Is WealthSimple Safe and Legit? Is WealthSimple a Scam? (2024)

Is WealthSimple Safe?

Wealthsimple has its roots in financial services with establishments in Toronto and New York. Even though it has a footprint in the US, it doesn't conduct operations there.

Curious about Wealthsimple's reliability? Continue reading.

A Brief on Wealthsimple

Established in 2014, Wealthsimple served both U.S. and Canadian clients until 2021 when it sold its U.S. operations to Betterment.

The firm manages its brokerage, cryptocurrency platform, and tax-related services, offering a range of solutions from investment guidance, banking, portfolio handling, to robo-advising.

While its main focus is now on the Canadian investors, Americans can still use it as overseas

investors.

The Safety of Wealthsimple

If you're from the US, you might note that Wealthsimple no longer maintains its operational licenses there, which could raise questions about its trustworthiness.

To address this, yes, Wealthsimple is reliable. It operates under all necessary regulations and insurances to ensure customer security.

Wealthsimple's Insurance Measures

Wealthsimple employs two primary insurances for customer protection: the Canadian Investor Protection Fund (CIPF), analogous to the U.S.'s SIPC, and the Canada Deposit Insurance Corporation (CDIC), mirroring the FDIC.

Much like their US equivalents, the CIPF covers up to 1 million Canadian dollars in securities, while the CDIC ensures banking deposits up to $100,000 for each insured category.

These insurances are in place to shield against brokerage issues. Should Wealthsimple close its doors, the investor's assets remain protected.

Open WealthSimple Account

Open WealthSimple Account

Is Wealthsimple Legitimate?

Wealthsimple operates under the oversight of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Securities Administrators (CSA).

These regulators ensure that investors receive fair prices, transparent operations, and protection for their data. And even though Wealthsimple isn't directly registered with the SEC or FINRA, US investors indirectly benefit from these bodies since Canadian brokerages need to satisfy their criteria to onboard U.S. clients.

Wealthsimple Reviews

Beyond regulatory and insurance checks, assessing customer reviews provides insights into a firm's

credibility. Platforms like the BBB, Trustpilot, and app stores can reveal user experiences.

For Wealthsimple, reviews are varied.

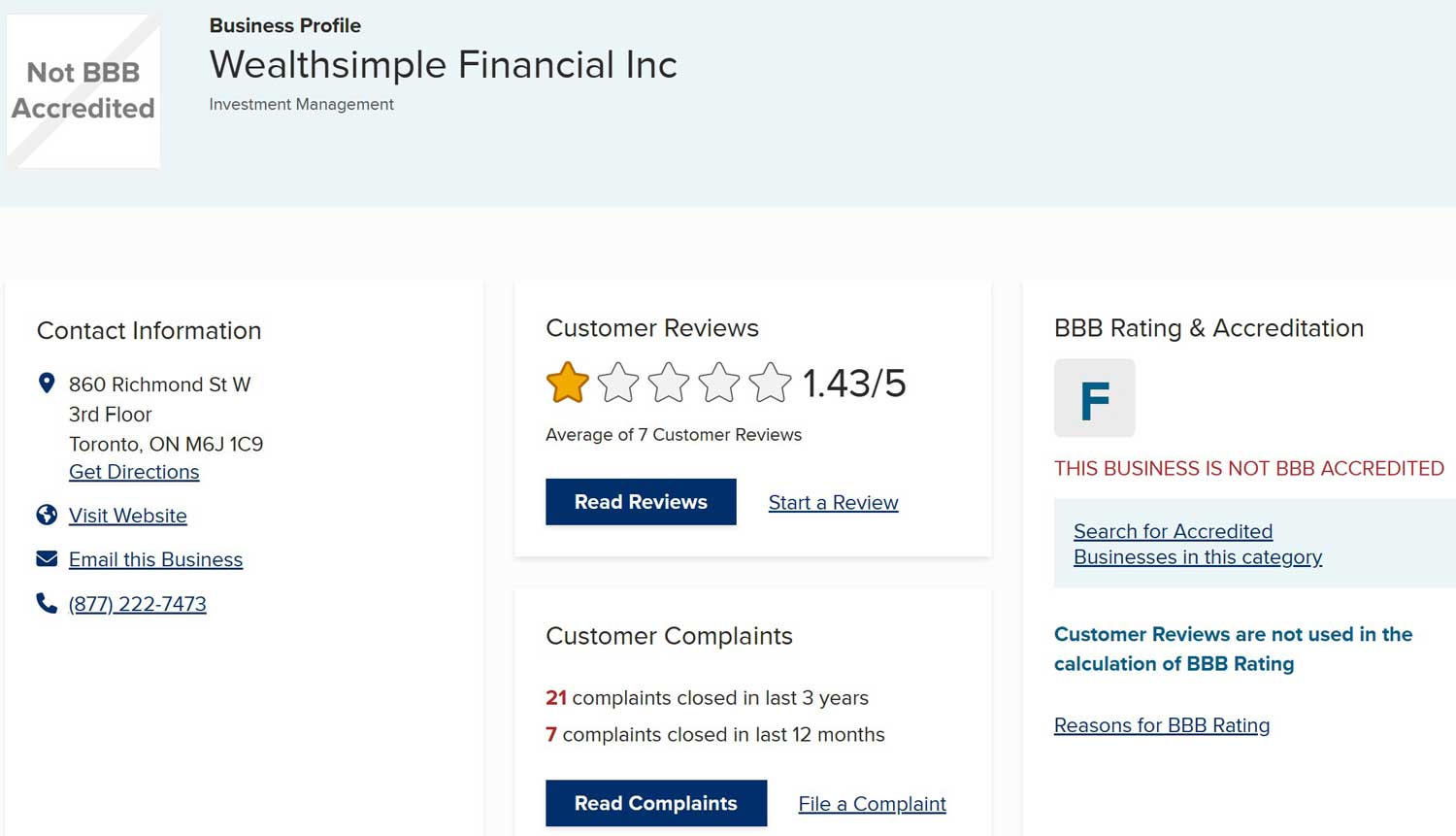

Wealthsimple's BBB Rating

While Wealthsimple isn't BBB-accredited, it does have reviews and ratings there. It currently possesses the lowest possible rating (F) and has garnered only one star. However, these ratings are influenced by factors like how complaints are addressed. For instance, Wealthsimple's unaddressed complaints seem to coincide with the period it merged its U.S. operations with Betterment, suggesting possible oversight post-merger.

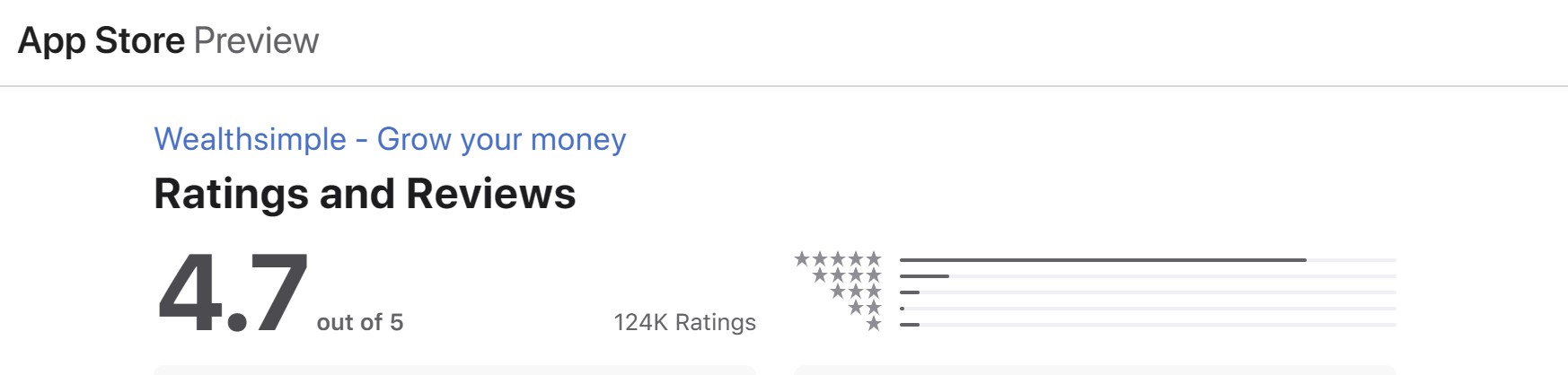

Wealthsimple Google Play and App Store Reviews

In contrast to the BBB, Wealthsimple's app boasts impressive scores. On Google Play, over 3,000

reviews have resulted in a 4.6/5 rating. Meanwhile, on the Apple App Store, close to 125,000 reviews have given it a 4.7/5 score.

Final Thoughts on WealthSimple's Safety

In essence, Wealthsimple stands as a trustworthy platform. Despite facing some complaints in its history, it remains a regulated institution. Its dealings are ensured to be just and clear-cut, with investor funds consistently secured by two of Canada's leading insurance bodies.

Open WealthSimple Account

Open WealthSimple Account