Transferring Brokerage Accounts Between JP Morgan and Ally Invest

Do you have an Ally Invest account? Do you want to give J.P. Morgan Investing a shot? If so, you have come to the right place. The following guide will show you in very plain English how to move a brokerage account from Ally Invest to J.P. Morgan Investing (and from J.P. Morgan Investing to Ally Invest).

Relocating from J.P. Morgan Investing to Ally Invest

Okay, so you have a brokerage account at J.P. Morgan Investing but you would rather be at Ally Invest. Thanks to the ACAT electronic transfer system, this is easy to do. Both brokerage firms participate in this really convenient service, so moving an account is a breeze.

The first step in this journey is to open a new Ally Invest account. An old one will also work as long as it is the same account type and has the same name on it as the account at J.P. Morgan Investing. The Ally Invest account can be either a self-directed or robo account. If you go for the robo account, Ally will only accept a transfer of cash.

Every asset class available inside a J.P. Morgan Investing account is also available at Ally Invest, so there’s not much that needs to be done with the old account (if you’re transferring into a self-directed account).

Keep in mind, however, that some mutual funds available at J.P. Morgan Investing may not be available at Ally Invest. You can check whether Ally offers your mutual funds by searching by ticker symbol on the company’s site. If you find any that Ally Invest doesn’t offer, reach out to customer service first to see if the fund or funds can be moved over.

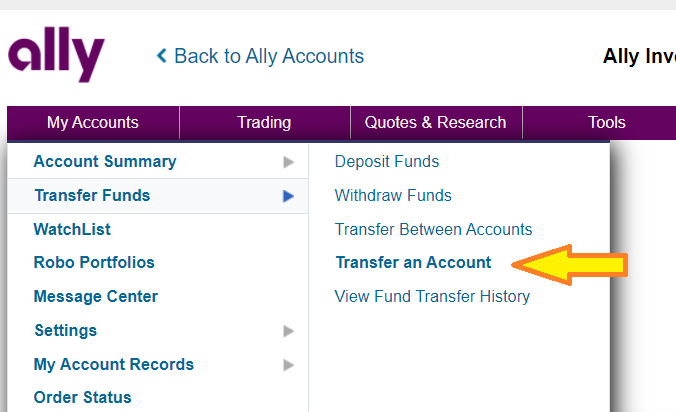

When you’re ready to pull the trigger, you’ll want to send an ACAT transfer request to Ally Invest. To do this, log into your Ally Invest account (be sure you’re on the brokerage platform and not inside a bank account) and click on the My Accounts link at the top of the website. Select Transfer an Account from the sub-menu that exists under Transfer Funds.

Now, you’ll have Ally’s brokerage account transfer form. For the outgoing broker, be sure to select JP Morgan Chase. You’ll need to supply your account number and a few other details.

You’ll have to select full or partial transfer. A full transfer will close your old account and move all of your holdings into your Ally Invest account. A partial transfer is different. It will leave your old account open and give you the opportunity to specify specific securities to move.

As for the cost of transferring, there is a $75 ACAT charge from J.P. Morgan Investing. The good news is that Ally Invest will reimburse this fee if you’re transfer is worth at least $2,500.

Best Discount Brokers

Relocating from Ally Invest to J.P. Morgan

Moving a brokerage account in the other direction will take on a similar strategy. First, you

need to get that J.P. Morgan Investing account up and running. It’s pretty straightforward. Just

head over to the broker’s website and

start the application. You can open either a self-directed or automated account. If you choose the latter, you’ll only be able to move cash from your Ally Invest account.

If you go with self-directed and you have some option contracts at Ally that you want to transfer, you’ll need to make sure that your J.P. Morgan Investing account is approved for options trading. The latter broker doesn’t offer margin accounts at this time, so don’t try to move option spreads or margin balances.

Furthermore, J.P. Morgan Investing does not accept transfers of penny stocks or short stock positions. These will need to be closed out prior to initiating a transfer.

With your J.P. Morgan Investing account ready to accept a deposit, it’s time to get that Ally Invest account prepped for the upcoming move. If you’re transferring into a robo account, this will require selling everything before starting the transfer.

If you’re transferring into a self-directed account, you can keep many of your investments, including ETFs used inside of Ally Invest’s managed service. Although J.P. Morgan Investing does offer trading in mutual funds, some funds at Ally may not be available at J.P. Morgan Investing. It’s best to check with the receiving broker to ensure it will accept your mutual fund positions.

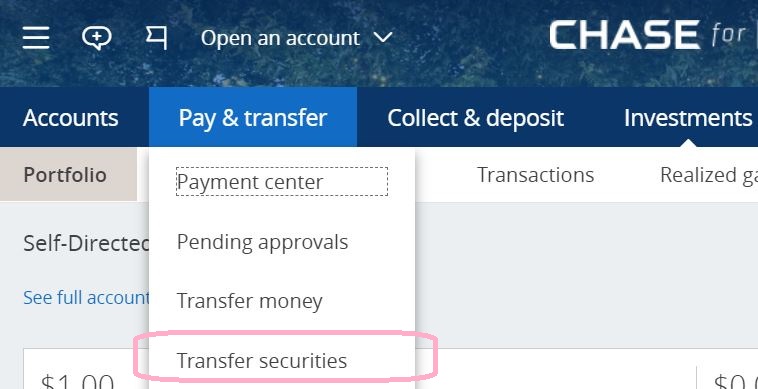

When both accounts are fully prepped, it’s time to pull the trigger and start the transfer. To do this, follow these prompts on the J.P. Morgan Investing site:

Pay & transfer -> Transfer securities -> From an external financial institution

On the broker’s virtual transfer form, Ally Invest is not listed as a possible outgoing brokerage firm. Instead, you will need to type in Apex Clearing as the outgoing brokerage firm. This is Ally’s clearing firm.

Also on J.P. Morgan’s online ACAT form, there is a link to a paper form if you prefer the old-school method. If you want to perform a partial transfer from Ally, you’ll actually have to use this pdf form because J.P. Morgan’s online transfer form can only be used for a full transfer.

Be prepared to pay $50 for either a full or partial transfer out of Ally Invest. This transfer fee is on top of the broker’s $25 IRA termination fee (a full transfer of an IRA would cost $75). J.P. Morgan Investing does not currently have any fee refund specials.

JP Morgan Chase Promotion

Open Chase Account

How Long Does a Transfer Take?

A brokerage account transfer using the ACAT system takes up to two weeks, assuming everything goes smoothly. Any snag along the way, such as paperwork not filled out correctly or attempting to transfer options into an account not approved for options trading, could extend this timeframe and probably will.

|