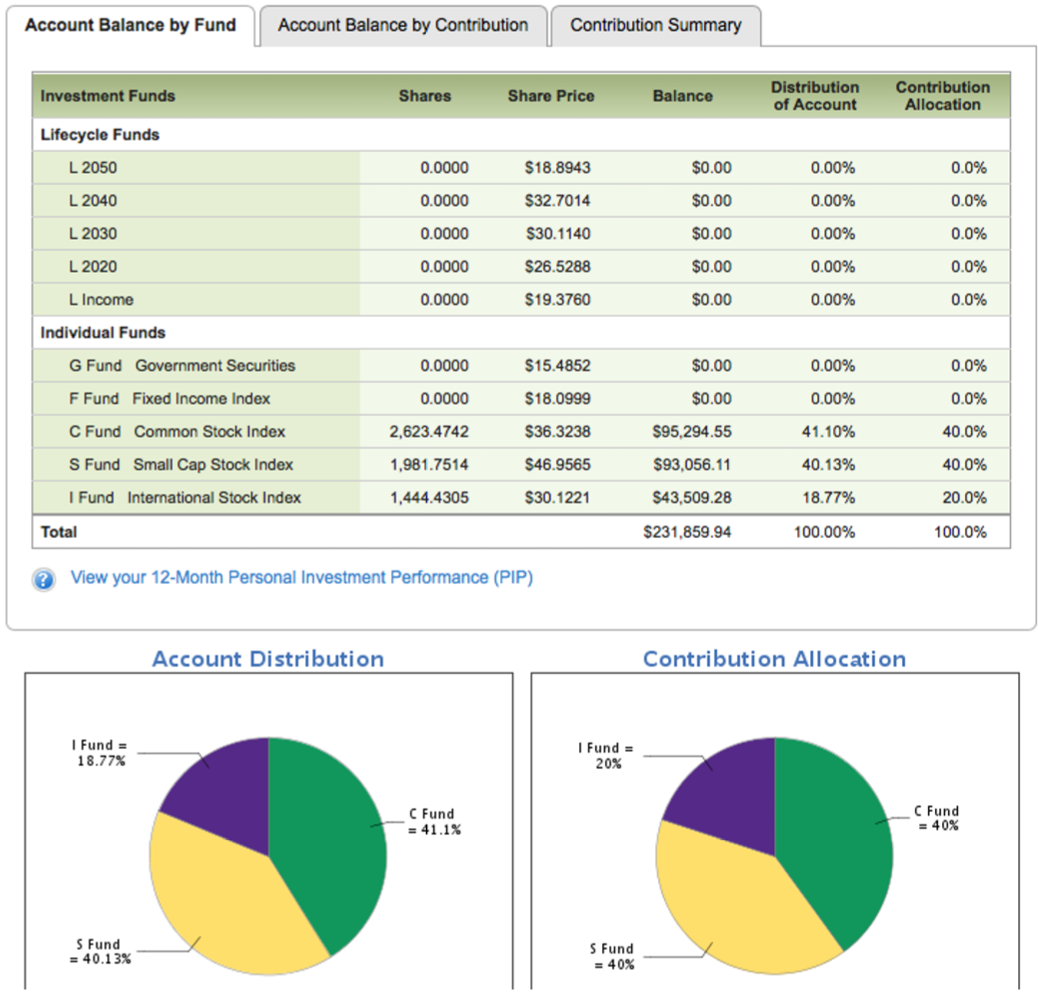

The C Fund, S Fund, and I Fund are all stock-based indexes. As such, they have a much greater volatility than the G and F Funds. Their returns over the last ten years were 7.0%, 8.1%, and 1.0% respectively. However, during the funds’ worst recent year (2008), investors stood to lose 37-42% of their investments value. Despite this volatility, investors will probably find that these funds offer the best growth for the long term. Like the F Fund, these funds strive to match certain market indexes. For example, the C Fund’s objective is to mirror the S&P 500. In all but one of the past ten years, it has slightly outperformed its model.

For investors who prefer not to balance their own portfolios, a series of lifecycle funds might prove most attractive. The L Funds utilize the five funds detailed above to minimize risk based on the age of the participant. These funds will automatically shift to become more conservative as the individual approaches retirement. Investors have the choice between four estimated retirement decades (2023-2050), or an L Income fund geared toward those who are currently retired. This fund is the most conservative, with 74% of assets in the G Fund. At their most aggressive, the lifestyle funds place over 80% of investor funds into stocks, dwindling down to about 36% right before an individual retires. Accordingly, these funds are a bit less volatile than the stock-based funds.

One of the winning factors within all of these ten funds is their low expense ratio. Ech of these funds cost 0.038%. For a $100,000 investment, this translates into a mere $38. The TSP is able to keep this expense ratio so low for several reasons: the funds are based on indexes, without active management, fund transfers are limited, and the federal government subsidizes the expenses with account forfeitures from unvested accounts and other fees.

Investors will also notice that the funds do not pay dividends, interest, or other gains. Instead, the TSP has opted to reinvest all of this income and include it in the price of each fund. This is a simple and no doubt cost-effective solution, but investors who want more detail might find the process a little opaque.

Rebalancing a TSP Account

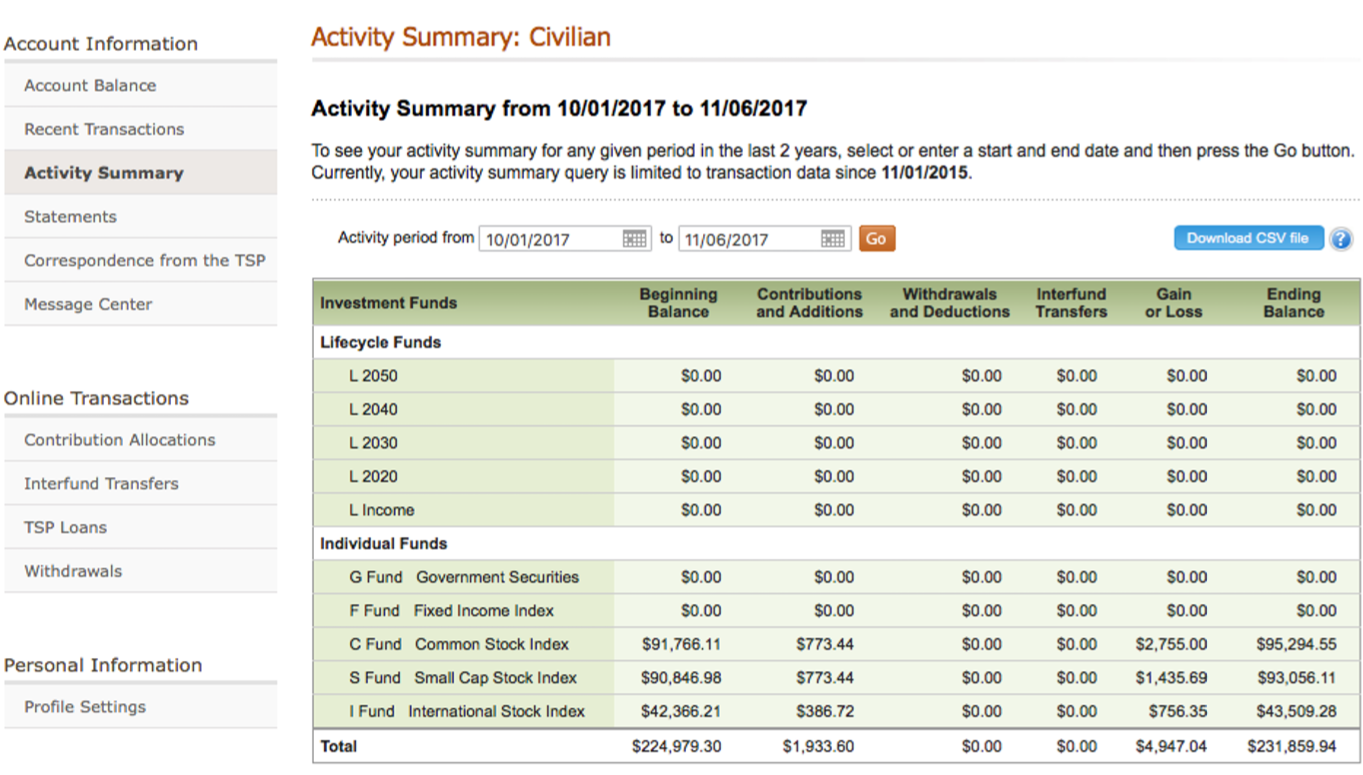

To change the account holdings from its original lifecycle designation, an investor will not buy or sell as they might in a typical retirement account. The TSP doesn’t have a cash or money market account as brokerage firms do. Instead, the investor must rebalance their account through an interfund transfer. This transfer will not cost the investor directly. The investor simply allocates the percentage of each fund they wish to hold in their account. The transfer will be executed after trading hours, and will generally be visible the following business day.

An investor must make a second change, however, to ensure new account contributions go to the appropriate fund. The contribution allocation selection allows all new money flowing into the account to reach the desired fund.

As mentioned above, these low-cost transfers do have limits. The TSP allows two free transfers within a given month. After that, the only transfers allowed are to move money into the G Fund. Limiting transfers is one of the ways that the TSP has kept the expense ratio low. The trading limits coupled with the after-hours transaction process is a clear sign to investors that the TSP is designed to build wealth and not to time the market.

Retiree Withdrawals

The TSP is one of the best vehicles for saving money, but it is not the most popular for withdrawing money in retirement. Retirees can opt to purchase an annuity, receive a one-time lump-sum or partial withdrawal, or receive a series of monthly payments. TSP guidelines stipulate that once payment has begun, an investor cannot change the original withdrawal choice. Because of this rule, retirees are not able to pull out money at will, which is a huge drawback. Legislation has been introduced and is progressing through Congress to make this process less cumbersome (follow H.R. 3031 for more information).

Top Alternatives

Planning

The TSP links to one of the more comprehensive online calculators. Their “Ballpark Estimate Calculator” is available to anyone, although it is designed for federal employees. The calculator requires a fair amount of information and it doesn’t provide easy-to-read graphics or simple-to-adjust results. Users will find that it does offer a comprehensive picture of their future retirement, in both today’s dollars and future dollars.

TSP Review Summary

Investing in the TSP should be an easy decision for those who qualify. Its low fees and straightforward investment choices offer a great way to build wealth. Investors who favor

timing the market with frequent and detailed information will find the TSP lacking. Likewise, retirees may be frustrated with limited withdrawal options, unless certain legislation

passes. Both of these groups might consider transferring their money into other Brokerage Firms. All other investors should keep leave their money in the TSP as long as possible to take advantage of consistent, low-cost returns.

|